Can O.J. Simpson’s Executor Stiff-Arm the Goldman Family?

Wealth Management

APRIL 15, 2024

Or will the family be able to squeeze the over $33 million they’re owed in civil judgments out of The Juice’s estate?

Wealth Management

APRIL 15, 2024

Or will the family be able to squeeze the over $33 million they’re owed in civil judgments out of The Juice’s estate?

Calculated Risk

APRIL 15, 2024

Altos reports that active single-family inventory was up 2.6% week-over-week. Inventory bottomed in mid-February this year, as opposed to mid-April in 2023, and inventory is now up 5.6% from the February bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of April 12th, inventory was at 526 thousand (7-day average), compared to 513 thousand the prior week.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

APRIL 14, 2024

Also on the site Some interesting developments in the financial media space. (abnormalreturns.com) Top clicks this week These 15 stocks destroyed the most value in the past decade. (morningstar.com) It's way too easy to mislead someone with charts. (awealthofcommonsense.com) Two things you probably don't need to worry about, including index concentration.

Nerd's Eye View

APRIL 19, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that CFP Board announced that it has crossed the milestone of 100,000 CFP professionals in the United States, and despite having just celebrated its 50th anniversary last year, just set a record high in the number of advisors sitting for the CFP exam this March, reflecting the value many financial advisors and consumers place on the brand, including the requirements to obtain i

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

APRIL 16, 2024

AlphaSimplex's Katy Kaminski describes how the firm uses data to measure where the markets are moving.

Calculated Risk

APRIL 17, 2024

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 12, 2024. The Market Composite Index, a measure of mortgage loan application volume, increased 3.3 percent on a seasonally adjusted basis from one week earlier.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

APRIL 17, 2024

After advisors do all of the work of bringing on a new client (Marketing! Prospecting! Onboarding! Compliance!), it can sometimes feel natural to let the relationship go into "maintenance mode". And while all may appear well on the surface – the client rarely contacts the advisor with problems but they show up for every annual meeting – they may actually be feeling quite disengaged with the financial planning services being provided.

Wealth Management

APRIL 17, 2024

The bill was expedited after Iran attacked Israel over the weekend.

Calculated Risk

APRIL 15, 2024

On a monthly basis, retail sales were up 0.7% from February to March (seasonally adjusted), and sales were up 4.0 percent from March 2023. From the Census Bureau report : Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent from the previous month , and up 4.0 percent above March 2023.

Abnormal Returns

APRIL 16, 2024

Strategy Joe Wiggins, "It is important to remember that behavioural finance would be redundant if it were easy; if it wasn’t hard it wouldn’t be useful." (behaviouralinvestment.com) Investing requires a measure of optimism in the future. (ofdollarsanddata.com) Fund management 15 more ideas from Seth Klarman's "Margin of Safety" including 'Investment must be thought of as more than stock selection or making a series of solid individual investment decisions.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Nerd's Eye View

APRIL 15, 2024

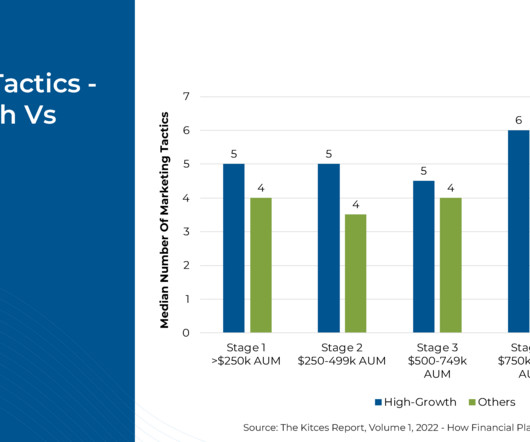

Growing an advisory firm is no easy task – and advisors who start firms often have few resources to spare (beyond their own knowledge and time), face huge to-do lists, and are required to wear a number of hats. Foremost among their responsibilities is business development, which compels them to seek out prospects who will eventually become clients (so that they can grow their firms, allocate resources accordingly, and do even more financial planning!).

Wealth Management

APRIL 16, 2024

KKR logged $3 billion in sales in products aimed for the private wealth channel—up from $400 million in sales per quarter in 2022. Morningstar published an explainer on the growing world of interval funds. These are among the investment must reads we found this week for wealth advisors.

Calculated Risk

APRIL 19, 2024

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen" Excerpt: From the NMHC: Apartment Market Continues to Loosen Amidst Worsening Financing Conditions Apartment market conditions continued to weaken in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for April 2024.

Abnormal Returns

APRIL 19, 2024

Markets TIPS are on sale. Time to buy. (morningstar.com) Two reasons why yields are higher this year. (carsongroup.com) The stock-bond correlation has flipped positive. (mrzepczynski.blogspot.com) Books Why you should read Rob Copeland's "The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a Wall Street Legend." (advisorperspectives.com) A review of "Enrich Your Future: The Keys to Successful Investing" by Larry Swedroe.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

The Big Picture

APRIL 13, 2024

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • This is the most consequential technology in America: (Spoiler alert: It’s YouTube.) It’s the most popular social app and music service, the healthiest economy on the internet and AI training fuel. ( Washington Post ) • What I Learned from Daniel Kahneman.

Wealth Management

APRIL 19, 2024

How to equip inheritors to handle a large influx of wealth.

Calculated Risk

APRIL 18, 2024

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 4.19 million SAAR in March Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 3.7% year-over-year compared to March 2023. This was the thirty-first consecutive month with sales down year-over-year.

Abnormal Returns

APRIL 17, 2024

Podcasts Roger Whitney talks retirement challenges with Christine Benz. (youtube.com) Sam Parr talks with 'Ryan' and 'Jeff' about the reality of retiring early. (podcasts.apple.com) Peter Lazaroff talks with Taylor Schulte and Benjamin Brandt about the new Retirement Podcast Network. (peterlazaroff.com) Justin Castelli talks curiosity and more with Tom Morgan.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

The Big Picture

APRIL 13, 2024

I wanted to share a few thoughts about the new podcast we formally launched in December of last year, At the Money. The idea behind the show: Short, focused conversations with experts about any and all issues that affect you and your money, from spending it to investing it. Think of it as a guided tour of key ideas, sherpaed with the experts who I believe add enormous value to our understanding of how humans do behave — and should behave — around money.

Wealth Management

APRIL 15, 2024

Most ETF issuers have agreed to pay a new maintenance fee to Fidelity, leaving only a handful that investors will have to pay $100 service fees to purchase.

Calculated Risk

APRIL 16, 2024

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up 22% Year-over-year in March; Multi-Family Starts Down Sharply A brief excerpt: Total housing starts in March were well below expectations, however, starts in January and February were revised up. The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Abnormal Returns

APRIL 16, 2024

Asset allocaiton Is regret a better measure to target for portfolio allocations? (blogs.cfainstitute.org) Why asset allocation is sensitive to goals and assumptions. (priceactionlab.com) The case against a cryptocurrency allocation. (insights.finominal.com) Global macro hedge funds are mid. (klementoninvesting.substack.com) Corporate finance Are family-controlled firms more at-risk of price crashes?

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Carson Wealth

APRIL 19, 2024

Congratulations, recent college graduate! You’ve worked hard to earn your degree, and now you’re ready to embark on the next chapter of your life. This is an exciting time – one filled with lots of changes, like starting a new career and learning how to manage living on your own. As you transition into the “real” world, one of the most crucial skills you can develop is managing your finances effectively.

Wealth Management

APRIL 18, 2024

The questions advisors should ask when considering private equity investments for their clients.

Calculated Risk

APRIL 17, 2024

Fed's Beige Book Overall economic activity expanded slightly , on balance, since late February. Ten out of twelve Districts experienced either slight or modest economic growth—up from eight in the previous report, while the other two reported no changes in activity. Consumer spending barely increased overall, but reports were quite mixed across Districts and spending categories.

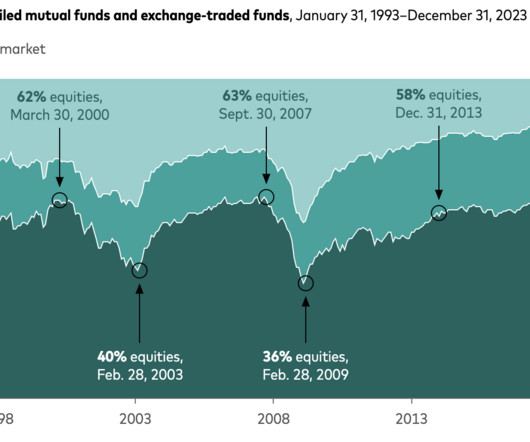

Abnormal Returns

APRIL 15, 2024

Podcasts Daniel Crosby talks about the unique needs of women and money with Lindsey Lewis. (standarddeviationspod.com) Christine Benz and Amy Arnott talk asset allocation and more with Matt Krantz. He is the personal finance and management editor at Investor’s Business Daily. (morningstar.com) The biz Why Dynasty Financial stands since putting plans for an IPO on ice.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

A Wealth of Common Sense

APRIL 19, 2024

How much money do you have to make to feel rich? It’s a subjective question. A lot depends on your lifestyle, where you live, how much you spend and save, your peer group, and your vulnerability to comparison. The comparison piece matters more than most are willing to admit. Wealth is relative. JP Morgan once said, “Comparison is the thief of joy.” It’s easy to say when you’re one of the weal.

Wealth Management

APRIL 18, 2024

Monaco Capital and Saling Simms have become the second and third firms to join Steward Partners’ new Legacy Division, established via acquisition late last year.

Calculated Risk

APRIL 17, 2024

Today, in the Calculated Risk Real Estate Newsletter: 4th Look at Local Housing Markets in March; California Home Sales Down 4.4% YoY in March A brief excerpt: The NAR is scheduled to release March existing home sales tomorrow, Thursday, April 18th at 10:00AM ET. The consensus is for 4.20 million SAAR, down from 4.38 million in February. Housing economist Tom Lawler expects the NAR to report sales of 4.23 million SAAR for March.

Abnormal Returns

APRIL 13, 2024

Hybrids Another sign that hybrid vehicles are a hot commodity. (heatmap.news) Things a potential hybrid buyer should keep in mind. (wsj.com) Plug-in hybrids help the environment if you actually plug them in. (advisorperspectives.com) Autos Tesla's ($TSLA) path to EV dominance has hit a speed bump. (wsj.com) Electric car companies are just car companies.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Let's personalize your content