Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

APRIL 5, 2023

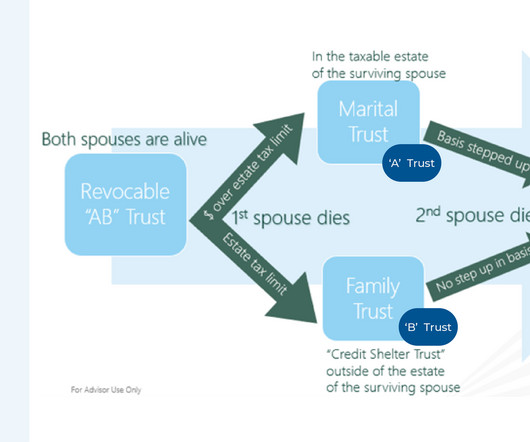

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it. riabiz.com) What is the target market for MAGA-centric Strive Wealth Management?

Nerd's Eye View

NOVEMBER 30, 2022

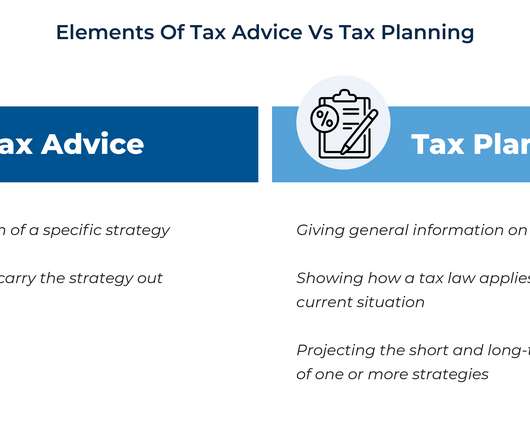

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Abnormal Returns

SEPTEMBER 4, 2024

morningstar.com) Early in retirement is the time to do some tax planning. nextavenue.org) Estate planning Mistakes to avoid in your estate planning. theretirementmanifesto.com) If you have a valuable collection you need a plan for its eventual disposition.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year.

Nerd's Eye View

JANUARY 8, 2024

improves on the previous iterations of planning by involving a more thorough technical analysis of a client's unique situation than it did before and drilling deeper to reveal more planning opportunities to present to clients. Specifically, Financial Advice 3.0

Nerd's Eye View

OCTOBER 7, 2024

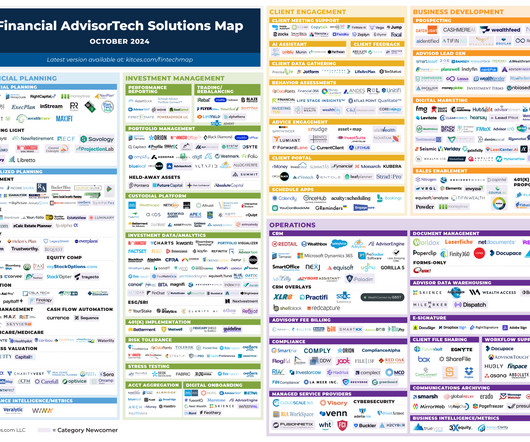

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Abnormal Returns

AUGUST 5, 2024

kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. papers.ssrn.com) Four steps to create a digital estate plan. alphaarchitect.com) Charitable giving A (big) primer on charitable giving.

Nerd's Eye View

SEPTEMBER 6, 2023

Beyond insurance, advisors and their clients can also consider options such as the use of corporate entities such as Limited Liability Companies (LLCs) for business interests, and estate tax planning tools such as Spousal Lifetime Access Trusts (SLATs) that can offer both estate planning and asset protection benefits for married couples.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Carson Wealth

JANUARY 8, 2025

Holistic Financial Management Beyond investment advice, financial advisors offer comprehensive services such as tax planning, estate planning, and risk management. This support can be important in maintaining discipline and making rational decisions amidst market fluctuations.

Carson Wealth

FEBRUARY 13, 2023

While there are certainly ways to do estate planning without a lawyer, for most people hiring an estate planning attorney makes the most sense. Estate plans can get complex fast, and even fairly straightforward estates can feel overwhelming if you’re not trained in the area. Do your research.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

AdvicePay

JUNE 13, 2024

Here are some examples of one-time and ongoing services you can offer clients under the fee-for-service model: One-Time Services Ongoing Services Comprehensive Financial Plan Ongoing Financial Planning Second Opinion Engagement Advising on Held-Away Accounts Student Loan Analysis Tax Planning Portfolio Tax Efficiency Review Estate Planning Housing (..)

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help with maximizing your retirement income through tax planning After retirement, your income sources may become limited to pensions, Social Security benefits, and investment income. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Inside Information

JANUARY 31, 2025

Depending on a firms tech strategy, she wrote, advisors may have to log in to the CRM, custodian, portfolio accounting, planning software, tax planning software, estate planning software, social security maximizer software, etc.,

Darrow Wealth Management

JULY 1, 2024

This tax benefit is scheduled to sunset at the end of 2026. Tax planning for 2026 Depending on your situation, income, and goals, your planning options will vary. As with anything in tax planning, it’s important not to let the tax-tail wag the dog.

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” These numbers show an opportunity for tax practices to build deeper, meaningful relationships with their clients, helping them to navigate some of life’s most challenging financial decisions.

Yardley Wealth Management

MARCH 1, 2022

Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. But tax planning isn’t just for your investments. But we can weave each event into the tax-planning fabric of your financial life.

Yardley Wealth Management

MARCH 1, 2022

Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . But tax planning isn’t just for your investments. Each can translate into tax-planning challenges and opportunities: .

Harness Wealth

MARCH 6, 2025

Determining the fair market value of stock options, for example, can be time-consuming, with a tax extension allowing individuals to make sure theyre maximizing the potential tax benefits of their equity compensation.

Yardley Wealth Management

FEBRUARY 15, 2022

Part 2: Tax-Wise Investment Techniques In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools. Tax breaks come and go, and are beyond our control. Remember, your goal is to minimize lifetime taxes paid.

Yardley Wealth Management

FEBRUARY 15, 2022

Part 2: Tax-Wise Investment Techniques. In our last piece, we introduced some of the tools of the tax-planning trade. These include tax-sheltered accounts for saving toward retirement, healthcare, and education, as well as tax-efficient tools for charitable giving, emergency spending, and estate planning. .

Integrity Financial Planning

MARCH 15, 2023

From financial plans to home remodeling, it’s common to be tempted to DIY your way there. Financial planning can be complicated. Have you thought about taxes or estate planning or when to withdraw and from where? Here’s what you’ll learn on today’s show: Why shouldn’t you plan retirement by yourself? (0:12)

International College of Financial Planning

JANUARY 18, 2023

Arun Thukral, New CFP Framework is different from other financial courses as it focuses on the practical aspects of financial planning. CFP course covers topics such as investment planning, retirement planning, estate planning, and tax planning.

Darrow Wealth Management

AUGUST 28, 2023

Your business advisory team may consist of: a business broker or M&A advisor, accounting and tax advisors, and transaction/M&A attorney. On the personal side, your financial advisor , estate planning attorney, and CPA/tax advisor should be involved throughout the process.

Fortune Financial

SEPTEMBER 25, 2023

Long-term goals typically encompass retirement planning, wealth preservation and estate planning. They are well-versed in various aspects of financial planning, including investments, retirement planning, estate planning and tax management.

WiserAdvisor

FEBRUARY 19, 2024

Blind Spot 3: Inadequate estate planning In today’s age, where 60 is the new 50 and people are more active and health-conscious than ever before, it is common to think that estate planning can wait. You can also consider using Roth accounts to optimize tax planning in retirement.

WiserAdvisor

JANUARY 5, 2024

Business ownership ensures the transfer of wealth through estate planning. Difference 4: Using tax planning strategies While both groups are subject to the same tax laws, the wealthy often employ sophisticated legal structures and financial tools to minimize tax burdens strategically.

Carson Wealth

SEPTEMBER 26, 2024

True North will now have access to Carson’s comprehensive ecosystem, including cutting-edge investment strategies, advanced tax planning, and sophisticated estate planning resources. Partnering with Carson Wealth was a game-changer for us.

Harness Wealth

FEBRUARY 20, 2024

Employed by law firms, corporate legal departments, or running their own practices, tax attorneys can be looked to for legal tax issues and disputes, along with comprehensive tax planning and preparation.

eMoney Advisor

FEBRUARY 9, 2023

Financial Planning Needs: Retirement planning Education and family planning Obtaining appropriate insurance coverage Business and tax planning Significant asset purchases Strategies for Serving Clients in This Stage: Clients at this stage are experiencing life events — both large and small — that will impact their financial planning needs.

Integrity Financial Planning

NOVEMBER 14, 2023

Gift Tax Exemptions Each year, you can give up to $17,000 to any number of people tax-free. This means that if you have two children, you can give each of them $17,000 without a tax penalty in 2023. [1] 1] This can be something you do as part of your estate plan.

International College of Financial Planning

DECEMBER 29, 2024

The CFP Program Structure Comprehensive Curriculum Design The CFP program offers a unique 4-in-1 certification structure that covers all essential areas of financial planning: Investment Planning: Understanding market dynamics, portfolio management, and asset allocation strategies Retirement and Tax Planning: Mastering retirement solutions and tax-efficient (..)

Harness Wealth

FEBRUARY 13, 2023

Whether you’re planning for an upcoming liquidity event , such as an IPO, or you’re interested in bringing more sophistication to your overall tax strategy, Harness Tax offers a range of services to meet your needs. We’ll provide a shortlist of tax experts who specialize in your profile and needs. How does it work?

International College of Financial Planning

FEBRUARY 23, 2024

It demonstrates to employers, peers, and clients alike that the holder possesses a comprehensive understanding of financial planning concepts, including retirement, tax planning, investment management and estate planning.

Fortune Financial

SEPTEMBER 25, 2023

Long-term goals typically encompass retirement planning, wealth preservation and estate planning. They are well-versed in various aspects of financial planning, including investments, retirement planning, estate planning and tax management.

Sara Grillo

JUNE 7, 2024

Several of the wealth managers had specialists in-house such as: Chief Philanthropic Advisor, Head of Tax Planning, Family Legal Counselor, Trust Officer If you can’t hire these specialists, work out an arrangement with a close third-party with this expertise. Wear a suit and present yourself conservatively.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content