The Non-Compete Revolution Begins

Wealth Management

JULY 29, 2024

RIAs are especially vulnerable to the potential changes stemming from the FTC’s rule.

Wealth Management

JULY 29, 2024

RIAs are especially vulnerable to the potential changes stemming from the FTC’s rule.

Calculated Risk

AUGUST 2, 2024

The headline jobs number in the July employment report was below expectations, and May and June payrolls were revised down by 29,000 combined. The participation rate increased, the employment population ratio decreased, and the unemployment rate increased to 4.3%. Construction employment increased 25 thousand and is now 645 thousand above the pre-pandemic level.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

JULY 28, 2024

Top clicks this week What is the best performing stock of all-time? (mebfaber.com) Three investment myths, debunked. (morningstar.com) Lessons learned from the best performing stocks of all-time. (awealthofcommonsense.com) For investors, inflation is THE enemy. (disciplinefunds.com) Ian Cassel, "Most big winners were ugly ducklings that transformed themselves into beautiful swans.

Nerd's Eye View

AUGUST 2, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that a Federal district court in Texas has put a stay on the effective date of the Department of Labor’s (DoL’s) new Retirement Security Rule (aka “Fiduciary Rule 2.0”), which had been scheduled to become effective in September, and related amendments to prohibited transaction exemptions.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Wealth Management

AUGUST 1, 2024

The finding is part of a broader Cerulli report examining the opportunities and challenges surrounding the use of alternative investments in the retail channel.

Calculated Risk

JULY 30, 2024

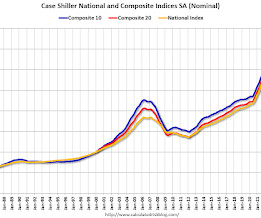

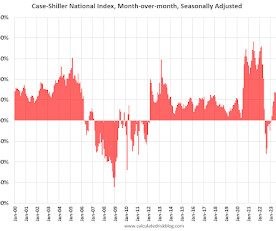

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Again Breaks Previous Month's All-Time High for May 2024 The S&P CoreLogic Case-Shiller U.S.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JULY 31, 2024

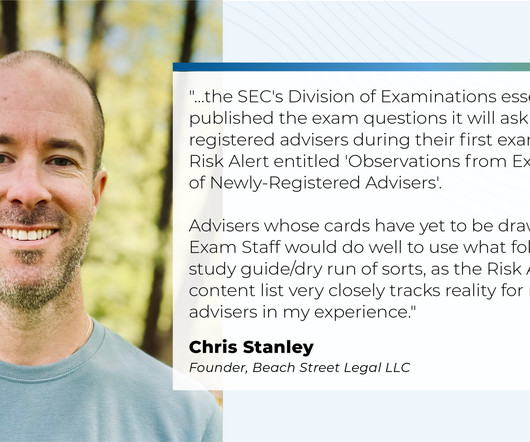

For SEC-registered financial advisors, the prospect of an upcoming examination by the SEC can be a source of high anxiety. This is especially the case with newly registered advisors or formerly state-registered advisors who recently became SEC-registered since they may be uncertain about how the examination process will work, what elements of the firm the SEC will dig into, or what information the advisor will need to provide to the examiners.

Wealth Management

JULY 31, 2024

The real-life succession story playing out among the Murdoch family.

Calculated Risk

JULY 31, 2024

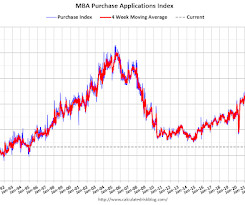

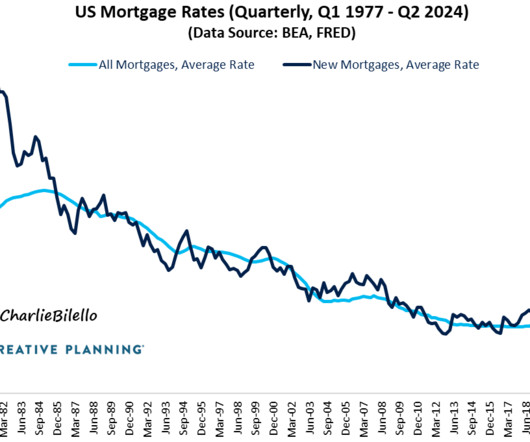

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending July 26, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 3.9 percent on a seasonally adjusted basis from one week earlier.

Abnormal Returns

AUGUST 2, 2024

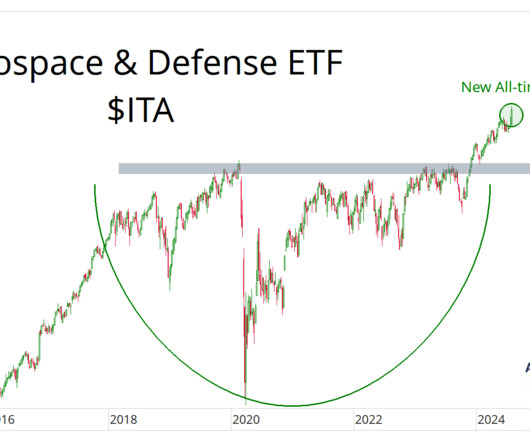

Markets Markets fear the Fed has missed their window to cut rates. (sherwood.news) High beta stocks are rolling over. (allstarcharts.com) August historically not been a great month for the stock market. (carsongroup.com) The story of QXO ($QXO) is a great lesson for investors. (wsj.com) Trading The best trading system is one that works for you. (allstarcharts.com) Why setting stops is so important psychologically.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Nerd's Eye View

JULY 29, 2024

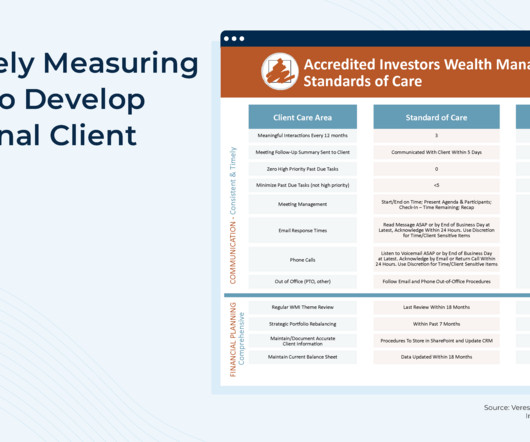

Most financial advisors strive to provide excellent client care and prioritize a systematic process to maintain regular communication with their clients both on a scheduled (e.g., annual meeting) and an "on demand" basis. And while individual advisors running solo firms are often able to intuitively sense when they're delivering their best, as they grow and scale their firms, that same advisor eventually goes from individually 'owning' every client relationship to sharing the workload with first

Wealth Management

JULY 30, 2024

They've expanded the number of possible portfolio constructions from 15 to 100 quintillion.

Calculated Risk

JULY 30, 2024

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 5.9% year-over-year in May; FHFA House Price Index Unchanged in May, up 5.7% YoY Excerpt: S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3-month average of March, April and May closing prices). May closing prices include some contracts signed in January, so there is a significant lag to this data.

Abnormal Returns

JULY 31, 2024

Bonds Bonds are doing okay in 2024, except for duration. (capitalspectator.com) Bonds drive markets. (allstarcharts.com) The case for central clearing of U.S. government bonds. (ft.com) Finance SPAC IPOs are back from the dead. (sherwood.news) PE fundraising is down in 2024. (institutionalinvestor.com) Companies Microsoft ($MSFT) capex spending has surged.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Nerd's Eye View

AUGUST 2, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that a Federal district court in Texas has put a stay on the effective date of the Department of Labor’s (DoL’s) new Retirement Security Rule (aka “Fiduciary Rule 2.0”), which had been scheduled to become effective in September, and related amendments to prohibited transaction exemptions.

Wealth Management

JULY 30, 2024

A new survey from Cerulli Associates found model portfolio providers are increasingly focused on offering custom options to keep their clients loyal.

Calculated Risk

AUGUST 1, 2024

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.9% Below 2022 Peak Excerpt: It has been 18 years since the bubble peak. In the May Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 73% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices).

Abnormal Returns

JULY 27, 2024

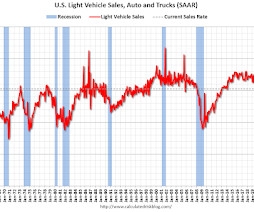

Autos Cars are rolling computers. How long will automakers update their software? (wired.com) Uninsured motorists are helping to drive up car insurance rates higher. (wsj.com) Automakers have been selling your driving data for (literally) pennies. (sherwood.news) The Tesla ($TSLA) Cybertruck is polarizing to say the least. (nytimes.com) Why convertibles are going out of style.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

The Big Picture

JULY 27, 2024

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • The Secret Battle for the Future of the Murdoch Empire : Rupert Murdoch, the patriarch, has moved to change the family’s irrevocable trust to preserve his media businesses as a conservative force. Several of his children are fighting back. ( New York Times ) • The world’s emotional status is actually pretty good, a new global report finds : But which country comes first in

Wealth Management

JULY 31, 2024

Getting clients financially and psychologically ready to exit.

Calculated Risk

JULY 27, 2024

The key report this week is the July employment report. Other key reports include Case-Shiller house prices for May, ISM manufacturing index and July vehicle sales. The FOMC meets this week and no change to the Fed Funds rate is expected. -- Monday, July 29th -- 10:30 AM: Dallas Fed Survey of Manufacturing Activity for July. -- Tuesday, July 30th -- 9:00 AM: S&P/Case-Shiller House Price Index for May.

Abnormal Returns

AUGUST 1, 2024

July 2024 How major asset classes performed in July 2024. (capitalspectator.com) The S&P SmallCap 600 was up 10.8% in July. (on.spdji.com) Rates The 10-year Treasury has dipped below 4.0% for the first time in awhile. (sherwood.news) Tether is benefiting greatly from elevated interest rates. (theblock.co) Fund management Bill Ackman pulled the IPO for Pershing Square USA.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Nerd's Eye View

JULY 31, 2024

For SEC-registered financial advisors, the prospect of an upcoming examination by the SEC can be a source of high anxiety. This is especially the case with newly registered advisors or formerly state-registered advisors who recently became SEC-registered since they may be uncertain about how the examination process will work, what elements of the firm the SEC will dig into, or what information the advisor will need to provide to the examiners.

Wealth Management

JULY 29, 2024

In his new book, the ‘father of life planning’ advocates for a broader fiduciary duty, one that extends to all institutions. Here’s how advisors play into that grand vision.

Calculated Risk

JULY 29, 2024

Altos reports that active single-family inventory was up 1.3% week-over-week. Inventory is now up 37.1% from the February seasonal bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of July 26th, inventory was at 677 thousand (7-day average), compared to 668 thousand the prior week. This is the highest level of inventory since June 2020 ; however, inventory is still far below pre-pandemic levels.

Abnormal Returns

JULY 29, 2024

Markets Commodities are back down to their lows of the year. (sherwood.news) Why forecasting is so difficult. (mrzepczynski.blogspot.com) Crypto Politicians are falling all over themselves to cater to the crypto crowd. (downtownjoshbrown.com) The U.S. government continues to move Silk Road Bitcoin. (coindesk.com) Finance Convertible bonds are having a moment this year.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

The Big Picture

AUGUST 2, 2024

This week, we speak with Lakshman Achuthan, co-founder of the Economic Cycle Research Institute. Achuthan met his mentor, Geoffrey H. Moore, at Columbia University in 1990; they formed ECRI with Anirvan Banerji in 1996. He serves on the board of governors for the Levy Economics Institute of Bard College. In 2004, he co-authored Beating the Business Cycle: How to Predict and Profit From Turning Points in the Economy.

Wealth Management

AUGUST 1, 2024

The LPL suit is similar to a class action complaint filed last month claiming the firm violated its duties to clients by allegedly making huge profits from the interest rates on cash sweep accounts.

Calculated Risk

AUGUST 1, 2024

The DOL reported : In the week ending July 27, the advance figure for seasonally adjusted initial claims was 249,000, an increase of 14,000 from the previous week's unrevised level of 235,000. The 4-week moving average was 238,000, an increase of 2,500 from the previous week's unrevised average of 235,500. emphasis added The following graph shows the 4-week moving average of weekly claims since 1971.

Abnormal Returns

JULY 29, 2024

Podcasts Josh and Michael talk with Alec Crawford, CEO of AI Risk, about the future of financial advice, how AI will be used by most advisors, and the critical role of AI cybersecurity in the financial industry (youtube.com) Michael Kitces talks with John Bowen, CEO and founder of CEG Worldwide and CEG Insights, about what makes advisory firms work.

Speaker: Duke Heninger, Partner and Fractional CFO at Ampleo & Creator of CFO System

Are you ready to elevate your accounting processes for 2025? 🚀 Join us for an exclusive webinar led by Duke Heninger, a seasoned fractional CFO and CPA passionate about transforming back-office operations for finance teams. This session will cover critical best practices and process improvements tailored specifically for accounting professionals.

Let's personalize your content