Never Mix Payroll and Household Survey Data

The Big Picture

NOVEMBER 29, 2024

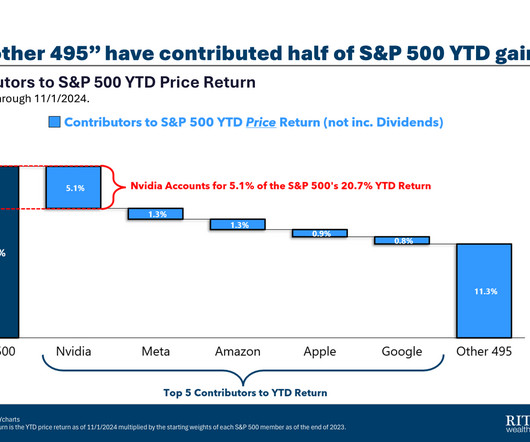

@TBPInvictus here (link is now to Bluesky) Let’s cut to the chase: A Hoover Institution analysis of California private job creation is off by a factor of 100. Between January 2022 and June 2024, the state created 523,700 private sector jobs — not 5,400 as claimed. MSM uncritically repeated the false number. I spend far too much time debunking economic b t.

Let's personalize your content