It’s Not ‘ESG Investing.’ It’s Just Investing

Wealth Management

APRIL 20, 2023

By not taking ESG factors into account, financial advisors may be shirking their fiduciary duty.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 20, 2023

By not taking ESG factors into account, financial advisors may be shirking their fiduciary duty.

Wealth Management

MARCH 21, 2025

The SEC accused Cambridge Investment Research's RIA business of breaching its fiduciary duty in recommending certain mutual funds and money market sweep funds.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 7, 2024

In contrast, the outgoing director of the SEC's Investment Management Division said the degree of risk in AI’s proliferation is “obvious.” The advocacy group for advisors argued the rule is overly broad.

Nerd's Eye View

JUNE 12, 2024

For example, if an advisor recommends an investment that prioritizes the commission they would receive rather than any benefit the client would derive from it, they could incur fines and sanctions for violating their fiduciary duty as an advisor.

Nerd's Eye View

OCTOBER 25, 2023

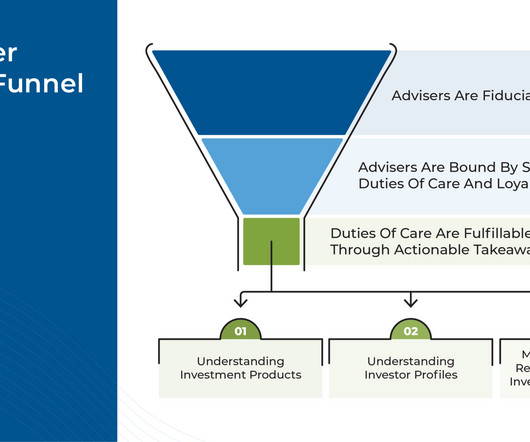

There is a general understanding that investment advisers have a fiduciary relationship with their clients – in other words, that they are required to act in the client's best interests. These 3 components in practice make up a core part of the adviser's fiduciary duty to their clients.

Nerd's Eye View

JUNE 21, 2023

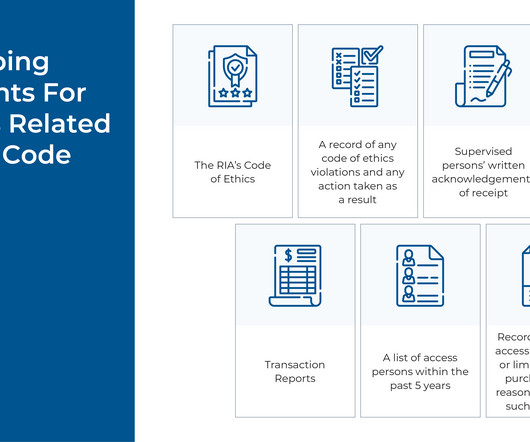

All investment advisers are fiduciaries that owe a duty of care and loyalty to their clients, and, in an ideal world, advisory firms and their staff would abide by these requirements without the need for a prescriptive code of ethics. Read More.

Abnormal Returns

JULY 26, 2023

money.usnews.com) Investing J.D. Roth, "Too many people try to overcomplicate investing. Too many people pay others to provide subpar investment results." jdroth.com) Why people underperform their own investments. awealthofcommonsense.com) Doug Boneparth, "Investing is hard, because nothing stays the same forever.

Nerd's Eye View

FEBRUARY 17, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the SEC is proposing to expand the adviser custody rule beyond securities and funds to cover all assets in a client’s portfolio, including private securities, real estate, derivatives, and cryptoassets.

Nerd's Eye View

SEPTEMBER 27, 2024

Also in industry news this week: As brokerage firms have faced a wave of lawsuits regarding the low interest rates paid on cash sweep accounts, some legal experts believe that RIAs could also be targeted for legal action if they allow clients' uninvested cash to sit in a cash sweep account rather than investing it or moving it to a higher-yielding (..)

Darrow Wealth Management

NOVEMBER 4, 2024

For non-fiduciary financial advisors, recommendations may only need to be suitable , not necessarily in the client’s best interest. Hybrid firms can switch between their status as a registered investment advisor and brokerage, which can be problematic for individuals seeking unbiased financial advice.

Abnormal Returns

JANUARY 31, 2023

papers.ssrn.com) Fund management How do active managers invest their own money? blog.validea.com) How anti-ESG movements could be contrary to a fiduciary duty. Indexing The index effect is disappearing. papers.ssrn.com) Does additional scrutiny, via index inclusion, hurt a company's performance. nytimes.com)

Ron A. Rhodes

MARCH 18, 2023

While the SEC has provided an interpretative release [SEC Release IA-5248, Commission Interpretation Regarding Standard of Conduct for Investment Advisers (July 12, 2019)] regarding the fiduciary duties of investment advisers,…

Darrow Wealth Management

FEBRUARY 13, 2025

Fee-only firms are unique as they do not receive commissions from selling financial products, such as insurance policies or investment products. Fee-only financial advisors are often registered investment advisors too, meaning they have a legal duty to act in the clients best interest. Independent firm.

Sara Grillo

MARCH 11, 2024

He figured out it would be better to invest more time initially to get people’s finances on the rails, and then adjust the amount downwards as the relationship progresses. He doesn’t touch investments because he sees less opportunity to add value. If he doesn’t, he feels he isn’t doing this fiduciary duty.

eMoney Advisor

DECEMBER 20, 2022

A recent announcement regarding cryptocurrency from the CFP Board provided advice on crypto-related investments stating CFPs® are neither required nor prohibited from providing advice related to cryptocurrency, but “should do so with caution.” Crypto Investing Deserves Special Consideration. Risks Associated with Crypto.

Good Financial Cents

JUNE 11, 2023

One thing that I have craved for investors is a tool that allows you to sync all your financial accounts – your investment portfolio, checking and savings accounts, credit cards and other loan accounts – in one place, and then provides an investment-related analysis of your entire portfolio. Personal Capital to the rescue.

Truemind Capital

SEPTEMBER 10, 2019

Investment management is never a part-time activity but a full-time job. Quality investment management is much more than selecting schemes from star-rating websites or buying a stock based on little insights. Unchecked conflict of interest can ruin your investment returns. 🔊 Play Audio.

Wealthfront

NOVEMBER 4, 2024

Wealthfront Advisers is a registered investment advisor, and that means we have a fiduciary duty to act in your best interest. As part of that commitment, we are always looking for opportunities to help you earn more and keep more.

Brown Advisory

SEPTEMBER 12, 2019

Sustainable Investing: Considerations for Trustees ajackson Thu, 09/12/2019 - 08:49 Sustainable investing. Impact investing. These terms all refer to the consideration of social and environmental factors in one’s investment decisions—a concept that is gaining serious traction in the investment universe.

Brown Advisory

SEPTEMBER 12, 2019

Sustainable Investing: Considerations for Trustees. Sustainable investing. Impact investing. These terms all refer to the consideration of social and environmental factors in one’s investment decisions—a concept that is gaining serious traction in the investment universe. Thu, 09/12/2019 - 08:49. Mission alignment.

International College of Financial Planning

AUGUST 31, 2023

Investing your money is crucial to securing your financial future and achieving your goals. Whether saving for retirement, buying a home, or building an emergency fund, investing grows your wealth over time. However, relying on a single asset class or Investment within an Asset class can be risky and limiting.

Park Place Financial

SEPTEMBER 8, 2022

Whether planning for retirement or evaluating different investment options, people seek the assistance of a personal financial advisor for many reasons. Registered Investment Advisor (RIA) . As the name indicates, an RIA recommends the best investment options based on a person’s financial circumstances and goals.

Brown Advisory

NOVEMBER 29, 2022

Investing in a Resilient Future: Our Role in Supporting the Climate mhannan Tue, 11/29/2022 - 14:04 Download the Report We live in an age of technological miracles, but many of these miracles come with steep costs for society. We also describe our initial plans under the Net Zero Asset Managers initiative (NZAMi).

Brown Advisory

NOVEMBER 29, 2022

Investing in a Resilient Future: Our Role in Supporting the Climate. To reduce emissions and/or resource use, many cities and even entire nations are investing meaningfully in these technologies as well as climate adaptation and mitigation, including labeled bond issues that pledge their proceeds toward specific environmental projects.

Ron A. Rhodes

APRIL 8, 2023

ON THE EXISTENCE OF MORAL HAZARD IN BANKING (ONCE AGAIN) The collapse of Silicon Valley Bank and Signature Bank in led to a March 12, 2023 joint statement from Secretary…

Ron A. Rhodes

AUGUST 9, 2023

a preliminary step in portfolio design is discerning the investment strategies that should be utilized. The choice of investment strategies, in… Before choosing specific securities (stocks, bonds, mutual funds, etc.),

WiserAdvisor

JUNE 12, 2022

The advisor can also help you create a well-diversified investment portfolio , plan your expenses and liabilities, and also help you manage your overall finances smoothly. The cost of doing so also depends on your requirement, corpus size, investment horizon, and the fee structure used by the financial advisor.

Brown Advisory

JUNE 18, 2020

Community and society Philanthropic activity Environmental impact, including our carbon footprint and our carbon-neutrality commitment Colleagues Career development support, including commitments to support colleague education Support for colleagues and their families, including revamped policies covering all expressions of gender and sexual orientation (..)

Brown Advisory

JUNE 18, 2020

General commitments to ethics and fiduciary duty. Sustainable investing programs, including an assessment of the ESG exposures, carbon emissions and positive impact of our institutional strategy holdings. Diversity and inclusion programs and metrics. Cybersecurity programs to protect clients and colleagues.

Sara Grillo

AUGUST 14, 2023

The word “fiduciary” is not a marketing term, not just something you throw out there to virtue signal. Researching costs of investments, services, and products rendered to the client Assessing if risk is reasonable for the client Assessing if performance expectations are reasonable for the client But these are all loose definitions.

Ron A. Rhodes

AUGUST 9, 2023

OVERVIEW: THE PRUDENT INVESTOR RULE The Uniform Prudent Investor Act (UPIA) (1995), adopted in some form by all 50 states, applies to the investment of private trust funds. The Prudent…

WiserAdvisor

MAY 31, 2022

Apart from these, investment frauds are also quite common. According to the FTC report, investment fraud cost $3,000 per victim in 2021. With the steeply rising number of frauds in the country, the birth of crypto investments, changing fintech rules, etc., What if you wait for a few days before investing?

Don Connelly & Associates

APRIL 8, 2024

If it's like the last couple of elections, financial advisors are sure to see some clients wringing their hands over which candidate will win the White House and how that will impact the financial markets and their investments. The post Should FAs Allow Clients’ Political Opinions to Influence Their Investment Decisions?

Brown Advisory

JANUARY 3, 2023

The “mainstreaming” of sustainable investing has been the story of the decade in investment management. A naming-and-shaming approach may be effective for a small list of big offenders, but we should all be more demanding of our investment managers and advisors. This is not the case in investing. is about people.

Brown Advisory

JANUARY 3, 2023

The “mainstreaming” of sustainable investing has been the story of the decade in investment management. A naming-and-shaming approach may be effective for a small list of big offenders, but we should all be more demanding of our investment managers and advisors. This is not the case in investing. is about people.

Brown Advisory

JANUARY 3, 2023

The “mainstreaming” of sustainable investing has been the story of the decade in investment management. A naming-and-shaming approach may be effective for a small list of big offenders, but we should all be more demanding of our investment managers and advisors. This is not the case in investing. is about people.

Tobias Financial

JULY 11, 2023

We hold our advisors to this rigorous requirement, ensuring that those who lead client relationships and provide investment advisory services possess this designation. It signifies a commitment to professionalism, ethics, and a fiduciary duty to act in our clients’ best interests. Why is the CFP® designation crucial to us?

Sara Grillo

DECEMBER 22, 2023

. #3 Leverage Fiduciary resources and learn what a pure fiduciary is Institute for the Fiduciary Standard houses a library of Advisor On My Side resources. Read about the six core fiduciary duties. Institute for the Fiduciary Standard. Six Core Fiduciary Duties for Financial Advisors.

Ron A. Rhodes

DECEMBER 21, 2023

In the 401(k) world there has for many years been the option for plan participants to contribute to Roth 401(k) accounts, rather than traditional 401(k) account. For contributions to Roth…

Park Place Financial

NOVEMBER 29, 2022

Discover some of the benefits of structured products and their value for investment. These pre-packaged investments usually feature assets connected to interest and an additional. SEC), meaning they operate similarly to traditional investments, such as stocks and bonds. similarly to traditional investments. investments.

Brown Advisory

DECEMBER 5, 2023

It also compels a good deal of humility, an acknowledgement of luck, and a desire to always learn more and to turn over more rocks, and to look at more information in order to arrive at investment insights. Here is an attempt to invoke fundamental investing basics to clarify exactly what we aspire to deliver for our clients.

Walkner Condon Financial Advisors

APRIL 17, 2023

Some advisors are primarily paid directly by the client, but then also might receive some compensation from insurance policies they sell to their clients or other investment products they recommend, like a specific fund or annuity. This fee covers not only investment management, but also financial planning. How are we compensated?

Carson Wealth

JANUARY 14, 2023

CFP ® , Director of Consumer Investment Research Being a fiduciary is holding a duty to a client that a financial advisor will act in the best interests of the client rather than the best interests of the advisor, the advisor’s employer, or any other entity. This may sound simple. Craig Lemoine, Ph.D.,

Walkner Condon Financial Advisors

APRIL 21, 2023

Some advisors are primarily paid directly by the client, but then also might receive some compensation from insurance policies they sell to their clients or other investment products they recommend, like a specific fund or annuity. This fee covers not only investment management, but also financial planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content