The Close Relationship Between Financial Planning and Estate Planning

Wealth Management

AUGUST 12, 2024

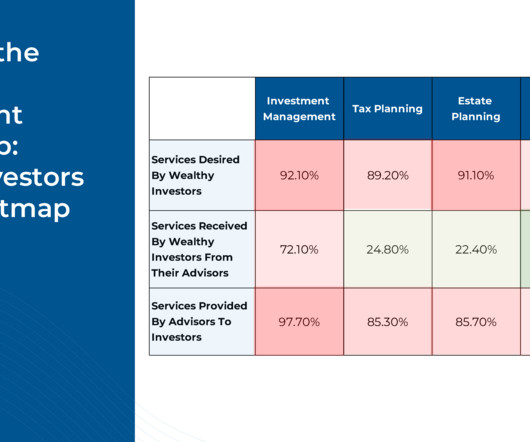

Estate planning and financial planning are two peas in a pod that are becoming inextricably tied.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 12, 2024

Estate planning and financial planning are two peas in a pod that are becoming inextricably tied.

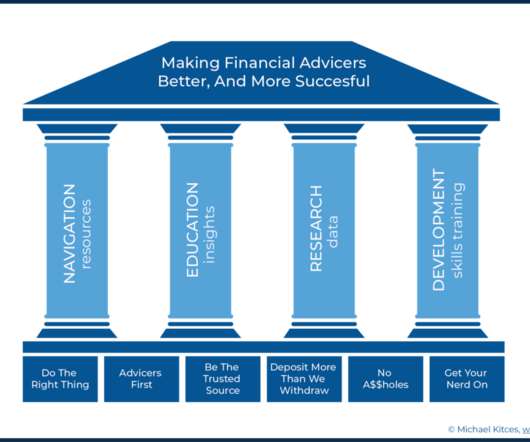

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

NOVEMBER 21, 2022

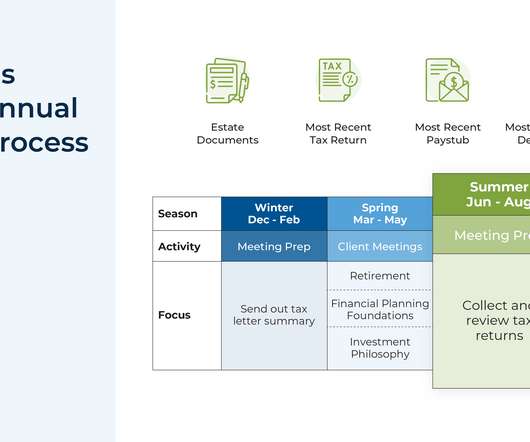

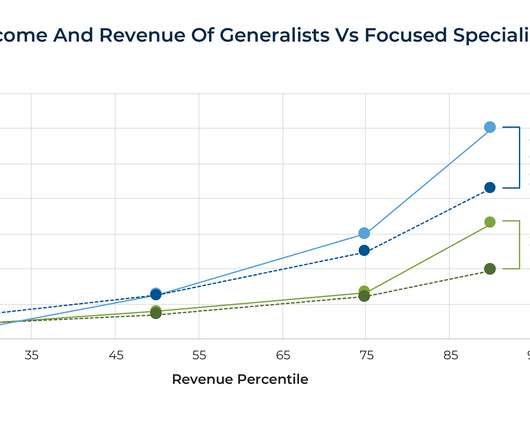

Which means that on any given workday, advisors might find themselves reviewing one client’s portfolio and another’s estate plan in the morning, and having a meeting with a third client later in the afternoon. With this approach, the advisor can focus on particular planning areas (e.g.,

Abnormal Returns

MARCH 4, 2024

Retirement JP Morgan Asset Management's 'Guide to Retirement.' am.jpmorgan.com) How longevity literacy affect financial wellness in retirement. advisorperspectives.com) Practice management Why RIAs need to focus on organic growth. fa-mag.com) Alts Should RIAs recommend funds managed by their PE-backers?

Cornerstone Financial Advisory

JANUARY 27, 2025

Tim Flick, CFP, CKA Certified Financial Planner Professional Certified Kingdom Advisor Founder, Investment Advisor Cornerstone Financial Advisory Phone: 317-947-7047 Email: tflick@cornerfi.com All Bible verses in this article are English Standard Version (ESV). What Does God Say About Financial Planning for an Estate?

Abnormal Returns

SEPTEMBER 4, 2023

standarddeviationspod.com) Creative Planning Creative Planning is buying Goldman Sachs' former Personal Financial Management unit. citywire.com) The deal underlines Creative Planning's rapid growth over the past few years. riabiz.com) Creative Planning could reintroduce the United Capital brand.

Nerd's Eye View

FEBRUARY 5, 2024

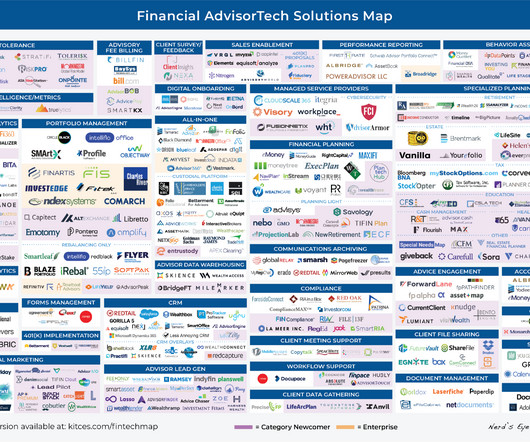

This month's edition kicks off with the news that financial planning software platform RightCapital has launched a workflow management tool called RightFlows to help advisors manage and assign steps in the financial planning process to team members and clients – which on the one hand capitalizes on advisor demand for workflow solutions tailored (..)

Abnormal Returns

MAY 6, 2024

Podcasts Brendan Frazier talks with Emily Koochel about the difference between behavioral finance and financial psychology. wiredplanning.com) Steve Chen talks with Jordan Hutchison, Vice President of Technology for RFG Advisory, about the evolving landscape of financial planning. kitces.com) What is financial planning?

Darrow Wealth Management

JANUARY 16, 2025

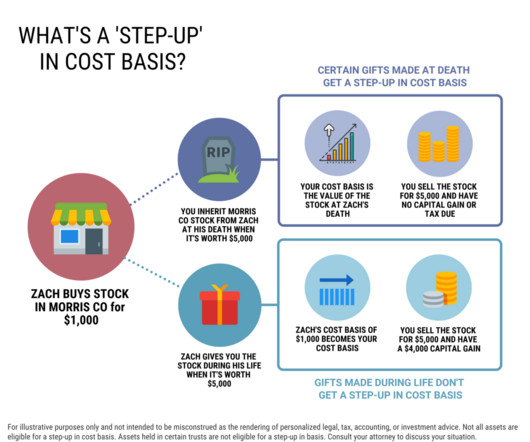

You’ll need to fill out paperwork with the custodian if there isn’t a financial advisor managing the accounts. At a high level, if the asset is part of the decedent’s estate it’s typically eligible for a step-up. Assets that bypass the estate through a trust or another mechanism are usually not eligible.

Dear Mr. Market

DECEMBER 31, 2024

Because when it comes to financial planning, you’re ready to write it downand studies show that writing down your goals makes you 42% more likely to achieve them. Heres your top 10 financial planning checklist for the new year. Track Progress Regularly Financial plans arent set it and forget it.

Nerd's Eye View

APRIL 3, 2023

million in seed funding to support its growth as it builds out its "end-to-end" financial planning and advice engagement platform (but will it be able to replace, rather than augment, advisors' existing financial planning software?)

Abnormal Returns

MARCH 20, 2023

(wiredplanning.com) Daniel Crosby talks with Emily Koochel about defining and seeking financial wellness. standarddeviationspod.com) Banks The combined UBS-CS will be a money management giant. barrons.com) The FDIC is planning to sell SVB Private separately from the rest of the bank. thinkadvisor.com)

Abnormal Returns

SEPTEMBER 9, 2024

Podcasts Michael Kitces talks financial wellness with Zack Hubbard. Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors. youtube.com) Brendan Frazier talks with Michael Kitces about mastering the human side of financial advice. kitces.com) How planning changes for the child-free.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively.

Nerd's Eye View

OCTOBER 18, 2022

equivalent of nearly $60 million in assets under management for 115 client households. Louis is the Director of WealthUp, an independent advice practice based in Cape Town, South Africa, that oversees the U.S.

Abnormal Returns

MAY 29, 2023

Podcasts Michael Kitces talks with Meg Bartelt of Flow Financial Planning about evolving her practice. kitces.com) Brendan Frazier talks with Bari Tessler, author of "The Art of Money: A Life-Changing Guide to Financial Happiness." ritholtz.com) Are you a Texas-based adviser interested working with Ritholtz Wealth Management?

Nerd's Eye View

JANUARY 22, 2024

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

Abnormal Returns

JUNE 28, 2023

Mack talks with Goldstone — a manager of investment research at Condor Capital Wealth Management and co-author of Condor's "Robo Report." financial-planning.com) Retirement How a Flexible Spending Strategy works in retirement, with some caveats. savantwealth.com) What is an estate plan? morningstar.com) Justin L.

Integrity Financial Planning

MAY 23, 2023

An estate plan is a legal document that outlines a person’s wishes for the distribution of their assets and property after their death. It is essential to create an estate plan to ensure that your family and loved ones are taken care of in the event of your passing. Contact us today to get started!

Nerd's Eye View

JULY 3, 2023

This month's edition kicks off with the news that Pershing X has announced the launch of its long-awaited (and newly renamed) “Wove” advisor technology platform – which despite purporting to be an open-architecture, multi-custodian solution allowing advisors to smoothly integrate all the technology they choose to bring onto it, in (..)

Nerd's Eye View

NOVEMBER 29, 2022

Welcome back to the 309th episode of the Financial Advisor Success Podcast ! Anh is the Founder and Managing Partner for SageMint Wealth, a corporate LPL-affiliated RIA based in Orange, California, that oversees nearly $325 million for 195 client households. My guest on today's podcast is Anh Tran.

Nerd's Eye View

OCTOBER 25, 2024

Also in industry news this week: The SEC this week released its list of priorities for 2025 examinations, which include advisers' use of Artificial Intelligence tools, adviser recommendations of complex investment products, and broker-dealers' compliance with Regulation Best Interest CFP Board has introduced a refreshed ad campaign encouraging students (..)

Nerd's Eye View

AUGUST 23, 2024

financial planning, CRM, portfolio management), while taking a more tailored approach to selecting tech in other categories. The survey found that most firms fall into the middle category, utilizing tech in categories that provide an assessed high return on investment (e.g., Read More.

Abnormal Returns

DECEMBER 5, 2022

Podcasts Rick Ferri talks estate planning with Ryan Barrett and Mike Piper. wsj.com) Planning The ways that a financial planner can add value for a client are nearly limitless. kitces.com) The financial planning process is becoming increasingly collaborative and less one-way. Here are 101 action items.

Nerd's Eye View

SEPTEMBER 3, 2024

Welcome to the 401st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Zack Hubbard.

Nerd's Eye View

JULY 25, 2022

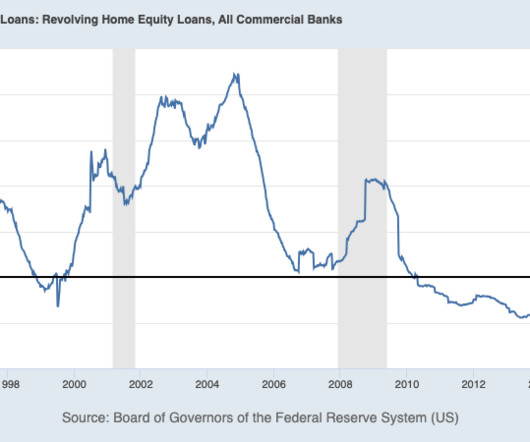

Yet despite this – and perhaps even because of it – advisory firms are putting an ever-greater focus on financial planning in 2022, as a way to both show value to clients in the midst of difficult market returns, and, more broadly, to help clients navigate the current environment.

Darrow Wealth Management

MARCH 31, 2023

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the assets. Once the divorce is finalized, a crucial (but often overlooked) part of the process is updating estate documents and beneficiary designations.

Carson Wealth

APRIL 25, 2024

There are some things in life you just can’t plan for: an unexpected illness, job loss, death of spouse, disability. And while experiencing one of these major events can drastically impact your life, having an effective financial plan can help ensure that it doesn’t ruin your financial well-being.

Steve Sanduski

FEBRUARY 18, 2025

Advisors who learn how to incorporate these and other emerging asset classes into Life-Centered Financial Plans will be offering a valuable service that sets them apart — especially in the eyes of high-net-worth individuals. Including collectibles in estate planning to avoid family disputes.

Carson Wealth

JANUARY 8, 2025

While some individuals manage their finances independently or utilize automated platforms, the personalized guidance of a financial advisor may offer distinct advantages. One study found that an advisor-managed portfolio could produce an additional 3% value add annually over a self-managed (DIY) portfolio.

Clever Girl Finance

AUGUST 15, 2022

Having a solid personal financial planning process is the first step in achieving your financial goals. Instead, you can leverage the same steps that financial advisors and Certified Financial Planners (CFPs) use to create financial plans for their clients. What is a financial plan?

eMoney Advisor

DECEMBER 6, 2022

Billion-dollar disasters, inflation, and increased building costs mean a perfect storm is brewing for financial planners’ risk management strategies. Insurance in Financial Planning. The CFP® Board includes risk management and insurance in its financial planning principal knowledge topics for a good reason.

Nerd's Eye View

SEPTEMBER 5, 2022

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including: SmartRIA launches an integration with Kitces.com to help RIAs manage the new IAR CE obligation rolling out from NASAA.

Carson Wealth

OCTOBER 25, 2023

The trustee then holds and manages those trust assets for the benefit of one or more beneficiaries. Managing assets requires time and patience. A trustee can manage your assets for you and your loved ones if and when that time comes. Consult with an estate planning attorney in your state for specific guidance.

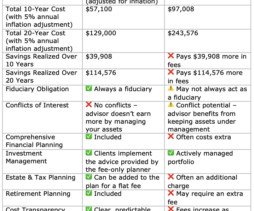

MainStreet Financial Planning

MARCH 7, 2025

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). Unbiased Advice from a Fiduciary Fee-only financial planners are fiduciaries, meaning they are legally required to act in your best interest.

Carson Wealth

APRIL 4, 2024

Once cognition or health is impaired, things can become far more difficult for everyone to manage. Information you’ll want to document includes: Bank accounts Investments Retirement accounts Estate planning documents (wills, trusts, etc.) Begin by emphasizing that you are there for them and that you will follow their lead.

Clever Girl Finance

DECEMBER 1, 2022

No one cares about your financial well-being more than you, so it's important to have a financial plan for yourself. Knowing how to make a financial plan will allow you to save money, afford the things you really want, and achieve long-term goals like saving for college and retirement. What is a financial plan?

Carson Wealth

JANUARY 4, 2024

Which decade should you really start to plan for retirement? Which decade should you focus on managing debt? Set yourself up for future financial success by living each decade to its fullest. Planning in Your 20s Is youth wasted on the young? Which decade can you afford to take more risk? Don’t wait to find out!

Harness Wealth

JUNE 23, 2023

Estate planning is a critical component of a comprehensive financial plan. Furthermore, estate planning includes aspects such as tax minimization strategies, asset protection, and charitable giving. There are many different types of trusts, each designed to address specific estate planning needs.

eMoney Advisor

MARCH 7, 2023

Stepchildren, remarriages, and ex-spouses: For the modern wealth management client with a blended family, planning to transfer wealth presents a web of complexity. Fortunately, financial professionals have tools and wealth transfer strategies that can help couples be intentional about the use of their assets in an estate plan.

eMoney Advisor

FEBRUARY 9, 2023

Of an estimated 104 million households seeking some level of financial advice, 88 million of those households want that advice from a financial professional. In this overview, we will explore the demographics of each stage, the financial planning needs of people in each stage, and strategies for serving them.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Abnormal Returns

SEPTEMBER 11, 2023

kitces.com) Christine Benz and Jeff Ptak talk with Cynthia Haddad, an expert on financial planning for people with disabilities and their families. riabiz.com) The biz Creative Planning is going to be flexible holding onto PIF advisers. investmentnews.com) Why the global wealth management is a growth business.

WiserAdvisor

NOVEMBER 4, 2022

For these reasons and several others, it is essential to follow specific financial planning tips for dual-income families. If you wish to learn about financial strategies that can help dual-income families plan their finances better, consider seeking the services of a professional financial advisor for the same.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content