How Advisors Can Work With Attorneys To Drive Better Estate Planning Outcomes For Clients

Nerd's Eye View

APRIL 29, 2024

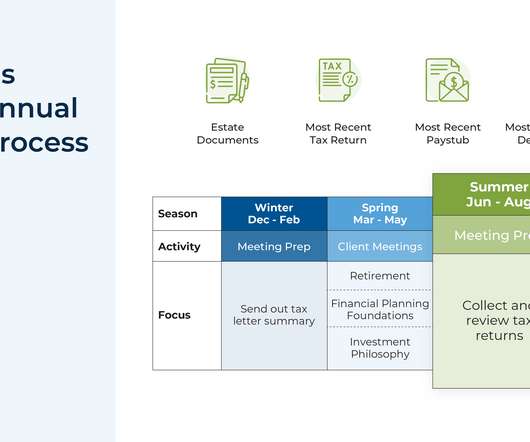

With this in mind, many financial advisors offer estate planning guidance to clients. However, because few advisors are also legal professionals (who can offer more detailed guidance and draft legal documents), many often collaborate with estate planning attorneys to ensure their clients' estate planning needs are met.

Let's personalize your content