Five Shifts Transforming Advisor Growth

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

The Big Picture

OCTOBER 20, 2023

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. It does that splendidly.” 1 Today, we’re going to look at a perennial (un)favorite #chartfail. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

OCTOBER 2, 2023

We all love to use quotations in our arguments. It’s both an appeal to higher authority as well as social proof ( Hey! I’m not the only one who believes this stuff ). I find it useful occasionally to go back to first principles and reconsider the sources that have influenced my thinmking. Along those lines, here are in chronological order, the thinkers who have helped shape how I view the world view, including how I philosophically think about the economy, markets, and investing.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Calculated Risk

OCTOBER 3, 2023

Wards Auto released their estimate of light vehicle sales for September: September U.S. Light-Vehicles Sales Bounce Back Despite Gloomy Conditions (pay site). Hard to say exactly how much but sales could have been slightly stronger in September if not for some lost inventory caused by production cuts related to plant shutdowns from UAW strikes at Ford, General Motors and Stellantis.

Abnormal Returns

OCTOBER 22, 2023

Top clicks this week We are living through the worst bond bear market in history. (awealthofcommonsense.com) Just how expensive are the 'Magnificent Seven' stocks? (blog.validea.com) Why TIPS now merit 'serious consideration.' (morningstar.com) There is no single definitive model for the term premium. (wsj.com) Do investors really understand the return profile of options-writing funds?

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

OCTOBER 31, 2023

Welcome back to the 357th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jon Henderson. Jon is the Founder and CIO for Echo45 Advisors, an independent RIA based in Walnut Creek, California, that oversees $163 million in assets under management for more than 180 client households. What's unique about Jon, though, is how he has carefully vetted and curated his advisor tech stack of third-party software to provide a strong "high-tech" client experience… and

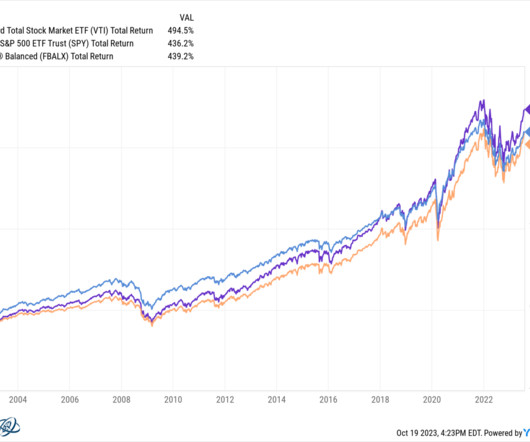

The Big Picture

OCTOBER 19, 2023

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for our clients. I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios. I like to finish with a thought-provoking, often “investing-adjacent” idea they might not have previously considered.

Wealth Management

OCTOBER 15, 2023

Wealth Management recently asked readers to nominate the investment book that most helped them in their investing careers.

Calculated Risk

OCTOBER 3, 2023

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16th. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period both contracts were available.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Abnormal Returns

OCTOBER 29, 2023

Top clicks this week A big regime shift has happened in the economy and financial markets. (ritholtz.com) The bond market bear market is pretty epic. (mrzepczynski.blogspot.com) Byron Wien's 20 rules for investing and life. (ritholtz.com) Why aren't stocks down more? (theirrelevantinvestor.com) Remember the guy who forgot the password for a hard drive with 7,002 Bitcoin on it?

The Reformed Broker

OCTOBER 17, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Earnings – “Average commercial and consumer loans were both down from the second quarter as higher rates and a slowing economy have weakened loan demand, and we’ve continued to take some credit tighteni.

Nerd's Eye View

OCTOBER 30, 2023

After several years of turmoil caused by the pandemic, financial advisor conferences seem to have found a "new [post-pandemic] normal", with events once again growing (some already surpassing their pre-pandemic highs). But that's not to say that the conference landscape was not altered by the pandemic; instead, the pandemic appears to have served as a catalyst that accelerated trends that were already underway, such that financial advisor conferences today look substantively different than they

The Big Picture

OCTOBER 23, 2023

The chart in this morning’s reads shows what it is going to cost to fund the interest payments on the federal debt. It’s gone vertical as rates have moved from effectively 0 to over 5%. When rates were zero all of corporate America refinanced, lowering the cost of their debt to historically low levels. Households did the same; today 61% of homeowners with a mortgage are paying 4% or less in interest.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Wealth Management

OCTOBER 30, 2023

Former rep Sidney Lebental is citing FINRA’s legal sparring match with Alpine Securities to halt disciplinary proceedings against him. Meanwhile, FINRA has responded to Alpine’s allegations.

Calculated Risk

OCTOBER 4, 2023

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 6.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 29, 2023. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.0 percent on a seasonally adjusted basis from one week earlier.

Abnormal Returns

OCTOBER 9, 2023

Podcasts Dan Haylett talks with George Kinder on the true impact of Life Planning on retirement. (humansvsretirement.com) Daniel Crosby talks financial wellness and therapy with Amanda Clayman. (standarddeviationspod.com) Brendan Frazier talks about why advisers should shift from "advice giver" to "thinking partner." (wiredplanning.com) Michael Kitces talks with Brett Danko who is the Founder of Brett Danko Educational Center, and the CEO and Managing Partner for Main Street Financial Solutions.

Wealth Management

OCTOBER 4, 2023

Orion Advisor Solutions’ chief behavioral officer explains why advisors should employ “human-first” thinking in their practices at annual Nitrogen conference.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Wealth Management

OCTOBER 9, 2023

This article examines three key use cases where AI can benefit financial advisors: practice management, client engagement and prospecting.

Calculated Risk

OCTOBER 31, 2023

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in August Click on graph for larger image.

The Big Picture

OCTOBER 12, 2023

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first discussed the companies that lost my affection during the pandemic nearly two years ago, Amazon continues to stand out as delivering an ever-worsening set of experiences. I wanted to wait until after the (faux retail holiday) Prime Day(s) ended before sharing a few tales of further (to use Cory Doctorow’s phrase) “ Enshittification.” There are many problem

Wealth Management

OCTOBER 4, 2023

The new marketing campaign uses Nitrogen’s “Risk Numbers” to help advisors drive traffic to its “Risk Assessment Questionnaire” and capture leads.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

The Big Picture

OCTOBER 4, 2023

Source: Visual Capitalist Batnick also takes a swing at this: What’s the Stock Market Worth? The post $109 Trillion Global Stock Market appeared first on The Big Picture.

The Big Picture

OCTOBER 7, 2023

This week, we speak with Michael Lewis, whose latest book is “ Going Infinite: The Rise and Fall of a New Tycoon , ” on FTX founder Sam Bankman-Fried. He takes readers into the mind of Bankman-Fried, whose rise and fall offers an education in high-frequency trading, cryptocurrencies, philanthropy, bankruptcy, and the justice system. We discuss his writing process, and what made this book so different than his prior ones: A focus on personalities instead of some broad social upheaval.

Calculated Risk

OCTOBER 26, 2023

From CoreLogic: US Serious Mortgage Delinquency Rate Drops to All-Time Low in August • The share of U.S. borrowers who were in serious mortgage delinquency (90 days or more late on payments) dropped to 0.9% in August, the lowest recorded since January 1999. • The overall national mortgage delinquency rate (30 days or more late) was at 2.6% in August, also a historic low. • The U.S. foreclosure rate held steady at 0.3% in August, unchanged since early 2022. • Only Idaho and Utah saw slight annual

Wealth Management

OCTOBER 16, 2023

It's often a better option, both in terms of dollars and cents and family stress, than passing on a residence to heirs.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

The Big Picture

OCTOBER 9, 2023

There is a thought-provoking discussion on short selling over at Russell Clark ; check it out (including audio) to get an overview of his perspective. I don’t really disagree with any of it but I do (did) see the world of short-selling from a different seat. Allow me to share a few thoughts about shorting as a trading strategy; I include specifics at the end.

Wealth Management

OCTOBER 4, 2023

Luis Rosa, founder of Build a Better Financial Future discusses the importance of authenticity in your approach and your business model.

Wealth Management

OCTOBER 6, 2023

Nitrogen’s annual Fearless Investing Conference was a clarion call to advisors for navigating waves of change, with a curated agenda laser-focused on growth through adaptation, agility and optimism.

Calculated Risk

OCTOBER 18, 2023

Today, in the CalculatedRisk Real Estate Newsletter: 30-Year Mortgage Rates Hit 8.0% Excerpt: Mortgage News Daily reports 30-year fixed rate mortgages rose to 8.0% today (for top tier scenarios). This will mostly impact closed sales in November and December, and strongly suggests we will see new cycle lows for existing home sales over the winter. Note: The National Association of Realtors (NAR) is scheduled to release September existing home sales tomorrow, Thursday, October 19th, at 10:00 AM ET

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content