Private Credit Giants Are Butting Heads Over a Hot New Asset Class

Wealth Management

NOVEMBER 6, 2023

PE-style “whitelists” hamper efforts to expand the secondary market for fund stakes, as regulators raise liquidity concerns about private capital.

Wealth Management

NOVEMBER 6, 2023

PE-style “whitelists” hamper efforts to expand the secondary market for fund stakes, as regulators raise liquidity concerns about private capital.

Calculated Risk

NOVEMBER 6, 2023

Altos reports that active single-family inventory was up 0.8% week-over-week. This is the latest in the year that inventory was still increasing! Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of November 3rd, inventory was at 567 thousand (7-day average), compared to 563 thousand the prior week. Year-to-date, inventory is up 15.5%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

NOVEMBER 6, 2023

Source: Chartr We talked about this 2 weeks ago , but the nation missed a fantastic opportunity to refinance all of the outstanding US debt at much lower levels. Every corporate debt issuer and homeowner in America refinanced at lower rates — except for Uncle Sam. If you were in Congress from 2015-2021, you are the reason why HALF of the projected federal debt will soon be interest payments.

Abnormal Returns

NOVEMBER 5, 2023

Top clicks this week Six lessons from William Bernstein's "The Four Pillars of Investing." (humbledollar.com) Be wary shifting too much of your money into bonds. (humbledollar.com) There's nothing magic about asset allocation. (obliviousinvestor.com) Money market returns look good.almost too good. (wsj.com) Traders are buying the dip in the iShares 20+ Year Treasury Bond ETF ($TLT).

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

NOVEMBER 9, 2023

New York-based Arch, which aims to solve for the workflow and data problems behind alternative investments, has received funding from Focus Financial Partners, the founders of Vanilla and Altruist, and others.

Calculated Risk

NOVEMBER 6, 2023

From the Federal Reserve: The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices The October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2023.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

NOVEMBER 4, 2023

EVs The EV business has hit a speed bump. (theverge.com) Tesla ($TSLA) has an Elon Musk problem. (lefsetz.com) EVs have an affordability problem. (businessinsider.com) Solid state batteries will change the EV equation. (axios.com) Transport Just how quickly can the shipping industry green itself? (nytimes.com) Railroad companies have been lax in maintaining bridges.

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

Calculated Risk

NOVEMBER 7, 2023

From the NY Fed: Household Debt Rises to $17.29 Trillion Led by Mortgage, Credit Card, and Student Loan Balances The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion.

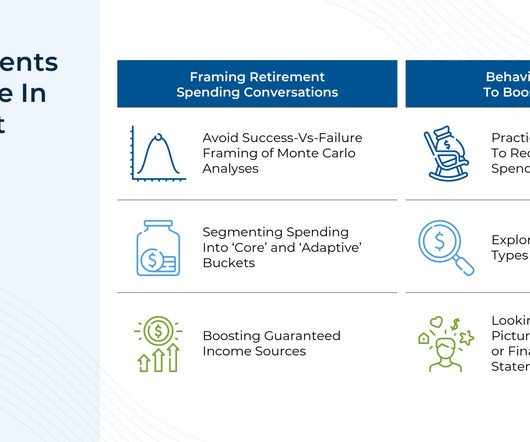

Nerd's Eye View

NOVEMBER 8, 2023

Retirement is often framed as one's "golden years", a time to enjoy the fruits of several decades of hard work. And for many retirees who have planned accordingly, this transition is not a problem as they might spend generously on travel, hobbies, or other pursuits. Nevertheless, some retirees can find it emotionally challenging to bring themselves to go beyond the basics in retirement spending (e.g., because they have a hard time switching from 'savings' mode to 'spending' mode) and can be hesi

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

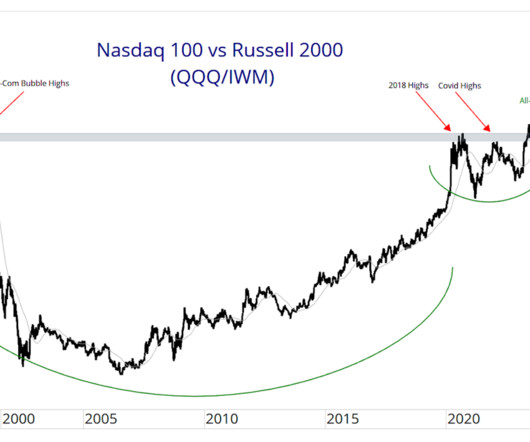

Abnormal Returns

NOVEMBER 10, 2023

Strategy The 40 of the 60/40 portfolio is finally earning people something. (awealthofcommonsense.com) There's still no sign of a turn in the trend favoring U.S. vs. international equities. (allstarcharts.com) The case for bonds. (blogs.cfainstitute.org) Energy Solar panel manufacturing is finally on the rise in the U.S. (nytimes.com) Why the cancellation of the NuScale, small modular reactor, project is such a bummer.

Wealth Management

NOVEMBER 6, 2023

The CEO of Banrion Capital Management discusses the importance of alternative investments in portfolio planning.

Calculated Risk

NOVEMBER 9, 2023

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 4, 2023 • Active inventory declined slightly, with for-sale homes lagging behind year ago levels by 0.2%. For 20 straight weeks, the number of homes available for sale has registered below that of the previous year, though by just a small margin this week. • N ew listings–a measure of sellers putting homes up for sale–were up this week, by 0.6% from

Nerd's Eye View

NOVEMBER 7, 2023

Welcome back to the 358th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Veronica Karas. Veronica is a Senior Financial Advisor at CAPTRUST and works from the RIA's Lake Success, New York, office, where she oversees $360 million in assets under management for about 200 client households. What's unique about Veronica, though, is the unique 3-question approach she uses to generate referrals not only from clients, but also from centers of influence as well, and ev

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Abnormal Returns

NOVEMBER 8, 2023

Markets The stock market usually goes up. (tker.co) Like it or not, technology stocks are leading. (allstarcharts.com) Technology How does the technology industry not get bigger? (notboring.co) OpenAI is laying out a path forward for a sustainable business. (stratechery.com) Meta ($META) has a path forward for WhatsApp profitability. (nytimes.com) Amazon ($AMZN) is going wide with offers for One Medical membership.

Wealth Management

NOVEMBER 9, 2023

Industry sources say Focus Financial Partners' new private equity owner plans to merge the sprawling ecosystem of firms into a small number of its existing entities.

Calculated Risk

NOVEMBER 9, 2023

I'll have much more on these projections - and the implications for housing - soon (I'm sure housing economist Tom Lawler will comment!) From Census: U.S. Population Projected to Begin Declining in Second Half of Century The U.S. population is projected to reach a high of nearly 370 million in 2080 before edging downward to 366 million in 2100. By 2100, the total U.S. resident population is only projected to increase 9.7% from 2022, according to the latest U.S.

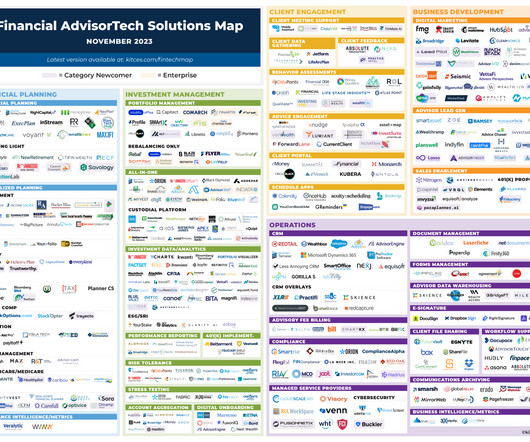

Nerd's Eye View

NOVEMBER 6, 2023

Welcome to the November 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Practice Intel has launched a new "growth platform" centered around quantifying the quality of an advisor's client relationships with an all-in "Relationship Quality Index" (RQI) – which while

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Abnormal Returns

NOVEMBER 6, 2023

Markets A five-step framework for reading market news. (tker.co) By these measures, small cap stocks are cheap. (morningstar.com) What happens historically after a Zweig Breadth Thrust? (quantifiableedges.com) Strategy Failure is inevitable when it comes to investing. (mrzepczynski.blogspot.com) Five benefits of higher rates on cash, including no drag on holding an emergency fund.

Wealth Management

NOVEMBER 7, 2023

They see a $10 trillion opportunity in the next decade, but obstacles remain to widespread use of private investments.

Calculated Risk

NOVEMBER 9, 2023

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-November A brief excerpt: The NAR reported sales were at a “seasonally adjusted annual rate of 3.96 million in September. Year-over-year, sales dropped 15.4% (down from 4.68 million in September 2022).” This was in line with the local markets I tracked for September.

The Reformed Broker

NOVEMBER 10, 2023

OK, we’re trying something new next week for registered financial advisors only. It’s a brand new show we’ve created and you can be there virtually to watch the pilot episode live. As an advisor, you’re going to spend time, money and energy implementing new technology and asset management solutions into your practice. You may as well get good at it.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Abnormal Returns

NOVEMBER 5, 2023

Markets Small and mid-cap stocks have badly lagged large caps. (awealthofcommonsense.com) This week was a good example why you should never be positioned for extremes. (theirrelevantinvestor.com) Why you should avoid big investment shifts. (humbledollar.com) Trading Brett Steenbarger, "The best traders evolve." (traderfeed.blogspot.com) Why cycles of speculation keep happening.

Wealth Management

NOVEMBER 6, 2023

The Pacific Legal Foundation, which has a record for arguing against “government overreach” before the Supreme Court, is representing Frank Black in the latest case challenging FINRA's Constitutionality.

Calculated Risk

NOVEMBER 8, 2023

Today, in the Calculated Risk Real Estate Newsletter: Inventory will Tell the Tale A brief excerpt: Two years ago, in November 2021, I wrote Inventory will Tell the Tale and recounted how changes in housing inventory had helped me forecast the housing market at several key points. Here is an update to that post with a few additional comments. Starting in January 2005, I was very bearish on housing , but I wasn’t sure when the market would turn.

The Big Picture

NOVEMBER 4, 2023

This week, we speak with Zeke Faux ,1 an investigative reporter for Bloomberg Businessweek and Bloomberg News. He has won the Gerald Loeb Award for explanatory journalism and the American Bar Association’s Silver Gavel Award , and was a National Magazine Award finalist. He is the author of Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Abnormal Returns

NOVEMBER 10, 2023

Economy Kyla Scanlon talks with David Dayen about the gap between the economy and consumer sentiment. (youtube.com) Justin Carbonneau and Jack Forehand talk all things macro with 3Fourteen Research founders Warren Pies and Fernando Vidal. (youtube.com) Business Matt Reustle talks with Staley Cates about the history of FedEx ($FDX). (joincolossus.com) Jordan Harbinger talks with Chris Miller author of "Chip War: The Fight for the World's Most Critical Technology.

Wealth Management

NOVEMBER 7, 2023

FMG Suite, Bento Engine, Asset-Map, Holistiplan and FP Alpha were among the companies highlighting new developments during the virtual conference.

Calculated Risk

NOVEMBER 10, 2023

From the MBA: Mortgage Delinquencies Increase in the Third Quarter of 2023 The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62 percent of all loans outstanding at the end of the third quarter of 2023 , according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The Reformed Broker

NOVEMBER 8, 2023

On this special episode of TCAF Tuesday, Michael Batnick, Barry Ritholtz, and Downtown Josh Brown are joined by Campbell Harvey to discuss: the state of the economy, the yield curve indicator, the next recession, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods! Listen here: Apple podcasts Spotify podcasts Google podcasts Everywhere else!

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Let's personalize your content