How “Probability Of Success” Differs Between One-Time And Ongoing Financial Plans

Nerd's Eye View

DECEMBER 21, 2022

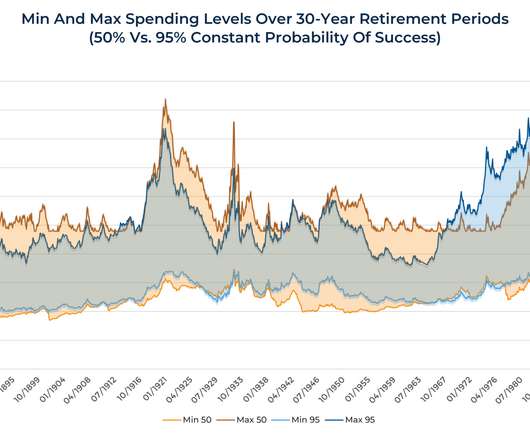

Monte Carlo simulations have become the dominant method for conducting financial planning analyses for clients and are a feature of most comprehensive financial planning software programs. By distilling hundreds of pieces of information into a single number that purports to show the percentage chance that a portfolio will not be depleted over the course of a client’s life, advisors often use this data point as the centerpiece when they present a financial plan.

Let's personalize your content