Inflation’s Impact on Retirement, Taxes and Estate Planning

Wealth Management

JUNE 24, 2024

Six ways to help clients gain peace of mind regarding inflation.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 24, 2024

Six ways to help clients gain peace of mind regarding inflation.

Nerd's Eye View

APRIL 29, 2024

While much of this process may focus on the client's own lifetime planning needs (e.g., helping them develop a retirement income plan), it often also addresses the client's goals for their wealth after their death. With this in mind, many financial advisors offer estate planning guidance to clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Wealth Management

JUNE 24, 2024

Estate planning is very important to clients but can be complicated and time consuming for people.

Abnormal Returns

MARCH 10, 2025

kitces.com) Estate planning Estate plans are a big lift for everyone, including advisers themselves. kindnessfp.com) Why clients need to organize their digital assets for estate planning purposes. wealthmanagement.com) The number of cash balance plans are on the rise. abnormalreturns.com)

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

Abnormal Returns

NOVEMBER 6, 2024

Podcasts Christine Benz and Amy Arnott talk the state of retirement with Anne Tergensen of the WSJ. podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. humbledollar.com) How to retire without regrets. hbr.org) Personal finance Won the game of life?

Nerd's Eye View

AUGUST 7, 2024

Traditionally, people tend to think of their estate as comprising one big 'pot' of assets, focusing on the sum of all the assets rather than on each individual asset itself.

Wealth Management

AUGUST 21, 2024

An often-overlooked tactic in estate planning.

Nerd's Eye View

DECEMBER 30, 2024

And as 2024 draws to a close, we wanted to highlight 24 of the most popular and insightful articles that were featured throughout the year (that you might have missed!).

Abnormal Returns

NOVEMBER 20, 2024

(sites.libsyn.com) Frazer Rice talks with Christine Benz author of "How to Retire" (podcasts.apple.com) Carl Richards talks money and more with journalist Kara Swisher. 50fires.com) Retirement Gray divorce can have a huge effect on your retirement. nytimes.com) Taxes in retirement only get more complicated.

Wealth Management

OCTOBER 22, 2024

Holistic advisory services like succession planning, retirement strategies and estate planning are needed now more than ever.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) What it means to be a great adviser to retired clients. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it. advisorperspectives.com)

Abnormal Returns

APRIL 10, 2024

(morningstar.com) Dan Haylett talks with Eric Brotman, who is the founder and CEO of BFG Financial Advisors, about retirement as 'graduation.' humansvsretirement.com) Estate planning Why you should update your estate plans periodically. wsj.com) Retirement Some reasons to go back to work after retiring.

Abnormal Returns

OCTOBER 23, 2024

nytimes.com) Retirement The sweet spot in retirement: working because you want to. contessacapitaladvisors.com) How to navigate retirement child-free. vox.com) Retirement savings The math behind tcontributing to your 401(k) plan. rationalwalk.com) How to fix 401(k) plans for the modern workforce.

Abnormal Returns

SEPTEMBER 4, 2024

(ritholtz.com) Rick Ferri talks with Christine Benz about her new book "How to Retire, 20 Lessons for a Happy, Successful, and Wealthy Retirement." morningstar.com) Sam Dogen talks in ins and outs of early retirement with Khe Hy. sites.libsyn.com) Retirement Why spending decisions in retirement are challenging.

Abnormal Returns

OCTOBER 9, 2024

(wsj.com) Another reminder that TreasuryDirect is a mess (wsj.com) Estate planning Why it often takes a crisis to prompt movement on an estate plan. kindnessfp.com) Where people without children are passing on their estates. wsj.com) Retirement savings How 401(k) rollovers can reduce your expenses.

Nerd's Eye View

NOVEMBER 8, 2023

Retirement is often framed as one's "golden years", a time to enjoy the fruits of several decades of hard work. And for many retirees who have planned accordingly, this transition is not a problem as they might spend generously on travel, hobbies, or other pursuits. On the behavioral side, clients could 'practice' retirement (e.g.,

Abnormal Returns

JUNE 5, 2024

(ritholtz.com) Dan Haylett talks with Stephanie McCullough, founder of Sophia Financial, about the challenges facing women planning for retirement. wsj.com) Retirement When to collect Social Security is a complex decision, that you can't take back. obliviousinvestor.com) Retirement is about making things work.

Abnormal Returns

OCTOBER 14, 2024

Podcasts Daniel Crosby talks with Michael Finke about how to deal with market volatility in retirement. riabiz.com) Estate planning Gifting is going to become more important as the TCJA expiration nears. kitces.com) Why it often takes a crisis to prompt movement on an estate plan. flowfp.com)

Abnormal Returns

DECEMBER 4, 2024

Podcasts Christine Benz talks 2025 taxes with Ed Slott author of "The Retirement Savings Time Bomb Ticks Louder." morningstar.com) Dan Haylett talks with Christine Benz, author of "How to Retire: 20 Lessons For a Happy, Successful, And Wealthy Retirement." humbledollar.com) Have you signed up for daily e-mail newsletter?

Cornerstone Financial Advisory

MARCH 14, 2025

As a Christian, your estate plan should represent your dedication to financial stewardship according to Scripture. W hat important factors should Christians consider when estate planning? W hat important factors should Christians consider when estate planning?

Nerd's Eye View

AUGUST 23, 2023

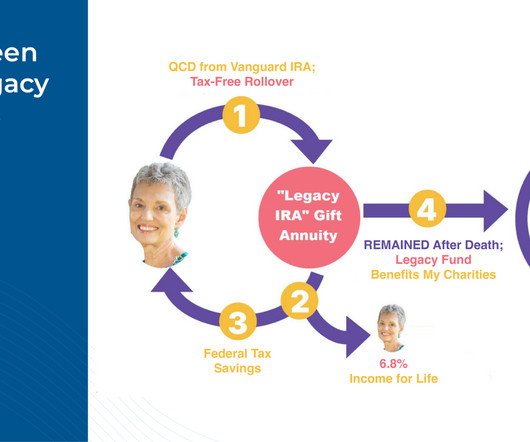

In this guest post, Kathleen Rehl, a semi-retired financial advisor and educator now focusing on her own estate planning considerations, shares her experience with creating her "Legacy IRA" rollover to a Charitable Gift Annuity to support her chosen nonprofits after Congress passed the SECURE 2.0 But the SECURE 2.0 Read More.

Abnormal Returns

AUGUST 16, 2023

thomaskopelman.com) Estate planning Four lessons learned about estate planning from Whitney Houston's will. wealthfoundme.com) Seven steps to building an estate plan. morningstar.com) When to revise your estate plan.

Carson Wealth

DECEMBER 20, 2024

You can move these large stock holdings to a DAF, get the tax break, and then use the money to make donations every year through your retirement. Your tax footprint for the year can grow substantially, depending on the size of your retirement accounts. government. Converting from a traditional IRA to a Roth IRA is a taxable event.

Abnormal Returns

JUNE 3, 2024

Podcasts Dan Haylett talks with Jamie Hopkins about rewiring the way we think about retirement and its underlying assumptions. riabiz.com) Retirement The signs of Alzheimer's disease often show up years ahead of time in financial behaviors like missed payments. nytimes.com) How estate planning for blended families can go wrong.

Abnormal Returns

MAY 8, 2024

(advisorperspectives.com) The 7 best retirement books including "More Than Enough: A Brief Guide to the Questions That Arise After Realizing You Have More Than You Need" by Mike Piper. morningstar.com) Retirement Three tips to improve your retirement including 'Pursue serendipity.' ft.com) Estate planning is all about tradeoffs.

Integrity Financial Planning

AUGUST 28, 2022

Understand the basics first, and then create an estate plan. Wills and trusts are both important estate planning tools with important differences. Many people may not know that their will does not control who inherits all of their assets, such as retirement accounts, life insurance, and annuities.

Abnormal Returns

MARCH 4, 2024

Retirement JP Morgan Asset Management's 'Guide to Retirement.' am.jpmorgan.com) How longevity literacy affect financial wellness in retirement. papers.ssrn.com) Why getting charitable giving in retirement right is challenging. (fa-mag.com) riabiz.com) Estate planning is growing in importance for advisers.

Abnormal Returns

NOVEMBER 27, 2024

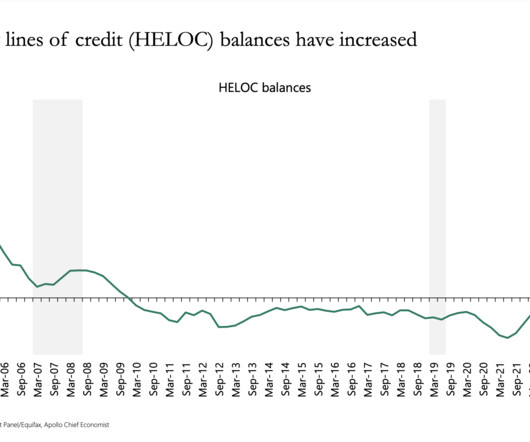

msn.com) Aging Spending more money doesn't necessarily make for a more fulfilling retirement. nextavenue.org) Lessons learned from Warren Buffett's estate planning, including 'Tell your kids you are proud of them.' (apolloacademy.com) How higher property taxes would help unlock the housing market.

Abnormal Returns

JULY 5, 2023

financiallywelloff.com) Peter Mallouk and Jonathan Clements on the key ingredients of a good retirement. open.spotify.com) Estate planning How to create a digital estate plan in three steps. 403bwise.org) Retirement 9 steps to a productive retirement including 'Stay flexible on the withdrawal rate front.'

Abnormal Returns

JULY 12, 2023

peterlazaroff.com) Retirement How to build in a victory lap before retirement. savantwealth.com) A real-life example of balancing differing wants in retirement. physicianonfire.com) Estate planning A look at some advanced estate planning techniques. (etftrends.com) Peter Lazaroff on whether U.S.

Abnormal Returns

AUGUST 23, 2023

(papers.ssrn.com) How 529 plan accounts are treated in a divorce. marketwatch.com) Estate planning Estate planning is about showing our love for our families. wealthfoundme.com) More families are at risk from estate taxes looking out into 2025 and beyond.

Abnormal Returns

JULY 3, 2023

beehiiv.com) A round-up of the past month's advisor-tech news including Vanilla's new "estate advisory" platform. kitces.com) Estate planning Four things to consider in anticipation of 2026. financial-planning.com) Wealth.com's Ester will help you read estate planning documents. (matts-newsletter-7a3f46.beehiiv.com)

Abnormal Returns

JUNE 12, 2024

semafor.com) Retirement Cognitive decline is inevitable. Why you need to plan for it. abnormalreturns.com) It's easy to let your spending fall in retirement. humbledollar.com) Some charts to help you think about retirement. theretirementmanifesto.com) A problem with Medicare Advantage plans. moneytalks101.substack.com)

NAIFA Advisor Today

APRIL 20, 2023

is here, but what does that mean for your clients' retirement and estate planning? SECURE 2.0 On Tuesday, May 9, from 12 pm to 3 pm eastern, join NAIFA and the Society of Financial Service Professionals for an Advanced Practice Center live virtual event, as three industry experts discuss the impact of SECURE 2.0,

Nerd's Eye View

JUNE 26, 2024

Because of the strict limitations on when and how the 529-to-Roth rollover can be done , it has limited usefulness as a planning tool beyond its intended purpose of giving individuals with overfunded 529 plans an opportunity to reallocate some of those funds tax-free towards their retirement savings. Read More.

Darrow Wealth Management

JANUARY 16, 2025

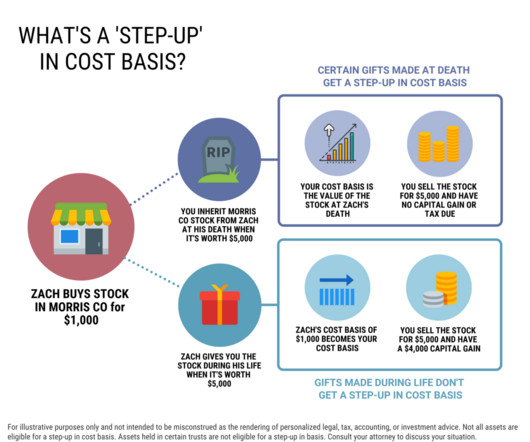

Non-retirement assets like stocks in a brokerage account, inherited home , antiques/art/collectables, or other real estate, are generally eligible for a step-up in cost basis. Retirement accounts and IRAs do not receive a stepped up basis. Explaining the double step-up Yes, depending on how your estate plan is structured.

Abnormal Returns

OCTOBER 11, 2023

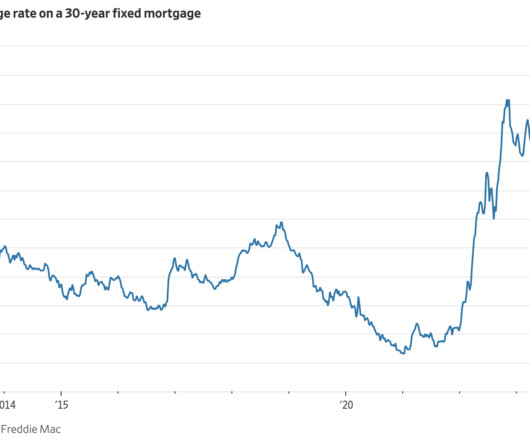

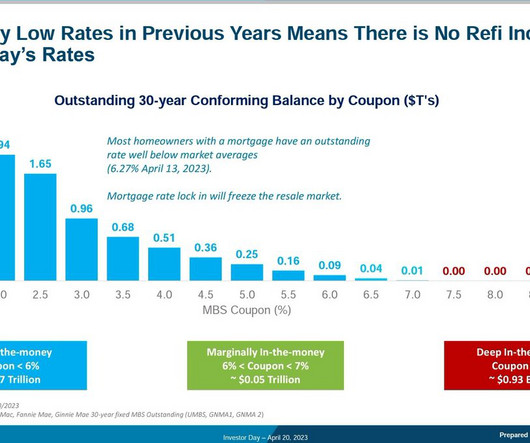

abnormalreturns.com) Retirement Elder care is challenging even under the best circumstances. morningstar.com) What men, specifically, lose in retirement. jlcollinsnh.com) An estate plan is only as good as the organization behind it. (abnormalreturns.com) Sub-3% mortgage rates are now a distant memory.

Your Richest Life

AUGUST 11, 2023

Your estate plan is the comprehensive guide to your wealth and property when you pass away or become incapacitated physically or mentally. it’s important that you update your estate plan to reflect those changes. As a physician, there are a few other areas to pay attention to when you’re working on your estate plan.

Abnormal Returns

SEPTEMBER 4, 2023

theadvisorjourney.com) Brendan Frazier talks about the challenge of retirement spending with Morningstar's Christine Benz. citywire.com) Why retiring advisers often have second thoughts. thinkadvisor.com) UHNW individuals don't want to talk about traditional retirement. thinkadvisor.com)

Abnormal Returns

MAY 10, 2023

financialducksinarow.com) Retirement The math behind savings rates and retiring early. ofdollarsanddata.com) Make sure you know what you are retiring to. obliviousinvestor.com) How to effectively withdraw money from a 529 plan. wsj.com) When building an estate plan, hire an attorney who specializes in it.

Abnormal Returns

JUNE 28, 2023

Podcasts Christine Benz and Jeff Ptak talk with Fritz Gilbert and Eric Weigel about retirement planning mistakes. financial-planning.com) Retirement How a Flexible Spending Strategy works in retirement, with some caveats. ofdollarsanddata.com) A first hand tale of un-retirement. Meir Statman.

Nerd's Eye View

JANUARY 31, 2024

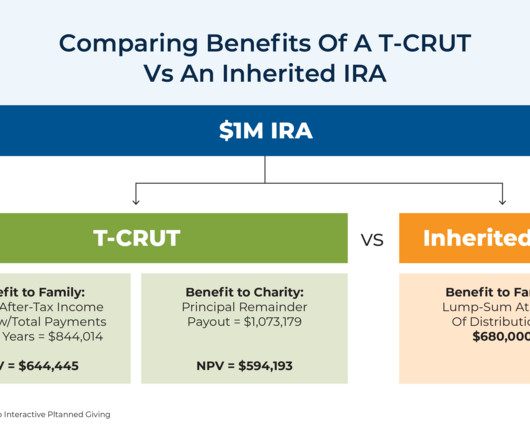

In late 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, introducing several significant changes to retirement planning. Of the many provisions in the bill, the so-called "Death of the Stretch" arguably received the lion's share of consternation from the financial advisor community.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content