Supreme Court Upholds US Tax on Foreign Business Income

Wealth Management

JUNE 20, 2024

The federal government estimates the mandatory repatriation tax would bring in $340 billion over 10 years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 20, 2024

The federal government estimates the mandatory repatriation tax would bring in $340 billion over 10 years.

The Big Picture

MARCH 2, 2025

But the more likely outcome, if present trends continue, is a party system so fractured that forming a coherent and stable government becomes nearly impossible. From out of the resulting chaos, it could become impossible to prevent one of the radical anti-system parties, including the AfD, from joining a governing coalition.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Harness Wealth

APRIL 4, 2025

This weeks Tax Advisor Weekly covers key updates for financial professionals. We begin with guidance on navigating property tax considerations during business mergers and expansions. In this blog post, well cover key business events that impact property tax and business licenses, along with what you need to consider for each.

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses. The costs of adopting a child can vary significantly depending on the method of adoption.

The Big Picture

JANUARY 24, 2024

At the Money: How to Pay Less Capital Gains Taxes (January 24, 2024) We’re coming up on tax season, after a banner year for stocks. Successful investors could be looking at a big tax bill from the US government. On this episode of At the Money, we look at direct indexing as a way to manage capital gains taxes.

Harness Wealth

MARCH 14, 2025

This edition of the Tax Advisor Weekly covers key updates for financial professionals. To round things out, we provide a refresher on the most common tax return mistakes to watch for this season. Citizens, Businesses ( Martha Waggoner , The Tax Adviser) U.S. Property taxes accounted for 70.2 You can find it here.

Calculated Risk

NOVEMBER 13, 2023

First, shutdowns are expensive, and many government employees continue to work (like the military), but don't get paid. Some issues could be Tax transcripts, Flood Certs, and SS# Authorization. However, there will be some private data to fill the gap. If the shutdown only lasts a week or so, there would probably be little impact.

Carson Wealth

DECEMBER 20, 2024

Strategic charitable giving not only benefits the recipient but can also create significant tax advantages for the giver. You can deposit money into the account now, receive the tax benefit, and then make the donation in your own time. Theres no time limit on when you need to make the donation.

Abnormal Returns

FEBRUARY 26, 2025

sherwood.news) Tesla Over time SpaceX and Tesla ($TSLA) have received at least $38 billion in government contracts, loans, subsidies and tax credits. wapo.st) Tesla ($TSLA) may have to name the federal government as a related party. (cnbc.com) What now for Him & Hers ($HIMS)?

Harness Wealth

MARCH 21, 2025

This weeks Tax Advisor Weekly covers key updates for financial professionals. We also highlight a report on unruly crowds at IRS tax assistance events last year. OBannon , CPA Practice Advisor) Nothing is certain but death and taxes. Did you miss last weeks edition? You can find it here. You can find it here.

Calculated Risk

AUGUST 24, 2022

The annual revision is benchmarked to state tax records. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. This preliminary estimate showed 571,000 more private sector jobs, and 109,000 fewer government jobs (as of March 2022) than originally estimated.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Carson Wealth

FEBRUARY 4, 2025

Understanding Tax Compliance and Risk Management Ultra-high-net-worth individuals face unique tax challenges, including high rates and ever-changing complex tax codes. If managed improperly or inefficiently, tax issues could significantly erode your familys wealth and even lead to legal complications. And, if the U.S.

Wealth Management

NOVEMBER 3, 2022

Property Tax Administration's assessment of the market value of the nation’s highest profile government buildings, such as the White House. Washington Business Journal cites D.C.

The Big Picture

MAY 9, 2024

Not if you spend tax season on a boat! I doubt he’s run the real numbers of being invested in the stock market tax deferred with an additional company match. There is lots more: A slew of bad tax advice likely to get-you-sent-to-jail-for-tax evasion: Live on a boat during tax season! Want to earn more money?

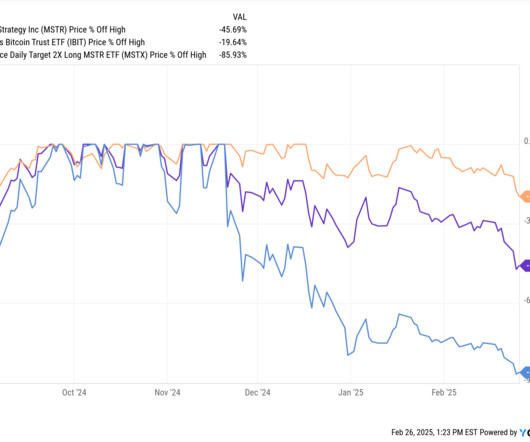

Abnormal Returns

FEBRUARY 24, 2025

citywire.com) Government Social Security is not rife with fraud. thinkadvisor.com) Cutting IRS workers is going to make life more difficult for tax preparers (and payers). (citywire.com) How Jacob Turner turned a professional baseball career into a wealth management business.

The Big Picture

OCTOBER 23, 2023

The US government? This goes back to Grover Norquists ‘ idea that the government should be made so small it could be “ drowned in a bathtub.” Your grandchildren will blame the toxic combination of incompetency and ideology for the massively increased carrying costs of unfunded spending and tax cuts.

Harness Wealth

MARCH 6, 2025

As is traditional, the 2025 IRS tax filing deadline is April 15th. In this guide, well explore the 2025 tax extension process, the reasons for requesting an extension, and how a tax advisor from Harness can help you. Table of Contents What is a tax extension? Why do I need a tax extension? This is not the case.

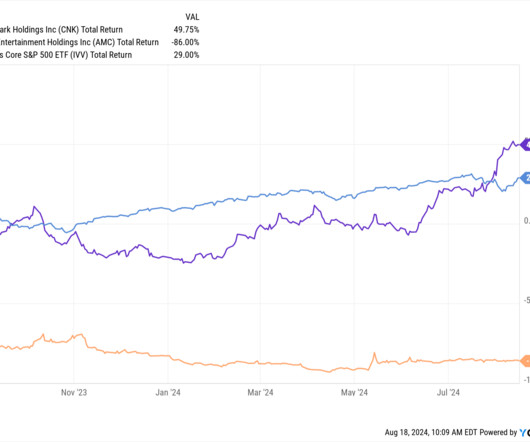

Abnormal Returns

AUGUST 18, 2024

disciplinefunds.com) Vanguard is launching two new active ETFs, the Vanguard Core Tax-Exempt Bond ETF ($VCRM) and Vanguard Short Duration Tax-Exempt Bond ETF ($VSDM). nytimes.com) Covid demonstrated what the federal government can do to support people. (sherwood.news) The Ozempic shortage is over.

Nerd's Eye View

NOVEMBER 15, 2023

government designed a number of small business relief packages to incentivize companies to keep workers on their payrolls. government designed a number of small business relief packages to incentivize companies to keep workers on their payrolls. To stave off a wave of business closures and a subsequent surge in unemployment, the U.S.

Trade Brains

DECEMBER 18, 2023

Top 5 Tax Havens In The World : Where most of us are already annoyed by the mere thought of paying income taxes, have you ever wondered how super-rich people avoid taxes legally? They park their money in tax-haven countries where it’s easy to evade taxes. What’s a Tax Haven? Top 5 Tax Havens In The World I.

Nerd's Eye View

FEBRUARY 8, 2023

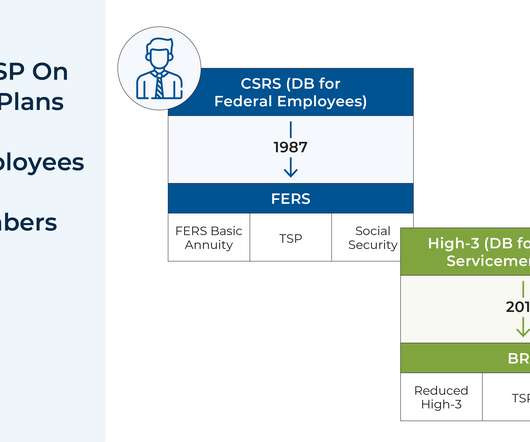

government is the largest employer in the country, it can be especially helpful for advisors to be familiar with the ins and outs of (and recent changes to) the Federal government’s own defined contribution plan: the Thrift Savings Plan (TSP). But given that the U.S.

Abnormal Returns

MAY 31, 2024

joincolossus.com) Finance Rick Ferri talks with Wes Gray, CEO of Alpha Architect, about ETFs and their unique tax characteristics. open.spotify.com) Stephen Clapham talks sustainability with Carine Smith Ihenacho is Chief Governance and Compliance Officer at Norges Bank, the Norwegian Sovereign Wealth Fund.

MainStreet Financial Planning

MARCH 14, 2024

As April 15th approaches, taxpayers across the country are gearing up to fulfill their annual obligation – filing taxes. Whether you’ve already submitted your returns or are yet to tackle the paperwork, now is the perfect time for a tax check-up. Other Resources Should I do my own taxes?

Abnormal Returns

FEBRUARY 13, 2023

citywire.com) Taxes Five tax mistakes to avoid when it comes to stock options, RSUs, etc. fa-mag.com) How to advise clients in the government Thrift Savings Plan. (mattreiner.com) SEC The SEC is going to focus on the new marketing rule in 2023. flowfp.com) The IRS has clarified its approach to state rebate payments.

Nerd's Eye View

DECEMBER 13, 2023

Although numerous tax-advantaged vehicles are available for retirement savings, Health Savings Accounts (HSAs) have particular benefits for individuals saving for retirement. Specifically, HSAs offer a "Triple Tax Benefit" that includes tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses.

Integrity Financial Planning

JULY 17, 2023

How you handle taxes and when you are taxed are two of the most important factors when it comes to retirement planning. There are also Roth 401(k)s that have a similar tax treatment but are subject to some different rules.

MazumaBusinessAccounting

JULY 27, 2022

It can be incredibly freeing to be your own boss, but doing your own self-employment taxes? All businesses need to pay annual taxes. If your small business expects to owe more than $1,000 in federal taxes, you’ll also need to pay quarterly taxes. Which Taxes Do I Have to Pay? Federal Income Tax.

Nerd's Eye View

SEPTEMBER 6, 2024

Notably, while the rule will create an additional compliance burden, the due diligence advisers offering comprehensive planning services (as well as their investment custodians) are likely already conducting on their clients to create an effective financial plan could be a 'defense mechanism' for these firms against criminals looking to take advantage (..)

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. Both plans allow for contributions up your tax filing date, including extensions for the prior tax year. As a fellow small businessperson, I know how hard you work.

MainStreet Financial Planning

JANUARY 17, 2025

Tax Return Deadlines and Info: In response to the recent wildfires, CDTFA has extended the January 31 sales and use tax filing deadline for Los Angeles County taxpayers until April 30, 2025. See the State of Emergency Tax Relief page for more information and a list of all tax programs covered by this relief.

The Big Picture

SEPTEMBER 28, 2023

Flying blind, with things about to get much worse, the government responses were: 1) Operation Warp Speed, a commitment to getting a COVID vaccine ready; 2) CARES Act 1, a $2.2 And without those government-ordered mitigation measures, cases and deaths would have surged uncontrollably. A tiny infrastructure build was also included.

Nationwide Financial

AUGUST 29, 2022

Key Takeaways: Even without new legislation, the prospect of higher taxes in the future is still looming. The impact of higher taxes on retirees could be substantial, so staying up to date on the current tax landscape is vital. But even without new legislation, the prospect of higher taxes in the future is still looming.

Abnormal Returns

JUNE 18, 2023

msn.com) Policy Nicholas Bagley, "We need a government that can build, whether it’s wind farms or websites." msn.com) Cutting IRS funding reliably reduces overall tax revenue. (bigtechnology.com) The bull case for the Apple ($AAPL) Vision Pro. trungphan.substack.com) Tesla's ($TSLA) last great advantage is its charging network.

Carson Wealth

JANUARY 25, 2023

Mike Valenti, CPA, CFP ® , Director of Tax Planning Tom Fridrich, JD, CLU, ChFC ® , Senior Wealth Planner It’s January, so it’s officially tax season! One of the most common client questions heard by tax preparers is, “So, what do you need from me?” This can result in additional tax owed, plus penalties and interest.

A Wealth of Common Sense

MAY 18, 2023

A reader asks: I have recently shifted a substantial portion of the cash portion of my savings into 3-4 month T-bills to take advantage of higher yields and state tax advantages. As of today, they are all set to mature in June and July.

Abnormal Returns

APRIL 20, 2023

semafor.com) India Stack, a government-backed set of APIs, is a new model for digital business. abnormalreturns.com) Just in time for tax day, a custom indexing linkfest! (theblock.co) Media Buzzfeed News is shutting down. variety.com) Insider is doing a round of layoffs. abnormalreturns.com) What you missed in our Wednesday linkfest.

Nerd's Eye View

OCTOBER 4, 2023

There's also the question of whether long-term equity returns could be significantly lower than we've experienced during the post-WWII era without the boost of lower interest and tax rates. And even though U.S.

Carson Wealth

FEBRUARY 29, 2024

But when does gifting become a tax issue? Let’s take a closer look at estate and gift taxes and how you can approach them with a financial planning mindset. Taxes on Giving??? Why do you have to pay taxes on money you’re giving away? This continued until the federal government wised up and imposed a federal gift tax.

Carson Wealth

DECEMBER 28, 2022

While everyone has different financial goals and objectives, one smart strategy can be to reap the benefits of tax-advantaged accounts to help mitigate your tax burden, whether for today or down the road. What Are Tax-Advantaged Accounts? . There are two types of tax-advantaged accounts: . Tax-Deferred Accounts .

The Big Picture

MARCH 22, 2023

But the government-orchestrated deal has angered many investors. Logging Into Zoom at the Beach Could Land You a Tax Bill Source: Bloomberg Sign up for our reads-only mailing list here. Financial Times Alphaville ) • Why Job Reshoring Is Merely a Trickle : U.S. manufacturing can’t compete on cost, but it has a leg up in some areas. (

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Carson Wealth

JANUARY 28, 2025

Plus, putting charitable giving in the context of other wealth planning strategies like estate and tax planning can help increase the effectiveness of your philanthropy and overall financial plan. This refers to the potential for your fund or foundation to lose financial value, due to poor investment decisions, insufficient tax planning, etc.

Harness Wealth

FEBRUARY 5, 2025

The rise of remote work and digital nomadism has made FEIE a common tax minimization strategy for Americans living abroad. What is the Foreign Tax Credit (FTC)? Financial and lifestyle considerations of living abroad The importance of professional tax advice for expats FAQs about the FEIE What is the Foreign Earned Income Exclusion?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content