Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

DECEMBER 30, 2024

We start with several articles on retirement planning: Why considering a client's retirement time horizon and spending flexibility could lead to more accurate (and often higher) safe withdrawal rates than the simpler "4% rule" Four unique risks retirees face when drawing down their assets, from sequence of returns risk to tax risk, and how financial (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

NOVEMBER 30, 2022

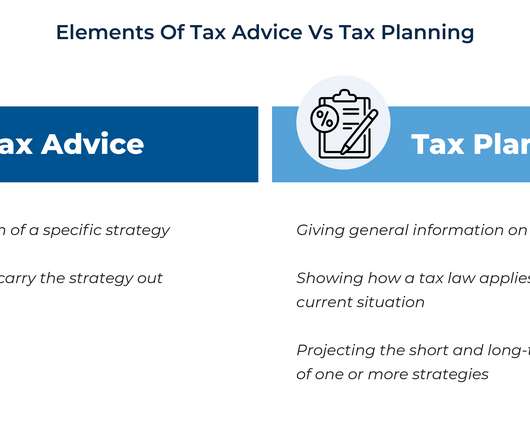

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan.

Nerd's Eye View

APRIL 5, 2023

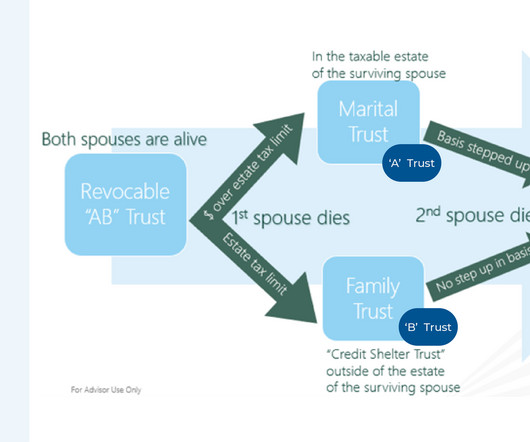

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it. riabiz.com) What is the target market for MAGA-centric Strive Wealth Management?

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Abnormal Returns

SEPTEMBER 4, 2024

morningstar.com) Early in retirement is the time to do some tax planning. nextavenue.org) Estate planning Mistakes to avoid in your estate planning. theretirementmanifesto.com) If you have a valuable collection you need a plan for its eventual disposition.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Nerd's Eye View

AUGUST 23, 2023

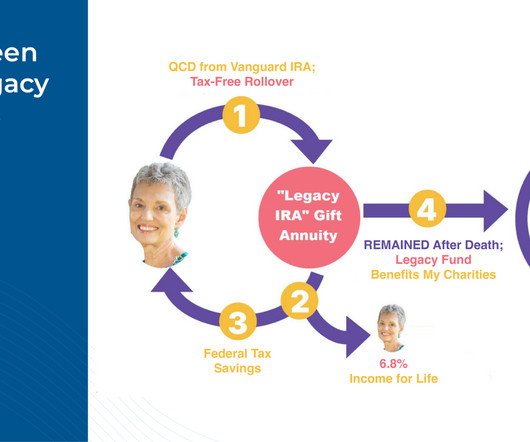

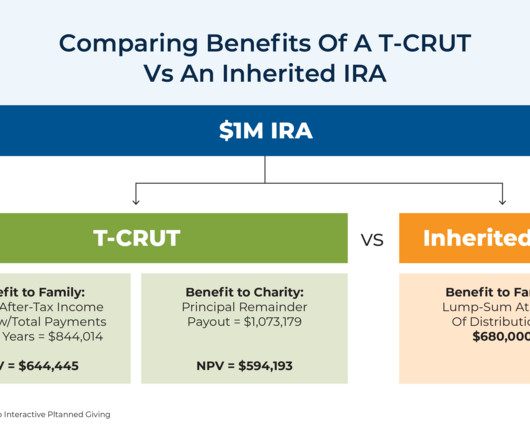

However, the caveat with current CGAs has been that they could only be funded with after-tax dollars before the donor’s death, meaning that if an individual only had tax-deferred funds (e.g., Second, they reduce the donor's tax bill in the year the CGA is created by excluding the amount contributed to the CGA from taxable income.

Cornerstone Financial Advisory

MARCH 14, 2025

As a Christian, your estate plan should represent your dedication to financial stewardship according to Scripture. W hat important factors should Christians consider when estate planning? W hat important factors should Christians consider when estate planning?

Darrow Wealth Management

JANUARY 16, 2025

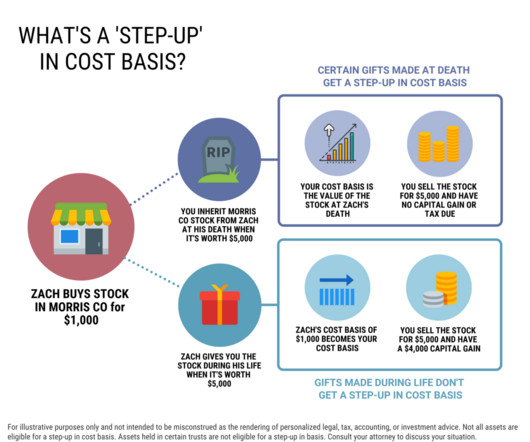

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Nerd's Eye View

AUGUST 9, 2024

Also in industry news this week: With a potential SEC regulation requiring RIAs to engage in enhanced "know your customer" practices under consideration, the Investment Adviser Association is arguing for a more tailored approach to identifying risky clients and a longer implementation period to relieve the potential burden on RIAs The SEC is investigating (..)

Nerd's Eye View

JUNE 21, 2024

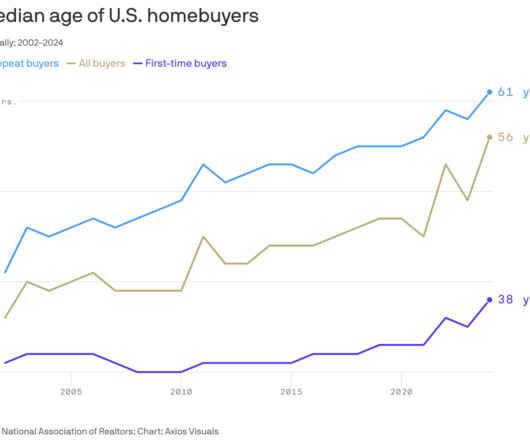

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Nerd's Eye View

JANUARY 31, 2024

This shift has led financial advisors to explore new strategies for mitigating the resulting tax-planning challenges. This allows the account to grow on a tax-deferred basis, with income to beneficiaries being taxed when distributions are made.

Nerd's Eye View

JANUARY 8, 2024

improves on the previous iterations of planning by involving a more thorough technical analysis of a client's unique situation than it did before and drilling deeper to reveal more planning opportunities to present to clients. Specifically, Financial Advice 3.0

Nerd's Eye View

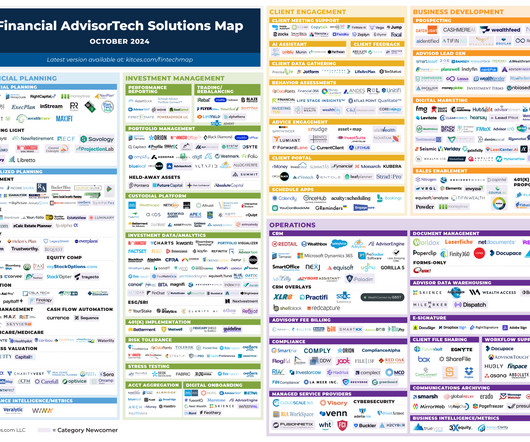

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

AUGUST 5, 2024

kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. papers.ssrn.com) Four steps to create a digital estate plan. (riabiz.com) The SEC Onsite SEC examinations are ramping up. forbes.com)

Harness Wealth

MARCH 6, 2025

As is traditional, the 2025 IRS tax filing deadline is April 15th. In this guide, well explore the 2025 tax extension process, the reasons for requesting an extension, and how a tax advisor from Harness can help you. Table of Contents What is a tax extension? Why do I need a tax extension? This is not the case.

Nerd's Eye View

SEPTEMBER 6, 2023

Beyond insurance, advisors and their clients can also consider options such as the use of corporate entities such as Limited Liability Companies (LLCs) for business interests, and estate tax planning tools such as Spousal Lifetime Access Trusts (SLATs) that can offer both estate planning and asset protection benefits for married couples.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Nationwide Financial

MARCH 6, 2023

Even if a client believes they would not be subject to estate or gift tax under current law, you may want to re-examine the value of their assets to determine whether they exceed a lower exemption amount. Tax season has begun, and it’s not too early to think about planning for the 2023 tax year.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. contained a number of changes relevant to estate planning. citizens and residents. The SECURE Act 2.0

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Zajac Group

NOVEMBER 7, 2024

One of the most important aspects of developing a thorough estate plan is tax planning, as this has the potential to diminish the impact of your gifts and your loved ones’ inheritances. Let’s take a look at the tax impact and other considerations of each. million before triggering federal estate taxes).

Harness Wealth

DECEMBER 8, 2022

Not only was the stock market fairly volatile, but there were also atypical tax regulation changes. Tax-loss harvesting. Paying taxes on investment gains can be a financial burden, but tax loss harvesting can reduce your bill. You can claim as much capital loss as your realized capital gain plus $3,000.

Carson Wealth

JANUARY 8, 2025

Holistic Financial Management Beyond investment advice, financial advisors offer comprehensive services such as tax planning, estate planning, and risk management. This support can be important in maintaining discipline and making rational decisions amidst market fluctuations.

Carson Wealth

FEBRUARY 29, 2024

It’s a simple, human act – one that seems like it shouldn’t take too much planning to do it correctly. But when does gifting become a tax issue? What do you need to consider about gifting as it relates to your overall estate plan? Taxes on Giving??? Why do you have to pay taxes on money you’re giving away?

Fortune Financial

JULY 28, 2022

When you transfer most assets to a taxable account, there will be income tax, but with company stock, you can take advantage of net unrealized appreciation (NUA). . However, the tax deferral benefit comes at a cost tradeoff. Almost every dollar distributed from a pretax retirement account will be taxed at ordinary income tax rates.

Ballast Advisors

SEPTEMBER 5, 2024

Navigating the complexities of estate planning can often feel like charting through uncharted waters, especially when it comes to handling assets, taxes, and ensuring one’s legacy is preserved according to their wishes. However, there are nuances to consider.

Integrity Financial Planning

NOVEMBER 14, 2023

We’re coming up on the end of the year, and while it’s a time to take a break and enjoy the holiday season, it’s also a good time to consider tax strategies that may benefit you. Gift Tax Exemptions Each year, you can give up to $17,000 to any number of people tax-free.

Darrow Wealth Management

JANUARY 29, 2024

There are no tax benefits during life nor are there any adverse tax implications. This article is a high-level overview of the various estate planning techniques and considerations when using revocable living trusts from the perspective of a wealth advisor (e.g. Other living trust benefits State estate tax planning.

WiserAdvisor

MARCH 13, 2024

Investment planning also plays a crucial role in tax optimization, enabling you to minimize tax liabilities and maximize after-tax returns. Additionally, tax-loss harvesting, and other tax-optimization strategies can further improve the tax efficiency of your investment portfolio, thereby enhancing overall returns.

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” These numbers show an opportunity for tax practices to build deeper, meaningful relationships with their clients, helping them to navigate some of life’s most challenging financial decisions.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens. You buy a business.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Tax-Planning Possibilities.

Carson Wealth

FEBRUARY 13, 2023

While there are certainly ways to do estate planning without a lawyer, for most people hiring an estate planning attorney makes the most sense. Estate plans can get complex fast, and even fairly straightforward estates can feel overwhelming if you’re not trained in the area. Do your research.

Darrow Wealth Management

OCTOBER 1, 2024

Choosing whether to fund a trust with your assets is an important decision in the estate planning process. A will and a trust are two different estate planning tools. There are no changes to the tax treatment of these assets. Limiting access can provide estate tax planning benefits for some).

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help with maximizing your retirement income through tax planning After retirement, your income sources may become limited to pensions, Social Security benefits, and investment income. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

Harness Wealth

JUNE 23, 2023

Estate planning is a critical component of a comprehensive financial plan. Furthermore, estate planning includes aspects such as tax minimization strategies, asset protection, and charitable giving. There are many different types of trusts, each designed to address specific estate planning needs.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content