FDIC Changes Insurance Coverage of Trust Bank Accounts

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

Wealth Management

SEPTEMBER 7, 2023

Also, GMO’s Nebo passes $1B in platform assets a year after launching, Finology Software’s website is now live and Focus Financial Partners is UPTIQ’s newest client.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

MARCH 15, 2023

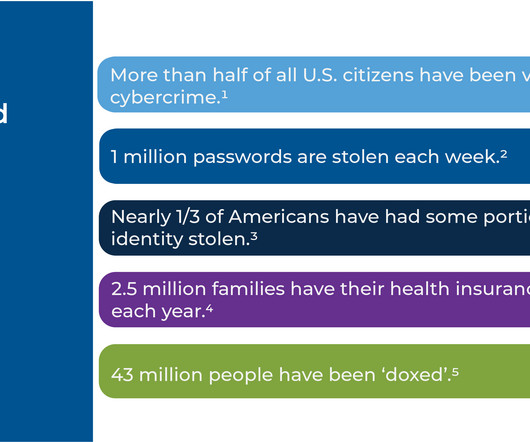

Risk management is a key part of many financial advisors’ value propositions. For instance, ensuring clients maintain the proper insurance coverage based on their needs is an important part of the financial planning process. At the same time, clients face another class of risks that advisors often do not consider: cyber.

Wealth Management

AUGUST 17, 2023

Digital fraud is a growing threat to advisors, who are on their own when it comes to buying insurance coverage for the risk.

Nerd's Eye View

JANUARY 22, 2024

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

Nerd's Eye View

MARCH 29, 2024

Also in industry news this week: With the new “T+1” rules for trade settlements will go into effect in late May, the SEC has issued a risk alert for broker-dealers and RIAs outlining the requirements they face and areas of focus for the regulator during upcoming examinations A recent survey suggests that while client satisfaction with their (..)

Ballast Advisors

JUNE 18, 2024

Join us as we delve into the tax strategy, legal documentation, and insurance coverage considerations needed to successfully balance the ownership of multiple residences for snowbirds. Review your coverage limits and consider factors such as driving habits and annual mileage.

Carson Wealth

JULY 3, 2024

Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Get Help with Tax Planning Tax planning is a critical component of financial management.

Ballast Advisors

JUNE 18, 2024

Join us as we delve into the tax strategy, legal documentation, and insurance coverage considerations needed to successfully balance the ownership of multiple residences for snowbirds. Review your coverage limits and consider factors such as driving habits and annual mileage.

Nerd's Eye View

OCTOBER 31, 2022

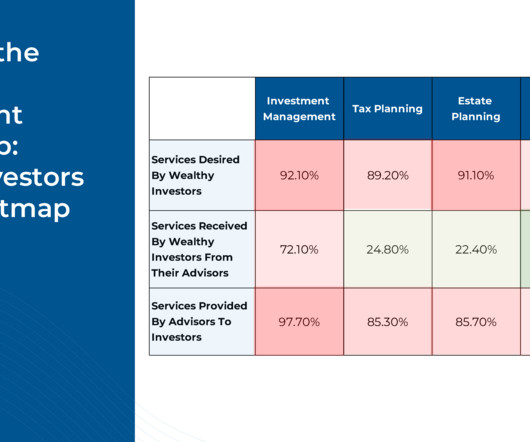

While many financial advisors may have focused primarily on portfolio management at one time, the evolution of the financial planning profession has opened up an ever-growing number of services that advisors now offer to their clients on a regular basis.

AdvicePay

JUNE 13, 2024

With the fee-for-service model, you can customize service offerings for clients seeking advice who don’t (yet) have traditional portfolio assets to transfer to your firm’s custodian for full-time management. This approach allows you to engage these clients by charging a fee that’s covered through their monthly cash flow.

Darrow Wealth Management

SEPTEMBER 25, 2023

And when something goes wrong, many homeowners are surprised to learn of gaps in their insurance coverage or their contractor’s. Limiting your liability with an umbrella insurance policy If you don’t already have an umbrella policy, you should seriously consider adding one. The post Starting a Home Renovation?

Clever Girl Finance

DECEMBER 23, 2024

Manage irregular income 6. Secure health insurance and other benefits 7. Q&A: Commonly asked questions about managing your money as a freelancer Related content to becoming a freelancer and managing your money Take charge of your freelance finances today! What tools can help me manage my finances?

MainStreet Financial Planning

MARCH 15, 2023

By entering information about their deposit accounts into the EDIE tool, users can generate a report that provides information on how their deposits are insured, what portion (if any) exceeds coverage limits, and what steps they can take to maximize their insurance coverage.

Trade Brains

NOVEMBER 4, 2024

It’s similar to having shining insurance coverage that never ends! are their own, and not that of the website or its management. Central banks hold gold bars in reserve to withstand economic downturns, much like we save money for unexpected expenses. Investing in equities poses a risk of financial losses.

Tobias Financial

MARCH 22, 2024

Is your life insurance coverage sufficient? Often it is not until a life-changing event that clients ensure their coverage is adequate. In fact, due to Covid concerns, life insurance policy sales grew 5% last year resulting in the largest annual increase in decades. To learn more, click here: [link]

Carson Wealth

SEPTEMBER 7, 2023

Some key points that consumers should know are: Premiums are generally lower compared to other types of life insurance. Coverage expires at the end of the term, and there is no cash value accumulation. This type of insurance policy is generally used to secure a high death benefit at a relatively low cost over a finite period of time.

Carson Wealth

APRIL 25, 2024

Once you have your goals set, you can build your plan with any combination of the following elements: Budgeting and expense management: Create a detailed budget outlining income, expenses, and savings targets. Debt management: Develop a strategy to pay off existing debts efficiently, minimizing interest costs.

Walkner Condon Financial Advisors

NOVEMBER 11, 2022

Those looking to manage their exposure to gift and inheritance tax also have until December 31 to make use of the annual gift exclusion amount. Insurance Amounts . Another overlooked area of a sound financial plan is insurance coverage and their respective coverage amounts. ABOUT THE AUTHOR. NATE CONDON.

Truemind Capital

SEPTEMBER 8, 2024

2 Adequate Life and Health Insurance Coverage Ensure you have sufficient health insurance—at least Rs 20 lakhs for a family of four in a metro city. A family floater plan with critical illness coverage is advisable. You can write to us at connect@truemindcapital.com or call us at 9999505324.

Clever Girl Finance

AUGUST 19, 2024

Review your maternity leave and insurance coverage 6. Update your life insurance policy 8. 15 Key tips to save money for a baby That said let’s dive into some practical tips to help you manage your money as you prepare for your little one. Adjust your budget to include baby expenses 2. Practice living on one income 4.

Nationwide Financial

OCTOBER 1, 2022

Small business owners wear many hats, and the topic of risk management presents an opportunity for you to add value. The last two-plus years have presented business owners with challenges they couldn’t have imagined, and many continue to face relentless disruption while managing through recovery and planning for growth.

eMoney Advisor

DECEMBER 6, 2022

Billion-dollar disasters, inflation, and increased building costs mean a perfect storm is brewing for financial planners’ risk management strategies. Insurance in Financial Planning. The CFP® Board includes risk management and insurance in its financial planning principal knowledge topics for a good reason.

Yardley Wealth Management

MAY 16, 2023

The post Spring Clean Your Finances appeared first on Yardley Wealth Management, LLC. They can also help you consolidate debt to make it more manageable. Checking your insurance coverage: A financial advisor can help you review your insurance coverage to ensure you have the right coverage for your needs.

Truemind Capital

APRIL 4, 2024

Outstanding debt should be manageable : The value of your investments should be equal to or more than the amount of outstanding debt to avoid bankruptcy in case of a sudden loss of income. In case the debt is more than the investments, a term insurance plan over the tenure of the debt is absolutely necessary.

International College of Financial Planning

MARCH 11, 2023

It can be tough to manage your finances, especially if you’re new to it. Here’s why it’s important and how to start Managing your money is essential for financial stability and security. Manage Debt: Create a plan to manage your debt levels, minimize interest costs, and improve your credit score.

eMoney Advisor

FEBRUARY 9, 2023

Financial Planning Needs: Retirement planning Education and family planning Obtaining appropriate insurance coverage Business and tax planning Significant asset purchases Strategies for Serving Clients in This Stage: Clients at this stage are experiencing life events — both large and small — that will impact their financial planning needs.

Good Financial Cents

JULY 7, 2023

This type of insurance is often viewed as the simpler and more affordable option , as it strictly provides coverage without any investment component. Life After Canceling Your Life Insurance: Managing Your Risks The aftermath of canceling your life insurance policy requires careful financial planning.

Carson Wealth

JANUARY 4, 2024

Which decade should you focus on managing debt? Now is when you should be more focused on managing debt and planning for – not just looking toward – the future. Debt management: In your 30s it’s important you manage debt obligations carefully. Which decade can you afford to take more risk? Don’t wait to find out!

Good Financial Cents

DECEMBER 9, 2022

They may not do much in terms of national advertising and brand management, but people throughout the country continue to hear about this century-old firm. What Doesn’t Home Insurance Cover? Typically, a named-peril policy costs less because it’s up to the insured to prove property damages resultant from a covered peril.

Good Financial Cents

DECEMBER 12, 2022

M1 Finance is a personal finance company that offers a variety of financial services, including investment management, portfolio analysis, and stock trading. They have grown quickly and now offer a variety of financial services, including investment management, portfolio analysis, and stock trading. Does M1 Finance Carry FDIC Coverage?

Workable Wealth

OCTOBER 14, 2020

One reason money can be so hard to manage is we don’t talk about it enough. Improper risk management and insurance coverage. This means having at least 3-6 months of living expenses earmarked in a highly-liquid account, maintaining proper insurance coverage, and building the right cash-flow management.

WiserAdvisor

MARCH 13, 2024

Achieving financial freedom in retirement requires meticulous planning, dedicated effort, and strategic management. It serves as a fundamental risk management strategy. Health insurance can be instrumental in tackling the escalating costs of healthcare. Without a solid plan, you risk drifting without direction.

Truemind Capital

FEBRUARY 2, 2021

Towards the end of the year when employees are scurrying to provide investment proofs, they are caught unaware in the nets of unscrupulous agents who could be a relative, a friend, or a bank relationship manager. Insurance is needed when you have dependents and do not have sufficient assets to take care of them in case of any mishap.

Clever Girl Finance

DECEMBER 1, 2022

The right type of insurance coverage (Life, health, disability, home, etc.). When you create a financial plan, be sure it includes a debt management system and how you'll pay off debt. Your insurance coverage should include health insurance , auto, disability, life, home or rental, and business.

WiserAdvisor

JULY 27, 2023

One camp firmly believes that AI can create retirement plans by providing enough detailed guidelines to enable one to manage their plans independently of a financial advisor. Manage Investment Risk: Reevaluate your investment portfolio to align with your retirement timeline and risk tolerance.

Clever Girl Finance

MARCH 28, 2024

Articles related to jobs and unemployment Final thoughts on living without a job Here are some key tips for managing your money when you are in-between jobs. Consider continuing health coverage Your previous employer likely provided your health insurance coverage. What to do if you are broke and unemployed?

Carson Wealth

JULY 19, 2022

These benefits can be critical in stakeholder management and building financial success. . Lastly, executive compensation plans may include split-dollar life insurance. Split-dollar life insurance is a way for an executive to receive life insurance coverage leveraging employer dollars and premium payments.

Clever Girl Finance

SEPTEMBER 2, 2022

When it comes to managing your finances, having patience is also essential. That’s why it’s important to prepare for the unexpected with an emergency fund and the proper insurance coverage. Having these boundaries allows you to further control your finances and manage them in a way that you’re comfortable with.

Clever Girl Finance

MARCH 19, 2024

It’s simply a long-term, organized approach to money management. your short, mid-term, and long-term goals) The right types of insurance coverage (Life, health, disability, home, etc.) Pay off debt When you make your money plan, be sure it includes a debt management system and a plan for paying off debt.

Clever Girl Finance

OCTOBER 13, 2022

There are tons of different types of insurance to help protect your financial situation, including: Health insurance. Property insurance. Life insurance. Disability income insurance. Pet insurance. Business insurance. You pay the first $50, and your insurance covers the remaining $100.

Gen Y Planning

JULY 1, 2023

Review Insurance Coverage One of the most effective ways to financially prepare for the unexpected is to incorporate the right insurance coverage into your financial plan. Create a Debt Management Plan The less debt on your plate, the fewer recurring financial obligations you have to tend to each month.

Yardley Wealth Management

JANUARY 18, 2022

The post Protecting What’s Yours (After You Pass) appeared first on Yardley Wealth Management, LLC. Identify who you’d like to name as legal representatives and/or administrators, to settle or manage your estate once you pass. (As What if your children aren’t yet ready to manage their inheritance? That’s what we’re here for!

Yardley Wealth Management

JANUARY 18, 2022

The post Protecting What’s Yours (After You Pass) appeared first on Yardley Wealth Management, LLC. Identify who you’d like to name as legal representatives and/or administrators, to settle or manage your estate once you pass. (As What if your children aren’t yet ready to manage their inheritance? How Can We Help?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content