Vanguard’s Head of Financial Advisor Services to Retire

Wealth Management

DECEMBER 19, 2023

Amma Boateng, who currently leads the broker/dealer channel within Financial Advisor Services, will succeed Tom Rampulla, effective Jan.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 19, 2023

Amma Boateng, who currently leads the broker/dealer channel within Financial Advisor Services, will succeed Tom Rampulla, effective Jan.

Nerd's Eye View

APRIL 2, 2025

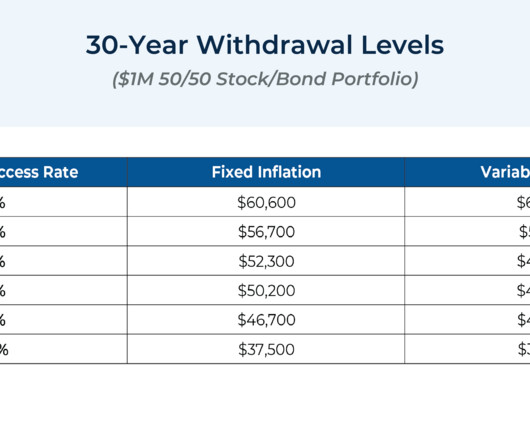

For many financial advisors, a core part of the retirement planning process involves simulating whether the client's assets will last through retirement. Ultimately, the key point is that retirement income planning is not just about statistics – it's about helping clients believe in their plan.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

Wealth Management

JANUARY 31, 2023

Vestwell conducted the fourth-annual “Retirement Trends Report” in fall 2022 and received responses from almost 1,300 savers, 500 financial advisors and 250 small businesses.

Wealth Management

JANUARY 10, 2025

A survey of DC recordkeepers found a large majority expect to see more financial advisors selling 401(k) plans with less than $5 million in assets.

Nerd's Eye View

JANUARY 17, 2025

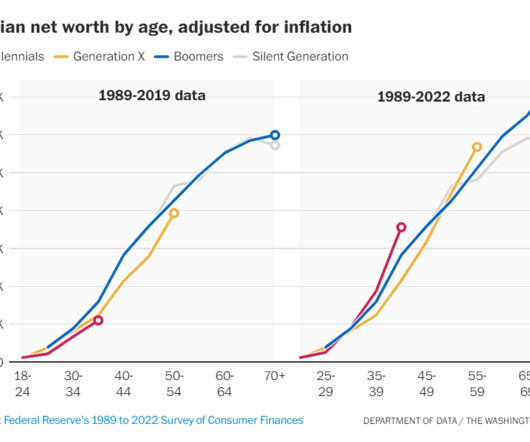

Also in industry news this week: A recent survey indicates that members of Generation X are struggling more with retirement planning compared to older Baby Boomers and younger Millennials, potentially offering opportunities for financial advisors to help Gen Xers create a plan to 'catch up' when it comes to both their retirement savings and their financial (..)

The Chicago Financial Planner

FEBRUARY 2, 2024

A part of this process might include hiring a financial advisor or hiring a new financial advisor if you have decided to move on from your current advisor. Hiring the right advisor for your needs is critical. Here are six questions to ask when choosing a financial advisor: How do you get paid?

Wealth Management

SEPTEMBER 19, 2024

A new survey from Wealth Enhancement Group found many people feel behind on retirement plans but aren’t doing enough to set and meet clear goals.

Nerd's Eye View

OCTOBER 29, 2024

Welcome to the 409th episode of the Financial Advisor Success Podcast ! Welcome, everyone! My guest on today's podcast is Travis Hornsby. Read More.

Nerd's Eye View

JANUARY 22, 2025

Financial advisors often engage with a variety of prospects, each with unique needs and motivations. Some prospects approach an advisor with an immediate 'problem to be solved', such as a fast-approaching retirement date. I help clients in retirement by doing X, Y, and Z.").

Nerd's Eye View

JANUARY 21, 2025

Welcome to the 421st episode of the Financial Advisor Success Podcast ! Welcome everyone! My guest on today's podcast is Daniel Friedman. Daniel is the CEO of WMGNA, a hybrid advisory firm based in Farmington, Connecticut, that oversees approximately $270 million in assets under management for 200 client households. Read More.

Abnormal Returns

JANUARY 29, 2025

morningstar.com) Peter Lazaroff on how much money you need to retire. yaleclimateconnections.org) Purpose Why you need a purpose in retirement. contessacapitaladvisors.com) On the value a financial advisor can add. abnormalreturns.com) Retirement includes a lot of uninsured health costs. cnbc.com)

A Wealth of Common Sense

DECEMBER 6, 2024

Retirement is still a relatively new concept. Throughout most of human history, people worked late into life, maybe retired for a few years or worked until they keeled over. Retiring to a life of leisure is a concept that’s only been around in a big way since the post-WWII era.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? Two popular small business retirement plans are the SEP-IRA and Solo 401(k).

Nerd's Eye View

APRIL 8, 2025

Welcome to the 432nd episode of the Financial Advisor Success Podcast! Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

Nerd's Eye View

AUGUST 24, 2023

For many next-gen financial advisors who start with or move their careers to an established firm, eventually earning an equity stake in that firm can be an exciting prospect and is often a major career goal that many advisors aspire to achieve.

Wealth Management

SEPTEMBER 30, 2024

Private bankers and retirement planners will increasingly use AI to invest and even communicate, but the human element will always be crucial.

Abnormal Returns

JANUARY 15, 2025

Podcasts Khe Hy talks with Christine Benz author of "How to Retire: 20 Lessons for a Happy, Successful and Wealthy Retirement." humansvsretirement.com) Peter Lazaroff on what you need to know when choosing a financial advisor. podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning.

Nerd's Eye View

OCTOBER 2, 2024

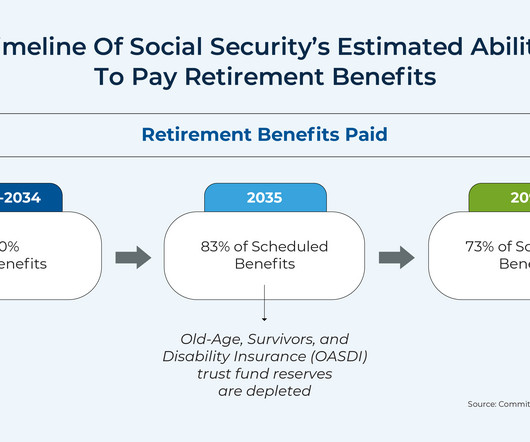

In this environment, financial advisors have the opportunity to add value for their clients not only by giving a clear explanation about the current status of Social Security and the potential legislative changes that could improve its solvency, but also by modeling what (realistic) changes would mean for their clients' financial plans.

Abnormal Returns

NOVEMBER 11, 2024

podcasts.apple.com) Daniel Crosby talks the racial wealth grap with Adam Tolliver who is a Partner Financial Advisor at Artisan Financial Strategies. advisorperspectives.com) A three-part approach to developing a 'statement of financial purpose.' kitces.com) What it means to be a great adviser to retired clients.

Nerd's Eye View

NOVEMBER 30, 2022

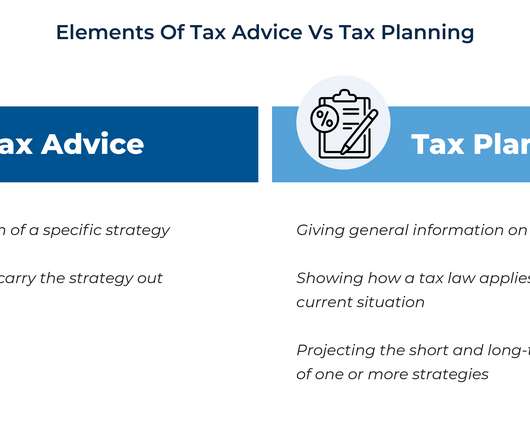

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. This strategy is valuable because it generally allows for higher initial withdrawal rates than more static approaches that don’t accommodate clients willing to adjust their spending in retirement.

Darrow Wealth Management

FEBRUARY 13, 2025

When starting to search for a financial advisor, investors may not realize the different types of advisors out thereand theyre not all trying to sell you something. If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products.

Abnormal Returns

MARCH 24, 2025

(citywire.com) What would an agentic AI solution look like for a financial advisor? crr.bc.edu) What do (different) surveys tell us about well-being in retirement? advisorperspectives.com) Ranking the adviser AI note taking apps. kitces.com) Aging Older Americans have a bad sense of the risk of long-term care costs.

Abnormal Returns

JUNE 12, 2024

ritholtz.com) Katie Gatti Tassin talks with Katy Song of Domain Money about how to break up with your financial advisor. semafor.com) Retirement Cognitive decline is inevitable. abnormalreturns.com) It's easy to let your spending fall in retirement. humbledollar.com) Some charts to help you think about retirement.

FMG

MARCH 6, 2025

Financial Advisor Websites and the Changing SEO Landscape Staying visible online is more challenging than ever, especially for financial advisor websites. AI-powered search, social media algorithms, and Answer Engine Optimization (AEO) are transforming how potential clients find financial advisors.

Darrow Wealth Management

FEBRUARY 9, 2025

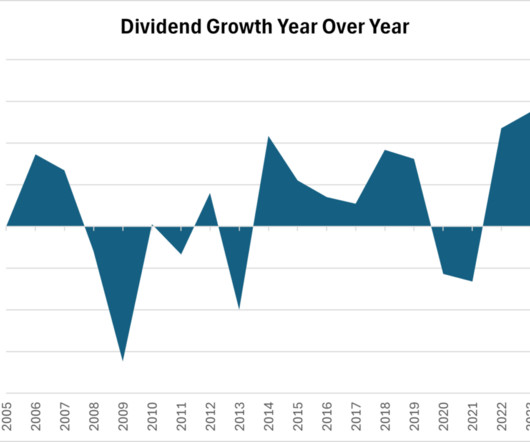

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income from dividends to cover lifestyle expenses. You may need more money than you think to retire on dividends. Retire on dividends?

Nerd's Eye View

SEPTEMBER 20, 2023

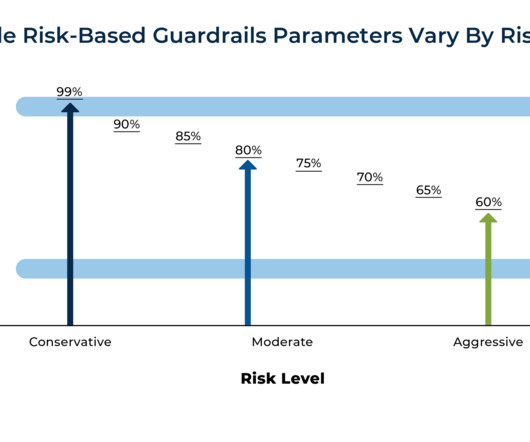

30 years ago, when financial plans relied mainly on constant investment return projections derived from straight-line appreciation and time-value of money calculations, financial advisors began acknowledging and accounting for the variable and uncertain nature of investment returns.

Indigo Marketing Agency

MARCH 19, 2025

Best Ad Practices That Work for Marketing Financial Advisor Services One of the most surefire ways of growing a business fast and keeping a steady stream of leads coming in is with advertising. Indigo Marketing Agency helps financial advisors get more clients with our complete marketing and advertising services.

Nerd's Eye View

FEBRUARY 11, 2025

Welcome to the 424th episode of the Financial Advisor Success Podcast ! David is the President of Succession Resource Group, an advisory consulting and valuation business based in Portland, Oregon that serves independent financial advisors with RIAs and broker-dealers. Welcome everyone! Read More.

Wealth Management

JANUARY 30, 2023

The new legislation brings many opportunities for financial advisors to rapidly scale their practices.

The Chicago Financial Planner

OCTOBER 21, 2021

Saving for retirement is a major undertaking for most of us. Health savings accounts (HSA) provide another vehicle to save for retirement. An HSA can serve as an additional retirement savings vehicle on top of your IRA or 401(k) to help cover healthcare and other retirement expenses. Click To Tweet. The Bottom Line.

FMG

MARCH 3, 2025

Financial advisors know that social media isnt just for posting updates; its for building connections. Social media for financial advisors doesn’t have to be challenging let’s dive into simple ways to encourage comments on your posts. For instance, many people feel overwhelmed by retirement planning.

Midstream Marketing

NOVEMBER 8, 2024

Key Highlights Find good ways to get new clients as a financial advisor. Explore several ways to get financial advisor leads. Get advice from experts about good tools and methods for lead generation in financial services. It will help you connect with potential clients looking for financial help.

Abnormal Returns

SEPTEMBER 16, 2024

(youtube.com) Daniel Crosby talks with Cady North, Founder and CEO of North Financial Advisor, about planning for a sabbatical. standarddeviationspod.com) Retirement Retirees go back to work for any number of reasons. investmentnews.com) A checklist if a client gets laid off near retirement age.

A Wealth of Common Sense

FEBRUARY 15, 2024

Josh Brown joined me again this week to discuss questions about career advice for younger advisors, when it makes sense to hire a financial advisor for retirement, 401ks vs. brokerage accounts and how to deploy cash in the face of all-time highs in the stock market. The post When Should You Hire a Financial Advisor?

Midstream Marketing

OCTOBER 29, 2024

Key Highlights A strong marketing plan is key for financial advisors. This guide offers helpful tips to create a good advertising plan in the financial services area. Introduction In today’s world, having a strong online presence is really important for financial advisors. It is key for the growth of your business.

Abnormal Returns

MARCH 13, 2024

open.spotify.com) Retirement A lot of things can upend a successful retirement. humbledollar.com) Managing withdrawals in retirement is a real challenge. morningstar.com) Should financial advice be gentle or authoritarian? tonyisola.com) The best financial advisor for you may not be local.

Zoe Financial

MARCH 21, 2025

What Do Financial Advisors Do? A financial advisor can help navigate the complexities of wealth management, from tax considerations to estate planning and retirement strategies. What Does a Financial Advisor Do? A financial advisor provides personalized guidance to help manage and grow your wealth.

Nerd's Eye View

JANUARY 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news of a survey indicating that about 90% of financial advisors would switch firms based on bad technology at their current firm, and that 44% have already done so. Read More.

Abnormal Returns

JULY 17, 2024

(ritholtz.com) Benjamin Felix and Cameron Passmore on when its time to hire a financial advisor. rationalreminder.libsyn.com) Dan Haylett talks with Suzi Campi about repurposing one's life in retirement. humansvsretirement.com) Thomas Kopelman and Jacob Turner talk about the mindset shift needed in retirement.

Midstream Marketing

OCTOBER 29, 2024

By understanding their financial concerns, online habits, and how they like to communicate, you can improve your marketing. Financial Advisor Marketing to Millennials Millennials are people born from 1981 to 1996. Still, these challenges also create new chances for financial advisors. Avoid hard financial terms.

Midstream Marketing

OCTOBER 30, 2024

Key Highlights A referral program helps financial advisors grow their businesses. Introduction In the busy area of financial advisory services, getting new clients is important for success. Old marketing methods still have their place, but referral marketing is a better option for financial advisors today.

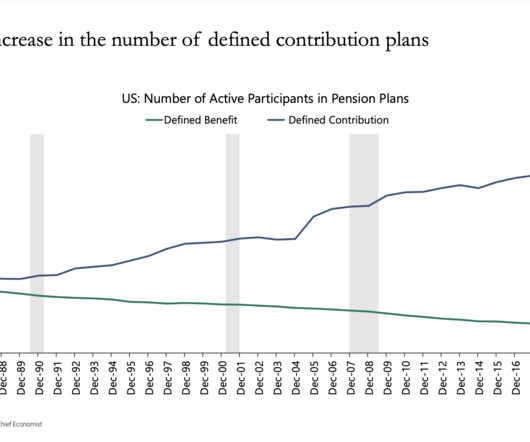

A Wealth of Common Sense

OCTOBER 28, 2024

When Ted Benna discovered a change in the tax code that would allow employees and employers to make tax-deferred retirement contributions in the late-1970s, it would change the retirement industry in immeasurable ways.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content