How to Best Integrate Tax Planning Into Your Financial Planning Process

Wealth Management

OCTOBER 15, 2024

Thursday, November 14, 2024 | 2:00 PM ET

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 15, 2024

Thursday, November 14, 2024 | 2:00 PM ET

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Pricing the impact of financial planning can be challenging, because many of its benefits – like peace of mind – are intangible, compelling in value but difficult to match with an exact price.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

DECEMBER 30, 2024

We start with several articles on retirement planning: Why considering a client's retirement time horizon and spending flexibility could lead to more accurate (and often higher) safe withdrawal rates than the simpler "4% rule" Four unique risks retirees face when drawing down their assets, from sequence of returns risk to tax risk, and how financial (..)

Nerd's Eye View

NOVEMBER 30, 2022

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. greatergood.berkeley.edu) The laws of financial health are pretty simple. marknewfield.substack.com) How to look for holes in your financial plan.

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Wealth Management

FEBRUARY 3, 2023

This week, Orion announced they were making it easier for those in need of free financial planning to find help, TIFIN and Morningstar partnered to enhance their AI-powered distribution platform and eMoney responded to recently-passed legislation with tax planning upgrades.

Carson Wealth

JULY 3, 2024

Develop a risk management plan to implement strategies that minimize or eliminate risks, and protect your business with appropriate insurance coverage, such as liability, property and business interruption insurance. Get Help with Tax Planning Tax planning is a critical component of financial management.

Nerd's Eye View

JULY 20, 2022

This could include planning for how their expenses will change during the sabbatical as well as simulating how the sabbatical will impact their financial picture going forward.

Nerd's Eye View

JANUARY 8, 2024

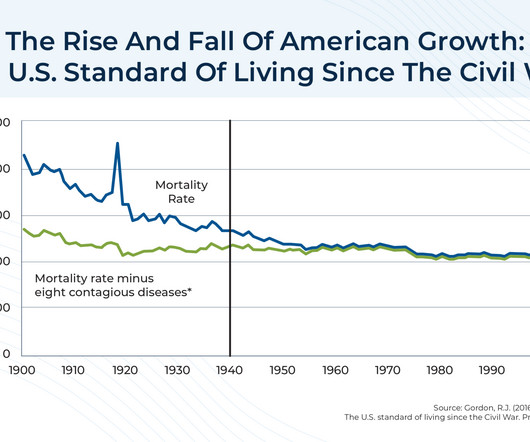

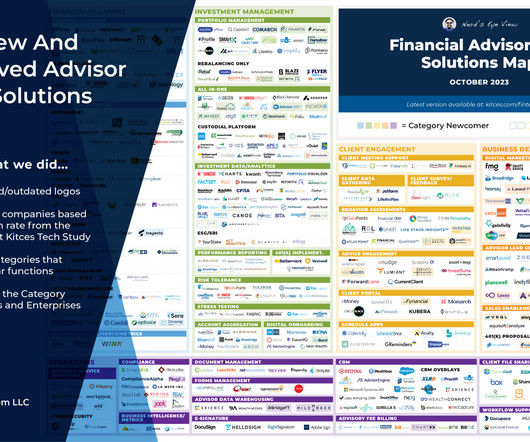

For instance, the financial advice industry has seen many changes to regulations (for both advisors and their clients), advisor business models, and the advisor technology landscape. In the context of the financial planning industry, whereas Financial Advice 1.0 Specifically, Financial Advice 3.0

Harness Wealth

NOVEMBER 12, 2024

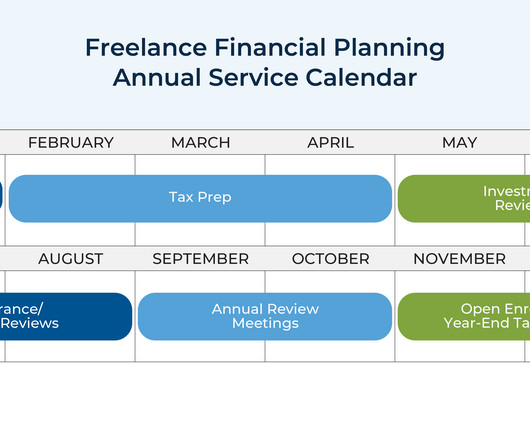

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. This is a product of Harness Tax LLC.

Abnormal Returns

AUGUST 28, 2023

riabiz.com) Charles Schwab ($SCHW) is planning more job cuts due to the TDA integration. investmentnews.com) Pro bono planning Does financial planning have a pro bono problem? mywealthplanners.com) The CFP Board wants to encourage pro bono planning. kitces.com) The SEC is focusing on RIA marketing.

Nerd's Eye View

SEPTEMBER 25, 2024

tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon. However, with the national debt expanding rapidly, observers of U.S.

Abnormal Returns

NOVEMBER 6, 2023

papers.ssrn.com) Taxes A 2023 year-end tax planning guide. kitces.com) Advisers How the profession of financial planning has changed over time. (riaintel.com) How to prep an RIA for sale. (fa-mag.com) fa-mag.com) Research into how RIAs grow. kindnessfp.com) The ins and outs of backdoor Roth IRAs.

Integrity Financial Planning

SEPTEMBER 19, 2022

So, make sure your Social Security and retirement account income plans are lined up so you can claim your maximum benefit with minimal taxation. Don’t just wait until tax season to figure out your tax plan. Taxes affect your whole retirement so factor them into your wealth preservation and income plan too.

Nerd's Eye View

AUGUST 9, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey indicates that clients of financial advisors are more confident than others about their financial preparedness for retirement and are more likely to have a financial plan in place that can weather the ups (..)

Carson Wealth

APRIL 25, 2024

There are some things in life you just can’t plan for: an unexpected illness, job loss, death of spouse, disability. And while experiencing one of these major events can drastically impact your life, having an effective financial plan can help ensure that it doesn’t ruin your financial well-being.

eMoney Advisor

APRIL 11, 2023

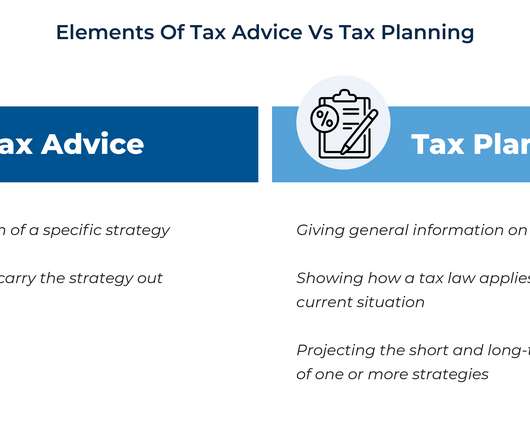

Financial planning and tax planning go hand in hand. Including tax planning as part of your service provides clients a comprehensive view of their finances and helps them achieve their financial goals.

Nerd's Eye View

SEPTEMBER 6, 2022

Read More.

Nerd's Eye View

MAY 8, 2023

In this post, Kitces.com Senior Financial Planning Nerd Ben Henry-Moreland writes about how he went from being hesitant to offer tax preparation at his solo RIA (given how common it is for tax preparers to work long hours throughout tax season) to embracing it as a core part of the business’ service offering.

Nerd's Eye View

SEPTEMBER 30, 2024

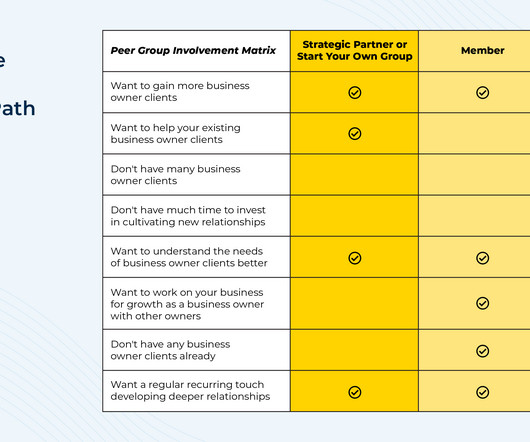

When it comes to focusing on a niche for financial advisors, business owner clients can be an appealing target as they can have complex financial planning problems ranging from cash flow management to tax planning to acquisition strategies.

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

JULY 12, 2022

In this episode, we talk in-depth about how, after years of working in an environment where she saw first-hand how ultra-high-net-worth clients keep and grow their wealth (and the lack of diversity among those clients), Kamila decided to build a practice that focused on providing holistic financial planning to communities of color with emerging wealth, (..)

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Nerd's Eye View

SEPTEMBER 6, 2024

Notably, while the rule will create an additional compliance burden, the due diligence advisers offering comprehensive planning services (as well as their investment custodians) are likely already conducting on their clients to create an effective financial plan could be a 'defense mechanism' for these firms against criminals looking to take advantage (..)

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Nerd's Eye View

MAY 31, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Financial Planning Association and Money.com are planning to publish a “Best Financial Advisors” list based on advisors’ education, credentials, and experience, as well as harder-to-quantify (..)

WiserAdvisor

NOVEMBER 4, 2022

For these reasons and several others, it is essential to follow specific financial planning tips for dual-income families. If you wish to learn about financial strategies that can help dual-income families plan their finances better, consider seeking the services of a professional financial advisor for the same.

Integrity Financial Planning

AUGUST 3, 2022

Why does tax planning matter for your retirement plan? Brian talks through the difference it can make and why you should pay attention to it now as a part of your financial plan. When it comes to taxes, should you use the same person that files taxes to do tax planning and retirement planning for you?

Nerd's Eye View

SEPTEMBER 7, 2022

For example, advisors who use a Customer Relationship Management (CRM) tool may be able to use that tool to narrow down the list of clients to those who are good tax-loss-harvesting candidates, such as those in higher tax brackets (who are likelier to realize more value from deducting capital losses). With these three tools (i.e.,

Nerd's Eye View

JANUARY 12, 2023

As comprehensive financial planning has become more widely adopted, many financial advisors have felt pressure to find new ways to differentiate themselves by demonstrating their unique value to clients. Others use frequent emails to stay in regular contact, sending reminders or helpful information relevant to their clients.

eMoney Advisor

FEBRUARY 9, 2023

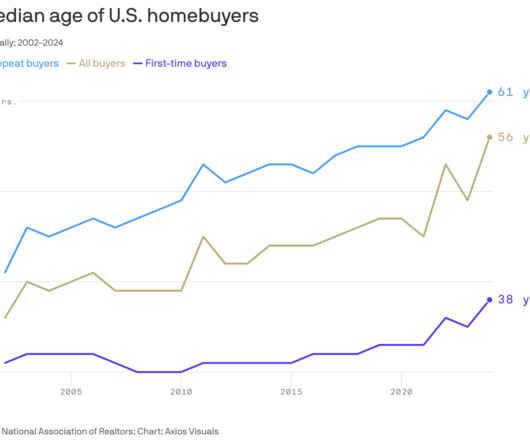

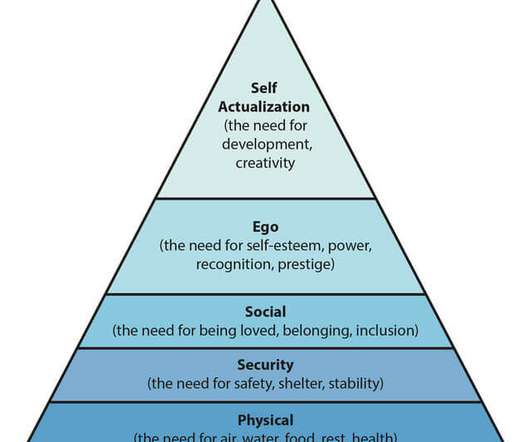

Of an estimated 104 million households seeking some level of financial advice, 88 million of those households want that advice from a financial professional. In this overview, we will explore the demographics of each stage, the financial planning needs of people in each stage, and strategies for serving them.

Carson Wealth

JANUARY 8, 2025

Holistic Financial Management Beyond investment advice, financial advisors offer comprehensive services such as tax planning, estate planning, and risk management. They can help you monitor your progress, adjust strategies as needed, and keep you informed about changes that may affect your financial situation.

eMoney Advisor

MARCH 16, 2023

Along the way, I’ve gathered six key insights about financial planning for Millennials. However, sometimes it gets to be too much when it comes to financial topics. Then we do the financial plan and tax planning around that—it’s been a lot of fun. I would say that’s accurate.

eMoney Advisor

DECEMBER 27, 2022

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. Financial freedom advances to long-term care and children’s education, as well as retirement savings and vacations. 3 Deckers, Lambert.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Nerd's Eye View

OCTOBER 2, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Holistiplan, after achieving success with its tax planning and analysis software, has announced an investment from Lead Edge Capital, signaling that it may be ready to expand into other financial planning areas beyond tax – (..)

WiserAdvisor

OCTOBER 11, 2022

Most people start financial planning with the goal of growing their finances through savings and investments. But financial planning is not limited to increasing your wealth alone. Tax planning is essential. Tax is charged on every penny you earn. What impact do taxes have on your financial planning?

Discipline Funds

DECEMBER 20, 2023

The end of the year is an ideal time to start planning for the year ahead and make sure you’re on target to achieve those goals. Good financial planning is all about asset and liability matching across time. A financial plan with an asset liability mismatch is likely to fail over time.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Life happens.

Carson Wealth

FEBRUARY 29, 2024

What do you need to consider about gifting as it relates to your overall estate plan? Let’s take a closer look at estate and gift taxes and how you can approach them with a financial planning mindset. Taxes on Giving??? Why do you have to pay taxes on money you’re giving away? After all, it’s yours!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content