2025 Tax Brackets, Social Security Benefits Increase, and Other Inflation Adjustments

MainStreet Financial Planning

NOVEMBER 25, 2024

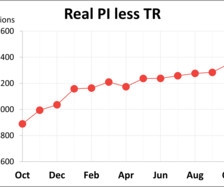

The IRS and Social Security Administration recently announced changes for 2025. Here are some highlights: The SSA has announced that benefit checks will rise 2.5% in 2025. Social Security and SSI beneficiaries are normally notified by mail starting in early December about their new benefit amount. The fastest way to find out your new benefit amount is to access your personal my Social Security account to view the COLA notice online.

Let's personalize your content