Tony Bennett’s Children Embroiled in Lawsuit Over His Estate

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

Calculated Risk

JULY 2, 2024

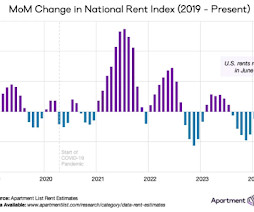

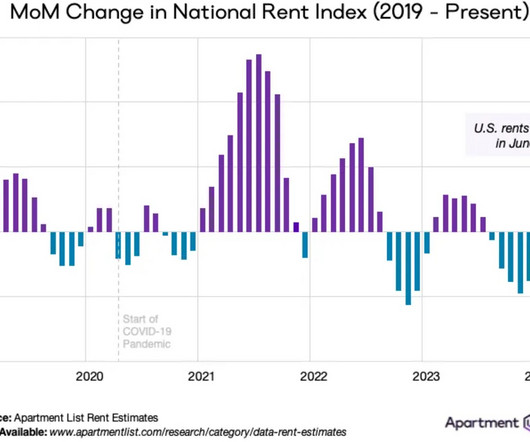

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year Brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

JUNE 30, 2024

Also on the site Some reasons why being online is so exhausting these days. (abnormalreturns.com) Top clicks this week Mean reversion happens in the stock market. Good luck trying to time it. (awealthofcommonsense.com) The degenerate economy is booming. (howardlindzon.com) Stop dissing standard deviation as a risk measure. (morningstar.com) Holding cash is comfortable right now, too comfortable.

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S. Supreme Court decision shifting authority to interpret laws passed by Congress from Federal agencies to the judicial system could have significant impacts on regulation of the financial advice industry, including the potential for additional legal challenges to regulations from the Securities and Exchange Commission (SEC), the Department of Labor (DoL), and o

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

JULY 5, 2024

If your only differentiator is that you charge 75 basis points, you’ll likely lose the battle when the advisor across town drops to 50.

Calculated Risk

JULY 3, 2024

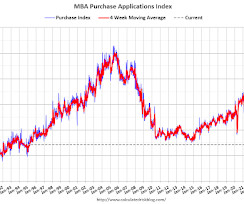

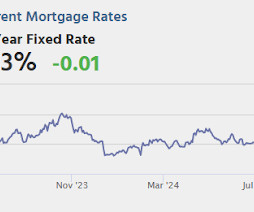

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 28, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JULY 1, 2024

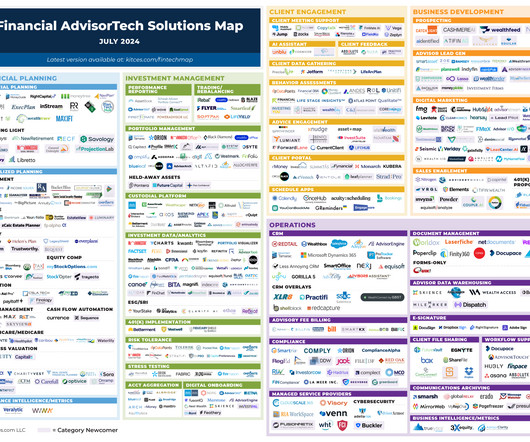

Welcome to the July 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that AI meeting support solution Jump has raised $4.6 million in venture capital, as meeting support has increasingly shown itself as a leading use case for AI as it applies to financial advisors given the s

Wealth Management

JULY 1, 2024

Last week, the Court ruled that the commission’s use of in-house administrative law judges violated the Constitution’s guarantee of a jury trial in certain cases. That may change the landscape for financial advisors defending themselves against SEC charges and civil penalties.

Calculated Risk

JULY 5, 2024

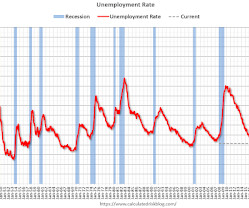

From the BLS: Employment Situation Total nonfarm payroll employment increased by 206,000 in June , and the unemployment rate changed little at 4.1 percent , the U.S. Bureau of Labor Statistics reported today. Job gains occurred in government, health care, social assistance, and construction. The change in total nonfarm payroll employment for April was revised down by 57,000, from +165,000 to +108,000, and the change for May was revised down by 54,000, from +272,000 to +218,000.

Abnormal Returns

JULY 5, 2024

Economy Paul Podolsky talks with Lev Borodovsky, creator of The Daily Shot. (paulpodolsky.substack.com) Tyler Cowen talks with Joseph Stiglitz, author of "The Road to Freedom: Economics and the Good Society." (conversationswithtyler.com) Roben Farzad talks with Hal Hodson about the mind-boggling solar revolution. (pod.link) Alternatives Eric Golden talks with Phil Huber, Head of Portfolio Solutions at Cliffwater, about the case for private credit.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Nerd's Eye View

JULY 2, 2024

Welcome everyone! Welcome to the 392nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Kristopher Heck. Kristopher is a Founding Partner of Tanager Wealth Management, an RIA based in London, England, that oversees approximately $1.1 billion in assets under management (AUM) for 630 client households. What's unique about Kristopher, though, is how his firm has scaled to more than a billion dollars of AUM while specializing in working with clients whose personal an

Wealth Management

JULY 5, 2024

On the Foundation for Research on Equal Opportunity website, advisors and clients can search for the ROI of individual programs offered by private and state colleges and universities.

Calculated Risk

JULY 1, 2024

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores A brief excerpt: Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q4 2023 (released this morning).

Abnormal Returns

JULY 2, 2024

Quant stuff Beware small sample sizes. (mrzepczynski.blogspot.com) Just how useful is historical financial markets data? (retirementresearcher.com) A round-up of recent white papers including 'Embracing Down Rounds: A Potential Path to Long-Term Equity Value.' (bpsandpieces.com) Corporate finance Are companies any good at timing share repurchases? (marketwatch.com) When a company shifts its financial targets - take note.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Nerd's Eye View

JULY 3, 2024

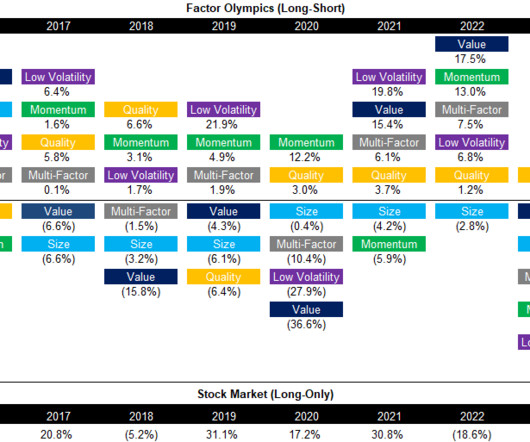

Over the past few decades, technological advances and plummeting transaction costs have facilitated the emergence of a dizzying variety of ways to gain exposure to very specific areas of the market. As a result, advicers have more options than ever to add value for their clients by tailoring investment portfolios that are specific to their unique needs, goals, and risk tolerance.

Wealth Management

JULY 5, 2024

Retirement industry thought leaders answer three probing questions on critical issues, providing an open, honest and candid dialogue.

Calculated Risk

JUNE 29, 2024

The key report scheduled for this week is the June employment report to be released on Friday. Other key reports include the June ISM Manufacturing survey, June Vehicle Sales and the Trade Deficit for May. -- Monday, July 1st -- 10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 48.7 in May. 10:00 AM: Construction Spending for May.

Abnormal Returns

JULY 3, 2024

Strategy Politics and investing don't mix. (howardlindzon.com) Good luck trying to time market factors. (rogersplanning.blogspot.com) Not all investment decisions are created alike. (behaviouralinvestment.com) Finance A lot of loans got repriced in 2024, so far. (axios.com) What former Vanguard OCIO clients should expect. (blogs.cfainstitute.org) Startups Half of VC funding in Q2 went to AI-related startups.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Big Picture

JULY 3, 2024

At The Money: Changing Your Behavior For Better Investing (July 3, 2024) If you could change only one thing that would help your investing, what would it be? Your own behavior. When it comes to investing, we are our own worst enemies. Why is this, and what can we do to avoid this fate? Neurologist and professional investor Dr. William Bernstein explains how to manage our emotions to avoid poor outcomes in markets.

Wealth Management

JULY 2, 2024

Dangers abound when wealth enterprises celebrate founders over advisors.

Calculated Risk

JULY 2, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM, The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in June, up from 152,000 in May. • At 8:30 AM, The initial weekly unemployment claims report will be released.

Abnormal Returns

JULY 2, 2024

Markets It's been awhile since we had a 1% drop in the S&P 500. (cautiouslyoptimist.com) Even when the stock market is up YTD there are plenty of stocks that are down on the year. (awealthofcommonsense.com) Putting the growth in private credit into some perspective. (apolloacademy.com) Fund management Hedge funds have a size problem. (bloomberg.com) A great reminder that index construction matters.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Big Picture

JULY 2, 2024

The transcript from this week’s, MiB: Eva Shang, CEO, Legalist , is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ Bloomberg Audio Studios, podcasts, radio News. This is Masters in business with Barry Ritholtz on Bloomberg Radio Barry Ritholtz : This week on the podcast.

Wealth Management

JULY 2, 2024

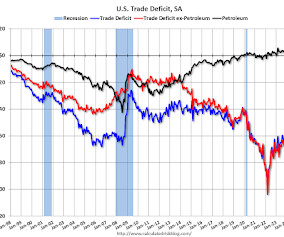

The U.S. has a major spending problem which neither political party seems willing to address.

Calculated Risk

JUNE 29, 2024

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • New Home Sales Decrease to 619,000 Annual Rate in May • Case-Shiller: National House Price Index Up 6.3% year-over-year in April • Inflation Adjusted House Prices 2.3% Below Peak • Watch Months-of-Supply! • Freddie Mac House Price Index Increased in May; Up 5.9% Year-over-year This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Abnormal Returns

JUNE 29, 2024

Autos Traffic deaths fell in Q1 but remain elevated. (fastcompany.com) A look at the growing battle over emergency braking systems. (axios.com) Waymo no longer has a wait list in San Francisco. (theverge.com) How much does it cost to insure a Tesla ($TSLA) Cybertruck? (sherwood.news) Energy We need a smarter grid, not just bigger. (semafor.com) How to use molten salt to store energy.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Carson Wealth

JULY 3, 2024

Running a small business involves juggling multiple responsibilities. Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Here are eight essential financial tips for small business owners to help ensure long-term success. 1.

Wealth Management

JULY 3, 2024

Without proper guidance regarding taxes, philanthropy and estate planning, high net worth entrepreneurs can miss opportunities.

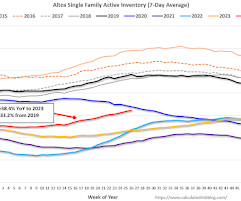

Calculated Risk

JULY 1, 2024

Altos reports that active single-family inventory was up 1.8% week-over-week. Inventory is now up 30.7% from the February seasonal bottom, and at the highest level since July 2020. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of June 28th, inventory was at 646 thousand (7-day average), compared to 634 thousand the prior week.

Abnormal Returns

JULY 3, 2024

Podcasts Barry Ritholtz talks with Peter Mallouk about keeping things simple. (ritholtz.com) Christine Benz and Jeff Ptak talk with Scott Burns about financial minimalism. (morningstar.com) Steve Chen talks with Andrew Biggs about whether there really is a retirement crisis brewing in the U.S. (podcasts.apple.com) Katie Gatti Tassin on whether you are saving too much for retirement.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Let's personalize your content