Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Abnormal Returns

NOVEMBER 11, 2024

(riabiz.com) What is the target market for MAGA-centric Strive Wealth Management? riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) Practice management Should you outsource your marketing to an outside firm? advisorperspectives.com)

Cornerstone Financial Advisory

MARCH 14, 2025

As a Christian, your estate plan should represent your dedication to financial stewardship according to Scripture. W hat important factors should Christians consider when estate planning? W hat important factors should Christians consider when estate planning?

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year.

Darrow Wealth Management

JANUARY 16, 2025

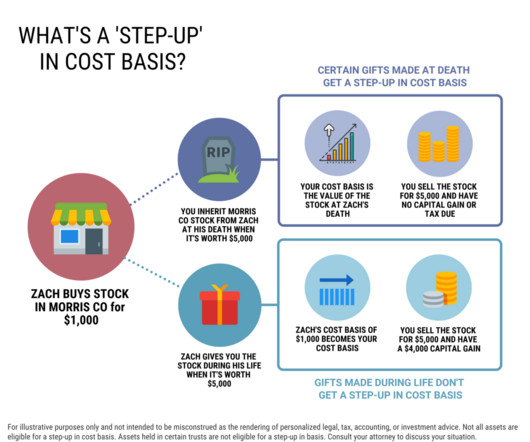

You’ll need to fill out paperwork with the custodian if there isn’t a financial advisor managing the accounts. At a high level, if the asset is part of the decedent’s estate it’s typically eligible for a step-up. Assets that bypass the estate through a trust or another mechanism are usually not eligible.

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Nerd's Eye View

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. forbes.com)

Carson Wealth

JANUARY 8, 2025

While some individuals manage their finances independently or utilize automated platforms, the personalized guidance of a financial advisor may offer distinct advantages. One study found that an advisor-managed portfolio could produce an additional 3% value add annually over a self-managed (DIY) portfolio.

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. contained a number of changes relevant to estate planning. citizens and residents. The SECURE Act 2.0

Nationwide Financial

MARCH 6, 2023

Informally fund nonqualified deferred compensation plans If the business has a nonqualified deferred compensation plan for key employees, it may make sense to informally fund that plan in 2023 to ensure the company has the cash flow to meet the future obligation.

Darrow Wealth Management

FEBRUARY 19, 2024

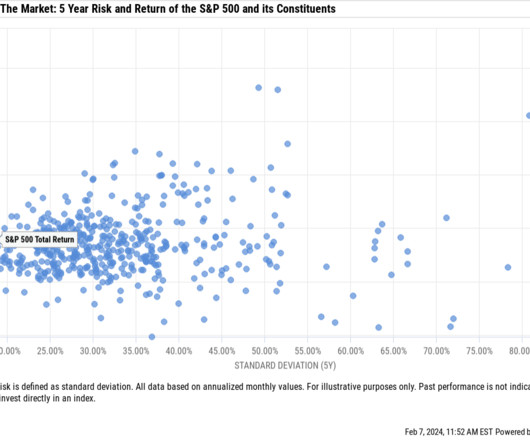

Here are five ways to manage a concentrated stock position. 5 ways to manage a concentrated stock position In no particular order, here are some strategies to reduce the risk of concentrated stock wealth. Taxes should always be a component of any investment decision — but not the main driver. Why diversify?

Darrow Wealth Management

JANUARY 29, 2024

This article is a high-level overview of the various estate planning techniques and considerations when using revocable living trusts from the perspective of a wealth advisor (e.g. The US has 50 states – each with their own tax laws and estate planning opportunities. States have their own estate tax laws.

WiserAdvisor

MARCH 13, 2024

Achieving financial freedom in retirement requires meticulous planning, dedicated effort, and strategic management. Without a solid plan, you risk drifting without direction. Diversification lies at the heart of investment planning. It serves as a fundamental risk management strategy.

AdvicePay

JUNE 13, 2024

With the fee-for-service model, you can customize service offerings for clients seeking advice who don’t (yet) have traditional portfolio assets to transfer to your firm’s custodian for full-time management. This approach allows you to engage these clients by charging a fee that’s covered through their monthly cash flow.

Harness Wealth

JUNE 23, 2023

Estate planning is a critical component of a comprehensive financial plan. Furthermore, estate planning includes aspects such as tax minimization strategies, asset protection, and charitable giving. There are many different types of trusts, each designed to address specific estate planning needs.

Darrow Wealth Management

OCTOBER 1, 2024

Choosing whether to fund a trust with your assets is an important decision in the estate planning process. A will and a trust are two different estate planning tools. This makes managing your financial affairs much easier in the event of death, incapacitation, or even a long trip overseas.

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help you with portfolio management, risk reduction, and inflation protection During retirement, your investment goals shift from accumulation to preservation of wealth. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. No wonder people get nervous when there’s lots of talk about higher taxes, but little certainty on what may come of it, and who it might affect. .

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Zoe Financial

DECEMBER 5, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA December 5, 2023 Watch Time: 3 minutes Transcript: Welcome to this week’s Wealth Management Digest. Financial planning, estate planning, tax planning, etc, rather than just picking stocks like in the old days.

Inside Information

JANUARY 31, 2025

Depending on a firms tech strategy, she wrote, advisors may have to log in to the CRM, custodian, portfolio accounting, planning software, tax planning software, estate planning software, social security maximizer software, etc.,

Darrow Wealth Management

JULY 1, 2024

This tax benefit is scheduled to sunset at the end of 2026. Tax planning for 2026 Depending on your situation, income, and goals, your planning options will vary. As with anything in tax planning, it’s important not to let the tax-tail wag the dog. appeared first on Darrow Wealth Management.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area. But with many options available, how do you choose the right one?

International College of Financial Planning

JUNE 30, 2022

Hiring a wealth manager is one of the biggest financial decisions you’ll make. Hiring a wealth manager is a long-term investment, so it’s important to find someone who will take the time to get to know your goals, values, and long-term goals. Factors to be considered before hiring a wealth manager. .

Harness Wealth

FEBRUARY 4, 2025

Risks: Lack of liquidity, long lock-up periods (5-10+ years), dependence on fund manager performance, concentration risk, and difficulty in accurately valuing investments. Credit funds also tend to have longer holding periods and unique tax considerations. How Are Alternative Investments Taxed?

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” These numbers show an opportunity for tax practices to build deeper, meaningful relationships with their clients, helping them to navigate some of life’s most challenging financial decisions.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques. In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Carson Wealth

APRIL 25, 2024

Once you have your goals set, you can build your plan with any combination of the following elements: Budgeting and expense management: Create a detailed budget outlining income, expenses, and savings targets. Debt management: Develop a strategy to pay off existing debts efficiently, minimizing interest costs.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Tax-Planning Possibilities.

Harness Wealth

JANUARY 24, 2023

Maryland is the only state that imposes both estate and inheritance taxes. These state taxes range from 0.8% all the way up to 20%, and can apply to estates with assets as low as $1 million. Washington, for example, which has no state income tax, does impose an estate tax of 10 to 20 percent on estates with assets of $2.2

Park Place Financial

MARCH 16, 2022

Since HNWIs have complex and extensive portfolios, few can manage their wealth without assistance from a financial planner. Some advisors specialize in high-net-worth planning and can direct clients to the unique advantages and opportunities that come with being an HNWI. Income Tax Planning. Retirement Planning.

Darrow Wealth Management

AUGUST 28, 2023

It’s not uncommon for some buyers to want the owner and/or members of the management team to stay on for a period to help with the transition. Your business advisory team may consist of: a business broker or M&A advisor, accounting and tax advisors, and transaction/M&A attorney. The post Selling a Business?

Carson Wealth

FEBRUARY 29, 2024

Tom Fridrich, JD, CLU, ChFC ® , Manager and Senior Wealth Planner Giving something you own to someone else. It’s a simple, human act – one that seems like it shouldn’t take too much planning to do it correctly. But when does gifting become a tax issue? Then, she meets with her financial advisor to review her estate plan.

International College of Financial Planning

MAY 29, 2023

The finance industry offers many career opportunities for aspiring professionals, with wealth management being one of the most rewarding and lucrative options. An Integrated Diploma in Wealth Management can provide you with the knowledge and skills required to excel in this dynamic field.

Carson Wealth

SEPTEMBER 26, 2024

The six-person team, led by managing partner, wealth advisor, Ty Vogele, and wealth advisors David Guenthner, CEPA ® and Ryan Wittman, AIF ® , manages over $400 million in assets. As advisors, we often find ourselves wearing too many hats,” said Ty Vogele, managing partner and wealth advisor. “We

Harness Wealth

APRIL 19, 2022

In this article on managing equity in a down market, we discuss: Why are tech stocks down? Tax efficient selling strategies. Gifting and tax-efficient trusts. From an estate planning perspective, if assets are down, it might be worth considering a trust, like a Grantor Retained Annuity Trust (GRAT). Margin Lending.

Fortune Financial

JULY 28, 2022

The analysis of how much, if any, of the employer securities within a retirement plan to elect NUA treatment is a unique decision based on three things: projected annual retirement needs, projected future marginal tax rates and estate planning considerations. Watch to Learn More About General Rules Surrounding NUA.

WiserAdvisor

JANUARY 5, 2024

A financial advisor can help you make sense of high-income earners’ investment strategies and methods of wealth management for the middle class. Business ownership ensures the transfer of wealth through estate planning. High-net-worth individuals are adept at using legal mechanisms to optimize their tax planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content