Sending (Private) Client Newsletters: How Advisors Can Do It Effectively To Reinforce Value

Nerd's Eye View

JANUARY 15, 2024

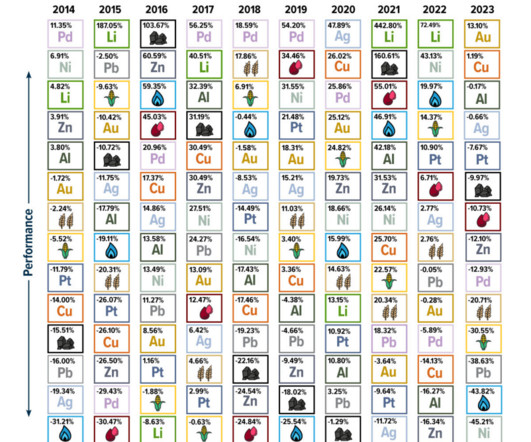

For financial advisors, an ongoing client service model often means finding ways to keep clients engaged and progressing toward their goals outside of the 1 or 2 typical client review meetings each year. For clients, more frequent communication can be a source of behavioral coaching and helpful information that can better equip them to stay the course through rocky markets.

Let's personalize your content