Osaic Super OSJ Rolls Out Affiliation Model for Fee-Only RIAs

Wealth Management

MAY 2, 2024

Rita Robbins sees an opportunity to bring Affiliated Advisors' service model to fee-only advisory firms bogged down in “the muddy middle.”

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Fee Only Related Topics

Fee Only Related Topics

Wealth Management

MAY 2, 2024

Rita Robbins sees an opportunity to bring Affiliated Advisors' service model to fee-only advisory firms bogged down in “the muddy middle.”

Wealth Management

OCTOBER 14, 2022

partners with Lincoln Investment to invest in growing fee-only RIAs. New RIA aggregator on the block, Transcend, formed by execs from Mercer and Budros, Ruhlin & Roe.,

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Wealth Management

OCTOBER 7, 2024

The Cleveland-based MAI's acquisition of Halpern Financial is the firm’s eighth deal this year and its 40th since 2018.

Wealth Management

AUGUST 19, 2024

Adding the Virginia and Pennslyvania-based Agili to CW Advisors will boost the combined firm to 11 offices nationwide, with 113 employees and $10 billion in AUM.

Nerd's Eye View

AUGUST 15, 2023

Jim is the founder of MainStreet Financial Planning, an hourly, fee-only financial planning firm, and also created Procrastination Junction, a coaching program for fee-only financial advisors looking to improve their sales skills. Read More.

Darrow Wealth Management

FEBRUARY 13, 2025

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Here are some ways to find the best fee-only financial advisor to suit your needs. Heres an explainer on the differences between fee-only and fee-based advisors.

MainStreet Financial Planning

MARCH 7, 2025

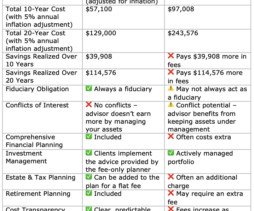

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). While AUM advisors may seem appealing, they often come with high lifetime fees and potential conflicts of interest.

Nerd's Eye View

SEPTEMBER 23, 2024

Starting a new firm can be a nerve-wracking time for an entrepreneurially minded financial advisor, as making the jump involves a significant amount of professional and financial risk.

Nerd's Eye View

NOVEMBER 28, 2024

Others may align with broader industry trends, like transitioning to fee-only structures to buffer against market volatility. Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning.

Wealth Management

FEBRUARY 6, 2024

Ryan Poterack shuttered his own RIA to join Private Advisor Group’s, as part of the firm’s growing cohort of fee-only advisors.

Wealth Management

JULY 5, 2023

The membership organization for fee-only advisors will now allow for a de minimis amount of commission business, as long as it's relinquished.

Nerd's Eye View

JUNE 30, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that NAPFA has announced that it will no longer exclude advisors who receive up to $2,500 in annual trailing commissions from previous product sales, if they agree to donate that money to a non-profit organization (..)

XY Planning Network

AUGUST 17, 2023

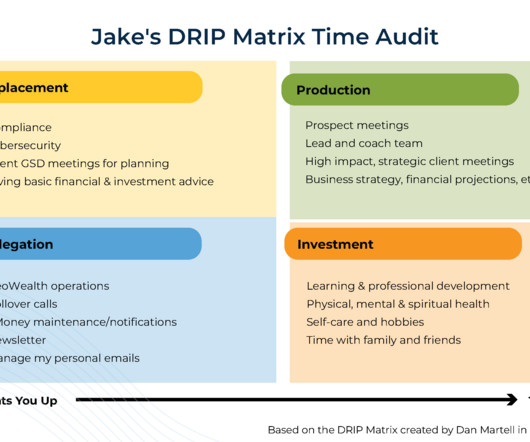

As fee-only planners, you dedicate your lives to your client’s financial well-being. A well-known piece of firm owner advice is to “put your clients first” when growing the business. And they’re right. Your clients are—and should be—the heart of your practice.

Wealth Management

AUGUST 23, 2022

based team sought to be fee-only and escape the contraints Wells Fargo placed on investment options and services he was able to offer his clients. Tom Moran and his Naples, Fla.-based

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Nerd's Eye View

DECEMBER 12, 2023

Christa is the Managing Director of Financial Planning and Business Development at Sebold Capital, a fee-only RIA based in Chicago, Illinois, which manages $300M across more than 100 client households. Welcome back to the 363rd episode of the Financial Advisor Success Podcast! My guest on today's podcast is Christa Madison.

Nerd's Eye View

NOVEMBER 1, 2022

Welcome back to the 305th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Mindy Crary.

Advisor Perspectives

APRIL 2, 2024

If you’re seeking greater flexibility, transparency, and even more ways to serve your clients, it’s time to start exploring the advantages of a being a fee-only advisor. Discover key insights to consider before embarking on this transition journey and explore the three distinct paths available for operating as an RIA.

Nerd's Eye View

NOVEMBER 28, 2022

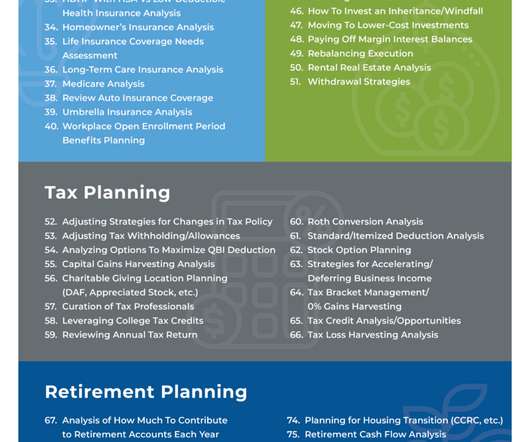

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Nerd's Eye View

NOVEMBER 28, 2022

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

XY Planning Network

AUGUST 17, 2023

As fee-only planners, you dedicate your lives to your client’s financial well-being. A well-known piece of firm owner advice is to “put your clients first” when growing the business. And they’re right. Your clients are—and should be—the heart of your practice.

Darrow Wealth Management

NOVEMBER 4, 2024

Most fiduciaries don’t sell products: Most fiduciary advisors are only paid by a percentage of assets they manage for clients. This AUM based fee structure is common among fee-only advisors who are almost always full-time fiduciaries. NAPFA advisors are all fee-only financial advisors.

XY Planning Network

JULY 25, 2022

With regulatory changes driving advisors to rein in their fees along with clients yearning for more holistic fiduciary advice, it’s becoming increasingly imperative that entrepreneurial-minded advisors are focused on building firms that ensure their interests align with their clients’. 4 MIN READ.

XY Planning Network

JULY 18, 2022

6 MIN READ. Although seemingly obvious, it’s worth saying—a firm isn’t a firm without clients. It can be tempting to think of your marketing activities as aside from your actual firm and what it is you do day to day.

Nerd's Eye View

APRIL 5, 2024

Also in industry news this week: The SEC has penalized 2 firms for false and misleading claims related to their use of Artificial Intelligence (AI), signaling the regulator's interest in advisers' "AI-washing" practices A research report suggests that fee-only RIAs with strong organic growth and enhanced service offerings for their clients are likely (..)

XY Planning Network

FEBRUARY 24, 2025

As a fee-only financial planner, youve built something special. You've poured your energy, passion, and expertise into growing your firm and are making your best life a reality. But as your business evolves, the strategies, tools, and metrics that got you to this point may no longer be enough.

The Chicago Financial Planner

FEBRUARY 2, 2024

Fee-only advisors receive no compensation from the sale of investment or insurance products. A part of this process might include hiring a financial advisor or hiring a new financial advisor if you have decided to move on from your current advisor. Hiring the right advisor for your needs is critical.

Nerd's Eye View

FEBRUARY 16, 2024

Which suggests that while advisors might be hesitant to publish their fees on their website before being able to meet face-to-face with prospects, doing so (and linking the fees to the value proposition they offer their ideal clients) could help certain consumers overcome their reluctance and start the process to becoming clients!

Nerd's Eye View

FEBRUARY 9, 2024

Also in industry news this week: A recent study finds that having a defined marketing strategy is a linchpin of marketing success, as advisors with a defined strategy were more likely to have seen an increase in inbound leads during the past 12 months and have more confidence in meeting their practice goals during the coming year than those without (..)

Inside Information

JULY 25, 2024

My subscription service is paid for by the user, just like fee-only advisors are paid by their clients. Are there free insights and ideas and in-depth reporting on important topics that I’m somehow missing? And then I realized what is the point of this rant.

Nerd's Eye View

JANUARY 12, 2023

And while providing fee-only advice or highlighting service as a fiduciary may have once been a fair differentiator, these services are now often considered table stakes, necessitating financial advisors to find more creative solutions that show current and prospective clients that they provide more value than other advisors.

Nerd's Eye View

AUGUST 15, 2022

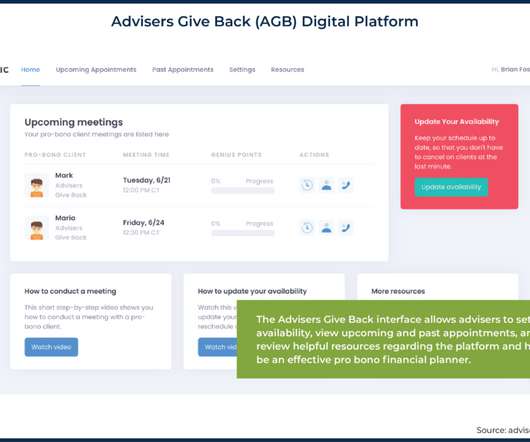

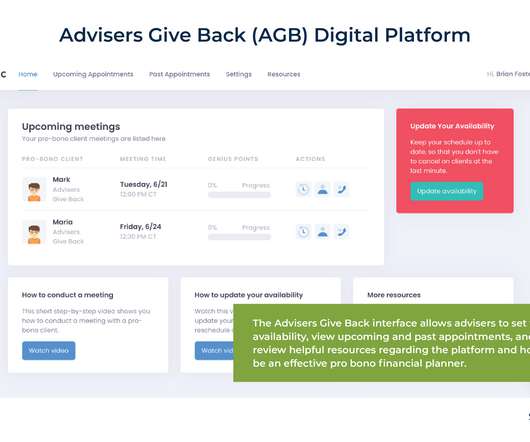

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it.

Nerd's Eye View

OCTOBER 16, 2023

Which led many firms to market all the ways they were 'better' than other sources of financial advice by highlighting their status as fiduciaries, fee-only advisors, or by offering (more) comprehensive financial planning services beyond investment management, as just a few examples.

Nerd's Eye View

OCTOBER 24, 2023

Sarah-Catherine is the founder of Aptus Financial, a fee-only financial planning firm based in Little Rock, Arkansas, that is approaching $2M in revenue and works with over 480 client households. Welcome to the 356th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sarah-Catherine Gutierrez.

Nerd's Eye View

AUGUST 15, 2022

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it.

Nerd's Eye View

JULY 26, 2022

In this episode, we talk in-depth about how after working for years in the financial industry, Amy realized there was a missed opportunity in working with career-driven Gen X women like her and decided to focus on serving that type of clientele she knew so well, how the initial fear of launching a firm on her own initially led Amy to partner with another (..)

Nerd's Eye View

MAY 21, 2024

, and the reason that Dann's firm has continued to stick with an AUM fee model despite an increasingly financial-planning-centric service offering.

Abnormal Returns

SEPTEMBER 30, 2024

wealthmanagement.com) Advisers 7 more lessons from building an fee-only RIA from scratch. (kitces.com) Tax strategies if the TCJA expires in 2026. flowfp.com) Don't let the potential for estate law changes be an excuse to not do estate planning. kitces.com) A Q&A with Barry Mulholland about attracting new planners to the industry.

XY Planning Network

NOVEMBER 6, 2023

Each piece of information is tracked year-over-year to show trends and provide fee-only financial planning firm owners with key metrics which they can measure their own businesses against. The survey focuses on revenue and expenses, client services, sources of clients/business, and pricing.

Nerd's Eye View

JUNE 4, 2024

We also talk about how Freeman has been able to turbocharge growth in his RIA, going from $7 million to now approaching $50 million in AUM in under 4 years, by using a local SEO strategy that emphasizes their status as one of the only fee-only fiduciary firms in their geographic area, why Freeman created 3 different websites targeted at the separate (..)

Nerd's Eye View

JUNE 4, 2024

We also talk about how Freeman has been able to turbocharge growth in his RIA, going from $7 million to now approaching $50 million in AUM in under 4 years, by using a local SEO strategy that emphasizes their status as one of the only fee-only fiduciary firms in their geographic area, why Freeman created 3 different websites targeted at the separate (..)

Nerd's Eye View

SEPTEMBER 19, 2023

In this episode, we talk in-depth about how Jessica leveraged her investment banking experience in wealth management mergers and acquisitions to build her own business where she could provide more independent M&A advice, why and how Jessica developed her flat-fee advice model for mergers and acquisitions to, similar to the evolution of fee-only (..)

XY Planning Network

JANUARY 29, 2024

And since keeping clean books that can survive any audit threat is our specialty, we’ve collected the most common 1099 questions fee-only advisors have had for us.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content