Lessons From Inflation’s Return

Fortune Financial

JUNE 21, 2022

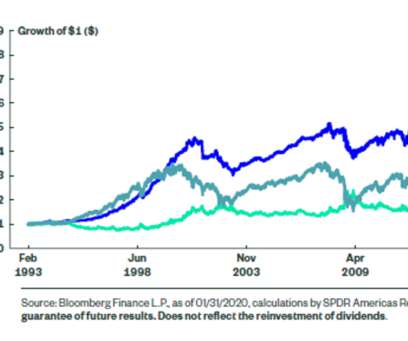

Inflation is now front and center in the minds of investors as domestic measures of consumer prices reach levels not seen in a generation: This is obviously a sea change for investors long accustomed to the benign inflationary environment that has prevailed with little interruption for several decades. Since I have written on the topic and its impact on financial assets on several different occasions I thought it would be worthwhile to revisit some of those ideas now that inflation has returned.

Let's personalize your content