Inflation’s Impact on Retirement, Taxes and Estate Planning

Wealth Management

JUNE 24, 2024

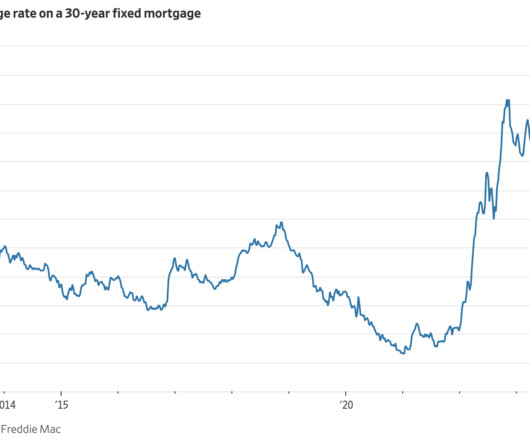

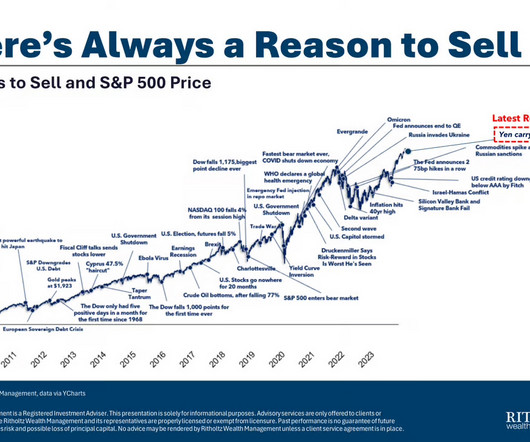

Six ways to help clients gain peace of mind regarding inflation.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 24, 2024

Six ways to help clients gain peace of mind regarding inflation.

Nerd's Eye View

DECEMBER 30, 2024

We start with several articles on retirement planning: Why considering a client's retirement time horizon and spending flexibility could lead to more accurate (and often higher) safe withdrawal rates than the simpler "4% rule" Four unique risks retirees face when drawing down their assets, from sequence of returns risk to tax risk, and how financial (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

AUGUST 7, 2024

Traditionally, people tend to think of their estate as comprising one big 'pot' of assets, focusing on the sum of all the assets rather than on each individual asset itself.

Abnormal Returns

NOVEMBER 6, 2024

Podcasts Christine Benz and Amy Arnott talk the state of retirement with Anne Tergensen of the WSJ. podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. humbledollar.com) How to retire without regrets. Quit playing.

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

Nerd's Eye View

AUGUST 23, 2023

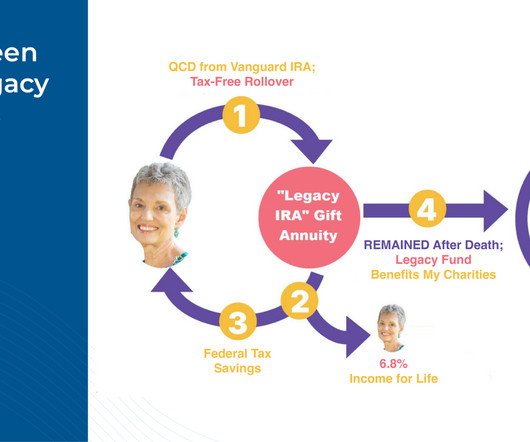

However, the caveat with current CGAs has been that they could only be funded with after-tax dollars before the donor’s death, meaning that if an individual only had tax-deferred funds (e.g., Second, they reduce the donor's tax bill in the year the CGA is created by excluding the amount contributed to the CGA from taxable income.

Abnormal Returns

NOVEMBER 20, 2024

(sites.libsyn.com) Frazer Rice talks with Christine Benz author of "How to Retire" (podcasts.apple.com) Carl Richards talks money and more with journalist Kara Swisher. 50fires.com) Retirement Gray divorce can have a huge effect on your retirement. nytimes.com) Taxes in retirement only get more complicated.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) What it means to be a great adviser to retired clients. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it.

Abnormal Returns

APRIL 10, 2024

(morningstar.com) Dan Haylett talks with Eric Brotman, who is the founder and CEO of BFG Financial Advisors, about retirement as 'graduation.' humansvsretirement.com) Estate planning Why you should update your estate plans periodically. wsj.com) Retirement Some reasons to go back to work after retiring.

Abnormal Returns

DECEMBER 4, 2024

Podcasts Christine Benz talks 2025 taxes with Ed Slott author of "The Retirement Savings Time Bomb Ticks Louder." morningstar.com) Dan Haylett talks with Christine Benz, author of "How to Retire: 20 Lessons For a Happy, Successful, And Wealthy Retirement." apolloacademy.com) Taxes Some things to know about doing a QCD.

Carson Wealth

DECEMBER 20, 2024

Strategic charitable giving not only benefits the recipient but can also create significant tax advantages for the giver. While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. It just needs to be given to a qualified 501(c)(3).

Abnormal Returns

JUNE 5, 2024

(ritholtz.com) Dan Haylett talks with Stephanie McCullough, founder of Sophia Financial, about the challenges facing women planning for retirement. humbledollar.com) Gold is not taxed like stocks and bonds. wsj.com) Retirement When to collect Social Security is a complex decision, that you can't take back.

Abnormal Returns

SEPTEMBER 4, 2024

(ritholtz.com) Rick Ferri talks with Christine Benz about her new book "How to Retire, 20 Lessons for a Happy, Successful, and Wealthy Retirement." morningstar.com) Sam Dogen talks in ins and outs of early retirement with Khe Hy. sites.libsyn.com) Retirement Why spending decisions in retirement are challenging.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Nerd's Eye View

NOVEMBER 30, 2022

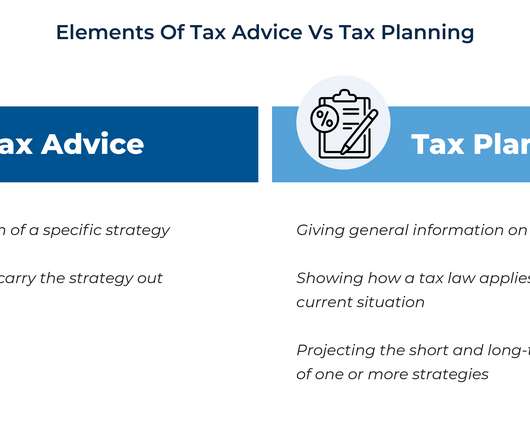

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Nerd's Eye View

FEBRUARY 15, 2023

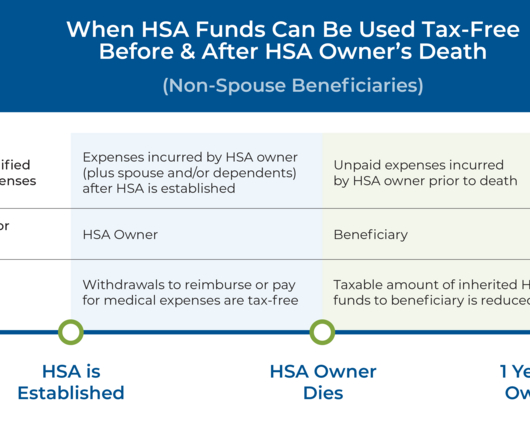

Health Savings Accounts (HSAs) feature useful tax advantages that make them a popular savings vehicle. One possible outcome of ‘superfunding’ an HSA, however, is that the account owner may not actually use up all of their HSA funds over their lifetime, which can have significant tax consequences. Read More.

Darrow Wealth Management

JANUARY 16, 2025

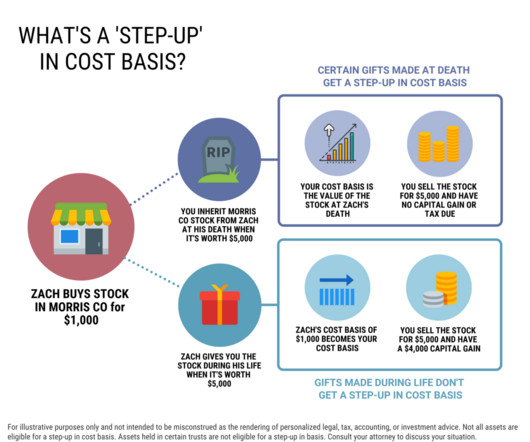

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Abnormal Returns

NOVEMBER 27, 2024

(apolloacademy.com) How higher property taxes would help unlock the housing market. msn.com) Aging Spending more money doesn't necessarily make for a more fulfilling retirement. nextavenue.org) Lessons learned from Warren Buffett's estate planning, including 'Tell your kids you are proud of them.'

Cornerstone Financial Advisory

MARCH 14, 2025

As a Christian, your estate plan should represent your dedication to financial stewardship according to Scripture. W hat important factors should Christians consider when estate planning? W hat important factors should Christians consider when estate planning?

Abnormal Returns

MAY 8, 2024

(advisorperspectives.com) The 7 best retirement books including "More Than Enough: A Brief Guide to the Questions That Arise After Realizing You Have More Than You Need" by Mike Piper. morningstar.com) Retirement Three tips to improve your retirement including 'Pursue serendipity.' ft.com) Estate planning is all about tradeoffs.

Nerd's Eye View

JUNE 26, 2024

And so the conundrum of people with "too much" savings in their 529 plan – either because they overestimated how much they needed to save, or because they chose a different path entirely that didn't involve going to college – has been how to get funds out of the plan without sacrificing a large part of their value to taxes and penalties.

Abnormal Returns

OCTOBER 11, 2023

abnormalreturns.com) Retirement Elder care is challenging even under the best circumstances. morningstar.com) What men, specifically, lose in retirement. humbledollar.com) Taxes How to compare the yields on taxable and muni bonds. marketwatch.com) Some basic things not to get wrong in your tax filings.

Abnormal Returns

AUGUST 23, 2023

(papers.ssrn.com) How 529 plan accounts are treated in a divorce. marketwatch.com) Estate planning Estate planning is about showing our love for our families. wealthfoundme.com) More families are at risk from estate taxes looking out into 2025 and beyond.

Nerd's Eye View

JANUARY 31, 2024

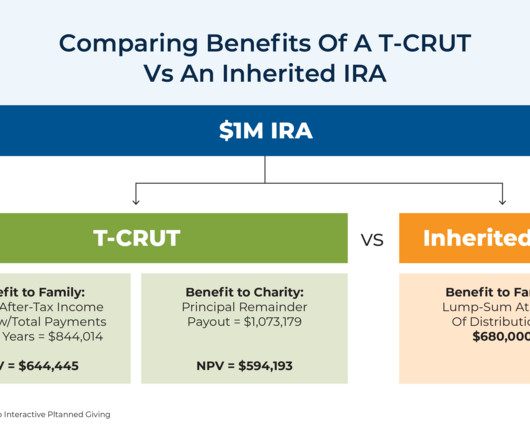

In late 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, introducing several significant changes to retirement planning. This shift has led financial advisors to explore new strategies for mitigating the resulting tax-planning challenges.

Integrity Financial Planning

AUGUST 28, 2022

Understand the basics first, and then create an estate plan. Wills and trusts are both important estate planning tools with important differences. Many people may not know that their will does not control who inherits all of their assets, such as retirement accounts, life insurance, and annuities.

Abnormal Returns

SEPTEMBER 27, 2023

awealthofcommonsense.com) Why you should keep track of the tax basis of your house. morningstar.com) A first-hand account of the case for hiring a tax preparer. dariusforoux.com) Want to be happier in retirement? marketwatch.com) Why your estate plan should include this letter.

Nerd's Eye View

AUGUST 9, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey indicates that clients of financial advisors are more confident than others about their financial preparedness for retirement and are more likely to have a financial plan in place that can weather the ups (..)

Abnormal Returns

JUNE 28, 2023

Podcasts Christine Benz and Jeff Ptak talk with Fritz Gilbert and Eric Weigel about retirement planning mistakes. financial-planning.com) Retirement How a Flexible Spending Strategy works in retirement, with some caveats. ofdollarsanddata.com) A first hand tale of un-retirement. Meir Statman.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Nerd's Eye View

NOVEMBER 21, 2022

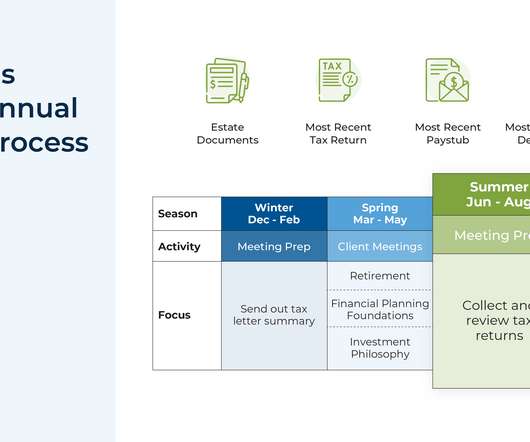

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client.

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

MainStreet Financial Planning

JANUARY 23, 2025

For 2024, the maximum taxable earnings subject to Social Security tax is $168,600. Review Your Estate Planning Documents Take some time to review the key documents in your estate plan, such as your will, power of attorney, and property deeds. If you notice any errors, you can easily request a correction online.

Dear Mr. Market

DECEMBER 31, 2024

Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA. Optimize Tax Strategies Its not what you makeits what you keep. Meet with your tax advisor to discuss harvesting tax losses, Roth conversions, and charitable contributions that might save you money. A good rule of thumb?

Your Richest Life

AUGUST 11, 2023

Your estate plan is the comprehensive guide to your wealth and property when you pass away or become incapacitated physically or mentally. it’s important that you update your estate plan to reflect those changes. As a physician, there are a few other areas to pay attention to when you’re working on your estate plan.

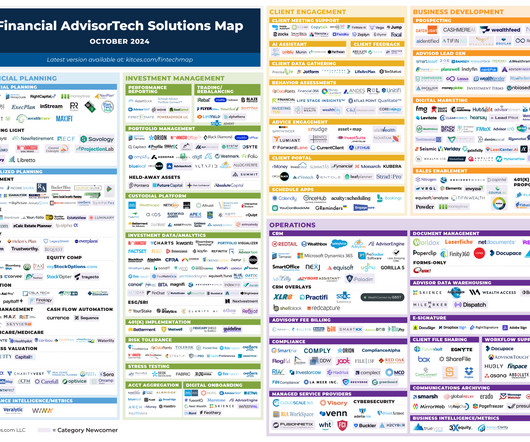

Nerd's Eye View

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. forbes.com)

Integrity Financial Planning

MAY 23, 2023

An estate plan is a legal document that outlines a person’s wishes for the distribution of their assets and property after their death. It is essential to create an estate plan to ensure that your family and loved ones are taken care of in the event of your passing. Contact us today to get started!

Carson Wealth

SEPTEMBER 27, 2023

For individuals, a permanent life insurance plan can play a key role in estate planning by helping reduce estate taxes. 1,2 Some states have an estate tax as well, and they may have a lower threshold for when the tax applies. As of 2023, that exclusion is $12.92 million ($25.84 million ($25.84

WiserAdvisor

MARCH 13, 2024

Achieving financial freedom in retirement requires meticulous planning, dedicated effort, and strategic management. Without a solid plan, you risk drifting without direction. Within this framework, the concept of the five pillars of retirement planning emerges as a valuable strategy.

WiserAdvisor

AUGUST 31, 2023

Financial advisors play a crucial role in assisting you before your retire. They can also help you optimize your savings and investment plans, ensuring that you maximize your earning potential while minimizing risks. Here are 5 benefits of hiring a financial advisor after you retire: 1.

Nerd's Eye View

SEPTEMBER 6, 2023

For instance, qualified plan assets (e.g., 401(k) and 403(b) plans) offer purportedly unlimited creditor protection for plan participants, meaning that if an individual were to be sued or file for Federal bankruptcy protection, balances in these accounts would not be at risk. tenancy by the entireties and community property).

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. However, awareness is key, both for clients and advisors. citizens and residents.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content