Monday links: building wealth over time

Abnormal Returns

AUGUST 19, 2024

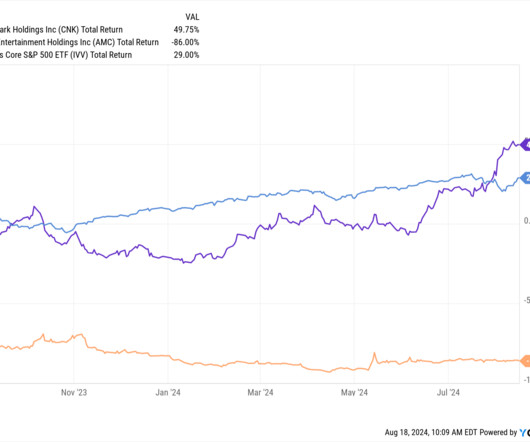

Markets There is big difference between politics and policies when it comes to investing. (optimisticallie.com) 20 pandemic darlings that have yet to rebound. (investmenttalk.co) Companies Couche-Tard seeks to buy US$31 billion owner of 7-Eleven stores (bnnbloomberg.ca) Why Carl Icahn and Icahn Enterprises ($IEP) just settled with the SEC. (ft.com) How the cannabis landscape is changing.

Let's personalize your content