Live From Heckerling: ESG Investing for Trustees

Wealth Management

JANUARY 8, 2024

Is ESG investing sustainable? Speakers at Heckerling discuss ESG investing within the lens of estate planning.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

Is ESG investing sustainable? Speakers at Heckerling discuss ESG investing within the lens of estate planning.

Wealth Management

AUGUST 31, 2023

Thursday, September 28, 2023 | 2:00 PM ET

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

SEPTEMBER 23, 2024

(youtube.com) Carl Richards and Michael Kitces talk about managing your firm knowing that market-related revenue declines happen. podcasts.apple.com) Thomas Kopelman and Jacob Turner talks estate planning for business owners. wealthmanagement.com) Why GV invested in Wealth.com. riaintel.com) How advisers can overstep.

Wealth Management

OCTOBER 15, 2023

Recently launched Alpaca Real Estate plans to take advantage of the dislocation in capital markets to invest in sectors with strong operating fundamentals and drive alpha through “innovative operating platforms.”

Abnormal Returns

MAY 8, 2023

Podcasts Michael Kitces talks with Jake Northrup, Founder of Experience Your Wealth, about scaling his practice. kitces.com) David Armstrong talks with Larry Swedroe of Buckingham Strategic Wealth about how he talks with advisers about investing topics. kitces.com) How personality traits affect estate planning decisions.

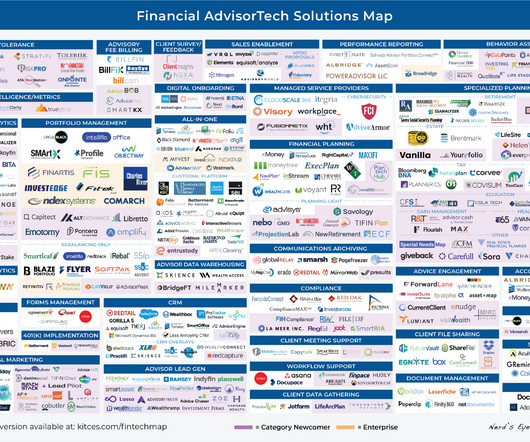

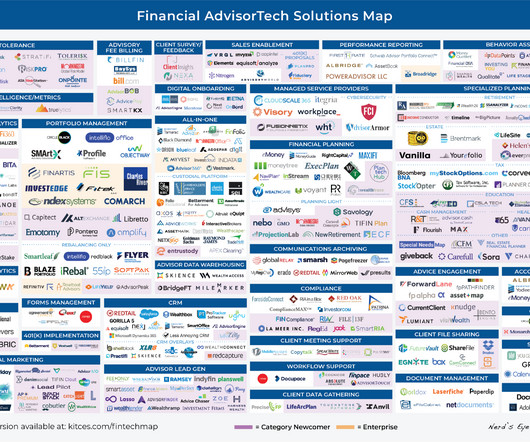

Nerd's Eye View

AUGUST 7, 2023

This month's edition kicks off with the news that estate planning platform Wealth.com has launched Ester, an AI-driven 'legal assistant' that uses machine learning to help advisors quickly review and extract the key information from clients' estate planning documents, as it joins FP Alpha in the competition to become 'Holistiplan for estate planning (..)

Wealth Management

JANUARY 8, 2025

The roughly 25 specialists will help Merrill financial advisors and their clients navigate financial needs including loans, estate planning and investment management.

Abnormal Returns

SEPTEMBER 9, 2024

kitces.com) Advisortech Is Vanguard really going to invest enough in technology to level up? wealthmanagement.com) The most recent news in the advisortech space including 'Blackrock's investment in GeoWealth.' fa-mag.com) How to use the new digital estate planning platforms.

Wealth Management

FEBRUARY 21, 2023

Private Client Solutions will help advisors access areas of expertise beyond investment management, including tax and estate planning and acquisition strategies.

Nerd's Eye View

JANUARY 22, 2024

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

The Big Picture

MAY 29, 2024

So it’s, we have this division that it’s maybe a third to 40 percent of all the private wealth that we manage for very wealthy people. The investments in your trust are going to be managed differently than your IRA because we’ve accounted for your estate plan as part of it.

Nerd's Eye View

JULY 3, 2023

This month's edition kicks off with the news that Pershing X has announced the launch of its long-awaited (and newly renamed) “Wove” advisor technology platform – which despite purporting to be an open-architecture, multi-custodian solution allowing advisors to smoothly integrate all the technology they choose to bring onto it, in (..)

Dear Mr. Market

DECEMBER 31, 2024

Review Investment Allocations Markets evolve, and so should your portfolio. Remember: investing isnt about timing the market, its about time in the market. Update Estate Plans If you have kids, own a business, or just want to make life easier for loved ones, make sure your will, trusts, and beneficiary designations are up to date.

Abnormal Returns

MARCH 4, 2024

(advisorperspectives.com) Practice management Why RIAs need to focus on organic growth. investmentnews.com) Investing Buffer ETFs are not a set-it-and-forget-it strategy. fa-mag.com) Alts Should RIAs recommend funds managed by their PE-backers? riabiz.com) Estate planning is growing in importance for advisers.

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Hybrid firms can switch between their status as a registered investment advisor and brokerage, which can be problematic for individuals seeking unbiased financial advice. Today, many investment advisors operate as a subsidiary of another larger, parent firm.

Abnormal Returns

JANUARY 22, 2024

Podcasts Michael Kitces talks social media with Thomas Kopelman who is the co-founder of AllStreet Wealth. kitces.com) Zach Conway and Kelsey McKenna talk with Michael Conway, CEO of Conway Wealth, about the multifaceted roles financial advisors play beyond managing investments.

Abnormal Returns

JULY 31, 2023

(riaintel.com) Creative Planning has inked a custody deal with Goldman Sachs ($GS). riabiz.com) Savvy Wealth is pushing hard on the AI front. investmentnews.com) Portfolio management How to evaluate a client's investment portfolio. morningstar.com) QLACs are coming to the 401(k) plan. financial-planning.com)

Nerd's Eye View

DECEMBER 1, 2023

Jarkesy, which in a narrow sense focuses on the SEC's use of in-house Administrative Law Judges to hear securities law cases rather than traditional Federal jury trials, but in a broader sense could call into question the SEC's (and other government agencies') authority to make rules and enforce laws in the absence of specific guidance from Congress (..)

Abnormal Returns

DECEMBER 5, 2022

Podcasts Rick Ferri talks estate planning with Ryan Barrett and Mike Piper. riaintel.com) What are the biggest mistakes when it comes to succession planning? kindnessfp.com) Despite all the recent noise, ESG investing is a long term proposition. bloomberg.com) Charitable giving strategies are as varied as the client.

Abnormal Returns

MAY 22, 2023

open.spotify.com) Austin, Texas Are you a Texas-based adviser interested working with Ritholtz Wealth Management? riaintel.com) CI Wealth The stock market did not react well to CI Financial's financial engineering. riabiz.com) Why Bain Capital invested in CI Private Wealth.

Wealth Management

MARCH 15, 2023

The properties would be “strictly investment assets, acquired at market rates” and managed by an in-house team, according to a summary prepared for Thursday’s meeting of the university’s Board of Regents.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Darrow Wealth Management

MARCH 13, 2025

A diversified portfolio is the cornerstone of a risk-adjusted investment strategy. Options Contracts: Utilizing options like cashless collars, covered calls, and protective puts to manage risk or generate income. Diversifying Around It: Balancing the portfolio by investing in assets that offset the concentrated position’s risk.

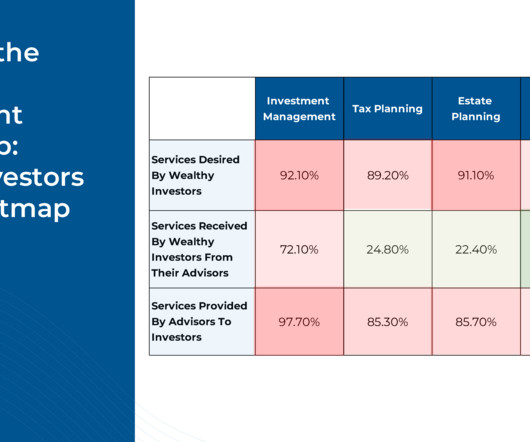

Zoe Financial

DECEMBER 5, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA December 5, 2023 Watch Time: 3 minutes Transcript: Welcome to this week’s Wealth Management Digest. ” Over the last year, they interviewed over 11,000 households with over $250,000 of investable assets.

Darrow Wealth Management

APRIL 21, 2025

If you wait until age 59 1/2 to take money out of a Roth IRA and have passed the more than five years holding period, then your investment earnings and growth will also be tax-free! Inheritance and estate planning There are a couple ways a Roth IRA conversion can assist with estate and legacy planning.

Carson Wealth

DECEMBER 13, 2022

CFP ® , Director of Consumer Investment Research . Regulators of financial planning firms and accrediting bodies do not lay out differences in nomenclature. On the other hand, activities such as giving investment advice or selling a mutual fund are regulated. What Do Wealth Managers Do? Craig Lemoine, Ph.D.,

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust . Charitable Remainder Unitrust .

International College of Financial Planning

JUNE 30, 2022

Hiring a wealth manager is one of the biggest financial decisions you’ll make. Hiring a wealth manager is a long-term investment, so it’s important to find someone who will take the time to get to know your goals, values, and long-term goals. Factors to be considered before hiring a wealth manager. .

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. A financial advisor provides personalized guidance to help manage and grow your wealth.

The Big Picture

SEPTEMBER 12, 2022

She is Head of North America Investments for Citi Global Wealth, which is a giant wealth management arm of the giant Citibank. She really has an incredible background in everything from capital markets to derivatives, to wealth management. And again, we carry this through to wealth management more broadly.

Darrow Wealth Management

OCTOBER 28, 2024

Deciding how to allocate and invest the proceeds after the sale of your company is a big decision that requires careful planning. If you are expecting a sudden windfall , develop a plan to allocate the proceeds and reinvest in your future. Are you planning to retire? Put the plan into action.

Indigo Marketing Agency

APRIL 28, 2023

Terms like “Wealth Manager,” “Financial Advisor,” and “Estate Planning” are more powerful than “Founder,” “Managing Partner,” or “CEO” from a keyword search perspective. Should Job Title Be Included? Advisors often ask me whether they should list their job title and firm name in their headline. What is the best?

International College of Financial Planning

MAY 29, 2023

The finance industry offers many career opportunities for aspiring professionals, with wealth management being one of the most rewarding and lucrative options. An Integrated Diploma in Wealth Management can provide you with the knowledge and skills required to excel in this dynamic field.

Darrow Wealth Management

JUNE 14, 2023

Engage a sudden wealth advisor and build your team Many individuals experiencing a sudden wealth event didn’t have a financial advisor before the windfall. At Darrow Wealth Management, we specialize in helping individuals manage a sudden wealth event.

Darrow Wealth Management

MARCH 31, 2023

You’ll also want to consider engaging a financial advisor, tax advisor, and estate planning attorney too. In contrast, investments in a brokerage account are only taxable above the cost basis. What’s more, investments in a brokerage account are taxed at favorable long-term capital gains tax rates when sold.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques. In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Darrow Wealth Management

JULY 1, 2024

Business owners may be able to accelerate tax-deferred savings even more through different retirement plan structures. Optimize your investments with asset location If investors haven’t already been working to optimize their tax situation with asset location, now is the time. appeared first on Darrow Wealth Management.

Integrity Financial Planning

FEBRUARY 10, 2023

It can also be helpful to have a dialogue with your family about how to manage the wealth you are going to pass down to them. [3] 3] One in four adults in the US said that their parents did not provide them with money lessons when they were children, which shows how little we talk with our kids about money and how to manage it. [4]

Carson Wealth

JULY 12, 2022

By Craig Lemoine, Director of Consumer Investment Research . We speak a secret language in financial planning. So much of our world is filled with abbreviations surrounding insurance and investment products, processes, education and accomplishments. . Broad Based Financial Planning Designations.

Diamond Consultants

FEBRUARY 11, 2025

Semantics aside, what each provides is a level of support to help advisors run independent registered investment advisory (RIA) businesses. Existing Infrastructure These firms provide scalable platforms and support to empower advisors to run a wealth management business.

Yardley Wealth Management

SEPTEMBER 24, 2021

The post 5 Steps for Creating a Financial Plan appeared first on Yardley Wealth Management, LLC. 5 Steps for Creating a Financial Plan. It does mean that you need to know the likely consequences of your action, or inaction, regarding your personal finance and investments,” said Garry. Keep your taxes low.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content