The Magic Phrase to Never Lose The Sale

Advisor Perspectives

JANUARY 7, 2025

In the rush to secure a new client, many advisors instinctively push for momentum during the sales conversation, often feeling the pressure to keep things moving forward.

Advisor Perspectives

JANUARY 7, 2025

In the rush to secure a new client, many advisors instinctively push for momentum during the sales conversation, often feeling the pressure to keep things moving forward.

Nerd's Eye View

JANUARY 10, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the "Social Security Fairness Act" was signed into law this week, eliminating the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) provisions, which previously reduced the Social Security benefits of individuals who worked in both "covered" (jobs for which they paid into the Social Security system) and "non-covered" (those in which they didn't,

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

JANUARY 8, 2025

Podcasts Ryan Morrissey talks with Larry Swedroe author of "Enrich Your Future: Keys to Successful Investing." (youtube.com) Peter Lazaroff on the need for professional help in retirement planning. (peterlazaroff.com) Katie Gatti Tassin talks with Dana Miranda author of "You Don't Need a Budget." (podcast.moneywithkatie.com) The Purpose Code Why you should read "The Purpose Code: How to Unlock Meaning, Maximize Happiness, and Leave a Lasting Legacy" by Jordan Grumet.

The Big Picture

JANUARY 8, 2025

SPOTIFY EMBED St. Vincent – Digital Witness [link] Digital witnesses, what’s the point of even sleeping? If I can’t show it, if you can’t see me What’s the point of doing anything? This is no time for confessing At The Money: with Matt Hougan on Crypto Technology (January 8, 2025) Are you crypto-curious? Are you interested in owning some bitcoin, Ethereum, or other crypto-coins?

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

Wealth Management

JANUARY 10, 2025

BofA announced it hired Ed Riley and Jessica Mullin several days after unveiling its new advisory group for ultra-high-net-worth clients based out of its Merrill Wealth division.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

JANUARY 5, 2025

Markets The 2020s has seen nothing but big market moves. (awealthofcommonsense.com) 30-year mortgage rates are at a six-month high. (axios.com) Strategy Don't let dividends take the wheel of your portfolio. (downtownjoshbrown.com) Or your expectations for the Fed. (tker.co) Companies Good luck making a positive case for an Intel ($INTC) turnaround. (wsj.com) Crowdstrike ($CRWD) stock has bounced back from its July outage.

The Big Picture

JANUARY 4, 2025

The weekend is here! Pour yourself a mug of Colombia Tolima Los Brasiles Peaberry Organic coffee, grab a seat outside, and get ready for our longer-form weekend reads: AI Wants More Data. More Chips. More Real Estate. More Power. More Water. More Everything : Businesses, investors and society brace for a demand shock from artificial intelligence. ( Bloomberg ) Its the Most Indispensable Machine in the Worldand It Depends on This Woman : I got a rare look at the one tool responsible for all the

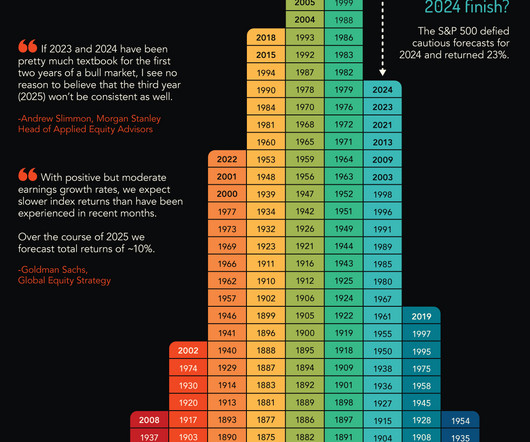

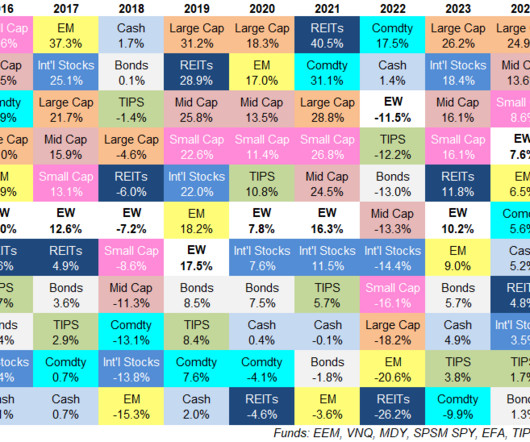

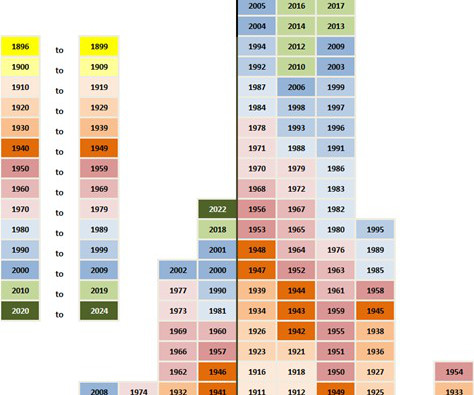

A Wealth of Common Sense

JANUARY 7, 2025

The first asset allocation quilt I created for this site covered the ten-year period from 2005-2014. Those returns look nothing like the last 10 years which is the whole point of this exercise. Here’s the latest quilt: Some observations: Inflation outperformed TIPS.The average inflation rate over the past 10 years was around 2.9% annually. Treasury-inflation protected securities were up 2.1% annually over the sam.

Nerd's Eye View

JANUARY 9, 2025

While financial advisors offer valuable services for their clients, it can sometimes be challenging to gauge how much clients actually value those services. On one hand, a client's willingness to pay an ongoing fee for financial advice suggests that they find the advisor's services worthwhile. On the other hand, the term "financial advice" often refers to much more than asset allocation and wealth management.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Abnormal Returns

JANUARY 5, 2025

Top clicks this week The growth in the Microstrategy ETF ecosystem is unprecedented. (on.ft.com) What's behind the slowdown in Chinese productivity? (noahpinion.blog) The proposed Strive Bitcoin Bond ETF will invest in the debt of companies buying Bitcoin. (etf.com) 2025 is setting up to be a consequential year for the Vanguard Group. (riabiz.com) Portfolio simplicity keeps paying off.

The Big Picture

JANUARY 10, 2025

This week, we speak with Brian Hurst , the Founder and Chief Investment Officer of ClearAlpha. Prior to founding ClearAlpha, Brian spent 21 years at AQR Capital Management as a portfolio manager, researcher, head of trading, and the firm’s first non-founding Partner. He was also Cliff Asness’ first hire at GSAM. Hurst was instrumental in designing and implementing AQR’s trading platform.

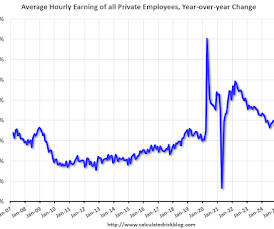

Calculated Risk

JANUARY 10, 2025

The headline jobs number in the December employment report was well above expectations, however, October and November payrolls were revised down by 8,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%. Earlier: December Employment Report: 256 thousand Jobs, 4.1% Unemployment Rate Prime (25 to 54 Years Old) Participation Since the overall participation rate is impacted by both cyclical (recession) and demograp

Nerd's Eye View

JANUARY 6, 2025

Welcome to the January 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that Orion, the "all-in-one" advisor technology platform, has acquired Summit Wealth Systems (and its founder Reed Colley, who previously built performance reporting platform Black Diamond), a client port

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Abnormal Returns

JANUARY 6, 2025

Advisers There is no shortage of movement among RIA C-suites. (riabiz.com) The case for delaying Social Security claiming. (thinkadvisor.com) A Q&A with Preston D. Cherry author of Wealth in the Key of Life. (thinkadvisor.com) How advisers can facilitate money discussions with clients before they get married. (thinkadvisor.com) Rising insurance costs are complicating the move for the wealthy to Florida and the like.

Clever Girl Finance

JANUARY 10, 2025

If someone asked what your money values were, would you know how to answer? Or would you find yourself searching for a response and coming up blank? Our values are a key part of who we are, yet we often don’t take the time to intentionally think about, define, and understand themespecially when it comes to money. For anyone looking to transform their relationship with finances, figuring out your money principles is a great first step.

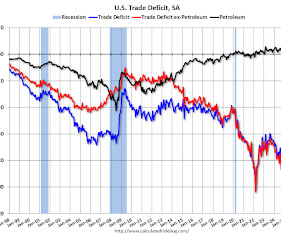

Calculated Risk

JANUARY 7, 2025

The Census Bureau and the Bureau of Economic Analysis reported : The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $78.2 billion in November , up $4.6 billion from $73.6 billion in October, revised. November exports were $273.4 billion, $7.1 billion more than October exports. November imports were $351.6 billion, $11.6 billion more than October imports. emphasis added Click on graph for larger image.

Nerd's Eye View

JANUARY 7, 2025

Welcome everyone! Welcome to the 419th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Peter Krull. Pete is the Director of Sustainable Investing of Earth Equity Advisors, an RIA based in Asheville, North Carolina, that oversees approximately $200 million in assets under management for 250 client households. What's unique about Pete, though, is how he has grown his firm by exploring with clients how they can align their portfolios with their own personal values,

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Wealth Management

JANUARY 10, 2025

A survey conducted in October by Ocorian found higher-for-longer rates are impacting investment hold period expectations.

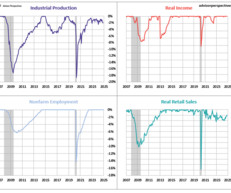

Advisor Perspectives

JANUARY 10, 2025

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Calculated Risk

JANUARY 6, 2025

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate Increased in Q4; Office Vacancy Rate at Record High A brief excerpt: From Moodys Analytics Economists: Multifamily Continued to Defy the Supply Shock, Offices Vacancy Rate Broke Another Record, Retail Rents Drift Higher with Tight Supply, And Industrial Maintains Status Quo Amid record-level inventory growth, average vacancy rate edged up 10 bps in each of the last two quarters and finished 2024 at 6.1%, 40 bps

Abnormal Returns

JANUARY 9, 2025

Markets Why the CAPE ratio should be higher today than it was in the past. (theirrelevantinvestor.com) What explains the big divergence between the U.S. and European stock market returns? (albertbridgecapital.com) Finance The stock market is getting more concentrated, and so are actively managed portfolios. (morningstar.com) Sell-side equity research ranks were in decline, even before the introduction of AI.

Speaker: Abdi Ali, Sr. Lease Accounting Consultant

Join this insightful webinar with industry expert Abdi Ali, who will discuss the challenges that can arise from managing lease accounting with spreadsheets! He will share real-world examples of errors, compliance issues, and risks that may be present within your spreadsheets. Learn how these tools, while useful, can sometimes lead to inefficiencies that affect your time, resources, and peace of mind.

Wealth Management

JANUARY 6, 2025

Ukrainian farmland could offer a chance to diversify your portfolio while fueling the recovery of a nation.

The Big Picture

JANUARY 5, 2025

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: The Truth About Musk, From His Biographer : A viral Bluesky thread introduced tens of thousands around the world to a first glimpse of a forthcoming biography of Elon Musk. Herein a single essayis some of what the world just learned. ( Proof ) The California Job-Killer That Wasnt : The state raised the minimum wage for fast-food workersand employment kept rising.

Calculated Risk

JANUARY 8, 2025

From the Fed: Minutes of the Federal Open Market Committee, December 1718, 2024. Excerpt: With regard to the outlook for inflation, participants expected that inflation would continue to move toward 2 percent, although they noted that recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated.

Advisor Perspectives

JANUARY 8, 2025

The AI boom of the past two years has largely been a two-horse race. Alphabet Inc.’s Google and Microsoft Corp.-funded OpenAI have duked it out for customers, while Amazon.com Inc. and Meta Platforms Inc. have nibbled at the margins for market share.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Wealth Management

JANUARY 8, 2025

Tax reform is on deck for the new Congress.

NAIFA Advisor Today

JANUARY 6, 2025

Tom Schmidt, CFBS CLTC LACP s story is one of resilience, adaptability, and unwavering dedication. From an unconventional start in the life insurance business to becoming a highly successful financial professional, Tom has navigated a career filled with challenges and triumphs. Over the decades, he has built enduring relationships with clients, many of whom have been with him for over 30 years.

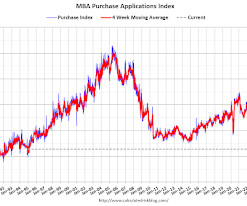

Calculated Risk

JANUARY 8, 2025

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Associations (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2025. This weeks results include an adjustment for the New Years holiday. The Market Composite Index, a measure of mortgage loan application volume, decreased 3.7 percent on a seasonally adjusted basis from one week earlier.

Let's personalize your content