What You Need to Know About the 200-Day Moving Average

The Irrelevant Investor

JULY 1, 2015

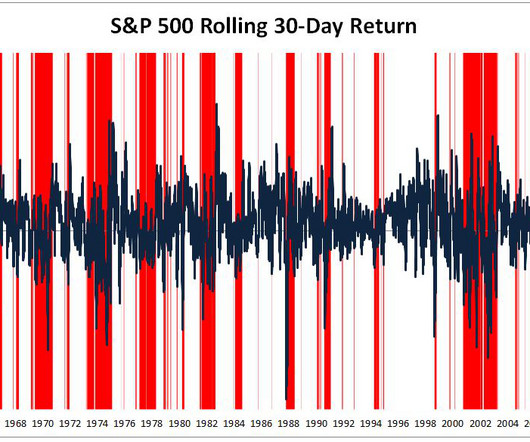

On Monday, for the first time since October 2014, the Dow Jones Industrial Average closed beneath its 200-day moving average. Many people wonder what the implications for this might be. Do stocks bounce right here and if so, how long can we expect them to hold? The truth is that speculating on where they go from here is a shot in the dark so rather than guessing, I want to share some facts about what the 200-day moving average has historically meant for stocks.

Let's personalize your content