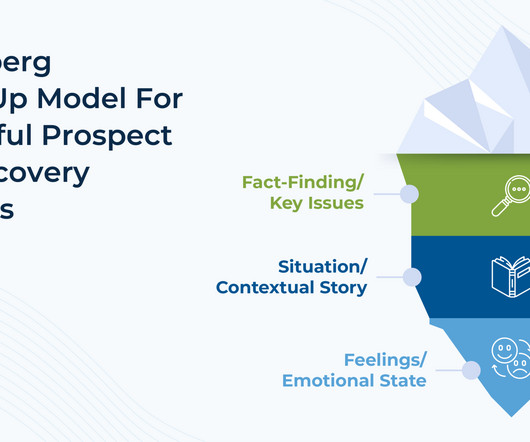

Fact, Situation, Feeling – Using The Iceberg Follow-Up Model To Connect With And Motivate Clients

Nerd's Eye View

FEBRUARY 7, 2024

The need for financial professionals to ask prospects and clients questions has a long history in the industry. In earlier days, questions simply facilitated the process of gathering information in order to open accounts and recommend the appropriate products to be sold. However, as the industry evolved from being primarily transaction-based to relationship-based, it has become increasingly important for advicers to become less sales-oriented and more focused on how they can better develop deep,

Let's personalize your content