MAI Capital Management Acquires $1.2B Fee-Only RIA

Wealth Management

OCTOBER 7, 2024

The Cleveland-based MAI's acquisition of Halpern Financial is the firm’s eighth deal this year and its 40th since 2018.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 7, 2024

The Cleveland-based MAI's acquisition of Halpern Financial is the firm’s eighth deal this year and its 40th since 2018.

Wealth Management

MAY 2, 2024

Rita Robbins sees an opportunity to bring Affiliated Advisors' service model to fee-only advisory firms bogged down in “the muddy middle.”

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

OCTOBER 14, 2022

partners with Lincoln Investment to invest in growing fee-only RIAs. New RIA aggregator on the block, Transcend, formed by execs from Mercer and Budros, Ruhlin & Roe.,

Wealth Management

AUGUST 19, 2024

Adding the Virginia and Pennslyvania-based Agili to CW Advisors will boost the combined firm to 11 offices nationwide, with 113 employees and $10 billion in AUM.

Darrow Wealth Management

FEBRUARY 13, 2025

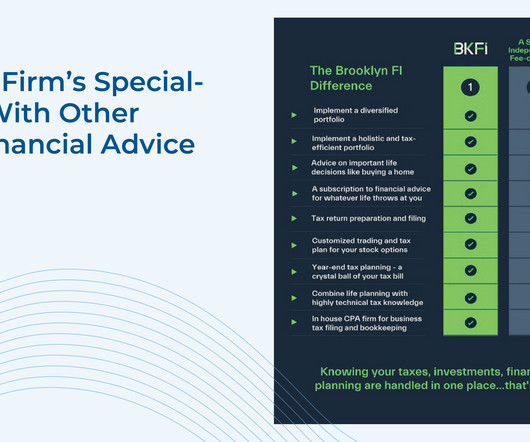

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Here are some ways to find the best fee-only financial advisor to suit your needs. What do fee-only financial advisors cost? Independent firm.

Nerd's Eye View

SEPTEMBER 23, 2024

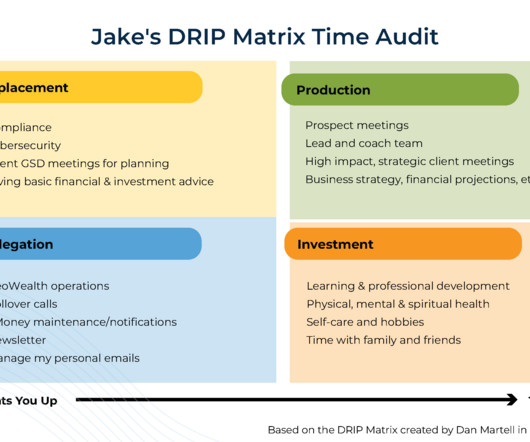

Nonetheless, after a year or 2 in business, some firm owners will find that their plate is becoming full and their available time is shrinking as they balance servicing current clients with marketing for new ones and also possibly managing staff. Jake also learned key lessons on managing daily schedules.

MainStreet Financial Planning

MARCH 7, 2025

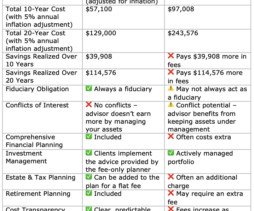

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). While AUM advisors may seem appealing, they often come with high lifetime fees and potential conflicts of interest.

Wealth Management

FEBRUARY 6, 2024

Ryan Poterack shuttered his own RIA to join Private Advisor Group’s, as part of the firm’s growing cohort of fee-only advisors.

Nerd's Eye View

JULY 26, 2022

Amy is the owner of Rooted Planning Group, an independent RIA based in Corning, New York that oversees $67 million in assets under management for 175 client households.

Wealth Management

MARCH 28, 2025

John Peluso, who led the creation of Wells Fargos RIA fee-only advisor program, is spearheading Thurston Springers exchange, which includes discounts in areas such as marketing and succession planning.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Wealth Management

JULY 5, 2023

The membership organization for fee-only advisors will now allow for a de minimis amount of commission business, as long as it's relinquished.

Nerd's Eye View

NOVEMBER 28, 2022

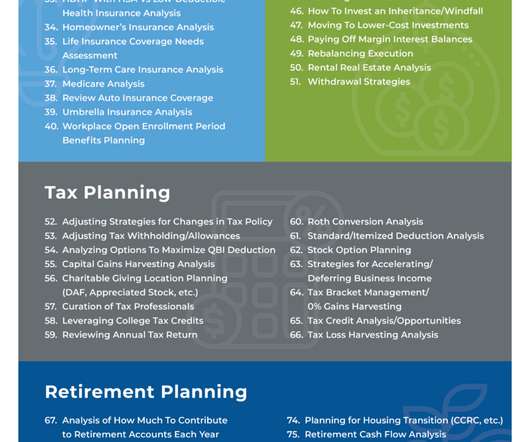

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Nerd's Eye View

NOVEMBER 28, 2022

From advisors who earn commissions from the sales of financial products to fee-only investment advisors who charge based on client assets under management, the value advisors provide to their clients has often been centered on investment management.

Wealth Management

AUGUST 23, 2022

based team sought to be fee-only and escape the contraints Wells Fargo placed on investment options and services he was able to offer his clients. Tom Moran and his Naples, Fla.-based

Nerd's Eye View

DECEMBER 12, 2023

Christa is the Managing Director of Financial Planning and Business Development at Sebold Capital, a fee-only RIA based in Chicago, Illinois, which manages $300M across more than 100 client households. Welcome back to the 363rd episode of the Financial Advisor Success Podcast!

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Only fiduciary advisors are legally bound to act in your best interest at all times. Independent wealth management firms have no affiliations or allegiances to a fund family or financial product. What is a fiduciary advisor? A note of caution on near me searches.

Yardley Wealth Management

MAY 30, 2023

The post What’s a Fiduciary & Fee-Only Advisor? appeared first on Yardley Wealth Management, LLC. What’s a Fiduciary & Fee-Only Advisor? A Guide for Financial Planning When it comes to managing your finances, it’s crucial to work with a professional who puts your interests first.

Nerd's Eye View

NOVEMBER 1, 2022

Mindy is the owner of Creative Money, an independent RIA based in Seattle, Washington, that offers a unique 12-month financial planning engagement – or as Mindy puts it on her homepage, “financial planning that doesn’t suck” – which has allowed her firm to work with nearly 400 client households just this year.

Nerd's Eye View

OCTOBER 16, 2023

Consumers have a wide range of options when it comes to choosing a provider of financial advice, from larger wirehouses and asset managers to smaller Registered Investment Advisers (RIAs).

Nerd's Eye View

OCTOBER 24, 2023

Sarah-Catherine is the founder of Aptus Financial, a fee-only financial planning firm based in Little Rock, Arkansas, that is approaching $2M in revenue and works with over 480 client households. Welcome to the 356th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sarah-Catherine Gutierrez.

Darrow Wealth Management

JUNE 14, 2023

Managing sudden wealth paid in cash after the sale of a business or winning the lottery also requires planning, but perhaps with a bit less to unpack in the beginning. Sudden wealth events rarely happen more than once during someone’s lifetime (if at all), so proper financial management is essential. What is sudden wealth?

Walkner Condon Financial Advisors

APRIL 17, 2023

Fee-Only financial advisors and firms receive no sales-related compensation or incentives. They are compensated only by the fee the client pays. Fee-Only financial advisors, on the other hand, do not receive commissions and are compensated through a fee-for-service model.

Nerd's Eye View

AUGUST 15, 2022

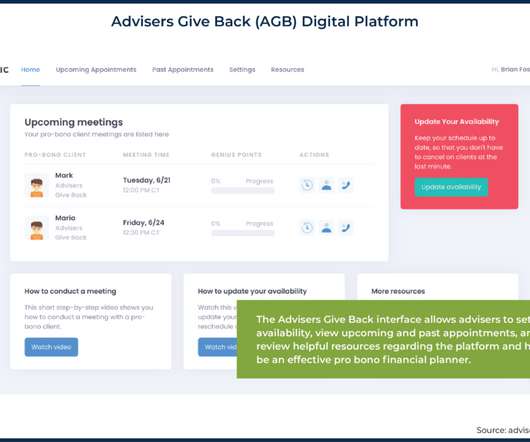

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it. law) with established pro bono programs.

Nerd's Eye View

SEPTEMBER 19, 2023

Jessica is the Founder and Principal for Turkey Hill Management, a mergers & acquisitions consulting firm that assists financial advisors with the sale, acquisition, integration, or merger of their firms. Welcome back to the 351st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jessica Polito.

Tobias Financial

APRIL 1, 2025

With nearly 10 years of experience working with high-net-worth individuals in the fee-only Registered Investment Advisor space, Chad is dedicated to helping clients navigate complex financial decisions.

Abnormal Returns

SEPTEMBER 30, 2024

(wealthmanagement.com) Advisers 7 more lessons from building an fee-only RIA from scratch. thinkadvisor.com) A Q&A with Moshe Milesky author of “The Religious Roots of Longevity Sharing: The Genesis of Annuity Funds in the Scottish Enlightenment and the Path to Modern Pension Management.” thinkadvisor.com)

Nerd's Eye View

AUGUST 15, 2022

But while new fee models have allowed fee-only advisors to reach an expanding range of potential clients, there are many Americans who could benefit from professional financial advice but might not have sufficient income or assets to pay for it. law) with established pro bono programs.

Nerd's Eye View

MAY 21, 2024

Dann is a Managing Partner of Sincerus Advisory, an RIA based in New York City, that oversees approximately $165 million in assets under management for nearly 150 client households. Welcome to the 386th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Dann Ryan.

Inside Information

JULY 25, 2024

billion in assets under management? You might be interested to know that Arkadios Capital recruited a former LPL team that manages $850 million in client assets. And in between, there are predictions and a lot of boasting from the largest investment management firms and custodians, who like to keep their names in the news.

Nerd's Eye View

JUNE 4, 2024

Freeman is the Co-Founder of La Crosse Financial Planning, an RIA based in La Crosse, Wisconsin, that oversees nearly $50 million in assets under management (AUM) for 73 client households. My guest on today's podcast is Freeman Linde.

Nerd's Eye View

JUNE 4, 2024

Freeman is the Co-Founder of La Crosse Financial Planning, an RIA based in La Crosse, Wisconsin, that oversees nearly $50 million in assets under management (AUM) for 73 client households. My guest on today's podcast is Freeman Linde.

Truemind Capital

JANUARY 24, 2025

Many of our clientscome to us after dealing with traditional wealth management setups. Too many products create clutter in the portfolio and distract from efficient management of your portfolio. The best way to avoid such a situation is to deal with fee-only SEBI RegisteredInvestment Advisors who cannot earn commissions by regulation.

The Big Picture

SEPTEMBER 5, 2024

Not just because of his personal experiences as a stockbroker or an advisor, or as a manager of once a brokerage firm and now an RIA – but because of his deep curiosity about what makes this industry tick. Wells Fargo Advisors said at the end of 2013 it had $375 billion in managed account assets, roughly 27% of the $1.4

Nerd's Eye View

MAY 28, 2024

Jenny is a Principal and Wealth Manager at Modera Wealth Management, an RIA based in Westwood, New Jersey, that oversees $12.5 billion in assets under management for approximately 4,700 client households. Welcome to the 387th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jenny Martella.

XY Planning Network

MAY 8, 2023

Many advisors—especially those who haven't managed their own compliance previously—can feel like it's the "monster in the closet." Let's talk compliance. Sometimes that one word has the power to make financial advisors break out in a sweat. But it doesn't need to be!

Nerd's Eye View

MAY 28, 2024

Jenny is a Principal and Wealth Manager at Modera Wealth Management, an RIA based in Westwood, New Jersey, that oversees $12.5 billion in assets under management for approximately 4,700 client households. Welcome to the 387th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jenny Martella.

XY Planning Network

NOVEMBER 21, 2022

One of the most common questions we hear from advisors interested in starting their own RIA is “What are my options for investment management?” After working with small business owners for over a decade, I am no stranger to the pressure so many people feel to get their ducks in a row, launch, and grow as quickly as possible.

The Chicago Financial Planner

NOVEMBER 8, 2021

Do it yourself if you’re comfortable or hire a fee-only financial advisor to help you. Manage your portfolio with an eye towards downside risk. Manage your portfolio with and eye towards downside risk. If you have a financial plan this is an ideal time to review it and see where you are relative to your goals.

Your Richest Life

JANUARY 27, 2025

Active investing involves a hands-on approach to managing your portfolio. Another problem is that there are fees associated with buying and selling in the markets. Transaction fees, management fees, and capital gains taxes can eat into your returns. of professionally managed portfolios in the U.S.

Sara Grillo

OCTOBER 21, 2022

In this blog, I interview paraplanning professionals to get their take on what the role is, what it pays, and what it potential is for someone who wants to get a job as a financial paraplanner, possibly as a stepping stone to other wealth management jobs. Fee-only advisors are bound to the fiduciary standard.

XY Planning Network

DECEMBER 9, 2024

Managing this process effectively is crucial for retaining clients and ensuring compliance. If you're an established financial advisor setting out to launch your own Registered Investment Advisor (RIA) firm, transitioning clients from your previous firm is likely at the forefront of your concerns.

Your Richest Life

FEBRUARY 24, 2025

Managing Investments During a Financial Crisis About Your Richest Life At Your Richest Life, Katie Brewer, CFP, believes you too should have access to financial resources and fee-only financial planning. The best way forward is to keep an eye on your long-term plans, and try not to get derailed by uncertainty.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content