Creative Planning Expands Tax Expertise With Latest Acquisition

Wealth Management

AUGUST 21, 2023

The deal to acquire CTB Financial Services will bring more tax-focused investment strategies to Creative Planning’s client base.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 21, 2023

The deal to acquire CTB Financial Services will bring more tax-focused investment strategies to Creative Planning’s client base.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Abnormal Returns

FEBRUARY 26, 2024

investmentnews.com) Advisers The American College of Financial Services notes the coming shortage of advisers. kitces.com) How advisers should work with tax professionals. advisorperspectives.com) How couples can approach a financial life together. (kitces.com) American consumers are increasingly trying out fintech apps.

Abnormal Returns

MAY 21, 2023

wsj.com) Apple ($AAPL) is playing the long game in financial services. nytimes.com) Taxes Tax filing companies are lining up against the IRS offering a free filing option. nytimes.com) Taxes Tax filing companies are lining up against the IRS offering a free filing option.

Abnormal Returns

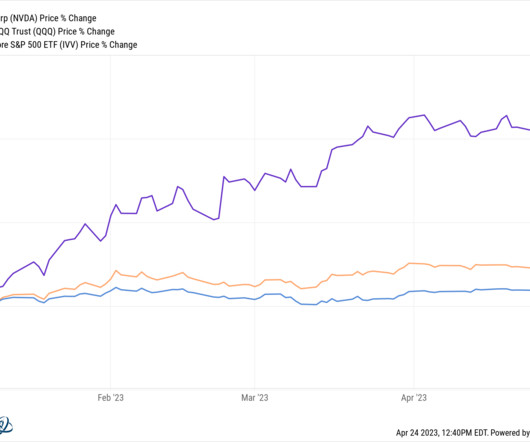

APRIL 24, 2023

ft.com) Don't discount Apple's ($AAPL) push into financial services. thereformedbroker.com) Income tax withholdings are in decline. (advisorperspectives.com) Finance Why the demise of Silicon Valley Bank shouldn't have been surprising. macworld.com) Twitter has stopped funding VCs it has committed to.

Nerd's Eye View

MAY 5, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week’s edition kicks off with the news that the House Financial Services Committee unanimously passed a bill that would direct the SEC to conduct a study and carry out a rulemaking on the definition of a "small entity" to reduce the compliance burden on small businesses, (..)

Abnormal Returns

FEBRUARY 13, 2023

standarddeviationspod.com) Peter Lazaroff talks with Dasarte Yarnway about the importance of diversity in financial services and how to increase it. citywire.com) Taxes Five tax mistakes to avoid when it comes to stock options, RSUs, etc. mattreiner.com) SEC The SEC is going to focus on the new marketing rule in 2023.

Abnormal Returns

MARCH 15, 2023

humbledollar.com) Advice How to fire your financial advisor in four steps. kindnessfp.com) When does it make sense to get help with your taxes? thomaskopelman.com) The financial services industry spends A LOT on lobbying. genyplanning.com) How to compare college financial aid awards.

Nerd's Eye View

OCTOBER 1, 2022

A new bill would make many parts of the Tax Cuts and Jobs Act of 2017 permanent, including its changes to tax brackets, the higher standard deduction, and the cap on state and local tax deductions.

Nerd's Eye View

SEPTEMBER 6, 2022

Read More.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Nerd's Eye View

JULY 17, 2023

In the early days when financial advisors were first and foremost salespeople for insurance and investments products, the reality is that "advisor training and education" wasn't really about finance or advice… it was mostly just about learning how the company's products worked and how to effectively sell them to consumers.

Nerd's Eye View

JULY 12, 2022

In this episode, we talk in-depth about how, after years of working in an environment where she saw first-hand how ultra-high-net-worth clients keep and grow their wealth (and the lack of diversity among those clients), Kamila decided to build a practice that focused on providing holistic financial planning to communities of color with emerging wealth, (..)

NAIFA Advisor Today

AUGUST 21, 2024

In a recent episode of the BetterWealth podcast , I had the opportunity to discuss the critical role NAIFA plays in the financial services industry, particularly in today’s politically charged environment.

WiserAdvisor

OCTOBER 11, 2022

While these can be avoided, there is another cash outflow that can considerably lower your savings and returns and is also hard to avoid – tax. Tax planning is essential. Tax is charged on every penny you earn. Tax evasion is a crime, and missing tax payments can lead to legal hassles that can be hard to get out of.

The Chicago Financial Planner

FEBRUARY 2, 2024

This argument continues in the financial services industry as the regulators work through this issue. The questions listed above are just a few of the many questions you should ask when choosing a new financial advisor or even to ask of an advisor with whom you currently have a relationship.

Abnormal Returns

APRIL 23, 2023

axios.com) Apple ($AAPL) is being very deliberate in its approach to financial services. abnormalreturns.com) Just in time for tax day, a custom indexing linkfest! abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? Companies RIP, Bed, Bath & Beyond ($BBBY).

Abnormal Returns

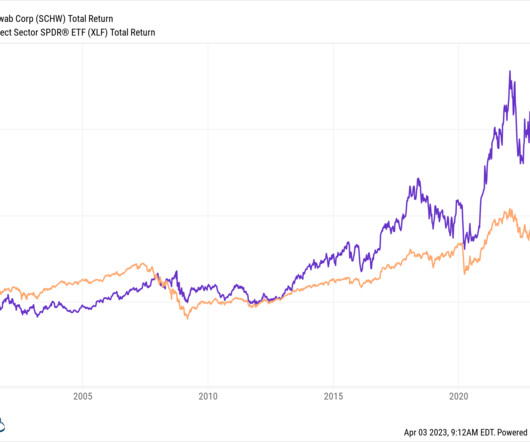

APRIL 3, 2023

wiredplanning.com) The biz Even before Fisher Investments' HQ move, Dallas-Fort Worth is already a hub for financial services firms. wsj.com) Somebody just paid a really big estate tax bill. (allaboutyourbenjamins.com) Brendan Frazier talks with Warren Berger about asking better (client) questions.

Carson Wealth

JULY 12, 2022

Financial service professionals like Tammy climb a competence stairway to work with clients. In this blog, we’ll break down industry jargon, share what various credentials indicate and explain why the financial services industry is so regulated. . Registration Standards for Financial Advisors.

Million Dollar Round Table (MDRT)

JUNE 4, 2023

By Sandy Schussel In any financial services practice, branding is a primary way to attract ideal clients. If you meet someone and tell them you’re a financial advisor who works with medical professionals to help them avoid taxes in retirement, you’re engaging in direct marketing.

Harness Wealth

OCTOBER 8, 2024

Key Takeaways: The Harness Marketplace allows your tax firm to be paired with high-value tax clients whose unique needs align with your expertise. The Harness Marketplace attracts employees, founders, and investors in tech, healthcare, management consulting, and other high-earning industries who need help managing complex tax needs.

Covisum

DECEMBER 7, 2022

Your work is important and helpful but showing clients the value of your advice is a critical differentiator between you and the rest of the financial service providers. Good financial planning software includes visuals that make challenging concepts feel straightforward.

Harness Wealth

JUNE 5, 2024

“Until I found Harness, starting my own tax practice wasn’t an option that I was seriously considering.” Due to Mr. Maddox’s relationship with Harness as a tax adviser on the platform, material conflicts of interest may arise. Maddox’s relationship with Harness as a tax adviser on the platform, material conflicts of interest may arise.

Advisor Perspectives

APRIL 2, 2025

The underrepresentation of women in financial services leadership is not a reflection of their ability – it’s a symptom of an industry that hasn’t evolved quickly enough to meet the challenges of the modern world. Addressing this gap requires more than a commitment to diversity.

Harness Wealth

MARCH 17, 2023

An Introduction to DeFi Decentralized Finance (DeFi) is a rapidly evolving space, offering blockchain-based financial applications that enable individuals and businesses to access various financial services, including lending, borrowing, trading, and earning interest without traditional financial institutions as intermediaries.

AdvicePay

JUNE 13, 2024

We encourage fee-based advisors to view these as synonymous processes– because just as regular oil changes and the occasional new part keep a car running smoothly, both one-time and ongoing financial services are integral to securing and optimizing a client's financial health.

Million Dollar Round Table (MDRT)

JUNE 4, 2024

You can either fall into the category of transactional advisors, where you are simply looking to sell a product, or you can take the wholly encompassing, 360-degree approach to giving good financial advice, supported by a range of other professional services. It’s a call or two you can then make the next day.

Midstream Marketing

DECEMBER 6, 2024

Digital Landscape for RIAs Digital marketing is changing the financial services world. Clients now want financial advice online. It is crucial to follow SEC rules because the laws for advertising in financial services are strict. Financial products can be complex as well.

Trade Brains

AUGUST 28, 2023

High Promoter Holding Stocks Under Rs 50 For our study, we’ll read about the business and operations of five companies from various industries such as power generation, financial services, and textiles. Furthermore, we’ll briefly talk about their financials. It reported a profit after tax of Rs 6,337.01 Dividend Yield 4.6%

Harness Wealth

OCTOBER 16, 2024

We recently connected with Michael Paley, Chief Operating Officer of Klingman & Associates , for a Q&A on how tax advisors can collaborate with wealth managers to better serve clients. Q: How can tax advisors align with the work of wealth advisors? Unlike an endowment, taxes really matter.

Harness Wealth

AUGUST 13, 2024

We are particularly excited to be recognized as both the fastest growing tax technology and WealthTech business in the rankings. We provide a seamless and insightful tax experience alongside a marketplace of supporting services to meet the advisory needs of small business & equity owners. For complete results of the Inc.

Midstream Marketing

NOVEMBER 6, 2024

Trust is very important in the financial services industry. When you provide valuable content that teaches and supports your audience, it shows you care about their financial health. Financial Goals: These include saving for retirement, managing money, and paying for education. Do you focus on a certain type of client?

Indigo Marketing Agency

MARCH 19, 2025

Be Clear, Not Clever Many financial advisors struggle to generate leads because their ads lack clarity, simplicity, and a compelling call to action. Financial services can be complex in the mind of our audience, and if potential clients have to decode your message, theyll keep scrolling. Book a free call today.

Nerd's Eye View

DECEMBER 15, 2022

For the better part of a decade, the financial services industry has anticipated the coming of fee compression, mainly due to the rise of robo-advisors offering low-cost automated wealth management services. tax and estate planning) to differentiate themselves.

Zoe Financial

MAY 16, 2023

Qualified withdrawals from a 529 plan are tax-free at the federal level, and some states also offer tax breaks to their residents. It’s important to evaluate the federal and state tax consequences of plan withdrawals and contributions before you invest in a 529 plan. The federal income tax treatment of these plans is identical.

Robert B. Ritter Jr.

MAY 30, 2022

(Click here for Blog Archive)(Click here for Blog Index) (Presentations in this Blog were created using the Loan-Based Split-dollar System and Wealthy and Wise®) Blog #221 follows up on Blog #220, which described coupling Premium Financing with Wealthy and Wise® to produce a powerful wealth planning concept called “Zero Estate Tax.”

WiserAdvisor

AUGUST 25, 2023

Tax considerations play a crucial role in retirement planning, as they can significantly impact your income and savings. Retirees must carefully strategize to minimize taxes during their non-working years. However, it is important to consider the immediate tax liabilities that come with converting to a Roth account.

Zoe Financial

APRIL 17, 2023

Implementing these strategies can help reduce tax bills, save more, and achieve financial goals sooner. The deadline for tax filing is around the corner. Besides meeting all the requirements for this date, have you considered the impact of implementing long-term tax strategies on your wealth?

WiserAdvisor

JULY 29, 2022

Some opt for a 401(k) account simply because it comes with the advantage of getting an employer match, while some go for a Roth IRA account to be able to make tax-free withdrawals in retirement. This is a tax-deferred investment account, meaning you will only have to pay taxes on the money when you withdraw it after you turn 59½.

The Big Picture

OCTOBER 30, 2023

Financial Times ) • When Sunset’s NOT SELLING: Nobody Is Buying the Fanciest LA Real Estate With a new mansion tax, fleeing insurers, and knock-on effects of the strike, multimillion-dollar homes are sitting, and sitting, on the market. Vanity Fair ) • They Cracked the Code to a Locked USB Drive Worth $235 Million in Bitcoin.

WiserAdvisor

MARCH 13, 2024

Investment planning also plays a crucial role in tax optimization, enabling you to minimize tax liabilities and maximize after-tax returns. Additionally, tax-loss harvesting, and other tax-optimization strategies can further improve the tax efficiency of your investment portfolio, thereby enhancing overall returns.

Cornerstone Financial Advisory

OCTOBER 9, 2023

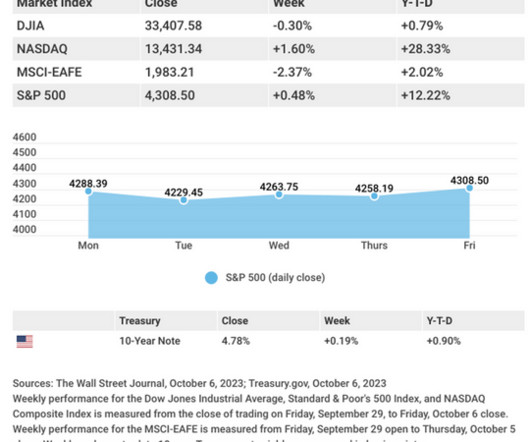

WFC), The PNC Financial Services Group, Inc. The Internal Revenue Service (IRS) has a handy tool called the Tax Withholding Estimator, which can help you manage having too much or too little tax withheld from your wages. This information is not intended to substitute for specific individualized tax advice.

Robert B. Ritter Jr.

MARCH 28, 2022

The post Blog #219: Exceptional Split-Dollar™ (Part 1 of 2) (Including a “Jim Harbaugh” Variation to Recruit a President for a Tax Exempt University) first appeared on Bob Ritter's Blog, ideas for financial service professionals. Still, such a strategy can look terrific if you know […].

Clever Girl Finance

NOVEMBER 16, 2022

IRA contribution statements for non-deductible contributions to prove that you paid taxes. Having this documentation is necessary to avoid tax implications due to errors or misfiling. Things like your divorce decree and anything involving child or spousal support, as well as the settlement and financial papers are essentials.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content