Carried Interest Offers Powerful Estate Planning Opportunities

Wealth Management

JULY 12, 2023

Make sure that clients are using the right valuation.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 12, 2023

Make sure that clients are using the right valuation.

Abnormal Returns

MAY 6, 2024

podcasts.apple.com) Altruist Altruist has raised $169 million, elevating its valuation to more than $1.5 advisorhub.com) How Altruist merited its new valuation. citywire.com) How advisers can best work with estate planning attorneys? kitces.com) What is financial planning? flowfp.com)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Carson Wealth

MAY 23, 2024

One of the most important decisions you’ll make when designing your estate plan is who to name in the various fiduciary roles: trustee, personal representative, executor and agent. The post Choosing the Right Trustee for Your Estate Plan appeared first on Carson Wealth.

Abnormal Returns

MAY 8, 2023

financial-planning.com) The biz What variables matter when it comes to RIA valuation. kitces.com) How personality traits affect estate planning decisions. (investmentnews.com) How JP Morgan Chase ($JPM) is trying to hold onto First Republic advisers. sciencedaily.com) How tax-adjusting a portfolio works in practice.

Park Place Financial

NOVEMBER 29, 2022

Estates Estate Planning in this Economic Climate Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. If you are in the middle of estate planning , consider the following strategies to develop a sound plan amidst widespread economic challenges. . Create a Trust . Charitable Remainder Unitrust .

Steve Sanduski

FEBRUARY 18, 2025

Including collectibles in estate planning to avoid family disputes. Things such as valuation, insurance, storage, and the succession plan. How advisors can help clients properly value, insure, and document their collections The tax implications of buying, selling, and trading collectibles.

Nerd's Eye View

AUGUST 5, 2024

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Envestnet has announced that it is being acquired and taken private in a $4.5

Darrow Wealth Management

AUGUST 28, 2023

Make your business more sellable later by getting advice now Business brokers often recommend getting a valuation done years before expecting to sell the company. On the personal side, your financial advisor , estate planning attorney, and CPA/tax advisor should be involved throughout the process.

Darrow Wealth Management

MARCH 31, 2023

You’ll also want to consider engaging a financial advisor, tax advisor, and estate planning attorney too. ” Even if all sides agree on the shares to include in the marital assets, valuation can be a challenge if the company is private. Get a new estate plan. This is a really important step.

Brown Advisory

SEPTEMBER 11, 2016

By Adi Padva, Equity Research Analyst ⚑ Equities Private Credit Outshines Many High-Valuation Stocks, Bonds Private credit occupies a sweet spot on the investment landscape, offering earlier distributions than private equity and higher yields than most publicly traded securities.

Brown Advisory

SEPTEMBER 11, 2016

Equities Private Credit Outshines Many High-Valuation Stocks, Bonds. Alternative Investments Proposed Tax Law Changes Prompt Estate Planning Review. Multi-generational planning, while best executed in prudent steps over long periods, sometimes requires a review because of changes in regulation or financial markets.

Brown Advisory

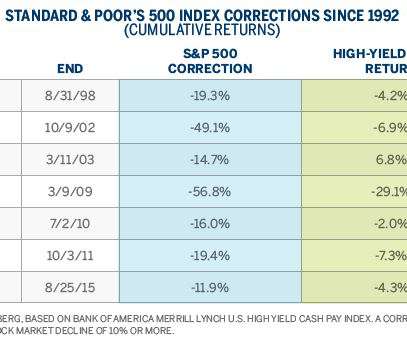

APRIL 1, 2020

These planning opportunities are driven primarily by four factors: Materially lower market values for publicly traded securities, and a likely downturn in valuations of real estate and other illiquid assets. GIFT AND ESTATE TAX PLANNING Outright Gifting. CHARITABLE PLANNING Charitable Giving.

Brown Advisory

APRIL 1, 2020

These planning opportunities are driven primarily by four factors: Materially lower market values for publicly traded securities, and a likely downturn in valuations of real estate and other illiquid assets. GIFT AND ESTATE TAX PLANNING. CHARITABLE PLANNING. tax code that are not permanent.

Brown Advisory

DECEMBER 2, 2015

It also encompasses intended lifestyle, charitable giving, retirement and estate planning, and liabilities, including anticipated costs for health care. During times of market volatility, such long-term planning enables clients to shake off an impulse to sell. Ensuring Legacies Last. By Joe Ferlise, Strategic Advisor.

Brown Advisory

MARCH 1, 2019

Tax and estate planning considerations are important during this stage; for example, we work with many clients to create trusts to hold business interests in a manner that will serve them well down the road. We also work with clients on best practices to support an eventual exit valuation of the enterprise. Post-Liquidity.

Brown Advisory

MARCH 1, 2019

Tax and estate planning considerations are important during this stage; for example, we work with many clients to create trusts to hold business interests in a manner that will serve them well down the road. We also work with clients on best practices to support an eventual exit valuation of the enterprise. Post-Liquidity.

Carson Wealth

JULY 26, 2023

Tax planning: This aspect must go hand in hand with your desired compensation, as the impact the sale has on your taxes may point you toward extending your payout, rather than taking a lump sum. Estate planning: The family impact of your succession plan is greater than most business owners appreciate.

Brown Advisory

SEPTEMBER 3, 2015

Still, we believe that attractive opportunities for fundamental, bottom-up investing endure in China S and Asia’s other emerging markets, where valuations are more attractive than for equities in the developed world like the U.S. Such protection can be a cornerstone for sound estate planning. Long-Term Winners.

Brown Advisory

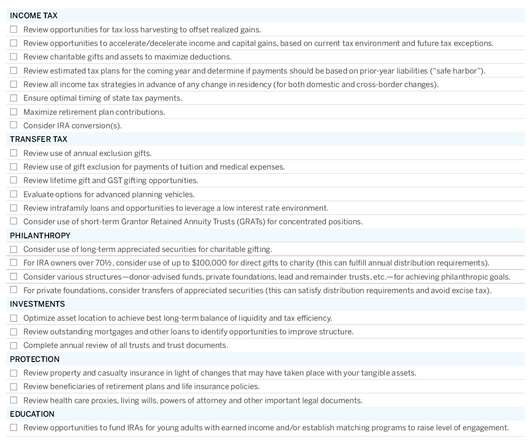

NOVEMBER 1, 2019

Market conditions may be volatile, but our planning efforts are, as always, focused on stability and consistency. You can find our annual planning checklist at the end of this article. It is important to evaluate near- and long- term planning options annually—each year can bring different opportunities.

Zoe Financial

FEBRUARY 21, 2023

Let’s review both of these in more depth: Financial Advisor A financial advisor helps you plan for your financial future by advising clients on investments, retirement planning, estate planning, insurance policies, tax strategies, and more. To acquire the CPA license, you need to meet specific requirements.

International College of Financial Planning

NOVEMBER 10, 2021

In this course program, you’d be trained in concepts such as capital budgeting, risk management, and option valuation to name a few. Retirement Planning Course – Retirement planning is gaining huge popularity among Indians. As the saying goes CFPs don’t have to hunt for jobs as jobs hunt for them.

Brown Advisory

SEPTEMBER 3, 2015

Among our holdings in sectors backed by clear flows of revenues, we maintain an overweight in health care and transportation and remain focused on credit stability, valuations and opportunities for price gains. Such protection can be a cornerstone for sound estate planning.

Brown Advisory

DECEMBER 2, 2015

In 2015, though, three trends began to weigh on stock prices: equity valuations rose above their historical average, record central-bank stimulus failed to fuel faster growth, and corporations, having already wrung out significant inefficiencies, made fewer gains in streamlining and improving profit margins, especially in the U.S.

Brown Advisory

DECEMBER 4, 2017

The outcome of the tax reform debate is likely to impact how we advise clients on tax planning, estate planning and a host of other topics. With the rise in asset valuation in recent years, we encourage clients to review asset protection plans. Since last year’s U.S.

Brown Advisory

NOVEMBER 12, 2015

Recharacterization: But what if you converted a traditional IRA to a Roth at a time when the assets were at peak valuation, and the value of the assets have since declined? We encourage you to speak with your team at Brown Advisory, who can help tailor your portfolio and your estate planning strategies to your particular circumstances. .

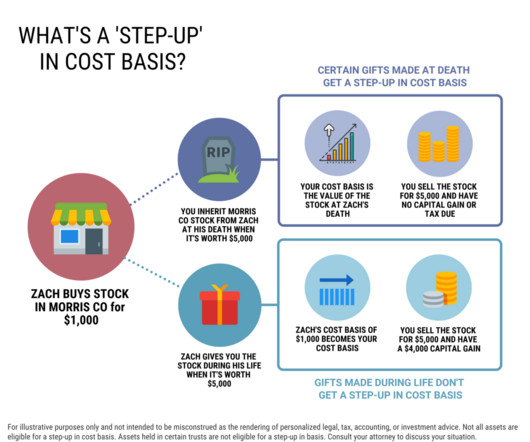

Darrow Wealth Management

JANUARY 16, 2025

Similarly, interests in a closely-held business will also need a professional valuation. At a high level, if the asset is part of the decedent’s estate it’s typically eligible for a step-up. This can get very tricky so it’s important to work with the estate planning attorney settling the estate.

eMoney Advisor

NOVEMBER 10, 2022

That occasion marked an agreement with the IRS on a $156 million value on Prince’s real estate and recordings for the artist who died in April 2016—without a will. What can we learn from celebrity estate planning disasters like this? Such cautionary tales prove the value of proper planning. It turns out, plenty.

Ballast Advisors

SEPTEMBER 5, 2024

Navigating the complexities of estate planning can often feel like charting through uncharted waters, especially when it comes to handling assets, taxes, and ensuring one’s legacy is preserved according to their wishes. Techniques such as swapping assets with a higher basis out of the estate can help achieve this objective effectively.

Brown Advisory

SEPTEMBER 12, 2016

Proposed Tax Law Changes Prompt Estate Planning Review achen Mon, 09/12/2016 - 06:00 A plan to maximize a family’s financial legacy usually saves the most tax by leveraging the longterm compounding of investments outside of the taxable estate.

Brown Advisory

SEPTEMBER 12, 2016

Proposed Tax Law Changes Prompt Estate Planning Review. A plan to maximize a family’s financial legacy usually saves the most tax by leveraging the longterm compounding of investments outside of the taxable estate. Adopting a program of planning early, and monitoring that program, often brings the best results.

Darrow Wealth Management

MAY 6, 2024

Checklist for executors of their parent’s estate Get organized Where are the original estate planning documents located? Who is the attorney who drafted the estate plan? Inform them of your parents passing and discuss options for support in settling the estate.

Harness Wealth

FEBRUARY 4, 2025

Risks: Illiquidity, subjective valuation, authenticity risks, fraud risks, market demand fluctuations, and high transaction costs. Their valuations can be uncertain since they are not traded on public markets. Additionally, complex tax implications and potential estate planning challenges should be considered before investing.

The Big Picture

JANUARY 21, 2025

And I think you will also, if you are at all curious about estate planning or investing or personal finance, this is not the usual discussion and I think it’s very worthwhile for you to hear this and share it with friends and family. And I, I found it to be an absolutely fascinating conversation.

Darrow Wealth Management

APRIL 25, 2023

In addition to making funeral arrangements and notifying family and friends, another priority is alerting your estate planning attorney and financial advisor. Asset Titling, Beneficiary Elections, and Probate The estate planning attorney is going to be critical here. But not everything needs to get done today.

Brown Advisory

NOVEMBER 1, 2023

There is a fundamental tradeoff between managing one’s estate tax burden and the capital gains tax burden that heirs may face; ultimately, both of these tax mechanisms combine to determine the efficiency of your estate plan. There are other ways to generate valuation discounts through indirect gifting strategies.

Darrow Wealth Management

OCTOBER 23, 2023

This stepped-up cost basis is usually the market value of the property on the date of death, though the estate may elect an alternate valuation date (six months after death). Estate plans are about distributions, not sentiments.

Darrow Wealth Management

MAY 6, 2024

Checklist for executors of their parent’s estate Get organized Where are the original estate planning documents located? Who is the attorney who drafted the estate plan? Inform them of your parents passing and discuss options for support in settling the estate.

Brown Advisory

OCTOBER 16, 2017

There are other ways to generate valuation discounts through indirect gifting strategies. So, while it is generally better to gift higher-basis assets and to pass lower-basis assets through inheritance, there are also some clear exceptions where it may make sense to consider lifetime gifts, even when the gifted assets are highly appreciated.

Brown Advisory

OCTOBER 16, 2017

There are other ways to generate valuation discounts through indirect gifting strategies. So, while it is generally better to gift higher-basis assets and to pass lower-basis assets through inheritance, there are also some clear exceptions where it may make sense to consider lifetime gifts, even when the gifted assets are highly appreciated.

James Hendries

OCTOBER 28, 2022

As we approach the end of the year, you may want to review areas that may impact your wealth and estate planning next year. As you plan for who pays taxes when your assets pass to your heirs, work with your financial and tax professionals to determine which tax-advantaged strategies are appropriate for your situation.

Brown Advisory

JUNE 16, 2016

The rules for annual exclusion gifts let you gift up to $14,000 each year to an unlimited number of beneficiaries without gift tax liability and without chipping away at your estate tax exemption. These gifts should therefore be a cornerstone of your estate plan if your estate exceeds the applicable estate tax exemption (currently $5.45

Brown Advisory

DECEMBER 1, 2023

CHANGING MARKET CONDITIONS: This year, clients will have an opportunity to revisit existing plans that were developed during a long era of low interest rates, negligible inflation and lofty asset valuations. What does this “great wealth transfer” mean for our clients and their descendants?

Brown Advisory

SEPTEMBER 17, 2021

Existing grantor trusts would still be out of the grantor’s estate and distributions from existing trusts would not be gifts. The elimination of certain valuation discounts frequently used in connection with estate planning transactions. Corporate Income Tax. An increase of the top corporate tax rate from 21% to 26.5%.

The Big Picture

APRIL 8, 2025

And then the next step up seems to be full on wealth management, where you’re dealing with philanthropy, generational wealth transfer, a lot of bells and whistles including estate planning tax. But we think that that valuations are there. You guys offer the full suite of services. 00:26:17 [Speaker Changed] Absolutely.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content