Tax Experts Discuss Estate-Planning Considerations for Financial Advisors

Wealth Management

APRIL 26, 2023

An overview of some of the important estate-planning proposals included in the 2024 Greenbook.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 26, 2023

An overview of some of the important estate-planning proposals included in the 2024 Greenbook.

Abnormal Returns

NOVEMBER 11, 2024

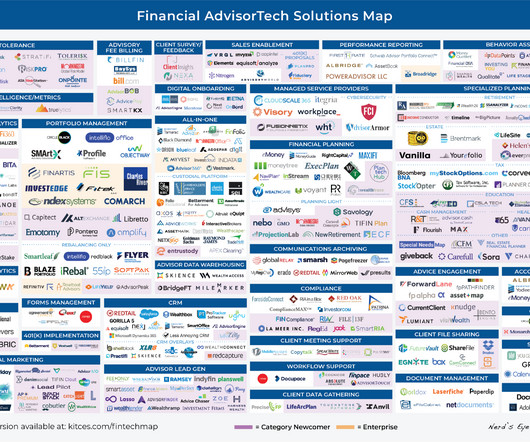

(riabiz.com) What is the target market for MAGA-centric Strive Wealth Management? riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) Practice management Should you outsource your marketing to an outside firm? advisorperspectives.com)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

MARCH 10, 2023

Helping improve your clients' estate plans can ensure their financial wellness for generations to come.

Wealth Management

JUNE 24, 2024

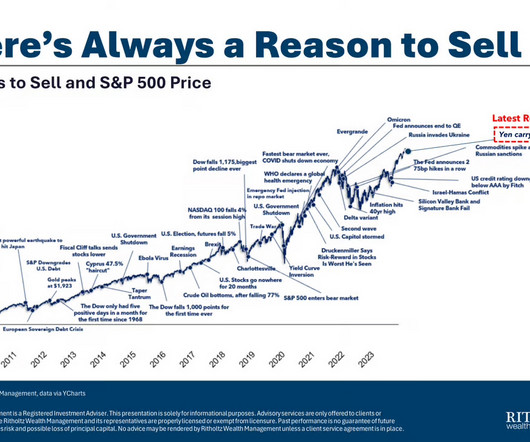

Six ways to help clients gain peace of mind regarding inflation.

Wealth Management

JANUARY 15, 2025

The right estate planning approach can result in a significant, tax-efficient transfer of your clients wealth.

Wealth Management

OCTOBER 2, 2024

Five ways to turn potential tax scares into sweet savings.

Wealth Management

SEPTEMBER 24, 2024

Don’t let the uncertainty about future tax policy interfere with taking action to meet your client’s goals.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Wealth Management

JULY 15, 2024

With the estate tax exemption sunset looming, the time to begin planning is now.

Wealth Management

JANUARY 24, 2024

Double-digit percentage point gains in both were notable findings in the annual advisor tech survey revealed at the T3 conference this week, as was the persistently low adoption of cybersecurity tools.

Wealth Management

OCTOBER 21, 2024

Administrative and tax issues, along with opportunities.

Wealth Management

AUGUST 31, 2023

Thursday, September 28, 2023 | 2:00 PM ET

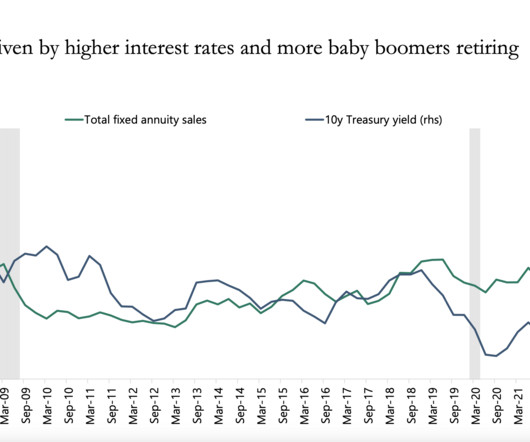

Abnormal Returns

FEBRUARY 19, 2024

washingtonpost.com) Daniel Crosby offers another sneak preview of an essay from his upcoming book, "The Soul of Wealth." standarddeviationspod.com) Trends The wealth management industry is going to be slammed with demand. morningstar.com) The biz Creative Planning was able to retain some 60% of the United Capital assets.

Wealth Management

OCTOBER 26, 2022

Could this approach turn the estate-planning industry upside down?

Wealth Management

JULY 3, 2024

Without proper guidance regarding taxes, philanthropy and estate planning, high net worth entrepreneurs can miss opportunities.

Wealth Management

AUGUST 21, 2023

King III provides an overview of the uncertain current and future status of state taxes and how they can impact your client’s planning needs.

Wealth Management

JULY 5, 2023

The IRS found the organization spent much time devoted to social and networking activities.

Wealth Management

MARCH 15, 2023

What “fair share” taxation means for estate planning.

Abnormal Returns

MAY 8, 2023

(citywire.com) Dynasty Financial Partners has formed Dynasty Investment Bank to provide services related to mergers and acquisitions in wealth management. thinkadvisor.com) The latest in advisortech news from April including the SEC's scrutiny of tax-loss harvesting systems.

Wealth Management

MARCH 8, 2023

Yet another lesson in how estate plans and family challenges can pose difficulties for all.

Wealth Management

FEBRUARY 21, 2025

A legally trained financial advisor helps clients stay on track and avoid missed opportunities for estate planning.

Wealth Management

JUNE 20, 2023

Integrated is launching the new insurance business largely due to recent changes in tax and estate planning regulations. Peter Kaplan, a former First American Insurance Underwriters vice president, will lead it.

The Big Picture

MAY 29, 2024

Not just the stocks and bonds, but your taxes, your will, your estate, any trusts, insurance, credit line, real estate, and anything that affects your financial health. So it’s, we have this division that it’s maybe a third to 40 percent of all the private wealth that we manage for very wealthy people.

Wealth Management

FEBRUARY 21, 2023

Private Client Solutions will help advisors access areas of expertise beyond investment management, including tax and estate planning and acquisition strategies.

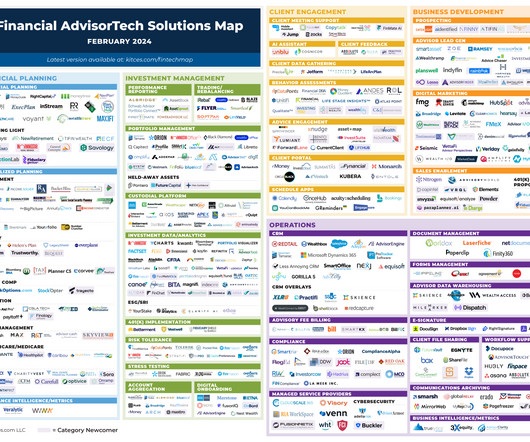

Nerd's Eye View

FEBRUARY 5, 2024

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Dispatch (formerly OneAdvisory) recently raised $8 million in seed funding as it seeks to provide a centralized data warehousing solution for advisory firms and eliminate the need for point-to-point data integrations between individual (..)

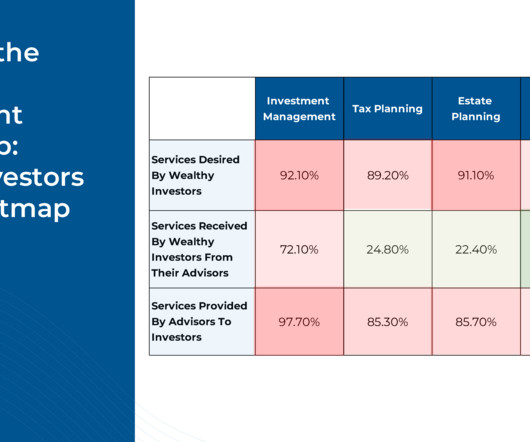

Nerd's Eye View

JANUARY 22, 2024

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

Dear Mr. Market

DECEMBER 31, 2024

Prioritize high-interest debt first (were looking at you, credit cards) while maintaining manageable payments on lower-interest loans like mortgages. Optimize Tax Strategies Its not what you makeits what you keep. Consolidation might be a smart move too.

Wealth Management

MARCH 26, 2025

Robinhood Strategies portfolios will include a mix of single stocks and ETFs for a 0.25% annual fee, while the private banking service will include estate planning and tax advice exclusively for Gold members.

Nerd's Eye View

JULY 3, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: All-in-one software platform Blueleaf has launched a new “aggregation-as-a-service” solution, promising better client data aggregation capabilities than existing solutions by automating the process of weaving multiple (..)

Abnormal Returns

DECEMBER 5, 2022

Podcasts Rick Ferri talks estate planning with Ryan Barrett and Mike Piper. advisorperspectives.com) IRAs Why asset location matters from a tax-perspective. wsj.com) Planning The ways that a financial planner can add value for a client are nearly limitless.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Abnormal Returns

OCTOBER 10, 2022

kitces.com) Peter Lazaroff on the difference between a financial adviser and wealth manager. riabiz.com) Taxes Why RIAs love to buy accounting firms. citywireusa.com) A look at the performance of automated tax-loss harvesting strategies. thinkadvisor.com) How taxes affect sustainable withdrawal rates. Panic is not.

Abnormal Returns

MAY 22, 2023

open.spotify.com) Austin, Texas Are you a Texas-based adviser interested working with Ritholtz Wealth Management? riaintel.com) CI Wealth The stock market did not react well to CI Financial's financial engineering. riabiz.com) Why Bain Capital invested in CI Private Wealth. Come meet the team in Austin on June 12-14th.

Abnormal Returns

AUGUST 5, 2024

kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. papers.ssrn.com) Four steps to create a digital estate plan. morningstar.com) Wealth matters when we activate it. forbes.com)

eMoney Advisor

MARCH 7, 2023

Stepchildren, remarriages, and ex-spouses: For the modern wealth management client with a blended family, planning to transfer wealth presents a web of complexity. Why Focus on Estate Planning for Blended Families A thoughtful plan and good communication can go a long way in heading off conflict in large families.

Darrow Wealth Management

MARCH 13, 2025

Charitable Contributions: Donating appreciated stock to charity while reducing capital gains tax. Options contracts as income and hedging strategies Options are often used in various hedging strategies, including single stock risk management strategies. Gifting: Transferring stock to family members or trusts.

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Independent wealth management firms have no affiliations or allegiances to a fund family or financial product. Advisors affiliated with a bank, broker dealer, or large asset manager might not be able to make a fully independent recommendation.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. Tax Considerations : Identifying strategies to optimize your tax situation. Ready to Grow Your Wealth?

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Zoe Financial

DECEMBER 5, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA December 5, 2023 Watch Time: 3 minutes Transcript: Welcome to this week’s Wealth Management Digest. Financial planning, estate planning, tax planning, etc, rather than just picking stocks like in the old days.

Abnormal Returns

OCTOBER 23, 2023

advisorperspectives.com) Vanilla is rolling out more AI tools for estate planning. riabiz.com) The upside of pro bono financial planning. wealthmanagement.com) Another example of an RIA adding tax capabilities. (investmentnews.com) Goldman Sachs ($GS) admits that the purchase of United Capital was a mistake.

Abnormal Returns

SEPTEMBER 30, 2024

riabiz.com) Taxes How pre-tax retirement contributions provide flexibility down the road. kitces.com) Tax strategies if the TCJA expires in 2026. flowfp.com) Don't let the potential for estate law changes be an excuse to not do estate planning.

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust . Charitable Remainder Unitrust .

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content