Calling It Versus Nailing It, Redux

The Irrelevant Investor

MARCH 4, 2016

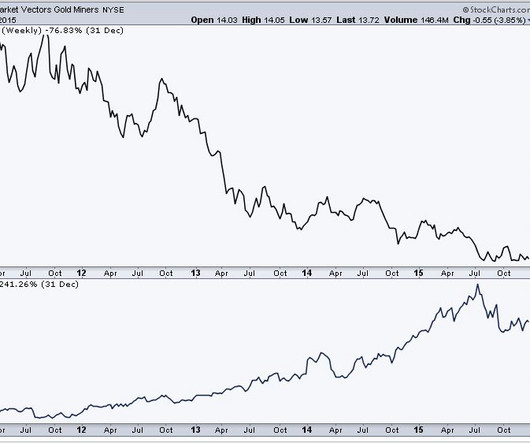

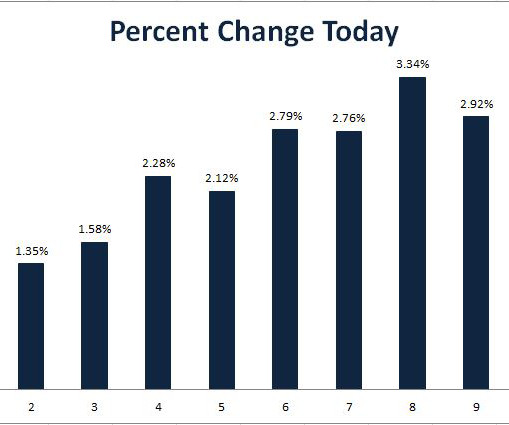

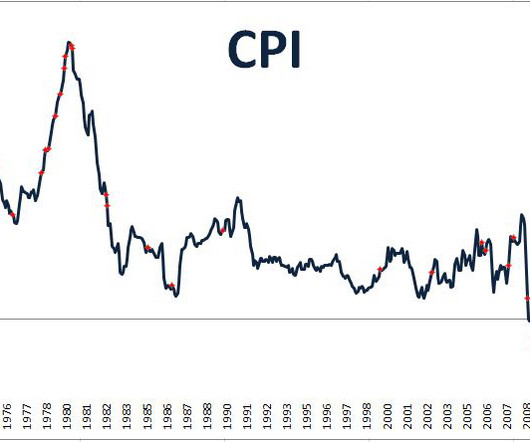

The only thing gold miners and biotech stocks have in common is their extreme performance over the past few years. While miners lost 76% of their value between 2011 and 2015, biotechs gained 241%. Below you'll see the 31-week rate of change of gold miners versus biotechs, which has spent most of the last few years deeply in the red. However, this ratio has jumped through the stratosphere, rocketing 144% in just the last 31 weeks.

Let's personalize your content