Weekend Reading For Financial Planners (May 18-19)

Nerd's Eye View

MAY 17, 2024

Altogether, the study suggests that social media engagement is driven more by the quality (and originality) of the advisor's content, rather than the quantity of posts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

MAY 17, 2024

Altogether, the study suggests that social media engagement is driven more by the quality (and originality) of the advisor's content, rather than the quantity of posts.

Nerd's Eye View

NOVEMBER 27, 2024

Charitable giving is an essential aspect of many people's financial lives. Some give through established channels, such as by donating to charities or volunteer work, others may give informally to family members on a regular but less structured basis – and some simply aspire to "do more". Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

APRIL 7, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the T3/Inside Information Software Survey is available, providing insights into which technology tools advisors use and their level of satisfaction with them, which highlighted the continued rise of specialized financial planning (..)

Nerd's Eye View

FEBRUARY 23, 2023

The increasing popularity of financial planning has led to a growing awareness of how important managing finances and planning for the future can be. For most financial advisors today, a website is a critical tool that allows them to market their services and communicate their fees to potential clients.

Nerd's Eye View

AUGUST 12, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the U.S.

Nerd's Eye View

MAY 22, 2023

Traditionally, financial planning internship programs have offered students who are aspiring financial planners a way to prepare for entering the workforce by gaining real-world experience in advisory firm settings (as well as a way to get their foot in the door with prospective employers).

Midstream Marketing

NOVEMBER 7, 2024

Key Highlights Learn how to improve your financial planner’s online visibility by using SEO and SEM wisely. Introduction In financial planning, it is key to know about search engine optimization (SEO) and search engine marketing (SEM). Digital marketing strategies are crucial for the success of financial planners.

Nerd's Eye View

AUGUST 12, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the U.S.

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

The Chicago Financial Planner

FEBRUARY 2, 2024

If the advisor’s primary service is focused in an area like constructing bond portfolios for their clients and you are looking for a financial planner to construct a comprehensive financial plan for you, this advisor may not be a good match. What can you do for me? What are your conflicts of interest?

International College of Financial Planning

MARCH 12, 2025

Fact-check everything: Follow SEBI-registered advisors, reputed financial planners, and research from credible sources. Final Thoughts: The Path to Financial Security Starts Today Smart financial planning isnt about giving up the things you enjoyits about making informed decisions that align with your goals.

Clever Girl Finance

DECEMBER 23, 2024

Freelancing is liberating, but without a solid financial plan, it can also be unpredictable. As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. That’s where financial planning for freelancers comes in. Plan for taxes ahead of time 4.

The Chicago Financial Planner

FEBRUARY 8, 2023

Its important for retirees to understand how taxes will impact their retirement finances and to include this in their retirement financial planning. Note the information above is a review of the basics of how Social Security benefits are taxed and should not be considered to be advice. Your situation may differ.

Nerd's Eye View

JULY 13, 2023

Establishing successful client relationships as a financial advisor relies on good communication skills not just to present information persuasively and with confidence, but also to establish client rapport that allows meaningful and engaging relationships to be built.

eMoney Advisor

MAY 1, 2023

When asked about how they started in the industry, many of the Asian-American financial planners I admire say the same thing: At first, they didn’t even know the profession existed. ” Only 4 percent of Certified Financial Planner™ professionals identify as Asian American or Pacific Islander (AAPI), though they make up 6.2

eMoney Advisor

MARCH 1, 2023

It is incredibly important for women to have a voice at the financial table. As financial planners, we need to build an inclusive environment where women have the confidence to use their voice in financial conversations, can discuss finances with people they relate to, and have their unique concerns addressed. Sources: 1.

The Chicago Financial Planner

JUNE 13, 2022

Assuming that you have a financial plan with an investment strategy in place there is really nothing to do at this point. Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. Nobody can predict how long this will last. Do nothing.

eMoney Advisor

JANUARY 12, 2023

If you’ve resolved to add more meaning to your work in 2023 using your skills as a financial planner, you’ve come to the right place. We’ve gathered seven unique volunteer opportunities for financial professionals, including pro bono financial planning. Foundation for Financial Planning.

Ballast Advisors

MAY 8, 2023

Financial planning is a vital aspect of life. Often, the financial lessons and advice passed down from generation to generation shape an individual’s approach to finances. In this blog, we’ll dive deep into some lessons they’ve learned and the role that financial planning plays in supporting their goals.

eMoney Advisor

FEBRUARY 7, 2023

Financial planners, there is no better time than now to make a few digital connections to help expand your knowledge and advance our profession. percent of Certified Financial Planner™ professionals in the U.S. We also offer financial planning firms access to a more diverse talent pool. Approximately 1.9

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

eMoney Advisor

NOVEMBER 9, 2022

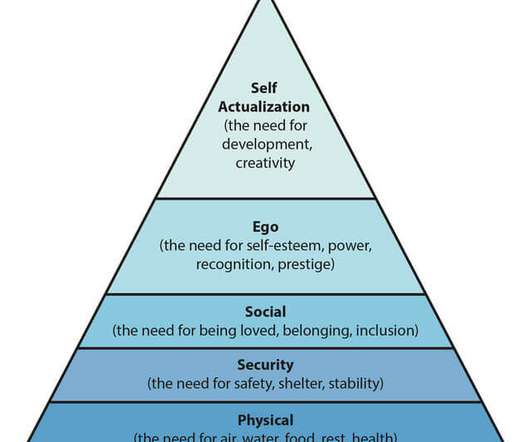

Cultural humility can help create a safe space for clients to share their most important financial information, which is a critical part of the financial planning process. The most notable shift to be aware of is the departure from the conventional financial service model and the journey to holistic planning.

eMoney Advisor

DECEMBER 5, 2022

When the resolved conflict is about money it can enhance their likelihood of achieving desired financial goals. By taking the clients back to the beginning, the financial professional can get to the heart of what the couple in conflict truly wants out of their financial plan.

International College of Financial Planning

OCTOBER 17, 2023

The digital age has brought forth numerous opportunities, especially for professionals in the financial services sector. Certified Financial Planners (CFPs) stand at the forefront of this revolution. The Rise of Financial Planning Software In financial services, staying updated in real-time has become crucial.

Your Richest Life

JULY 17, 2024

In the 10 years I’ve spent running a financial planning firm, I’ve learned a lot about how people handle (or don’t handle) their finances. Money lesson #6: Be careful where you get your investment information from. The internet is drowning in financial advice, both good and bad.

eMoney Advisor

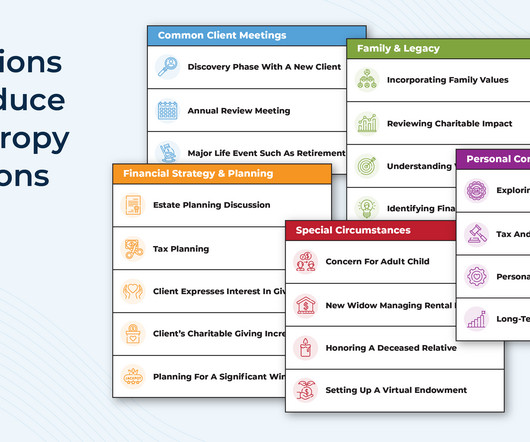

DECEMBER 27, 2022

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. It’s about incorporating more life events—large and small—which allows for agile, “just in time” planning.

eMoney Advisor

DECEMBER 21, 2022

Goal-based financial planning entails setting and achieving individual financial goals based on a client’s aspirations, assets, and savings. Whereas cash flow-based financial planning involves a precise approach to meeting goals based on the money flowing into and out of a household every month.

International College of Financial Planning

SEPTEMBER 3, 2021

When it comes to choosing a financial planner, it’s important to choose the right fit for you. To ensure that an advisor who will help you plan your finance, follow these steps. Do the research of the available advisors – the first step is to find a financial planner who will help you plan your finances.

Steve Sanduski

APRIL 8, 2025

Bill Keen, Matt Wilson, and I discuss: How Bill’s experiences at big brokerage firms informed his vision for Keen Wealth. Keen Wealth’s checklist-driven financial planning process. Our team is so focused on the financial planning side of the equation for everyone that they just eat up all this planning.

Indigo Marketing Agency

FEBRUARY 19, 2025

Back in the day, financial planners used to be able to place ads in the local paper and Yellow Pages to get clients. Of course, this is a scenario that leaves zero time to actually serve financial practice clients and manage their money! But thats still not good enough for financial planners, given the highly regulated industry.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. Credentials matter in any profession and when it comes to personal finance, there’s no certification more highly coveted than Certified Financial Planner.

eMoney Advisor

DECEMBER 19, 2022

Financial planning is inherently a helping profession. I feel fortunate to have a career as a financial planner, dedicating every day to helping others make the best life decisions they can with their money. This is where we find the dynamic nature of our financial planning software so powerful.

International College of Financial Planning

OCTOBER 26, 2023

Why Do You Need a Financial Planner? In the vast realm of finance, numerous pathways lead to the esteemed financial advisor title. Let’s unveil the roles of these dedicated experts, who tirelessly weave strategies to illuminate the path towards their clients’ financial aspirations. Who is a Financial Advisor?

Tobias Financial

JULY 14, 2023

We are thrilled to announce that our CEO Marianela Collado has been appointed to the Association of International Certified Professional Accountants (AICPA) Personal Financial Planning (PFP) Executive Committee. The AICPA PFP Executive Committee is dedicated to broadening the competency of CPA financial planners.

Your Richest Life

JULY 15, 2022

In late 2021, I was honored to receive D Magazine’s Best Financial Planners in Dallas award for the seventh year in a row. I also received the Investopedia Top 100 Financial Planner distinction for the third year in a row. Listed as a D Magazine Best Financial Planner for the seventh year in a row.

International College of Financial Planning

APRIL 25, 2024

Achieving the status of Certified Financial Planner® (CFP®) represents a significant professional milestone in financial services. What Is a Certified Financial Planner®? A Certified Financial Planner® is a distinguished professional who has met the stringent standards set by the FPSB Board.

Sara Grillo

JANUARY 8, 2024

While financial planning has become more popular, it’s still not center stage for most advisors. I’ve got Zack Hubbard , the director of financial planning and participant engagement at Greenspring Advisors, a fee only RIA. I am an irreverent and fun marketing consultant for financial advisors. Repeatable?

Sara Grillo

OCTOBER 21, 2022

I am an irreverent and fun marketing consultant for financial advisors. Before we get started, I wanted to give hanks to Jonathan Grannick of Wonder Wealth , as well as other financial planners for their input. He cold called over 500 financial planning companies over a year or so to get to a full book of clients.

WiserAdvisor

JULY 1, 2022

That said, entrepreneurship can sometimes be cumbersome in spirit, especially in terms of financial planning. Long working hours, lack of financial security, irregular income, managing investors, liquidity issues, insufficient equity, and more, while juggling personal finances, can be a daunting task.

International College of Financial Planning

NOVEMBER 16, 2023

According to the “Value of Financial Planning ” study conducted by the Financial Planning Standards Board in 2023, Indians are in the top quartile when it comes to leveraging technology to manage finances. They’re not just one-way streets but platforms where you can share and receive information.

Sara Grillo

MAY 23, 2022

What’s up with these “advice-only financial planners?” I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. What is an advice-only financial planner? The benefits of advice-only financial planners.

AdvisorPR

SEPTEMBER 28, 2023

Comprehensive, current, and actionable program trains members to engage with the media and use FPA MediaSource, the automated media query platform connecting financial planners and journalists. With an eye on supporting the needs of journalists, the Association introduced FPA MediaSource in 2016.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content