Can You Live Off Dividends In Retirement?

Darrow Wealth Management

FEBRUARY 9, 2025

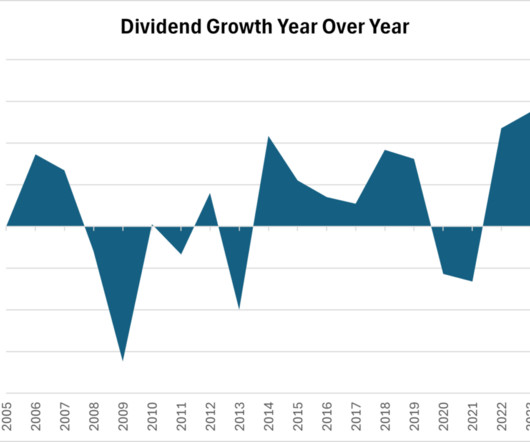

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income from dividends to cover lifestyle expenses. Over the last 30 years, the S&P 500’s average dividend yield was 1.98%. So historically, every $1 million invested would yield annual dividend income of $19,800 on average… before tax.

Let's personalize your content