Adjusted for Risk: State of the Financial Markets

Wealth Management

AUGUST 12, 2024

Rose Advisors' Patrick Fruzzetti details what advisors should consider when building investment portfolios for the current market environment.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 12, 2024

Rose Advisors' Patrick Fruzzetti details what advisors should consider when building investment portfolios for the current market environment.

Abnormal Returns

OCTOBER 25, 2023

Strategy A big regime shift has happened in the economy and financial markets. investmenttalk.co) Finance Poor recent performance has put the IPO market back on ice. ritholtz.com) Rapid company growth comes with its own risks. onveston.substack.com) Not all share buybacks are created equal.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

NOVEMBER 2, 2022

abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? (abnormalreturns.com) Research links: an extremely long horizon. abnormalreturns.com) Spending does more than change your bank balance.

Your Richest Life

NOVEMBER 1, 2024

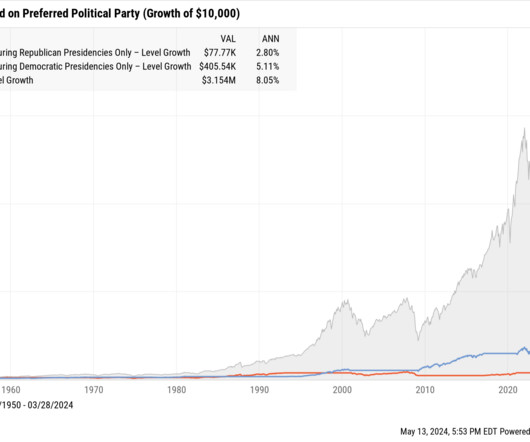

presidential election, and while we can’t predict the outcome, we can predict that there will likely be a response from the financial markets. Exactly how the markets will react is less clear, but history has shown us that in times of great change or uncertainty, markets react. We are days out from the next U.S.

Abnormal Returns

MARCH 31, 2024

(awealthofcommonsense.com) Which bonds prove as the best portfolio diversifier? wsj.com) Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. morningstar.com) The equity risk premium is skimpy at the moment. capitalspectator.com) What will it take for small caps to outperform?

Abnormal Returns

OCTOBER 29, 2023

Top clicks this week A big regime shift has happened in the economy and financial markets. ritholtz.com) The bond market bear market is pretty epic. wired.com) Bond bear markets are different than stock bear markets. awealthofcommonsense.com) Where the valuation of the 60/40 portfolio stands.

Validea

NOVEMBER 25, 2024

Watch on YouTube Listen on Apple Podcasts Listen on Spotify The post What the Rise of Passive Investing Means for Your Portfolio | Special Guest: Dave Nadig appeared first on Validea's Guru Investor Blog.

The Big Picture

SEPTEMBER 9, 2023

McAuliffe has a unique track record of successful innovation applying statistical methods to real-life prediction problems, particularly in the financial markets. We discuss his career in machine learning, from Amazon’s recommendation engine to using AI to manage portfolios.

Tobias Financial

APRIL 8, 2025

Recent headlines around escalating tariffs have rattled the financial markets, leaving many retirees understandably concerned. At Tobias Financial Advisors, were here to help you navigate times like these with clarity and confidence. So, what should retirees do right now? First and foremost, dont panic.

The Big Picture

JANUARY 25, 2023

The researchers describe financial markets as “slowly evolving communities of practice whose habits, routines and ways of knowing can be difficult to shift, even when faced with overwhelming evidence that what they are doing doesn’t work most of the time.”

Your Richest Life

FEBRUARY 24, 2025

2025 may prove to be a bumpy ride, but a strong, well-balanced portfolio is designed to weather storms. Managing Investments During a Financial Crisis About Your Richest Life At Your Richest Life, Katie Brewer, CFP, believes you too should have access to financial resources and fee-only financial planning.

Calculated Risk

APRIL 19, 2023

The financial market effects of a debt default would be highly uncertain , both because of its unprecedented nature, and because (as events in recent years have illustrated) we have only a limited understanding of the dynamics of the financial system when hit with a major shock.

Trade Brains

SEPTEMBER 17, 2023

Best Porinju Veliyath Portfolio Stocks: Investors are always on the lookout for small-cap companies which can lead to multi-bagger returns. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. EPS ₹8 Stock P/E 196 RoE 3.2%

Truemind Capital

APRIL 19, 2024

Consequently, the portfolio allocation should reflect these probabilities depending on the risk profiles. Therefore, we maintain our underweight position to equity (check the Model Portfolio Current asset allocation below). Debt Market Insights: Someone rightly said that the Fed has the most difficult job in the world.

Pragmatic Capitalism

SEPTEMBER 19, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ]

Nerd's Eye View

MARCH 26, 2025

While financial markets tend to rise in the long run, short-term volatility can be alarming for investors. As a starting point, it's helpful to reinforce that investing success isn't about timing the market or picking winning stocks, sectors, or asset classes. Read More.

Trade Brains

SEPTEMBER 17, 2023

List of Stocks Held by Goldman Sachs Company Name Market Cap (Cr) CMP % Held by Goldman Qty Held (Cr) Holding Value (Cr) Mahindra Logistics Ltd 2,977.6 Cr Spandana Sphoorty Financial Ltd 5,405.5 The post Top Indian Stocks Held By Goldman Sachs – Portfolio Analysis! 1,630,031 67.4 Cr Sula Vineyards Ltd 3,989.9 288,341 75.5

Investing Caffeine

FEBRUARY 21, 2023

Slome, CFA®, CFP®, Founder of Sidoxia Capital Management, LLC, will share 10 crucial mistakes made by investors that can destroy your portfolio. Learn how to avoid these missteps and expand your wealth. Register Here To Attend Replay will also be made available and posted to Investing Caffeine.

Trade Brains

SEPTEMBER 28, 2023

It was founded in 1943 and operates through 5 segments – Corporate Banking, Commercial Banking, Branch & Business Banking, Retail Assets and Treasury & Financial Markets Operations and is one of the leading private banks in the nation. The bank currently has over 13.6

Trade Brains

NOVEMBER 11, 2023

Its domestic broadcast portfolio includes over 48 channels. The Company’s 41-channel international broadcast portfolio is available in over 170 countries. The post Top Indian Stocks Held By Vanguard Group – Portfolio Analysis appeared first on Trade Brains. ZEE5 is its over-the-top (OTT) platform.

Trade Brains

AUGUST 18, 2023

Best Vijay Kedia Portfolio Stocks: Many investors keep a close eye on stock buys and sales of ace investors for ideas and inspiration. In this article, we’ll look at the best Vijay Kedia portfolio stocks and see if they can be an interesting opportunity for us as well. Market Cap (Cr.) Who is Vijay Kedia? Net Profit Margin 15.6%

The Big Picture

SEPTEMBER 21, 2022

Spoiler: It wasn’t luck that gave Morgan Stanley Investment Management, Carmignac, Baird, and Invesco some of the top equity portfolios. Don’t Take Financial Advice From Kanye West : Nothing fails quite like success. . • Were Those Great Returns the Result of Skill — or Just Luck? Of Dollars And Data ). • Bloomberg ). •

Trade Brains

OCTOBER 23, 2023

The product portfolio includes rear axle shafts, spindles, and splined shafts, and rear axle shafts contributing to the majority of revenue. List Of Stocks Held By HDFC Small Cap Fund Company Name CMP (Rs) Market Cap (Cr) HDFC Small-Cap Fund Holding (%) Insecticides (India) Ltd 486 1,491.88 Cr in FY22 to Rs. Cr in FY22 to Rs.

The Big Picture

FEBRUARY 24, 2023

They discuss AQR’s 60/40 portfolio strategy and the risks facing financial markets, with Sonali Basak and Guy Johnson on “Bloomberg Markets.” Sonali Basak interviews AQR Capital Management’s Cliff Asness.

Trade Brains

OCTOBER 4, 2023

Written by Sheshadri N By utilizing the stock screener , stock heatmap , portfolio backtesting , and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks also get updated with stock market news , and make well-informed investment decisions.

Brown Advisory

SEPTEMBER 21, 2022

Resilience is Core to Sustainable Portfolio Construction. While the old adage “only time will tell” generally refers to a future outcome, it is apropos of our belief that a truly sustainable portfolio must consist of businesses that have proven to be resilient under a variety of macroeconomic circumstances. Wed, 09/21/2022 - 10:50.

A Wealth of Common Sense

JANUARY 10, 2023

It’s now well-documented that 2022 is one of the worst years in history for financial markets. The logical next step is to look at what has happened next following the prior worst years for stocks, bonds and diversified portfolios. Last year was one of the worst years ever for stocks and the worst year ever for bonds.

Pragmatic Capitalism

SEPTEMBER 7, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ].

A Wealth of Common Sense

DECEMBER 31, 2023

2022 was one of the worst years ever for financial markets. Over the past 100 years: It was the third worst year for a 60/40 portfolio. It was the worst year ever for the Barclays Aggregate Bond Market Index. It was the seventh worst year for the S&P 500. It was the worst year ever for the 10 year Treasury bond.

The Big Picture

DECEMBER 23, 2023

His Monthly Chart Portfolio of Global Markets and Market Analysis Commentary are both widely read among professional traders. Pring Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications by John J.

The Big Picture

NOVEMBER 20, 2023

My firm RWM uses Canvas for those clients who want their portfolios to reflect their values. The most popular ESG application of direct indexing software has been to remove guns and tobacco from portfolios. It reflects the desire for investors to have their portfolios reflect their personal values.

Discipline Funds

FEBRUARY 28, 2025

Buffett said: Having loads of liquidity lets us sleep well … during episodes of financial chaos that occasionally erupt in our economy, we will be equipped both financially and emotionally to play offense while others scramble for survival. But why is Buffett able to remain so persistently aggressive?

Abnormal Returns

AUGUST 30, 2022

advisorperspectives.com) How financial markets respond to climate risks. alphaarchitect.com) Why ESG ratings are no way to run a portfolio. ft.com) Stock markets in autocratic countries experience lower returns and more risk. ESG Historically good companies to work for have been good investments.

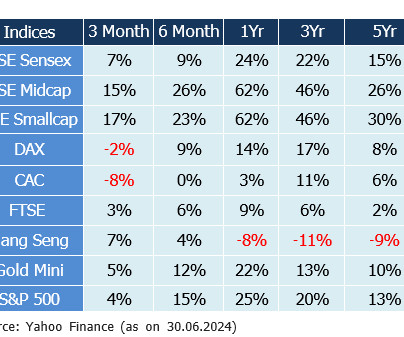

Truemind Capital

OCTOBER 18, 2024

That’s exactly what we’ve seen in India’s financial markets in the quarter ending September 2024. Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards ALL KEY ASSET PRICES ARE GOING NORTHWARDS!

The Big Picture

FEBRUARY 7, 2024

To find out more, I speak with Jeremy Schwartz, Global Chief Investment Officer of WisdomTree, leading the firm’s investment strategy team in the construction of equity Indexes, quantitative active strategies and multi-asset Model Portfolios. So his own portfolio started selling the S&P 500 and buying value.

Truemind Capital

NOVEMBER 8, 2024

Like the circle of life, good times are followed by bad times, and bad times are followed by good times, stock markets also go through cycles of excessive greed/optimism to excessive fear/pessimism. For the sustainable long-term progress of financial markets, corrections are healthy and useful.

Truemind Capital

JULY 19, 2024

Although, the sharp uninterrupted equity rally over the last few years have emboldened heightened retail participation and speculation leading to excessive valuations in many market segments, there are no signs of bad news that could disrupt this rally. The current P/E Multiple of ~24.5x is higher compared to long term averages of 20-21x.

Trade Brains

OCTOBER 4, 2023

Written by Sandeep R By utilizing the stock screener , stock heatmap , portfolio backtesting , and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks also get updated with stock market news , and make well-informed investment decisions.

Darrow Wealth Management

JUNE 10, 2024

And they definitely shouldn’t let politics upend their long-term financial plans. Because historically, financial markets have rewarded investors who stay the course. stock market has gone up over time—regardless of who is running for office. Yes, the market hates uncertainty, including political ambiguity.

Darrow Wealth Management

FEBRUARY 26, 2025

Swings in the financial markets also highlight the benefitsand limitationsof diversification. During times of economic, financial, and political uncertainty, investors often wonder where to invest or what changes to make to their portfolio. Aggregate Bond Index isnt enough to ensure your portfolio is properly diversified.

The Big Picture

FEBRUARY 16, 2024

He is the chair of the Bretton Woods Committee , and Chairman of the Committee on the Global Financial System of the Bank for International Settlements. He also serves as Senior Portfolio Manager for all long equity strategies and is a member of Morgan Stanley Wealth Management’s Global Investment Committee.

The Big Picture

SEPTEMBER 25, 2024

. ~~~ About Jeremy Schwartz: Jeremy Schwartz is Global Chief Investment Officer of WisdomTree, leading the firm’s investment strategy team in the construction of equity Indexes, quantitative active strategies, and multi-asset Model Portfolios. Jeremy Schwartz : You know, we do believe very much in diversification, owning the full market.

The Big Picture

MARCH 6, 2025

To help us unpack all of this and what it means for your portfolio, let’s bring in Austin Goolsbee. The stock market. Other financial markets can influence those two things, partly through the wealth effect. And I said this, look, the fed by law is supposed to be looking at the real economy and financial markets.

Abnormal Returns

NOVEMBER 6, 2022

awealthofcommonsense.com) A bear market allows you to restructure your portfolio without tax consequences. abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? Then check out our weekly e-mail newsletter.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content