User Agreements: The Hidden Risks in Third-Party Integrations

Wealth Management

AUGUST 30, 2024

Advisors need to be diligent when it comes to their third-party technology and terms of service.

Wealth Management

AUGUST 30, 2024

Advisors need to be diligent when it comes to their third-party technology and terms of service.

Abnormal Returns

AUGUST 25, 2024

Top clicks this week 15 sure-fire ways to lose money in the markets. (awealthofcommonsense.com) Successful investors have a long time horizon. (awealthofcommonsense.com) Stop paying attention to stuff that doesn't matter. (behaviouralinvestment.com) What do you get when you buy a share of Berkshire Hathaway ($BRK.B)? (sherwood.news) It's not your imagination, market moves are getting faster.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans. Which wasn't necessarily a big issue back when most clients hired advisors after they had already retired and were able to roll over their employer plans into an IRA managed by the advisor; but as advisors have increasingly taken on working-age clients (and t

Calculated Risk

AUGUST 27, 2024

CR Note: On vacation. I will return on Thursday, Sept 5th (If I don't get lost!) In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk. From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Wealth Management

AUGUST 28, 2024

After more than 20 years in the wealthtech business, Orion's president of advisor technology says he's taking a break from the industry. He’ll stay on as an advisor to Orion’s CEO for the rest of this year.

Abnormal Returns

AUGUST 28, 2024

Podcasts Peter Lazaroff on why you don't have to pick stocks to be successful. (peterlazaroff.com) Barry Ritholtz talks with Prof. Aswath Damodaran about the lifecycle of companies. (ritholtz.com) Khe Hy talks with Rachel Feintzeig about the ins and outs of taking a sabbatical. (youtube.com) Retirement How to plan for retirement. (humbledollar.com) The case against downsizing in retirement.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

AUGUST 24, 2024

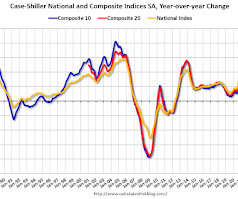

I'll be out of contact from August 20th until Sept 4th. I'll be back for the August employment report. The key indicators this week include the second estimate of Q2 GDP, Personal Income and Outlays for July, and Case-Shiller house prices for June. -- Monday, August 26th -- 8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data. 8:30 AM: Durable Goods Orders for July from the Census Bureau. 10:30 AM: Dallas Fed Survey of Manufacturing Activity for Augus

Wealth Management

AUGUST 30, 2024

After a sluggish first six months of 2023, publicly-traded REIT total returns are up more than 10% in the third quarter and by double-digits year-to-date.

Abnormal Returns

AUGUST 24, 2024

EVs People overestimate how much they drive: a week with a Kia EV9. (wsj.com) Can solar energy be used to power an EV? (goodgoodgood.co) EV adoption by state. (visualcapitalist.com) Energy Natural gas is plentiful. (wsj.com) Everything that is holding back nuclear power in the U.S. (freethink.com) How the growth in renewables in California is playing out.

Nerd's Eye View

AUGUST 30, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent benchmarking study suggests that a number of RIAs are looking to move 'upmarket' and work with wealthier clients by expanding their service menu to include family office services, investment banking, and/or trust services.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

The Big Picture

AUGUST 28, 2024

Why Fees Really Matter with Eric Balchunas , Bloomberg Intelligence (Nov 8, 2023) Fees matter more than you think. Over the long term, the difference between a few basis points can turn into real, big money. On this episode, Bloomberg Intelligence ETF analyst Eric Balchunas joins us to discuss how fees can significantly impact your portfolio. ~~~ About this week’s guest: Eric Balchunas is been an ETF Analyst for Bloomberg Intelligence.

Wealth Management

AUGUST 30, 2024

Advisory firms grew 5.7% last year, according to a new study by The Ensemble Practice. It’s a wakeup call for firms to make marketing a vital function.

Abnormal Returns

AUGUST 26, 2024

Strategy Why pessimism sells on Wall Street. (optimisticallie.com) You can't just lock in money market rates. (obliviousinvestor.com) Finance Building a better global market index. (ft.com) The big index fund managers have a problem on their hands. (humbledollar.com) Ukraine How Ukraine successfully invaded Kursk. (ig.ft.com) How Ukraine defeated Russia in the Black Sea.

Nerd's Eye View

AUGUST 26, 2024

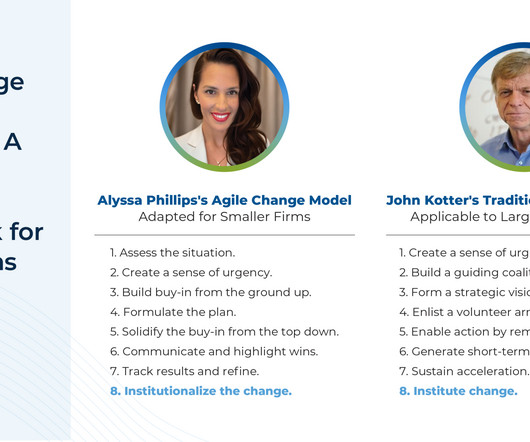

For most of its history, the financial advice industry has been very slow to change. Over the last 50 years, even the most substantial changes to occur – such as the movement away from commissions and towards fee-based compensation, and the shift from an investment-centric approach to more holistic financial planning – have taken place over decades and, in many cases, are still ongoing.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

A Wealth of Common Sense

AUGUST 27, 2024

The firehose of information we’re afforded these days is a double-edged sword. There is an abundance of news, analysis, charts and opinions but it can all be overwhelming if you don’t have an effective filter in place. When it comes to finance I have some filters to help understand which types of sources and people to safely ignore. These are the types of financial voices and data I immediately ignore: Pricing.

Wealth Management

AUGUST 27, 2024

Once the deal closes later this year, the combined RIA will have $32 billion in assets under management.

Abnormal Returns

AUGUST 30, 2024

The biz It's not your imagination. Podcasts are running more ads. (wsj.com) The Kelce brothers just signed a big deal for their podcast with Amazon's ($AMZN) Wondery. (variety.com) How Apple ($AAPL) has fumbled its lead in podcasting. (spyglass.org) Economy Cameron Passmore and Benjamin Felix talk with Kyla Scanlon, author of "In This Economy?: How Money & Markets Really Work.

Nerd's Eye View

AUGUST 27, 2024

Welcome everyone! Welcome to the 400th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Mark Tibergien. Mark is the former CEO of Pershing Advisor Solutions, a former Principal with Moss Adams Consulting, and is a longtime practice management consultant and thought leader in the financial advisory industry. What's unique about Mark, though, is how, over the course of a 50-year career in financial services, he has seen firsthand the evolution of the financial advi

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

A Wealth of Common Sense

AUGUST 25, 2024

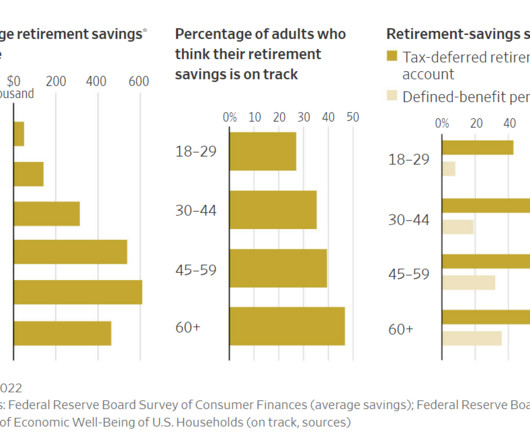

Household net worth is at all-time highs. Housing prices are at all-time highs. The stock market is near all-time highs. But not everyone is feeling great about their finances. Here’s a look at average retirement balances by age along with the share of each cohort who feels like they’re on the right track for retirement: The good news is confidence tends to increase as you age.

Wealth Management

AUGUST 27, 2024

The recent outperformance in low-volatility ETFs marks a reversal of factor performance trends.

Abnormal Returns

AUGUST 25, 2024

Strategy Another star manager, another disaster for investors. (awealthofcommonsense.com) Just because something is an index fund doesn't mean its a good investment. (wsj.com) Most market arguments are because of differing time frames. (tker.co) Why you likely don't need to focus on dividend paying stocks. (humbledollar.com) Companies Complexity is killing Starbucks ($SBUX).

Advisor Perspectives

AUGUST 26, 2024

As tough as financial advisors claim to be, we still get nervous about “firing” clients, too. When we say “graduate,” that is our delicate way of handling an uncomfortable situation. It’s a cheap, but effective way to massage the misgivings that we have about terminating client relationships.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

A Wealth of Common Sense

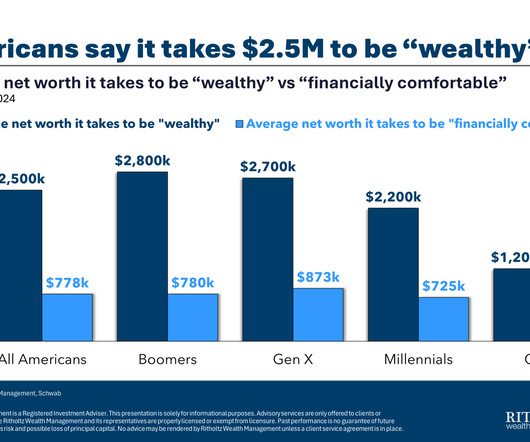

AUGUST 30, 2024

Finance definitions are tough to pin down because money is often in the eye of the beholder. The goalposts are always moving as you age and mature, and tastes change. Your perception of wealth can be impacted by: How you were raised. The wealth and material possessions of your peers. Your lifestyle. Your contentment with what you have. How your circumstances change over time.

Wealth Management

AUGUST 30, 2024

According to the settlement letter, the brokerage regulator argued Raymond James didn’t properly check that personnel were filling out forms to ensure that written customer complaints were submitted to FINRA quarterly.

Abnormal Returns

AUGUST 27, 2024

Quant stuff Just how much financial analysis can AI already do? (sparklinecapital.com) A look at three different backtesting methodologies. (papers.ssrn.com) Index funds On the performance of stocks kicked out of major indices. (researchaffiliates.com) Why do index funds change benchmarks? (morningstar.com) Private equity A look at the dispersion in private fund returns.

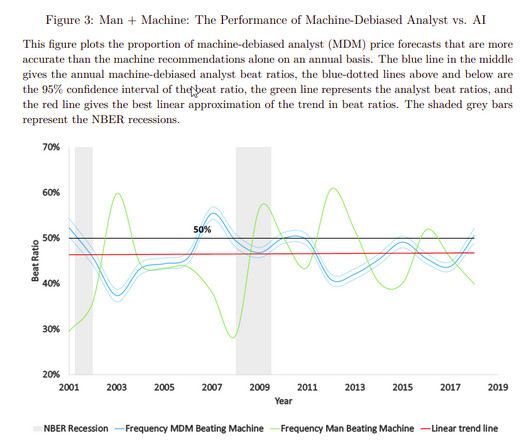

Alpha Architect

AUGUST 26, 2024

An AI analyst trained to digest corporate disclosures, industry trends, and macroeconomic indicators surpasses most analysts in stock return predictions. AI wins when information is transparent but voluminous. Humans provide significant incremental value in “Man + Machine,” which also substantially reduces extreme errors. From Man vs. Machine to Man + Machine: The Art and AI of Stock Analyses was originally published at Alpha Architect.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

A Wealth of Common Sense

AUGUST 29, 2024

A reader asks: My asset allocation has been pretty conservative since the market run-up in 2020. My basic thesis is that the market is overvalued, and the only way I can keep myself in equities at all is to have a 60/40 stock/bond allocation. One thing I like about having the 60/40 split is that it gives me the option of changing to a more aggressive allocation if stock valuations fall.

Wealth Management

AUGUST 27, 2024

What can make or break a successful transition?

Abnormal Returns

AUGUST 28, 2024

Markets The Fed's balance sheet continues to shrink. (sherwood.news) Money is flowing into the iShares 20+ Year Treasury Bond ETF ($TLT). (ft.com) The rise of Nvidia ($NVDA) is simply unprecedented. (sherwood.news) Companies Is any media companies actually investable? (hollywoodreporter.com) Will Japanese customers abide a takeover of 7-Eleven? (washingtonpost.com) Lego is still crushing it.

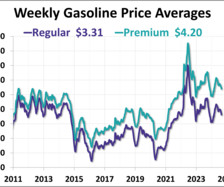

Advisor Perspectives

AUGUST 27, 2024

Gas prices fell to their lowest level in 6 months this past week. As of August 26th, the price of regular and premium gas decreased 7 cents and 5 cents from the previous week, respectively. The WTIC end-of-day spot price for crude oil closed at $77.42, up 5.1% from last week.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content