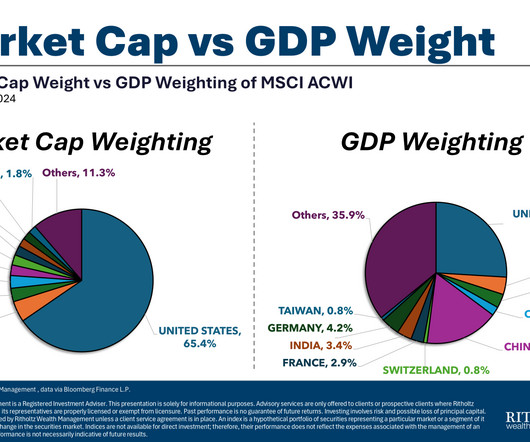

U.S. Markets Are Swallowing the Rest of the World

A Wealth of Common Sense

DECEMBER 3, 2024

The United States is the envy of the world in terms of financial markets and economic performance. Ruchir Sharma at The Financial Times outlines how this is impacting capital flows: Global investors are committing more capital to a single country than ever before in modern history. And the dollar, by some measures, trades at a higher value than at any time since the developed world abandoned fixed exchange rates 50 years.

Let's personalize your content