The Power of Thoughtful Financial Advice During Key Life Events

Wealth Management

JUNE 16, 2023

Proactive engagement reflects a commitment to comprehensive financial wellness, creating a meaningful and long-lasting impact on clients’ lives.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 16, 2023

Proactive engagement reflects a commitment to comprehensive financial wellness, creating a meaningful and long-lasting impact on clients’ lives.

Nerd's Eye View

NOVEMBER 18, 2024

The possibilities at the intersection of AI and financial advice are exciting – faster processes, better connections, less time on ‘busy work’ – but also come with uncertainty about the future of the field. What might the field of financial advice even look like in 10 years?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

Abnormal Returns

MAY 13, 2024

blogs.cfainstitute.org) How life events affect retirement planning. papers.ssrn.com) Advisers There is an tension inherent in the practice of financial advice. investmentecosystem.com) Reflections on eight years of running a financial planning practice.

Nerd's Eye View

JANUARY 13, 2025

Which is surprising to some, given that a decade ago, the emergence of so-called "robo-advisors" was supposed to displace human financial advisors and compress advisory fees. In reality, though, the robos struggled to gain traction, and the human financial advice business just continues to grow.

The Big Picture

MARCH 18, 2025

Media Madness : Do we really need 24/7 financial advice for our investments we wont draw on for decades? when the best course for our long-term financial health is to do nothing? We are too often swayed by recent events. Why are we constantly prodded to take action now! It boils down to context.

Nerd's Eye View

JULY 17, 2023

has increasingly made financial services products available directly to consumers, financial advisors have focused more and more on the business of financial advice itself. But as technology (in particular, the internet!)

Abnormal Returns

APRIL 12, 2023

open.spotify.com) Christine Benz and Jeff Ptak talk with James Choi about personal financial advice and the importance of defaults. calibratingcapital.com) Five signs you need a financial advisor including experiencing a big life event. Podcasts Morgan Housel talks about the importance of 'playing your own game.'

Darrow Wealth Management

NOVEMBER 17, 2022

The ‘millionaires’ tax will also ensnare taxpayers who exceed the $1M limit after selling a home, business, stock options, or other types of one-time events. Article is a general communication only and should not be used as the basis for making any type of tax, financial, legal, or investment decision.

The Big Picture

MAY 9, 2024

Bad financial advice reaches naïve, impressionable consumers of social media without any guardrails or controls. Always be wary of social media influencers who use engagement bait tactics to sell a course or event.” 2 Sure, you can claim mainstream media is bad, but social media is worse.

Nerd's Eye View

OCTOBER 1, 2024

We also talk about how Gaetano has built his current practice up to $75 million in just 5 years in part through client referrals that came after he got really proactive in addressing client concerns (from phone calls to webinars to additional written commentary and even crafting an expertise on PPP loans while they were available) during the COVID-induced (..)

Nerd's Eye View

AUGUST 24, 2022

While many IRAs include a clause in their advisory agreements limiting their liability in giving financial advice in good faith, the SEC and state regulators have recently been scrutinizing such ‘hedge clauses’ to the extent that they may be found impermissible going forward.

Nerd's Eye View

AUGUST 24, 2022

While many IRAs include a clause in their advisory agreements limiting their liability in giving financial advice in good faith, the SEC and state regulators have recently been scrutinizing such ‘hedge clauses’ to the extent that they may be found impermissible going forward.

Nerd's Eye View

SEPTEMBER 25, 2023

Gradually, CFP Board also raised the ethical standards for CFP professionals, introducing a fiduciary standard on financial planning in 2008 and, in 2020, an expanded fiduciary standard that applies whenever the certificant is giving financial advice.

Nerd's Eye View

OCTOBER 19, 2023

pre-retirees with employer pension annuity choices), political or religious affiliations, or significant life events that create central themes and recurring concerns that an advisor can specialize in (e.g., Most commonly, niches present as particular needs of a firm's clients.

Midstream Marketing

OCTOBER 29, 2024

Key Highlights Millennials can benefit a lot from getting financial advice. You should change your marketing approach to meet the specific financial needs and interests of millennials. Listen to their concerns and adjust your financial advice to align with their goals. Right now, few of them use advisors regularly.

Nerd's Eye View

MAY 16, 2024

In the initial stages of their careers, many financial advicers find that, with little revenue coming in and less than a full load of client-facing work to do, they spend the majority of their time on operations and marketing as they try to establish their practice.

NAIFA Advisor Today

JANUARY 28, 2025

Richardson is a financial planner who has been providing sound financial advice to his clients since 2005. His primary focus is to help people align their financial decisions with their values and truths to live enriching lives.

Steve Sanduski

NOVEMBER 12, 2024

including their intense focus on metrics, culture, growth, referral marketing , and how they’ve structured their regions and “pods” to deliver “wealth alignment” that goes far beyond typical financial advice. Broadening the client experience to include world-class events (like an African safari!)

Midstream Marketing

OCTOBER 30, 2024

Key Highlights The financial advice world is changing. They need to put in more effort to attract prospective clients looking for financial advice. Understanding the Marketing Landscape for RIAs The world of financial advice is changing fast. This helps them draw in new clients who need financial advice.

Midstream Marketing

NOVEMBER 12, 2024

[link] [link] [link] New Financial Advisor Prospecting When You Attend Networking Functions Keep Your Business Cards In Your Car When attending networking functions, it’s crucial to always have your business cards handy. This helps potential clients find you when they look for financial advice online.

Midstream Marketing

NOVEMBER 6, 2024

By making helpful and interesting content often, you show that you are a reliable choice for financial advice. This approach can draw in new clients who are looking for guidance in today’s complicated financial world. Trust is very important in the financial services industry. Be unique with your financial advice.

FMG

OCTOBER 6, 2022

From financial planning and risk analysis tools to marketing automation platforms , technology streamlines processes, increases productivity, and helps you grow your business faster. From intuitive event calendars to account administration, Wealthbox and FMG Suite work in sync to give financial advisors more control and flexibility. .

Midstream Marketing

DECEMBER 10, 2024

Another way is to collect business cards at events. A great way for financial advisors to build strong relationships and get referrals is by knowing their community and networking. Think about joining local events, supporting charity projects, or joining business groups. Basic financial advice doesnt work anymore.

Advisor Perspectives

MARCH 8, 2023

By 2030, $30 trillion, or two-thirds of U.S.

FMG

JANUARY 24, 2024

According to Smart Asset , only 11% of millennials use financial advisors regularly. Only about a third of financial advisors actively target millennials. That means many millennials need financial advice and plenty of opportunities for financial advisors.

eMoney Advisor

APRIL 13, 2023

Closer Than Ever to Clients “We are incredibly bullish on the future of financial advice.” ” That’s Shawn Mihal, LPL’s new head of financial institution services, sharing his firm’s recent successes with the Bank Insurance and Securities Association (BISA).

FMG

FEBRUARY 22, 2023

As a refresher, some of the most popular forms of marketing include: Events Webinars Social Media Email Marketing SEO/Website Traffic Podcasts Video/YouTube PPC Read on to see real-life examples of financial advisors using some of these marketing tactics and how they worked for them. Looking to start planning events for your firm?

eMoney Advisor

DECEMBER 27, 2022

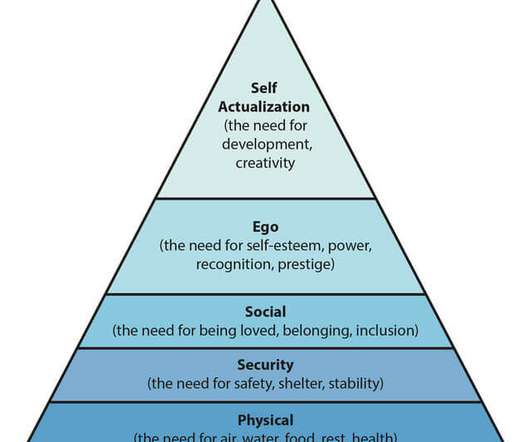

One way to assess this is to look at the value of financial advice as it stacks up to basic human needs. Cash flow and basic needs encompasses food, housing, and daily expenses and ensures the fundamentals, including physiological needs, are covered financially. Money and Maslow’s Hierarchy of Needs.

Indigo Marketing Agency

AUGUST 22, 2024

Financial decisions are often tied to significant life events which can be a source of uncertainty, and anxiety. To utilize this client retention strategy, go beyond mere financial advice by listening actively, showing empathy, and asking about client concerns, aspirations, and feedback.

Midstream Marketing

NOVEMBER 5, 2024

Introduction In the busy world of financial advice, it’s important to stand out. If you are a financial advisor looking to grow your client base and make a real impact, you need to learn good marketing strategies. It allows financial advisors to stand out. Clients often look for financial advice that suits them.

WiserAdvisor

OCTOBER 5, 2023

However, a vast majority of people still place their trust in human financial advisors with whom they can communicate face-to-face and receive pertinent financial advice. Advice via AI-powered robo-advisors AI-powered robo-advisors have become popular tools for managing investments. Is AI the future of personal finance?

Sara Grillo

JANUARY 8, 2024

As many corporate employees tend to have smaller account sizes, this entire group would be shunned by the typical financial advisor who usually has high account minimums of $1MM or above. By the way, if you happen to be a small investor looking for financial advice, I have a list of advisors who are open to serving such clients.

Zoe Financial

NOVEMBER 20, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

Zoe Financial

NOVEMBER 6, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

The Big Picture

DECEMBER 7, 2022

There are periods of time when we all flip on the TV and watch live events unfold in real-time. National disasters, wars, crises, big entertainment and sporting events all tend toward communal viewing. How does all of this “free financial advice” impact your collective psyche? Viewership soared… ~~~.

WiserAdvisor

DECEMBER 1, 2023

This article will shed light on why physicians particularly need financial advisors to navigate the financial intricacies of their lives. These milestones can often bring unique financial challenges for physicians. each of these events can profoundly impact an individual’s financial situation.

Zoe Financial

NOVEMBER 27, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

Zoe Financial

OCTOBER 23, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

Zoe Financial

OCTOBER 16, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

eMoney Advisor

FEBRUARY 9, 2023

Recent research 1 found that there is a large population of Americans interested in financial guidance. Of an estimated 104 million households seeking some level of financial advice, 88 million of those households want that advice from a financial professional. Focus on short-term goals.

Harness Wealth

AUGUST 13, 2024

Media Contact Nate Eldridge neldridge@harnesswealth.com About Harness Founded in 2018, Harness seeks to make bespoke tax & financial advice accessible to more households and small businesses by curating a community of innovative advisory firms and powering them with a modern practice platform. For complete results of the Inc.

Zoe Financial

NOVEMBER 13, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

Zoe Financial

OCTOBER 30, 2023

Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Actual economic or market events may turn out differently than anticipated. We believe financial advice should come from unbiased and certified professionals. Economies and markets fluctuate.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content