A Timeline Of Financial Markets

The Big Picture

MAY 1, 2023

Their failure sent shockwaves throughout France’s financial markets as investors rapidly sold off shares in a desperate attempt to minimize losses, which exacerbated the issue.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Market Related Topics

Financial Market Related Topics

The Big Picture

MAY 1, 2023

Their failure sent shockwaves throughout France’s financial markets as investors rapidly sold off shares in a desperate attempt to minimize losses, which exacerbated the issue.

A Wealth of Common Sense

JANUARY 17, 2023

You learn more about yourself during a bear market than a bull market. Last year was one of the worst for financial markets in modern eco. This piece I wrote at Fortune delves into 5 lessons for investors from 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

APRIL 28, 2024

A colleague recently asked me to run the 30 year annual returns for U.S. stocks, bonds and cash. He just wanted the returns. I couldn’t help but slice and dice the numbers and overanalyze the data because that’s what we do here. Let’s dig in.

Wealth Management

MARCH 22, 2024

Should wealth management storytelling tap into the feelings of the audiences it's targeting?

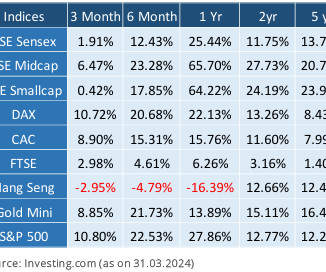

Truemind Capital

APRIL 19, 2024

CONNECT WITH TRUEMIND ADVISOR The post Financial Market Round-Up – Apr’24 appeared first on Investment Blog. TRUEMIND’S MODEL PORTFOLIO – CURRENT ASSET ALLOCATION Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform.

Abnormal Returns

JULY 14, 2024

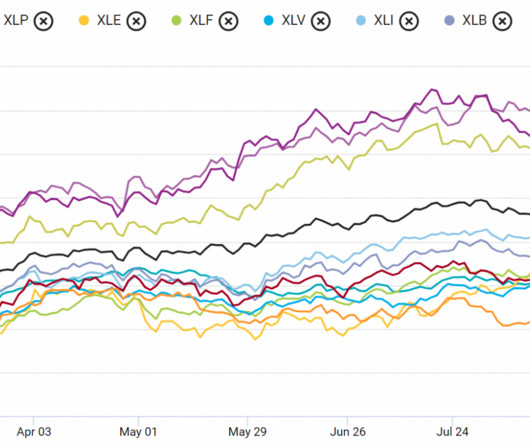

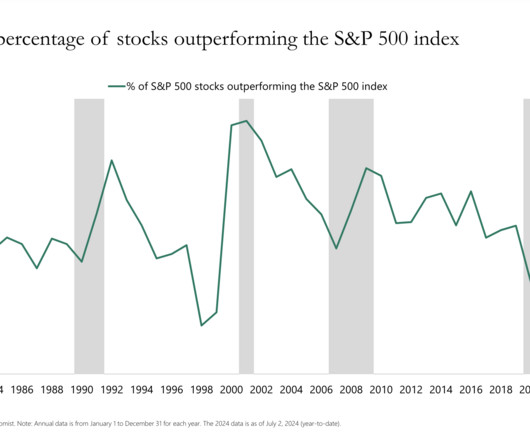

politico.com) Today's constructive CPI report rang a bell for financial markets. sherwood.news) How have the market's five largest stocks performed over the long run? ft.com) Just how much has indexing affected markets? Maybe this measure does.

Abnormal Returns

JULY 7, 2024

capitalspectator.com) Just how useful is historical financial markets data? downtownjoshbrown.com) Europe's stock market has badly lagged the U.S. Top clicks this week How major asset classes performed in June 2024. retirementresearcher.com) Don't forget, stocks are real assets. How much longer can it last?

Abnormal Returns

MARCH 31, 2024

wsj.com) Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. (capitalspectator.com) What will it take for small caps to outperform? ft.com) What it takes to add an EV charger in your garage. klementoninvesting.substack.com) There are no guarantees in life. Risk is everywhere.

Wealth Management

DECEMBER 20, 2024

From inflation to the fixed income tug of war to whether the market will continue to rely on the 'Magnificent 7' for performance.

Wealth Management

MAY 11, 2023

Contrary to the current media narrative, certain real property segments—namely multifamily—have and continue to demonstrate solid performance.

Abnormal Returns

OCTOBER 29, 2023

Top clicks this week A big regime shift has happened in the economy and financial markets. ritholtz.com) The bond market bear market is pretty epic. mrzepczynski.blogspot.com) Byron Wien's 20 rules for investing and life. ritholtz.com) Why aren't stocks down more?

Abnormal Returns

OCTOBER 8, 2024

mrzepczynski.blogspot.com) Using AI to better explain past financial market returns. alphaarchitect.com) Some academic research that has informed our understanding of market returns. (etf.com) Index replication need not be entirely mechanistic. alphaarchitect.com) Volatility and anxiety are not the same thing.

Abnormal Returns

JULY 2, 2024

mrzepczynski.blogspot.com) Just how useful is historical financial markets data? marketwatch.com) When a company shifts its financial targets - take note. Quant stuff Beware small sample sizes. bpsandpieces.com) Corporate finance Are companies any good at timing share repurchases?

Wealth Management

AUGUST 12, 2024

Rose Advisors' Patrick Fruzzetti details what advisors should consider when building investment portfolios for the current market environment.

The Big Picture

JANUARY 25, 2023

The researchers describe financial markets as “slowly evolving communities of practice whose habits, routines and ways of knowing can be difficult to shift, even when faced with overwhelming evidence that what they are doing doesn’t work most of the time.”

Abnormal Returns

MAY 21, 2024

papers.ssrn.com) How 'good' and 'bad' inflation affect financial markets. papers.ssrn.com) A round-up of research on market analytics including 'Regime-Based Strategic Asset Allocation.' (mrzepczynski.blogspot.com) Global pricing models are a better way forward. papers.ssrn.com) How complex 10-Ks affect analyst forecasts.

Midstream Marketing

OCTOBER 31, 2024

Key Highlights In today’s online world, businesses in the financial services industry need financial marketing consultants to succeed. These consultants connect complex financial products with the right customers. These experts know the challenges of marketing in financial services.

Abnormal Returns

JANUARY 1, 2023

topdowncharts.substack.com) Six things that don't change in financial markets including the attraction of 'shiny objects.' (crossingwallstreet.com) The best books Ben read in 2022 including "Die With Zero" by Bill Perkins. awealthofcommonsense.com) A look at the best charts of 2022.

Abnormal Returns

MARCH 26, 2024

wsj.com) Books Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. (capitalspectator.com) Higher for longer is helping to push Treasury yields higher. klementoninvesting.substack.com) What you can learn from Carrie Sun's new book “Private Equity: A Memoir.”

The Big Picture

SEPTEMBER 15, 2023

Tune in for a deep dive into the financial markets with Barry, who reveals how his background in behavioral finance and his fearless approach when launching his blog, the “Big Picture,” earned him the reputation as “one of the most dangerous people in financial media.”

Abnormal Returns

JUNE 28, 2024

bnnbloomberg.ca) The financial markets are noisy. Strategy Is the small cap premium dead? awealthofcommonsense.com) Home bias illustrated: the case of Canadian investors. You need a path through. marknewfield.substack.com) Companies Accenture ($ACN) is making bank on generative AI.

Abnormal Returns

OCTOBER 25, 2023

Strategy A big regime shift has happened in the economy and financial markets. investmenttalk.co) Finance Poor recent performance has put the IPO market back on ice. ritholtz.com) Rapid company growth comes with its own risks. onveston.substack.com) Not all share buybacks are created equal.

Abnormal Returns

JULY 11, 2024

Markets Today's constructive CPI report rang a bell for financial markets. finance.yahoo.com) The market for leveraged loans is open for business, especially refinancings. sherwood.news) Falling interest rates helped push 30-year mortgage rates well below 7.0%.

The Big Picture

SEPTEMBER 9, 2023

McAuliffe has a unique track record of successful innovation applying statistical methods to real-life prediction problems, particularly in the financial markets. Previously, he developed and managed statistical arbitrage trading strategies at D.E.Shaw.

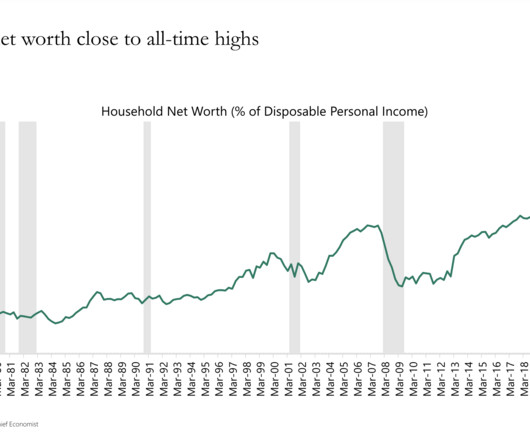

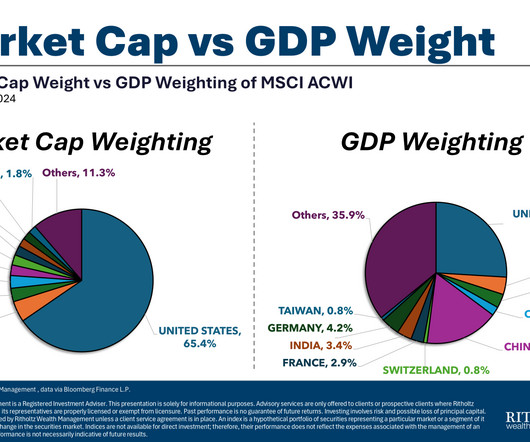

A Wealth of Common Sense

DECEMBER 3, 2024

The United States is the envy of the world in terms of financial markets and economic performance. Ruchir Sharma at The Financial Times outlines how this is impacting capital flows: Global investors are committing more capital to a single country than ever before in modern history.

Abnormal Returns

JULY 19, 2024

podcasts.apple.com) Cameron Passmore and Benjamin Felix talks about the dynamics of the financial market with Prof. rationalreminder.libsyn.com) Stephen Dubner on how a single company, EssilorLuxottica, came to dominate the global eyeglass market. Valentin Haddad.

Pragmatic Capitalism

SEPTEMBER 19, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ]

Abnormal Returns

OCTOBER 16, 2023

wealthmanagement.com) Global The UK's financial markets are dying on the vine. (axios.com) Charles Schwab's ($SCHW) bank is still leaking deposits. advisorhub.com) Sports is a bright spot in M&A this year. ft.com) Working in Hong Kong is no longer worth the risk for many companies.

Truemind Capital

OCTOBER 18, 2024

That’s exactly what we’ve seen in India’s financial markets in the quarter ending September 2024. Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards ALL KEY ASSET PRICES ARE GOING NORTHWARDS!

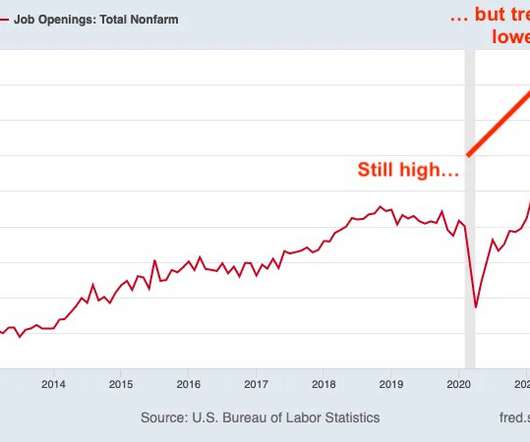

Abnormal Returns

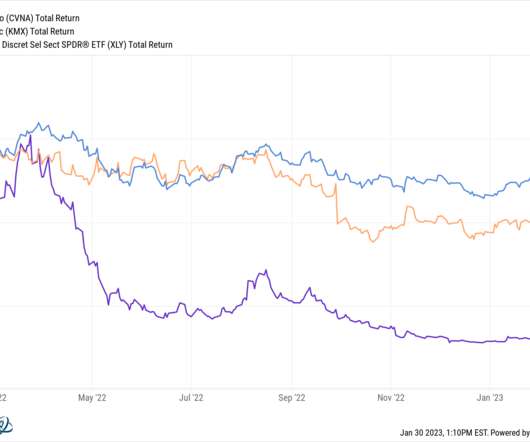

JANUARY 30, 2023

nytimes.com) Funds How the launch of the SPDR S&P 500 ETF Trust ($SPY) changed financial markets. (nytimes.com) How layoffs.fyi became the go-to site for data on tech layoffs. slate.com) What to do with job satisfaction surveys. morningstar.com) Why sustainable funds can charge a premium. consumer is tightening their belts.

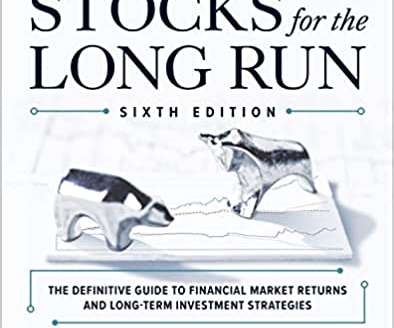

The Big Picture

OCTOBER 29, 2022

Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies, Sixth Edition by Jeremy Siegel. His new book “ The Price of Time: The Real Story of Interest ” is a nominee for FT’s 2022 Business Book of the Year. The latest SFTLR by Jeremy Siegel with Jeremy Schwartz.

Abnormal Returns

NOVEMBER 2, 2022

abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? (abnormalreturns.com) Research links: an extremely long horizon. abnormalreturns.com) Spending does more than change your bank balance.

Abnormal Returns

MAY 23, 2023

theblock.co) AI Fake AI stories will continue to roil the financial markets. (mailchi.mp) Crypto Prosecutors are pouring through a ton of evidence in the SBF case. nytimes.com) Coinbase ($COIN) is not sitting back in its fight with the SEC. finance.yahoo.com) OpenAI competitor Anthropic just raised a $450 million Series C round.

The Big Picture

APRIL 22, 2023

Fowler and Clymer (dubbed the “ High Priest of Horology “) discuss all things wristwatches and timepieces, including their experiences at the 2023 Watches & Wonders , why the marketplace has exploded over the past few years, and what are their favorite grail watches.

Abnormal Returns

NOVEMBER 3, 2022

abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? (abnormalreturns.com) Personal finance links: yesterday's news. abnormalreturns.com) Spending does more than change your bank balance.

The Big Picture

SEPTEMBER 22, 2023

21, 2021) The Federal Reserve’s latest dot plot, explained (BankRate September 20, 2023) The Fed and its Dots lavish portrait (James Lavish, Dec 18 2022) The Fed ‘Dots’ Put Financial Markets In A Tizzy (Forbes 6/19/21) The post Nobody Knows Anything, Dot Plot Edition appeared first on The Big Picture.

The Big Picture

APRIL 5, 2023

A $3 Trillion Threat to Global Financial Markets Looms in Japan Source: Bloomberg Sign up for our reads-only mailing list here. Churchill was the top U.S. private equity lender in 2022 and was “Lender of the Year” according to M&A Advisor. Kencel was named one of private credit’s 20 power players.

The Big Picture

AUGUST 19, 2022

With surging inflation and a new war in Europe, the first half of 2022 was understandably gloomy for economies and financial markets around the world. My end-of-week morning train WFH reads: • Holes in the Recession Story. Project Syndicate ).

The Big Picture

SEPTEMBER 21, 2022

A Wealth of Common Sense ) see also The 6 Ways of Influence : 6 ways of influence show up in the financial world and how you can prevent yourself from falling for such trickery. ( If nothing else, it’s good to hear from a wide range of sources to ensure you don’t get too full of yourself. ( Of Dollars And Data ). • Bloomberg ). •

A Wealth of Common Sense

DECEMBER 31, 2023

2022 was one of the worst years ever for financial markets. It was the worst year ever for the Barclays Aggregate Bond Market Index. Over the past 100 years: It was the third worst year for a 60/40 portfolio. It was the seventh worst year for the S&P 500. It was the worst year ever for the 10 year Treasury bond.

A Wealth of Common Sense

MARCH 5, 2024

I was a late bloomer when it came to becoming interested in the markets. I knew literally nothing about the financial markets until my senior year in college when I got an internship in sell-side research. I wasn’t one of these wunderkinds reading Barron’s every weekend and picking stocks when I was young.

The Big Picture

FEBRUARY 24, 2023

They discuss AQR’s 60/40 portfolio strategy and the risks facing financial markets, with Sonali Basak and Guy Johnson on “Bloomberg Markets.” Sonali Basak interviews AQR Capital Management’s Cliff Asness.

The Big Picture

JANUARY 5, 2023

Why Markets Were Down in 2022 : there was also an Occum’s razor answer for the losses in financial markets in 2022. My early morning train WFH reads: • Get Ready for the Richcession : Well-off Americans could get hurt more than usual in the next downturn ( Wall Street Journal ). •

A Wealth of Common Sense

JANUARY 4, 2023

There were a number of reasons for the large losses in financial markets this past year — the Fed went on a rating hiking rampage, bond yields rose a great deal, inflation hit 40 year highs, there was a war and about a dozen other factors. Sometimes the reason asset prices fall is because they went up too much in the f.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content