When The 4% Rule Isn't 4%

Random Roger's Retirement Planning

NOVEMBER 20, 2024

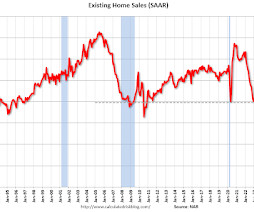

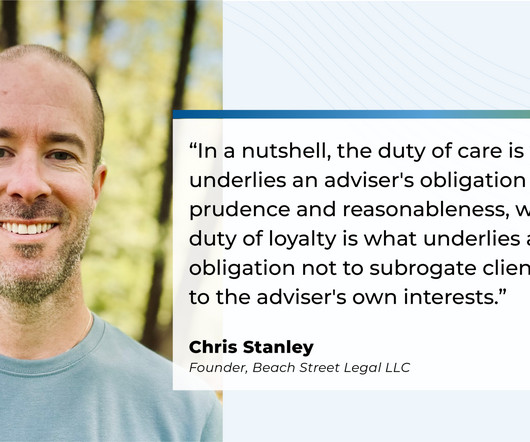

Bill Bengen, known for deriving the 4% rule sat for a podcast with Sam Dogen , a well known FIRE proponent and blogger. The 4% rule is generally the accepted standard for a safe withdrawal rate in retirement to ensure the assets last for 30 years. Listen to the podcast. Their conversation was very illuminating. Get ready to be very surprised. Bengen retired as a financial advisor in 2013 but he also considers himself a researcher.

Let's personalize your content