The Contrarian’s Guide: Inside David Dreman’s Value Investment Strategy

Validea

NOVEMBER 2, 2024

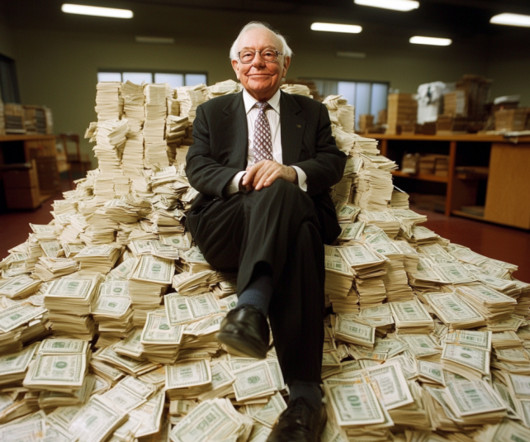

David Dreman made his name and fortune by going against the crowd. As one of the pioneers of contrarian investing, he built an impressive track record by systematically targeting stocks that were out of favor with the market. Let’s explore how Dreman developed his contrarian approach and break down the key elements of his quantitative strategy.

Let's personalize your content