The Magic Phrase to Never Lose The Sale

Advisor Perspectives

JANUARY 7, 2025

In the rush to secure a new client, many advisors instinctively push for momentum during the sales conversation, often feeling the pressure to keep things moving forward.

Advisor Perspectives

JANUARY 7, 2025

In the rush to secure a new client, many advisors instinctively push for momentum during the sales conversation, often feeling the pressure to keep things moving forward.

Calculated Risk

JANUARY 7, 2025

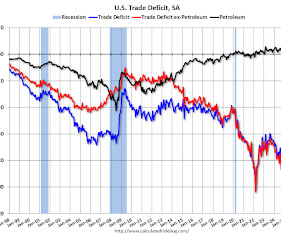

The Census Bureau and the Bureau of Economic Analysis reported : The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $78.2 billion in November , up $4.6 billion from $73.6 billion in October, revised. November exports were $273.4 billion, $7.1 billion more than October exports. November imports were $351.6 billion, $11.6 billion more than October imports. emphasis added Click on graph for larger image.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JANUARY 9, 2025

While financial advisors offer valuable services for their clients, it can sometimes be challenging to gauge how much clients actually value those services. On one hand, a client's willingness to pay an ongoing fee for financial advice suggests that they find the advisor's services worthwhile. On the other hand, the term "financial advice" often refers to much more than asset allocation and wealth management.

Abnormal Returns

JANUARY 8, 2025

Podcasts Ryan Morrissey talks with Larry Swedroe author of "Enrich Your Future: Keys to Successful Investing." (youtube.com) Peter Lazaroff on the need for professional help in retirement planning. (peterlazaroff.com) Katie Gatti Tassin talks with Dana Miranda author of "You Don't Need a Budget." (podcast.moneywithkatie.com) The Purpose Code Why you should read "The Purpose Code: How to Unlock Meaning, Maximize Happiness, and Leave a Lasting Legacy" by Jordan Grumet.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

JANUARY 10, 2025

BofA announced it hired Ed Riley and Jessica Mullin several days after unveiling its new advisory group for ultra-high-net-worth clients based out of its Merrill Wealth division.

Calculated Risk

JANUARY 6, 2025

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate Increased in Q4; Office Vacancy Rate at Record High A brief excerpt: From Moodys Analytics Economists: Multifamily Continued to Defy the Supply Shock, Offices Vacancy Rate Broke Another Record, Retail Rents Drift Higher with Tight Supply, And Industrial Maintains Status Quo Amid record-level inventory growth, average vacancy rate edged up 10 bps in each of the last two quarters and finished 2024 at 6.1%, 40 bps

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Big Picture

JANUARY 8, 2025

SPOTIFY EMBED St. Vincent – Digital Witness [link] Digital witnesses, what’s the point of even sleeping? If I can’t show it, if you can’t see me What’s the point of doing anything? This is no time for confessing At The Money: with Matt Hougan on Crypto Technology (January 8, 2025) Are you crypto-curious? Are you interested in owning some bitcoin, Ethereum, or other crypto-coins?

Abnormal Returns

JANUARY 5, 2025

Markets The 2020s has seen nothing but big market moves. (awealthofcommonsense.com) 30-year mortgage rates are at a six-month high. (axios.com) Strategy Don't let dividends take the wheel of your portfolio. (downtownjoshbrown.com) Or your expectations for the Fed. (tker.co) Companies Good luck making a positive case for an Intel ($INTC) turnaround. (wsj.com) Crowdstrike ($CRWD) stock has bounced back from its July outage.

Calculated Risk

JANUARY 10, 2025

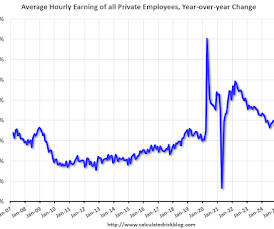

The headline jobs number in the December employment report was well above expectations, however, October and November payrolls were revised down by 8,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%. Earlier: December Employment Report: 256 thousand Jobs, 4.1% Unemployment Rate Prime (25 to 54 Years Old) Participation Since the overall participation rate is impacted by both cyclical (recession) and demograp

Nerd's Eye View

JANUARY 10, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the "Social Security Fairness Act" was signed into law this week, eliminating the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) provisions, which previously reduced the Social Security benefits of individuals who worked in both "covered" (jobs for which they paid into the Social Security system) and "non-covered" (those in which they didn't,

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Wealth Management

JANUARY 9, 2025

Security is becoming a central consideration in structuring everything from family offices to succession plans.

Abnormal Returns

JANUARY 5, 2025

Top clicks this week The growth in the Microstrategy ETF ecosystem is unprecedented. (on.ft.com) What's behind the slowdown in Chinese productivity? (noahpinion.blog) The proposed Strive Bitcoin Bond ETF will invest in the debt of companies buying Bitcoin. (etf.com) 2025 is setting up to be a consequential year for the Vanguard Group. (riabiz.com) Portfolio simplicity keeps paying off.

Calculated Risk

JANUARY 8, 2025

From the Fed: Minutes of the Federal Open Market Committee, December 1718, 2024. Excerpt: With regard to the outlook for inflation, participants expected that inflation would continue to move toward 2 percent, although they noted that recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated.

Nerd's Eye View

JANUARY 6, 2025

Welcome to the January 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Orion, the "all-in-one" advisor technology platform, has acquired Summit Wealth Systems (and its founder Reed Colley, who previously built performance reporting platform Black Diamond), a client port

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Big Picture

JANUARY 10, 2025

This week, we speak with Brian Hurst , the Founder and Chief Investment Officer of ClearAlpha. Prior to founding ClearAlpha, Brian spent 21 years at AQR Capital Management as a portfolio manager, researcher, head of trading, and the firm’s first non-founding Partner. He was also Cliff Asness’ first hire at GSAM. Hurst was instrumental in designing and implementing AQR’s trading platform.

Abnormal Returns

JANUARY 6, 2025

Advisers There is no shortage of movement among RIA C-suites. (riabiz.com) The case for delaying Social Security claiming. (thinkadvisor.com) A Q&A with Preston D. Cherry author of Wealth in the Key of Life. (thinkadvisor.com) How advisers can facilitate money discussions with clients before they get married. (thinkadvisor.com) Rising insurance costs are complicating the move for the wealthy to Florida and the like.

Calculated Risk

JANUARY 7, 2025

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA). From CoreLogic: CoreLogic: Northeastern, New England States Continue to Lead US for Annual Home Price Growth in November The national home price gain was 3.4% year over year in November 2024, down from the 5.2% growth recorded in the same month of 2023.

Wealth Management

JANUARY 6, 2025

Ukrainian farmland could offer a chance to diversify your portfolio while fueling the recovery of a nation.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Clever Girl Finance

JANUARY 10, 2025

If someone asked what your money values were, would you know how to answer? Or would you find yourself searching for a response and coming up blank? Our values are a key part of who we are, yet we often don’t take the time to intentionally think about, define, and understand themespecially when it comes to money. For anyone looking to transform their relationship with finances, figuring out your money principles is a great first step.

Abnormal Returns

JANUARY 9, 2025

Markets Why the CAPE ratio should be higher today than it was in the past. (theirrelevantinvestor.com) What explains the big divergence between the U.S. and European stock market returns? (albertbridgecapital.com) Finance The stock market is getting more concentrated, and so are actively managed portfolios. (morningstar.com) Sell-side equity research ranks were in decline, even before the introduction of AI.

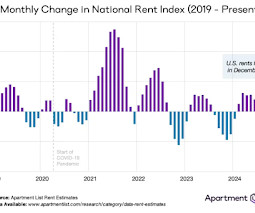

Calculated Risk

JANUARY 7, 2025

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year Brief excerpt: Another monthly update on rents. Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure. Welcome to the January 2025 Apartment List National Rent Report.

Wealth Management

JANUARY 8, 2025

Tax reform is on deck for the new Congress.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

MainStreet Financial Planning

JANUARY 10, 2025

A quote from one of my favorite books, The Little Prince by Antoine de Saint-Exupery says, A goal without a plan is just a wish. As we enter 2025, its the perfect moment to take stock of your financial journey and map out your path for the year ahead. Whether you’re focused on building a retirement fund, saving for a big purchase, or simply improving your financial habits, setting clear, realistic goals and crafting a solid plan are the keys to success.

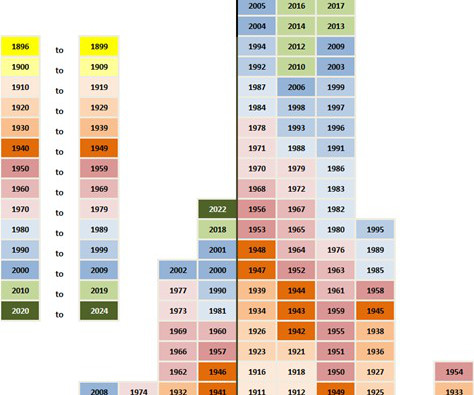

Alpha Architect

JANUARY 6, 2025

Advisors and managers will have to adopt a more nuanced view of risk as recognition of the frequency of equity underperformance becomes widespread. Stocks aren’t always the best in the long-run was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Calculated Risk

JANUARY 8, 2025

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in December A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to December 2019 for each local market (some 2019 data is not available). This is the first look at several early reporting local markets in December.

Wealth Management

JANUARY 9, 2025

The additions bring Savvys total number of advisors to 40 and assets under management to more than $1 billion.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

NAIFA Advisor Today

JANUARY 6, 2025

Tom Schmidt, CFBS CLTC LACP s story is one of resilience, adaptability, and unwavering dedication. From an unconventional start in the life insurance business to becoming a highly successful financial professional, Tom has navigated a career filled with challenges and triumphs. Over the decades, he has built enduring relationships with clients, many of whom have been with him for over 30 years.

Million Dollar Round Table (MDRT)

JANUARY 5, 2025

By Antoinette Tuscano, MDRT senior content specialist When clients dont understand what you can offer them and object, theyre not saying no to you. Instead, theyre reacting to their biases. As a financial advisor, you can ask clients questions and discover the bias behind their objections. Find out how these MDRT members ask questions that challenge clients assumptions about passing on generational wealth and legacy planning.

Calculated Risk

JANUARY 8, 2025

From ADP: ADP National Employment Report: Private employers added 122,000 jobs in December The labor market downshifted to a more modest pace of growth in the final month of 2024, with a slowdown in both hiring and pay gains. Health care stood out in the second half of the year, creating more jobs than any other sector. emphasis added This was below the consensus forecast of 143,000.

Wealth Management

JANUARY 10, 2025

A survey conducted in October by Ocorian found higher-for-longer rates are impacting investment hold period expectations.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Let's personalize your content