How Kwanti is Simplifying Portfolio Analytics

Wealth Management

MARCH 4, 2024

The T3/Inside Information Survey helps drive Kwanti's roadmap.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 4, 2024

The T3/Inside Information Survey helps drive Kwanti's roadmap.

Nerd's Eye View

DECEMBER 18, 2024

For investment management services, documenting the entire client engagement – such as onboarding, reviewing and recommending portfolio adjustments in line with collected suitability information, opening and funding accounts, conducting periodic reviews, and rebalancing – can help clearly evidence the services provided.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Wealth Management

MARCH 11, 2025

During this very informative and fun conversation., Mount Lucas Management's COO, Senior Portfolio Manager & Managing Partner, Jerry Prior drops a ton of insight about investing in managed futures.

Nerd's Eye View

OCTOBER 20, 2022

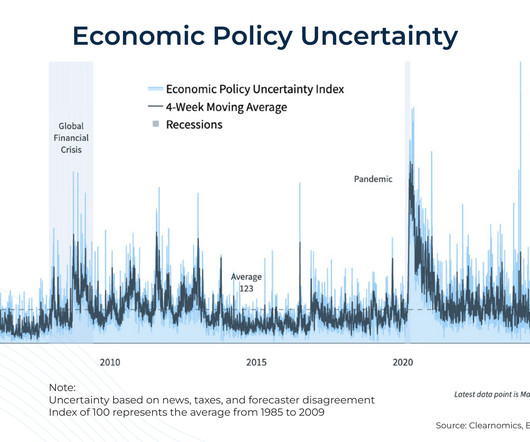

In recent years, politically charged topics have become the forefront of news and media, and with the rise of access to digitally distributed media, it has become commonplace for clients to have concerns about the possible impact of political events on their portfolios.

The Big Picture

JANUARY 2, 2025

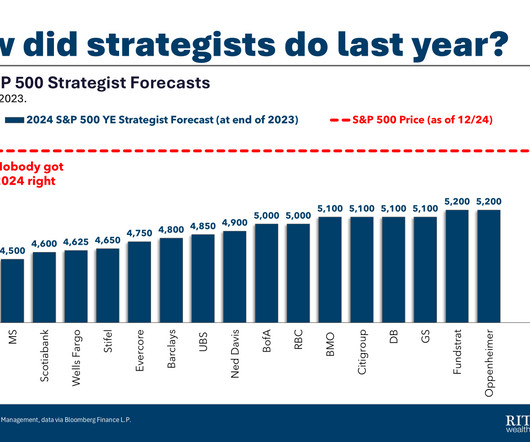

Not only do many investors pay attention to this guesswork, but some change their portfolios in response to them. I promise you will find it both entertaining and informative. This has proven to be an unproductive strategy. ” If you want to read more of the fun details, well, than order the book.

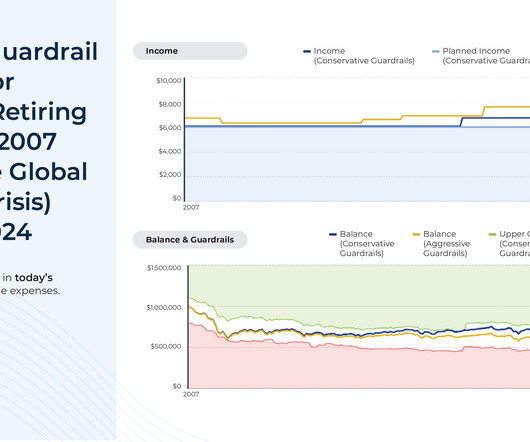

Random Roger's Retirement Planning

MARCH 15, 2025

You're 81 and been taking income from your portfolio for 15 years, what matters to you more, that you can continue to take what you need from your portfolio or that four year run in your mid-50's when you beat (or lagged) the market? If you're 81 and can no longer meet your income need from your portfolio, that is what matters.

Nerd's Eye View

NOVEMBER 25, 2024

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Wealth Management

JUNE 28, 2024

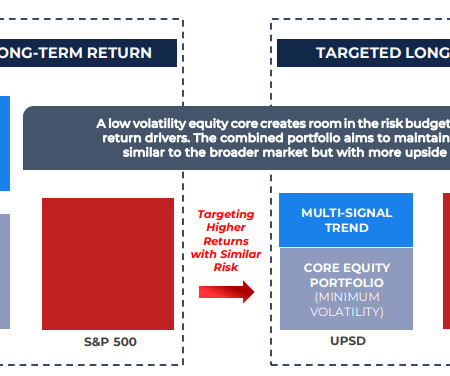

Jon Adams, CIO of Calamos Wealth Management, a $3.75B RIA, speaks on how the firm's roots in asset management inform its approach to investment selection.

Random Roger's Retirement Planning

MARCH 12, 2025

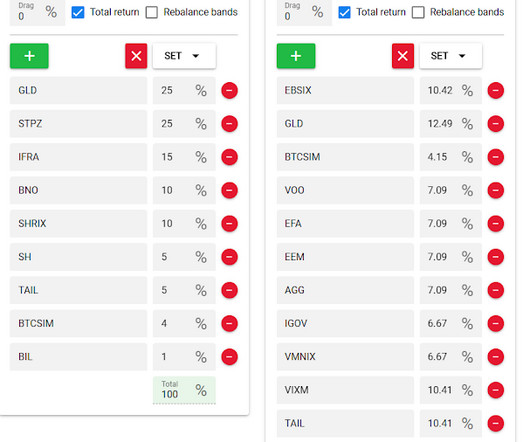

Let's dig in some more on Permanent Portfolio quadrant style. Next is the allocation for the United States Sovereign Wealth Fund ETF that I made up a few days ago and next to that is my most recent attempt from November to recreate the Cockroach Portfolio which is managed by Mutiny Funds. That is a very specialized type of result.

The Big Picture

MARCH 18, 2025

It is about the art of using imperfect information to make probabilistic assessments about an inherently unknowable future. Emotional Decision-Making : We make spontaneous decisions for reasons unrelated to our portfolios. Cognitive Deficits : You’re human unfortunately, that hurts your portfolio. We behave emotionally.

The Big Picture

DECEMBER 30, 2024

He co-authored Investment Analysis and Portfolio Management , now in its fifth edition. Zeikel famously shared his investing insights in a 1994 letter to his daughter: “Personal portfolio management is not a competitive sport. Most investors underestimate the stress of a high-risk portfolio on the way down. Make decisions.

The Big Picture

NOVEMBER 27, 2024

Investors should consider this when they create a portfolio. Never confuse opinion marketing with actual, useful information. ~~~ Give thanks this weekend! We rarely understand fully how each new event will impact all of the others that came before it and how the next events in time will affect what preceded it. Count your blessings.

Nerd's Eye View

JANUARY 6, 2025

FINNY AI, an AI-powered prospecting tool, has raised $4.2

A Wealth of Common Sense

MARCH 3, 2025

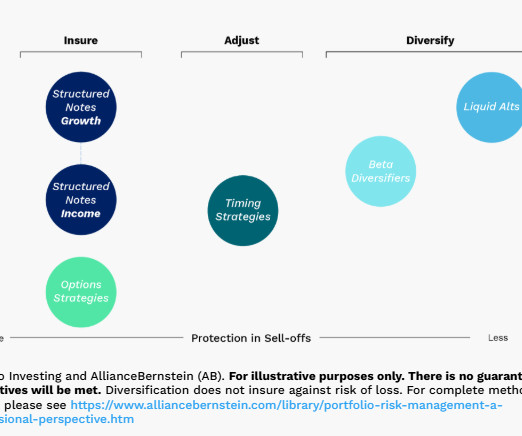

Today’s Talk Your Book is brought to you by Halo Investing: See here for more information on Halo’s structured product suite On today’s show, we discuss: The difference between buffered ETFs and structured notes Understanding structured note investing Halo’s structured note SMAs Using structured notes as an insurance policy (..)

Random Roger's Retirement Planning

FEBRUARY 11, 2025

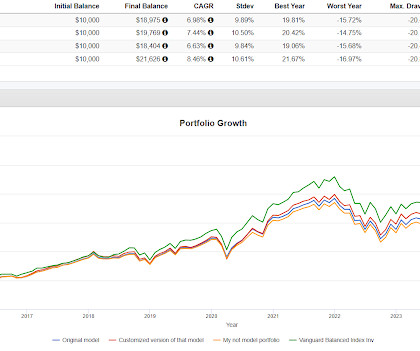

Morningstar did a quick writeup on model portfolios. The article wasn't too insightful but there was an example of a model portfolio and then an example of how to customize that same model. All I tried to do was simplify the portfolio, not do anything to improve it. Should a model portfolio have any sort of differentiation?

Abnormal Returns

JANUARY 23, 2025

(awealthofcommonsense.com) Why your portfolio may need rebalancing. techcrunch.com) Even institutional investors can't get information on their private equity investments. morningstar.com) Just because you can launch a meme coin doesn't mean you should. howardlindzon.com) Finance MicroStrategy ($MSTR) is the convertible bond king.

A Wealth of Common Sense

MARCH 10, 2025

Today’s Talk Your Book is brought to you by Aptus Capital Advisors: See here for more information on the full suite of active ETFs and services provided by Aptus On today’s show, we discuss: Who Aptus is The profile of the typical advisor Aptus works with Why option strategies are getting popular How to replace traditional allocation with (..)

Trade Brains

NOVEMBER 6, 2024

These companies manage profitable real estate portfolios across various sectors. Portfolio Diversification: Through REITs, investors gain exposure to various property types. Moreover, tracking market trends affecting commercial real estate helps investors make informed decisions and adjust their strategies accordingly.

Nerd's Eye View

MAY 17, 2024

Altogether, the study suggests that social media engagement is driven more by the quality (and originality) of the advisor's content, rather than the quantity of posts.

Abnormal Returns

FEBRUARY 28, 2024

(blockworks.co) Strategy Rubin Miller, "Investing on hopes and hunches — making emotional decisions — is why so few portfolios earn the actual market return." behaviouralinvestment.com) Why the 60/40 portfolio isn't going anywhere. abnormalreturns.com) Research links: information and noise.

Random Roger's Retirement Planning

OCTOBER 19, 2024

Barron's had an article about rebalancing portfolios noting that the run in stocks was a good time to rebalance the equity allocation back down closer to target, whatever that might be and also rebalance down some of the relative winners. Over the years, I've trimmed here and there when holdings get too big relative to the portfolio.

Trade Brains

SEPTEMBER 17, 2023

Cr Written by Sandeep R By utilizing the stock screener , stock heatmap , portfolio backtesting , and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks also get updated with stock market news , and make well-informed investment decisions.

Nerd's Eye View

OCTOBER 5, 2022

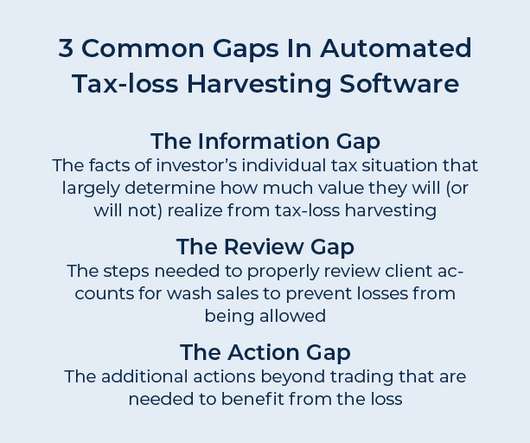

The 1%+ added value of automated tax-loss harvesting may be achievable in some ‘ideal’ cases, such as an investor who frequently contributes to their portfolio, has short-term losses to offset, and/or has many individual security holdings.

The Big Picture

DECEMBER 11, 2024

And on today’s edition of at the money, we’re going to discuss how Wall Street has been using personal health to gain a competitive advantage to help us understand all of this and its implications for your portfolio. How does that show up in our portfolios? Not only does that show up in our portfolios.

Nerd's Eye View

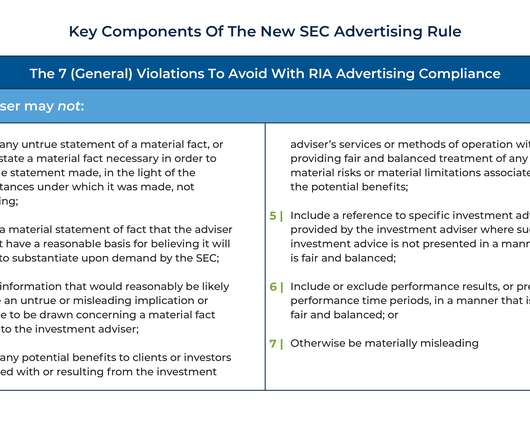

DECEMBER 7, 2022

The Marketing Rule also requires performance results to be presented consistently over 1-, 5-, and 10-year time periods (or the time period the portfolio has existed, if shorter than a particular prescribed period) preventing advisers from cherry-picking time periods that would make their returns appear more favorable.

Nerd's Eye View

DECEMBER 21, 2022

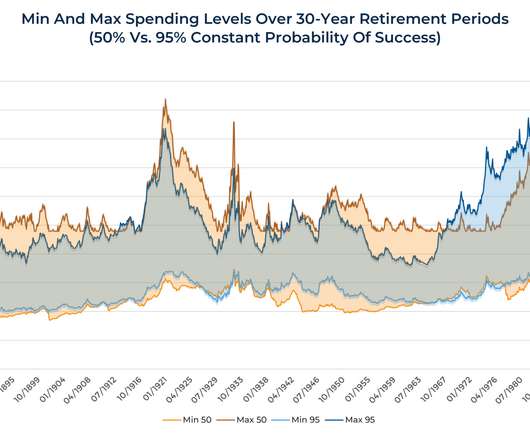

By distilling hundreds of pieces of information into a single number that purports to show the percentage chance that a portfolio will not be depleted over the course of a client’s life, advisors often use this data point as the centerpiece when they present a financial plan.

The Big Picture

FEBRUARY 18, 2023

Previously, he was chief investment officer and chief information officer, overseeing the company’s internally managed stock, bond, and money market portfolios as well as its investment research and methodology. Buckley has been with Vanguard for 32 years and has been CEO for the past 5.

The Big Picture

MAY 5, 2023

The problem is not how good or bad their track records are (they tend toward mediocre); rather it is our failure to use these tools properly, consistent with an inherently unknowable future always subject to new data and information that changes those probabilities. The odds change constantly as new information gets incorporated.

Abnormal Returns

JANUARY 4, 2023

Retirement Why you need a diversified life portfolio in retirement. abnormalreturns.com) This startup site is designed to provide people with information about divorce. abnormalreturns.com) This startup site is designed to provide people with information about divorce. wsj.com) Why you want to have options in retirement.

Abnormal Returns

AUGUST 8, 2023

capitalspectator.com) How ChatGPT can suss out information in company filings. morningstar.com) Behavior Another indication that political polarization is showing up in investor portfolios. Quant stuff James Picerno, "In short, there are no silver bullets for building a solid backtest."

The Big Picture

OCTOBER 2, 2023

“ To make better, more informed decisions about the future, we advise people to have “strong opinions, which are weakly held. ” -Bob Johansen at the Palo Alto Institute for the Future Investing is a probability exercise where we have to make decisions using imperfect information about an unknowable future.

Nerd's Eye View

MARCH 20, 2024

By distilling hundreds of pieces of information into a single number that purports to show the percentage chance that a portfolio will not be depleted over the course of a client's life, advisors often place special emphasis on this data point when they present a financial plan.

Abnormal Returns

FEBRUARY 27, 2023

Podcasts Christine Benz and Jeff Ptak talk with Derek Tharp about retirement-spending strategies, sequence risk, and portfolio construction. kitces.com) Clients, and potential clients, are awash in bad financial information on social media. morningstar.com) Daniel Crosby talks with Rachel J.

Nerd's Eye View

JUNE 12, 2024

Or if an advisor knowingly misled a client in giving information that led them to make an investment decision, they could be penalized for giving fraudulent advice under state or Federal law.

Nerd's Eye View

MARCH 26, 2025

Rather, it's about constructing a portfolio that aligns with a client's long-term goals. In that same vein, diversification remains the core of a healthy portfolio to protect against market corrections and underperformance, as no single asset class outperforms indefinitely.

The Big Picture

JULY 24, 2024

At The Money: Behavior Beats Intelligence (July 24, 2024) We focus most of our investing efforts on information and knowledge. We’re going to discuss how to make sure your behavior is not getting in the way of your portfolio. You need more information. And because there’s not a lot of information.

Nerd's Eye View

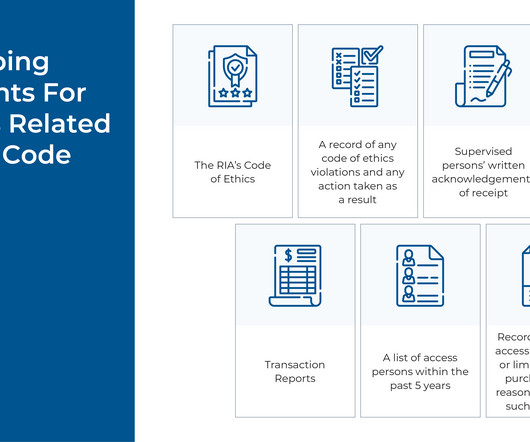

JUNE 21, 2023

As a starting point, investment advisers must address 3 important questions when designing and implementing a compliant code of ethics: who within the firm is subject to reporting their personal securities transactions; what information needs to be reported; and when this information must be reported.

Random Roger's Retirement Planning

MARCH 5, 2025

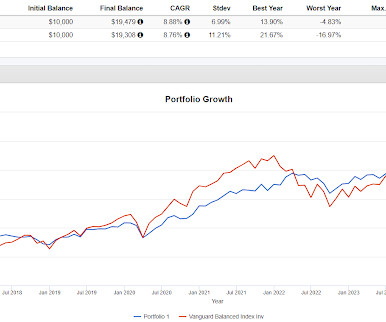

It is not intended to be a surrogate for a 60/40 portfolio, although it was close in 2024, and it clearly will not and is not intended to look like the US equity market. The correlation of the portfolio to the S&P 500 isn't that low at 0.64 Maybe it could be thought of as having some all-weather attributes.

Nerd's Eye View

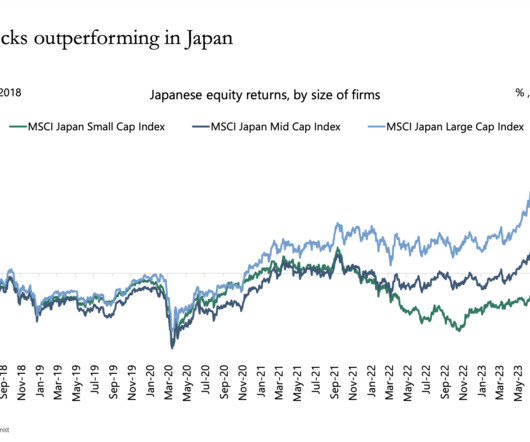

JULY 5, 2023

But because no one can be sure of when and where these recoveries will happen, investors who are willing to spread the risk of slightly lower returns from globally diversified portfolios stand to yield the rewards of having an edge in the natural cycle of global markets in the aggregate. and global investments.

Abnormal Returns

MAY 7, 2024

papers.ssrn.com) How to rebalance a portfolio with turnover constraints. blogs.cfainstitute.org) Are analysts long-term growth forecasts informative for loss-making firms? (papers.ssrn.com) Research Factors are not immutable. mrzepczynski.blogspot.com) Is the price of gold still tethered to inflation?

Carson Wealth

JANUARY 8, 2025

One study found that an advisor-managed portfolio could produce an additional 3% value add annually over a self-managed (DIY) portfolio. This personalized approach can help you make financial decisions that are well-informed and strategically sound. Lets explore a few of these. The post Why Should I Hire a Financial Advisor?

Nerd's Eye View

MARCH 8, 2024

Also in industry news this week: A recent survey has found that a majority of prospective financial planning clients across all age brackets are open to working with a remote advisor, creating opportunities for advisors to grow their businesses and for clients to find the ‘best’ advisor for their needs, regardless of their location A federal (..)

Tobias Financial

MARCH 16, 2025

As you work toward your financial goals, regularly reviewing your investment portfolio is essential. Whether youre new to investing or have years of experience, taking a step back to evaluate your strategy can help ensure that your portfolio remains aligned with your objectives, especially in times of market uncertainty and volatility.

Zoe Financial

JANUARY 28, 2025

A diversified portfolio of investments held for several years has historically proven to provide greater returns than those who try to jump in and out of the market at what they believe are the lows and highs. Disclosure: This material provided by Zoe Financial is for informational purposes only. Ready to Grow Your Wealth?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content