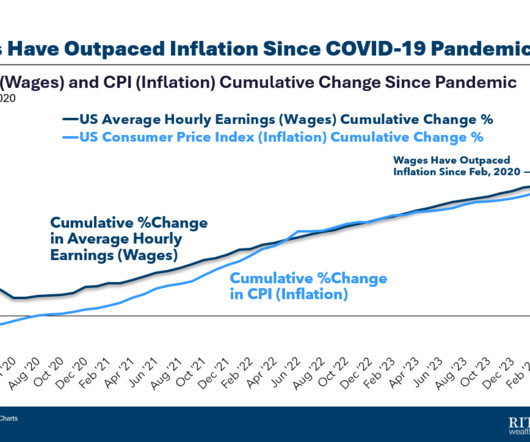

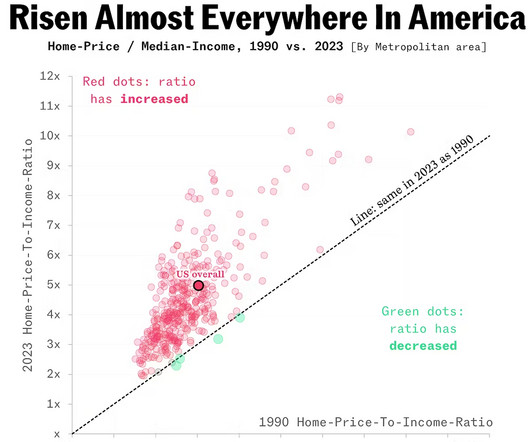

Inflation is Obvious But Wage Gains Seem Invisible

The Big Picture

JUNE 27, 2024

I’ve been observing how radically unusual various sentiment readings have been for a few years now. It made little sense to me that the post-pandemic era saw sentiment levels far below major dislocations such as the ‘87 crash, the 9/11 terrorist attacks, the Dotcom implosion, or the 08-09 great financial crisis. We have tried to identify the causal factors by considering social media , increases in partisanship , ignorance, even trolling of pollsters.

Let's personalize your content