Weekend Reading For Financial Planners (February 15–16)

Nerd's Eye View

FEBRUARY 14, 2025

Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g.,

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

FEBRUARY 14, 2025

Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g.,

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JANUARY 20, 2025

Luckily, alongside the increasing popularity of podcasts on a seemingly infinite range of topics, there is a growing ecosystem of podcasts aimed at financial advisors, covering everything from practice management and career development to technical topics, such as investment, tax, and estate planning.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

JANUARY 20, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that several states are considering a series of tax hikes targeting higher-income and ultra-high-net-worth residents after similar proposals failed to pass at the Federal level. Read More.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S.

Nerd's Eye View

JULY 28, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that RIAs appear to be building more comprehensive and more integrated tech stacks, and are benefiting from greater operational efficiencies, according to the latest Schwab RIA Benchmarking Study, with larger firms (..)

Nerd's Eye View

SEPTEMBER 1, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Massachusetts Supreme Judicial Court ruled that the state's fiduciary rule for broker-dealers can stand, potentially opening the door for other states to impose similar standards that exceed the requirements of the Securities (..)

Nerd's Eye View

FEBRUARY 23, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while both the total number of RIAs and advisor headcount have seen significant gains in recent years, client assets remain concentrated among the largest firms, according to data from Cerulli Associates, with the 7% of RIAs (..)

Nerd's Eye View

SEPTEMBER 15, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent survey indicates financial advisors are the most trusted source of financial advice for consumers across generations, and are particularly trusted among wealthier individuals.

Nerd's Eye View

OCTOBER 20, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study from Fidelity Institutional highlights the growing popularity of the RIA model and the success advisors have had after going independent. Read More.

Nerd's Eye View

DECEMBER 8, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a new study from research firm Cerulli has found that investors' willingness to pay for financial advice has risen over the last 15 years, with more investors reporting using a financial advisor (and a decreasing share considering (..)

Abnormal Returns

JANUARY 15, 2024

Podcasts Michael Kitces talks about starting over with Kimberly Enders who is the Lead Financial Planner and Managing Partner of Enders Wealth Management. riabiz.com) Why women are still struggling to make progress in the world of financial advice. riabiz.com) Avise is a cooperative platform for advisers.

MainStreet Financial Planning

MARCH 7, 2025

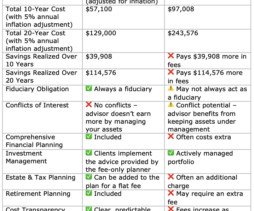

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). Instead, they provide objective, conflict-free financial advice at a predictable cost.

Abnormal Returns

SEPTEMBER 9, 2024

youtube.com) Brendan Frazier talks with Michael Kitces about mastering the human side of financial advice. kitces.com) Ownership Nearly half of all financial planners surveyed by the CFP Board have an ownership stake in the company where they work. citywire.com) A lot can change when you sell your practice.

Abnormal Returns

OCTOBER 16, 2023

wiredplanning.com) Daniel Crosby talks with Matt Reiner partner at Capital Investment Advisors about the future of financial advice. investmentnews.com) Advisers How a financial planner is like a general practitioner. Podcasts Brendan Frazier talks with Meghaan Lurtz about re-engaging with existing clients.

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Here are five ways you can find a full-time fiduciary financial advisor. A fiduciary advisor is a financial professional who is legally obligated to act in the best interest of their clients. What is a fiduciary advisor?

Nerd's Eye View

OCTOBER 1, 2024

Gaetano is a partner and senior financial advisor at Fountainhead Advisors, an RIA based in Warren, New Jersey, that oversees approximately $900 million in assets under management for 1,000 client households.

eMoney Advisor

DECEMBER 15, 2022

In an era of uncertainty, the value Americans place on professional advice from a financial planner has increased. adults said their most trusted source of financial advice was a financial advisor. 1 Market volatility was found to be a major factor in spurring people to seek advice.

NAIFA Advisor Today

JANUARY 28, 2025

Richardson is a financial planner who has been providing sound financial advice to his clients since 2005. His primary focus is to help people align their financial decisions with their values and truths to live enriching lives.

The Chicago Financial Planner

NOVEMBER 8, 2021

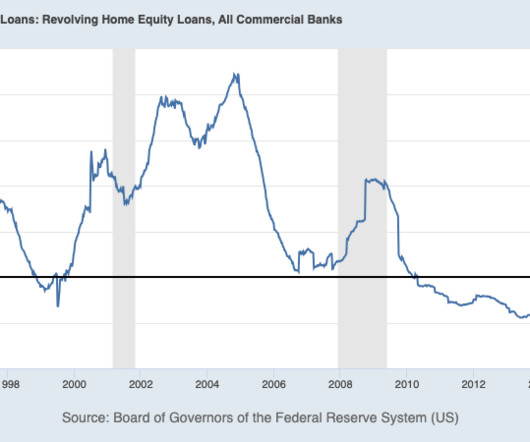

This might have been their own doing or the result of poor financial advice. Manage your portfolio with an eye towards downside risk. Manage your portfolio with and eye towards downside risk. Check out my Financial Review/Second Opinion for Individuals service for detailed advice about your situation.

International College of Financial Planning

MAY 6, 2022

A Certified Financial Planner (CFP) is a professional designation awarded to individuals who have completed a rigorous course of study and passed a comprehensive exam. The CFP designation is recognized worldwide and marks excellence in the financial planning industry. FP designation. It reveals everything about finance to you.

Your Richest Life

JULY 17, 2024

In the 10 years I’ve spent running a financial planning firm, I’ve learned a lot about how people handle (or don’t handle) their finances. And it doesn’t matter how much money someone has coming in; it can still be challenging to manage money and investments well. The internet is drowning in financial advice, both good and bad.

International College of Financial Planning

MARCH 12, 2025

Unlike their predecessors, they are tech-savvy, investment-curious, and financially independent-inded. But they also have a mild addiction to online shopping, an over-reliance on BNPL schemes, and a tendency to take financial advice from influencers who may or may not know what theyre talking about.

International College of Financial Planning

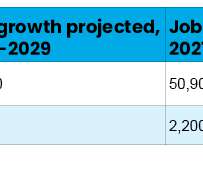

FEBRUARY 23, 2024

In the professional domain of finance, the role of a financial planner has become increasingly pivotal. As individuals and businesses alike strive for financial stability and growth, the demand for skilled financial planners has surged.

International College of Financial Planning

OCTOBER 17, 2023

The digital age has brought forth numerous opportunities, especially for professionals in the financial services sector. Certified Financial Planners (CFPs) stand at the forefront of this revolution. The Rise of Financial Planning Software In financial services, staying updated in real-time has become crucial.

International College of Financial Planning

SEPTEMBER 3, 2021

When it comes to choosing a financial planner, it’s important to choose the right fit for you. Do the research of the available advisors – the first step is to find a financial planner who will help you plan your finances. A planner should be able to answer any question that you may have regarding his services.

Sara Grillo

MAY 23, 2022

It’s so clear to me what the future of financial advice is – what it should be – and what it will be. The advice-only movement is a bigger move than a shift in fees – it’s a transcendence to a higher level of morality, transparency, and service to the consumer. Find out by listening to the show.

Sara Grillo

OCTOBER 21, 2022

In this blog, I interview paraplanning professionals to get their take on what the role is, what it pays, and what it potential is for someone who wants to get a job as a financial paraplanner, possibly as a stepping stone to other wealth management jobs. I am a CFA® charterholder and I used to be a financial advisor.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

WiserAdvisor

NOVEMBER 21, 2022

As an individual or business owner, you have a unique set of circumstances, goals, and risk tolerance that are each necessary to consider when creating a successful financial plan. This is where a Certified Financial Planner (CFP) can step in. What is a Certified Financial Planner?

NAIFA Advisor Today

DECEMBER 20, 2023

Richardson is a financial planner who has been providing sound financial advice to his clients since 2005. His primary focus is to help people align their financial decisions with their values and truths to live enriching lives.

Indigo Marketing Agency

MARCH 19, 2025

Example: Instead of writing something like: With our advanced wealth management strategies, we help high-net-worth individuals maximize tax-efficient investments while securing generational wealth. Book a free call and get a custom financial strategy.) Use bullet points or numbered lists to break down information.

Ballast Advisors

MAY 8, 2023

Jean and her husband worked hard to realize their financial goals, being a snowbird in Florida, golfing, traveling, and loving on eight great-grandchildren. Jean admits she still worries about money, but working with a financial planner has helped give her peace of mind. We followed the advice of our financial planner.

International College of Financial Planning

APRIL 25, 2024

Achieving the status of Certified Financial Planner® (CFP®) represents a significant professional milestone in financial services. What Is a Certified Financial Planner®? A Certified Financial Planner® is a distinguished professional who has met the stringent standards set by the FPSB Board.

Carson Wealth

JULY 12, 2022

The financial service profession is regulated at the federal or state level, and professionals who sell products or provide financial advice to clients for a fee are required to meet minimum required regulatory standards. . Three broad financial planning designations include: .

The Irrelevant Investor

JULY 30, 2019

Jason Zweig and Andrea Fuller pulled no punches yesterday in their piece, Looking for a Financial Planner? For example, the Journal uncovered that more than 60 Certified Financial Planners filed for bankruptcy within the past decade. The Go-To Website Often Omits Red Flags.

International College of Financial Planning

MAY 20, 2024

Opting for a job oriented course after graduation in wealth management can be particularly advantageous, offering a direct route into a vibrant and lucrative financial sector. Course Curriculum: The curriculum should be comprehensive, covering essential topics in demand in wealth management.

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. Frequently Asked Questions What Services Does a Financial Advisor Provide? Here, we focus on two such studies.

International College of Financial Planning

JULY 10, 2023

How Investment Advisors Play a Significant Role in Managing Finances? If you have an analytical mindset, a keen interest in the financial markets, and the desire to help others achieve their financial goals, a career as an investment advisor may be the perfect fit.

Midstream Marketing

DECEMBER 6, 2024

Digital Landscape for RIAs Digital marketing is changing the financial services world. Clients now want financial advice online. Scheduling tools, like Hootsuite, can help you manage your social media accounts. These clients usually have their own financial goals and unique investment needs.

Sara Grillo

JANUARY 8, 2024

As many corporate employees tend to have smaller account sizes, this entire group would be shunned by the typical financial advisor who usually has high account minimums of $1MM or above. By the way, if you happen to be a small investor looking for financial advice, I have a list of advisors who are open to serving such clients.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content