Billionaire Sues IRS for Disclosing Confidential Tax Return Information

Wealth Management

DECEMBER 19, 2022

Kenneth Griffin claims the agency violated his right to privacy.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 19, 2022

Kenneth Griffin claims the agency violated his right to privacy.

The Chicago Financial Planner

FEBRUARY 8, 2023

You’ve paid Social Security taxes over the course of your working life and you’ve earned these benefits. Many retirees and others collecting Social Security wonder about the tax treatment of their benefit. The answer to the question in the title is that your Social Security benefits may be subject to taxes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

NOVEMBER 4, 2024

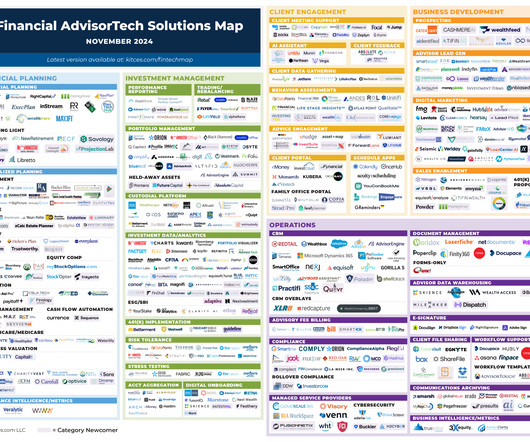

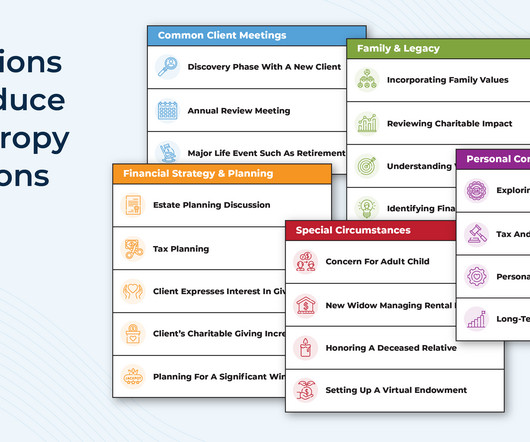

This month's edition kicks off with the news that Holistiplan has announced the rollout of a new estate plan document extraction tool to stand alongside its highly popular tax return scanning tool – which highlights how advances in AI technology have allowed tools like Holistiplan to go beyond tax returns and scan nearly any kind of document (..)

MainStreet Financial Planning

NOVEMBER 25, 2024

The maximum amount of earnings subject to Social Security tax (taxable maximum) will increase to $176,100 from $168,600. The individual tax brackets for ordinary income have been adjusted by inflation. On average, tax parameters that are adjusted for inflation will increase about 2.80%.

Nerd's Eye View

OCTOBER 9, 2024

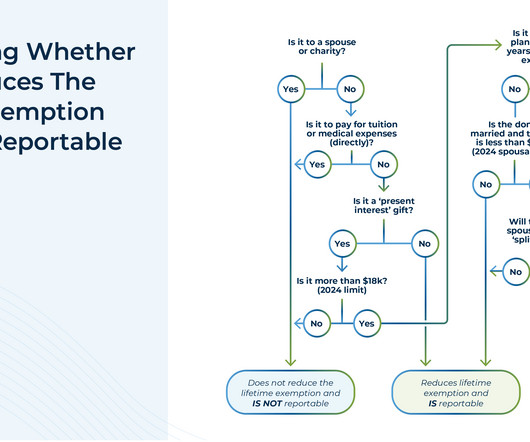

The rules around gifting are nuanced and can create confusion for clients, but advisors with a clear understanding of gifting strategies can guide them toward informed decisions. Furthermore, every individual also has a lifetime gift and estate tax exemption ($13.61M per recipient in 2024). Read More.

Nerd's Eye View

OCTOBER 5, 2022

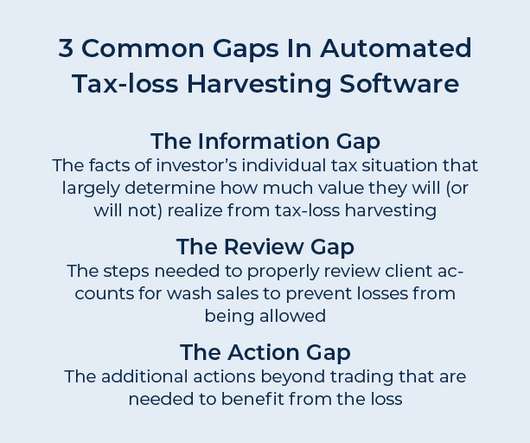

In recent years, numerous software solutions have sprung up that aim to automate the process of tax-loss harvesting. But what the providers of automated tax-loss harvesting often don’t mention is that the actual value of tax-loss harvesting depends highly on an individual’s own tax circumstances.

Nerd's Eye View

NOVEMBER 30, 2022

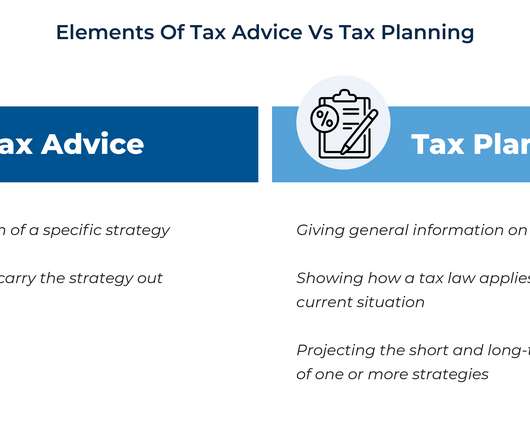

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Nerd's Eye View

NOVEMBER 27, 2024

Some give through established channels, such as by donating to charities or volunteer work, others may give informally to family members on a regular but less structured basis – and some simply aspire to "do more". Charitable giving is an essential aspect of many people's financial lives.

Nerd's Eye View

NOVEMBER 25, 2024

These clients, typically in or near retirement, face key challenges like reducing taxes, managing investment risk, and maximizing income. This timeline not only allows for the prospect to provide their information and Taylor's team to complete the analysis, but also gauges the prospect's commitment to a long-term relationship.

Nerd's Eye View

MAY 8, 2023

Traditionally, financial advice and tax preparation have existed as 2 related, but separate, services. CPA, EA, or JD) to prepare tax returns and represent clients before the IRS, there has also been the impression that there is simply not enough time for one person to do both.

Nerd's Eye View

OCTOBER 26, 2022

Roth conversions are, in essence, a way to pay income taxes on pre-tax retirement funds in exchange for future tax-free growth and withdrawals. Conversely, if the opposite is true and the converted funds would be taxed at a lower rate upon withdrawal in the future, then it makes more sense not to convert.

Nerd's Eye View

SEPTEMBER 7, 2022

Tax-loss harvesting – i.e., selling investments at a loss to capture a tax deduction while re-investing the proceeds to maintain market exposure – is a popular strategy for financial advisors to increase their clients’ after-tax investment returns. With these three tools (i.e.,

XY Planning Network

MARCH 3, 2025

Tax season is here, and it's crucial to be aware of the latest updates for 2024 to ensure you're compliant and maximize your returns. Tax law is an everchanging beast, with new rules and regulations being introduced every year. Professions are built around them, and the consequences of misreporting them can be hefty taxes from the IRS.

Harness Wealth

MARCH 14, 2025

This edition of the Tax Advisor Weekly covers key updates for financial professionals. We start with a piece about the Treasury Department announcing it will not enforce beneficial ownership information (BOI) penalties on U.S. To round things out, we provide a refresher on the most common tax return mistakes to watch for this season.

Harness Wealth

MARCH 21, 2025

This weeks Tax Advisor Weekly covers key updates for financial professionals. We also highlight a report on unruly crowds at IRS tax assistance events last year. OBannon , CPA Practice Advisor) Nothing is certain but death and taxes. Did you miss last weeks edition? You can find it here. You can find it here.

Harness Wealth

MARCH 6, 2025

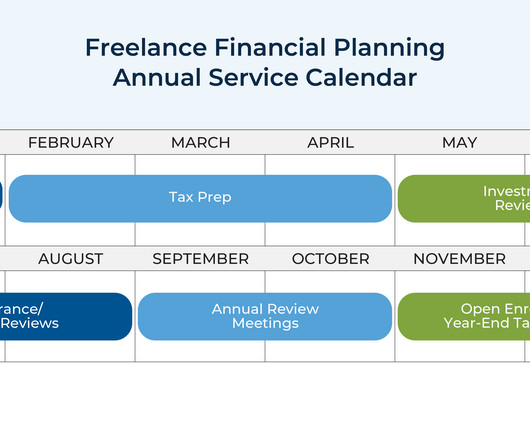

Freelancers and contractors may enjoy greater flexibility and independence than full-time employees, however, this autonomy brings increased tax responsibility. Unlike W-2 employees, freelancers and independent contractors are responsible for managing their own tax obligations, which can be a complex process.

Harness Wealth

MARCH 7, 2025

This weeks Tax Advisor news roundup covers key updates for financial professionals. Last but not least, we have a rundown of the IRSs ‘Dirty Dozen’ tax scams for 2025. Wealth Taxes in Europe, 2025 ( Cristina Enache , Tax Foundation) Net wealth taxes are recurrent taxes on an individuals wealth, net of debt.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Harness Wealth

MARCH 6, 2025

As is traditional, the 2025 IRS tax filing deadline is April 15th. In this guide, well explore the 2025 tax extension process, the reasons for requesting an extension, and how a tax advisor from Harness can help you. Table of Contents What is a tax extension? Why do I need a tax extension? This is not the case.

Harness Wealth

JANUARY 10, 2025

Tax advice is a common topic on social media platforms like TikTok. Influencers promise easy ways to secure tax deductions, simplifying complex ideas into bite-sized claims that gloss over important details in the process. Can Hiring Your Children Help You Save on Taxes? Can You Claim Your Pet as a Tax Write-Off?

Your Richest Life

MARCH 12, 2025

The tax deadline is next month, and if youre like most Americans, you are still preparing to file. Standard and Itemized Deduction for filing 2024 Taxes For the 2024 tax year, the standard deduction increased to $29,200 for married filing jointly, $14,600 for single filers and married filing separately, and $21,900 for heads of household.

MainStreet Financial Planning

MARCH 7, 2025

Tax season can feel overwhelming, whether you’re filing for the first time or you’ve been doing it for years. Should you tackle your taxes on your own, or is it time to bring in a professional? Lets explore the pros and cons of DIY tax preparation and when seeking expert help might be the right move.

Harness Wealth

MARCH 14, 2025

For many small tax firms, the process of collecting client tax documents can be a time-consuming and a prolonged process. The good news is that technology solutions, like Harness, can streamline document collection and transform the way tax professionals work. Client experience is another area where manual processes fall short.

Nerd's Eye View

JANUARY 24, 2025

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

Nerd's Eye View

JANUARY 6, 2025

This month's edition kicks off with the news that Orion, the "all-in-one" advisor technology platform, has acquired Summit Wealth Systems (and its founder Reed Colley, who previously built performance reporting platform Black Diamond), a client portal and data hub for unifying key client information from multiple sources into a single client-friendly (..)

Harness Wealth

JANUARY 29, 2025

Tax-loss harvesting is a powerful strategy that investors can use to reduce their taxable income. As effective as tax-loss harvesting can be, there are a number of important details that investors need to be aware of in order to implement the strategy successfully while following regulations. How does tax-loss harvesting work?

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Abnormal Returns

DECEMBER 9, 2024

kitces.com) Taxes Nvidia ($NVDA) CEO Jensen Wang and his wife have good estate attorneys. nytimes.com) Why some wealthy Americans deliberately fail to file their taxes. investmentnews.com) Retirement savers need information. (barrons.com) Advisortech DPL Financial just raised another round of capital.

Carson Wealth

FEBRUARY 6, 2025

Every year brings changes in tax rules, and 2025 is no exception. Staying informed about these tax updates isn’t just about being prepared for tax seasonit’s about making smart money moves all year long. For married couples, this means more of your income will be taxed at lower rates.

Abnormal Returns

OCTOBER 13, 2024

downtownjoshbrown.com) Who died and paid the IRS a $7 billion estate tax bill? sherwood.news) Two questions you should ask about any piece of market information. (blogs.cfainstitute.org) There is a whole class of pundits out there trying to knock you off your game.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Harness Wealth

JANUARY 29, 2025

April 15 marks the IRS tax return filing deadline for 2025. Although this is the traditional tax filing deadline, given the spate of recent natural disasters (such as the California wildfires and Hurricane Milton), the IRS is granting certain filing and payment extensions beyond this date.

The Big Picture

MARCH 18, 2025

It is about the art of using imperfect information to make probabilistic assessments about an inherently unknowable future. Be tax-aware. How can we re-engineer our media consumption to make it more useful to our needs? Sophistry : The Study of Bad Ideas: Investing is really the study of human decision-making.

The Big Picture

APRIL 11, 2024

And even still, fund fees and taxes remained a major cost element. In 1978, Congress enacted Internal Revenue Code Section 401(k), which allowed tax-deferred savings through a company-administered plan. Lower trading costs, a rampaging bull market, and tax-deferred investing led to millions of new entrants into markets.

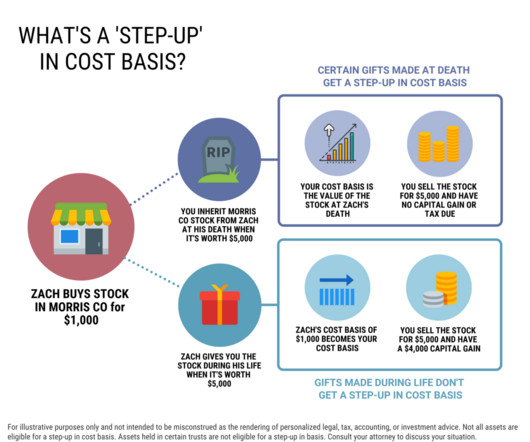

Darrow Wealth Management

JANUARY 16, 2025

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Abnormal Returns

DECEMBER 19, 2023

canvas.osam.com) Family firms do a better job of keeping information secret. indexologyblog.com) Inflation makes tax efficiency all the more important. (on.ft.com) Corporate finance Stock-based compensation makes a big difference for company valuations. tdmgrowthpartners.com) Profit margins are high, debt refinancings are coming.

MainStreet Financial Planning

JANUARY 17, 2025

We have also gathered some resources that may provide information and guidance to help you or your family during this time of crisis. For more information visit the CDPH website for a list of county recorders. See the State of Emergency Tax Relief page for more information and a list of all tax programs covered by this relief.

Abnormal Returns

MAY 31, 2023

open.spotify.com) Taxes What Is a 83(b) election? thomaskopelman.com) Who is eligible for the retirement savings tax credit? substack.com) Why everybody needs a 'Mary Jean' list of important financial information. podcasts.apple.com) Morgan Housel on the 'art of spending money.' moneytalks101.substack.com)

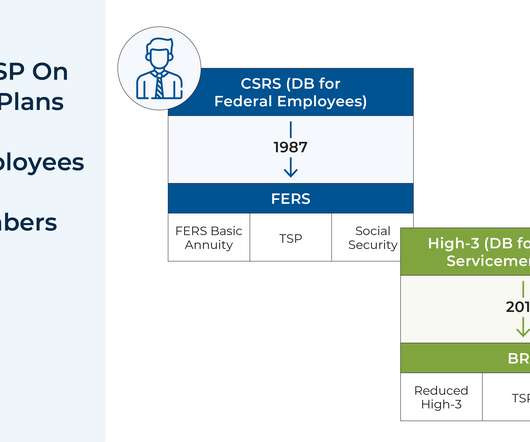

Nerd's Eye View

FEBRUARY 8, 2023

In addition, the TSP updated its website and introduced a smartphone app, which required participants to create new credentials and verify their personal information. Advisors working with clients who have been deployed to combat zones can also add value by being aware of the related TSP considerations.

MainStreet Financial Planning

JANUARY 23, 2025

Verify that the information is accurate and that all your credit cards, store accounts, and loans are properly listed. For 2024, the maximum taxable earnings subject to Social Security tax is $168,600. This will help catch any errors or fraudulent activity. If you notice discrepancies, file a dispute with the relevant credit bureau.

Zoe Financial

JANUARY 28, 2025

Disclosure: This material provided by Zoe Financial is for informational purposes only. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Economies and markets fluctuate.

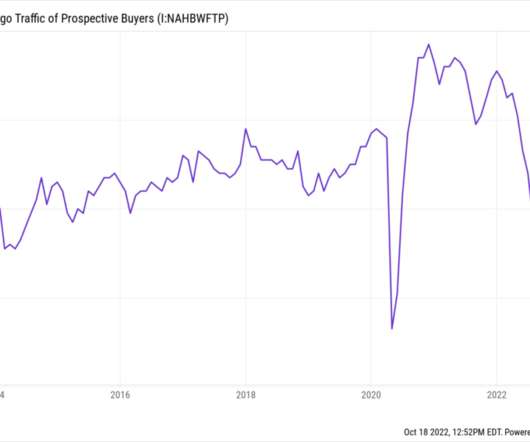

The Big Picture

OCTOBER 18, 2022

The team & I put together the most revealing and informative slides. We have discussed in the past why the actual purchase price of a home matters less than the monthly carrying costs: The sale price is somewhat abstract while homeowners must pay their monthly mortgage, utilities, HOA, and taxes. This is atypical.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Nerd's Eye View

SEPTEMBER 5, 2022

This month's edition kicks off with the news that VRGL (pronounced “Virgil”) has raised a $15M Series A round to scale up its tool that can scan investment account statements and automatically extract the available information about their holdings to analyze the prospect’s performance, risk, diversification, fees, and taxes, with (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content