Weekend Reading For Financial Planners (July 6-7)

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S.

Nerd's Eye View

AUGUST 19, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the FPA is planning to leave the Financial Planning Coalition (which also includes the CFP Board and NAPFA) at the end of the year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

APRIL 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor released the final version of its Retirement Security Rule (a.k.a.

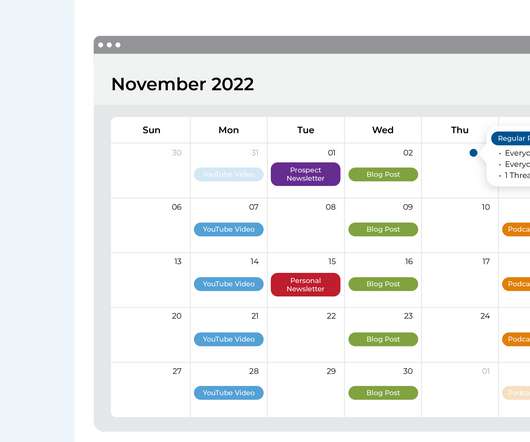

Indigo Marketing Agency

JANUARY 16, 2025

10 Growth Marketing Strategies for Financial Planners in 2025 The new year wipes the slate clean and gives financial planners a fresh opportunity to focus on marketing strategies that attract and retain more clients in less time and with less energy. Our team can help you map out a sales funnel. The good news?

Nerd's Eye View

OCTOBER 4, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent survey from Charles Schwab indicates that advisors see technology as the biggest driver of change in the RIA industry, with the growing number of AdvisorTech solutions as the most frequently cited tech-related driver (..)

Nerd's Eye View

MAY 3, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study indicates that nearly a third of advisors in the independent broker-dealer channel have considered transitioning to the RIA channel during the past year as they seek higher payouts and not just "independence" but (..)

Nerd's Eye View

JULY 7, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that recent survey data indicate that advisors are more satisfied and productive when they have more time to spend with their clients and when those clients fit within their ideal client profile, in terms of needs, (..)

Nerd's Eye View

MAY 31, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Financial Planning Association and Money.com are planning to publish a “Best Financial Advisors” list based on advisors’ education, credentials, and experience, as well as harder-to-quantify (..)

Nerd's Eye View

NOVEMBER 3, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor this week released its long-awaited "retirement security rule", its latest effort to curb conflicts of interest around retirement savings recommendations.

Nerd's Eye View

FEBRUARY 9, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey sponsored by CFP Board demonstrates the upsides of a career in financial planning, from a median salary of nearly $200,000 to flexible work schedules and a strong sense of purpose among advisors.

Nerd's Eye View

SEPTEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli has shown a sharp increase in the number of affluent investors willing to pay for advice, which on the one hand reflects the increasing financial complexity in peoples' lives (while they've also gotten (..)

Nerd's Eye View

JUNE 30, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that NAPFA has announced that it will no longer exclude advisors who receive up to $2,500 in annual trailing commissions from previous product sales, if they agree to donate that money to a non-profit organization (..)

Nerd's Eye View

DECEMBER 25, 2024

This sales technique involves asking a "negative" question such as, "Joining with a financial planner can be a really scary jump to make, right?" Advisors then face a dilemma: How do they follow up politely, without being overbearing, and still help the client either make a decision or voice their real concerns?

Nerd's Eye View

APRIL 4, 2024

Advisor Metrics, Cerulli Associates predicts that 37.5% (or nearly 110,000) of financial advisors will retire over the next 10 years. Beyond that, however, obligating financial planners to hire and train new advisors could create some unintended (and detrimental) consequences. Read More.

Nerd's Eye View

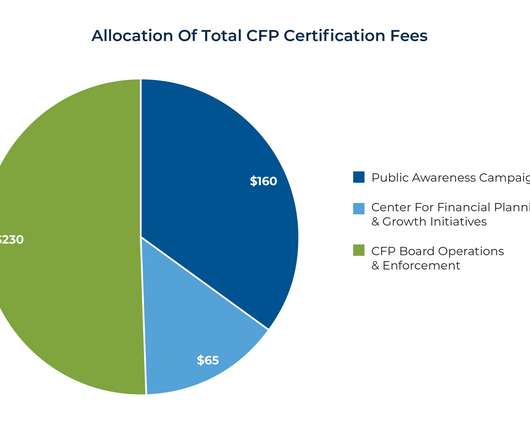

AUGUST 19, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the FPA is planning to leave the Financial Planning Coalition (which also includes the CFP Board and NAPFA) at the end of the year.

Indigo Marketing Agency

FEBRUARY 8, 2025

Marketing for Financial Planners: Strategies to Build Trust and Grow Your Client Base Strategic Client Growth: Win Trust in a Trust Economy More than many other fields, trust is truly the currency that drives growth for financial planners. But thats not even the biggest challenge you face with winning more clients.

Nerd's Eye View

JULY 18, 2022

But these positions are often tenuous for new advisors, with extremely high failure rates, driven in large part by compensation that is reliant primarily on commissions from product sales.

The Chicago Financial Planner

FEBRUARY 2, 2024

Here are six questions to ask when choosing a financial advisor: How do you get paid? Fee-only advisors receive no compensation from the sale of investment or insurance products. Check out my Financial Review/Second Opinion for Individuals service for detailed guidance and advice about your situation. What can you do for me?

Darrow Wealth Management

NOVEMBER 4, 2024

Stockbrokers, registered representatives, dual registered advisors, insurance agents, and other types of advisor-sales roles don’t always have to act in your best interest depending on the situation. For non-fiduciary financial advisors, recommendations may only need to be suitable , not necessarily in the client’s best interest.

The Chicago Financial Planner

JUNE 13, 2022

I don’t advocate market timing but buying a good long-term investment is even more attractive when it’s on sale so to speak. Check out my freelance financial writing services including my ghostwriting services for financial advisors. Markets will always correct at some point. Be a smart investor.

Nerd's Eye View

JANUARY 23, 2023

However, for advisors looking to reach a different type of client – such as those in younger generations like Millennials, who often have an aversion to such straightforward sales tactics – finding a message that resonates often requires a more tailored approach that speaks to the specific audience and what they are going through.

Nerd's Eye View

OCTOBER 1, 2024

What's unique about Gaetano, though, is how after breaking away from an insurance broker-dealer with barely $5M in assets under management, he has been able to quickly build his practice to $75 million in AUM in just 5 years in part by turning what was originally a liability for him in his 20s – being a 'young' advisor who prospective clients (..)

Indigo Marketing Agency

FEBRUARY 19, 2025

Why Hiring a Digital Marketing Agency for Financial Services Is the Key to Growing Your Business In the mid-2000s, digital marketing was just one of many mediums local businesses were starting to utilize to growalong with newspaper ads, phone book ads, direct mail ads, radio and TV ads, billboards, door-to-door sales, and more.

oXYGen Financial

MAY 9, 2023

International College of Financial Planning

SEPTEMBER 3, 2021

When it comes to choosing a financial planner, it’s important to choose the right fit for you. Do the research of the available advisors – the first step is to find a financial planner who will help you plan your finances. A planner should be able to answer any question that you may have regarding his services.

Sara Grillo

MAY 23, 2022

What’s up with these “advice-only financial planners?” I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. What is an advice-only financial planner? The benefits of advice-only financial planners.

Sara Grillo

OCTOBER 21, 2022

I am an irreverent and fun marketing consultant for financial advisors. Before we get started, I wanted to give hanks to Jonathan Grannick of Wonder Wealth , as well as other financial planners for their input. What is a financial paraplanner? How do you get a job as a financial paraplanner?

Nerd's Eye View

FEBRUARY 13, 2024

We also talk about how Melody invested early, at least relative to her revenue and profits, in business coaches and her own employees in order to sustain the service model that would meet her own standards, why Melody decided to hire with a focus on character over technical skills, reasoning that while she could teach paraplanning work, she couldn't (..)

Investment Writing

FEBRUARY 6, 2024

If you’re using your CFP designation in sales or advertising Here’s what The Chicago Manual of Style says on its website: Q. In publications that are not advertising or sales materials, all that is necessary is to use the proper spelling and capitalization of the name of the product.

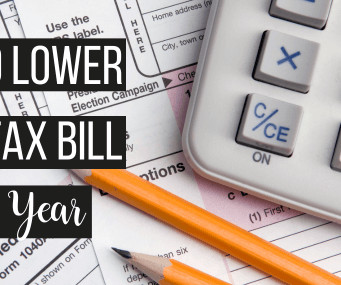

Carson Wealth

OCTOBER 26, 2022

Step three: You match up the loss and the gain — selling one investment at a loss to offset the capital gain generated by the sale of the investment you sold at a profit. In play: the sale of Mrs. Investor’s business later in the year for a gain of $500,000. How Tax Loss Harvesting Works. XYZ is now selling at $50 a share.

NAIFA Advisor Today

OCTOBER 6, 2023

John Wheeler is an accomplished Certified Financial Planner (CFP) with a wealth of experience in the financial services industry since 1969. In his current role, John supports his firm through seminars, advanced joint sales work, recruiting, and developing financial planning services.

Indigo Marketing Agency

APRIL 28, 2023

Author, Speaker, Life Coach & Veterinary Pharmaceutical Sales” This may be my favorite. While this may be your title and company, it tells me nothing about who you serve, what your firm does, what you do, or how I can benefit. Unfortunately, this is the most common headline I see for advisors.

Inside Information

MARCH 11, 2025

And I do think its possible to have a good, productive relationship with a sales agent. Prospect : Wait What do you mean, sales agent? Advisor: People who call themselves advisors or financial planners follow a variety of different business models. Advisor: Edward Jones Yes, I know a little bit about them.

International College of Financial Planning

JULY 10, 2023

Different Types of Investment Advisors Financial Planner: A financial planner assists individuals achieve their financial goals. They help clients manage their financial aspects and develop customized strategies based on their needs. Excellent communication and interpersonal skills.

Walkner Condon Financial Advisors

APRIL 21, 2023

What does it mean to be a Fee-Only financial advisor ? Fee-Only financial advisors and firms receive no sales-related compensation or incentives. What is a Certified Financial Planner (CFP) ? It is one of the most recognized and respected financial planning certifications in the industry.

Your Richest Life

JUNE 30, 2023

If you go this route, just make sure you don’t re-purchase the same investment thirty days before or after the sale. If you do, you could trigger wash sale rules. About Your Richest Life At Your Richest Life, physician-focused financial planner Katie Brewer, CFP®, wants to help you build a successful financial future.

Inside Information

JULY 31, 2022

If you’re as old as Methuselah, like I am, you might remember a pivotal moment in the evolution of the planning profession, when Forbes magazine noticed that brokers, life insurance and tax shelter salespeople were starting to call themselves ‘financial planners.’ But not as a financial planner.). Pandemonium!

Discipline Funds

AUGUST 4, 2023

Retail sales have slowed to 0.5%. After all, time is the core problem that financial planners and investment managers try to solve. The environment is so strange that there’s a narrative for pretty much everyone. For instance: Permabears can argue: Industrial production has slowed to 0%. PMI has been contracting all year.

International College of Financial Planning

MARCH 13, 2023

Investors who are not experts on the stock market can rely on professional financial planners and brokers to help them choose the right investments. Financial Planners conduct research on different investment plans and offer their clients the most worthwhile options. These will eat into your returns.

XY Planning Network

SEPTEMBER 19, 2022

your sales or business development plan. Whether you plan to grow a large or boutique firm, there are many actions you must take to legally prepare as you “open the doors” of your firm. With all these “to do’s,” one aspect that doesn’t get enough attention when building a successful pre-launch is. Let’s fix that!

Harness Wealth

JUNE 30, 2023

In this article, we’ll dive into the many tax and financial considerations of buying and selling real estate, how real estate fits into estate planning, and the role that a wealth manager or financial planner can play in guiding your decision-making. down payment.

Nationwide Financial

FEBRUARY 14, 2023

Industry partners include the Employee Benefit Research Institute , the Defined Contribution Institutional Investment Association (DCIIA) , the American Retirement Association , the Certified Financial Planner Board of Standards (CFP Board) , and The American College of Financial Services.

Yardley Wealth Management

MARCH 1, 2022

Work with a financial planner or tax professional to determine how and when to exercise your options for maximum tax-efficiency. You receive a financial windfall, such as an inheritance. Keep an eye on any gains from the sale. Engage a tax-wise professional financial planner to facilitate the acquisition.

Yardley Wealth Management

MARCH 1, 2022

Work with a financial planner or tax professional to determine how and when to exercise your options for maximum tax-efficiency. . You receive a financial windfall, such as an inheritance. . Keep an eye on any gains from the sale. Engage a tax-wise professional financial planner to facilitate the acquisition. .

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content