The Inside ETFs Podcast: Nancy Davis on Portfolio Management For 2023

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

The Big Picture

FEBRUARY 14, 2025

This week, I speak with Christine Phillpotts , Portfolio Manager for Ariel Investment s emerging markets value strategies. Previously, she spent 10 years at AllianceBernstein as Portfolio Manager and Senior Research analyst in emerging markets. She also covers all sectors in Africa.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

The Big Picture

DECEMBER 30, 2024

He eventually became president of Merrill Lynch Asset Management, leading the division with a value-oriented approach and a focus on long-term fundamentals. He co-authored Investment Analysis and Portfolio Management , now in its fifth edition. Investment capital becomes a perishable commodity if not handled properly.

The Big Picture

NOVEMBER 15, 2024

He is the portfolio manager of the Return Stacked ETF Suite, manging 800 million in ETF assets. Corey is an active researcher and his work has been published in the Journal of Indexing and the Journal of Alternative Investments. He is also the host of the popular quantitative investing podcast Flirting with Models.

Wealth Management

NOVEMBER 12, 2024

At Nitrogen's 2024 Fearless Investing Summit, experts discuss how new technology is empowering advisors to deliver hyper-personalized portfolios through seamless integration and cost-saving strategies.

Wealth Management

DECEMBER 6, 2023

Celso Munoz, portfolio manager at Fidelity Investments, shares a comprehensive approach to enhancing risk-adjusted returns in the dynamic world of fixed income investments.

Nerd's Eye View

NOVEMBER 25, 2024

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Nerd's Eye View

MARCH 3, 2025

This month's edition kicks off with the news that Morningstar Office will be shutting down in early 2026 as a part of Morningstar's ongoing effort to refocus on its core investment data and analytics business – forcing advisors currently using the tool to switch (which might be a net positive for many of those advisors who have long complained (..)

Wealth Management

JANUARY 13, 2025

Listen in as Shannon Rosic, Director of WealthStack, Content & Solutions at Informa Connect, sits down with Andrew Choi, Portfolio Manager and Senior Analyst at Parnassus Investments, to explore the transformative role of artificial intelligence in investment strategies.

Wealth Management

DECEMBER 5, 2023

Insights from Nidhi Gupta, portfolio manager at Fidelity Investments, on identifying attractively valued stocks, leveraging global research, and navigating market environments for long-term portfolio growth.

Wealth Management

MARCH 11, 2025

Mount Lucas Management's COO, Senior Portfolio Manager & Managing Partner, Jerry Prior drops a ton of insight about investing in managed futures. During this very informative and fun conversation.,

The Big Picture

OCTOBER 22, 2022

This week, we speak with Marta Norton, Chief Investment Officer for Morningstar Investment Management (MIM ). The firm manages or advises on about $250 billion in advisor assets. Norton’s responsibilities include equity, alternative and fixed income research, asset allocation, and portfolio management.

Wealth Management

NOVEMBER 10, 2022

Boutique portfolio management firm in OK further expands the insurance giant’s wealth advisory arm.

Wealth Management

DECEMBER 4, 2023

Harley Lank, portfolio manager at Fidelity, discusses high yield, selective decision-making, and navigating credit market dislocations.

Abnormal Returns

DECEMBER 1, 2023

ritholtz.com) Andrew Stotz talks with Larry Swedroe why a great company does not always make a great investment. myworstinvestmentever.com) Justin Carboneau and Jack Forehand talk with Joel Tillinghast the long-tenured portfolio manager of the Fidelity Low-Priced Stock Fund.

Wealth Management

MAY 15, 2024

Often the most accessible investment choices deliver the best returns, according to portfolio managers.

The Big Picture

FEBRUARY 7, 2025

Be sure to check out our Masters in Business next week with Christine Phillpotts , Portfolio Manager at Ariel Investments. She manages Ariels Emerging Markets Value strategies. All of our earlier podcasts on your favorite pod hosts can be found here.

The Big Picture

FEBRUARY 23, 2024

This week, we speak with Andrew Slimmon , managing director at Morgan Stanley Investment Management , where he leads the Applied Equity Advisors team. He began his career at Morgan Stanley in 1991 as an adviser in private wealth management, and later served as chief investment officer of the Morgan Stanley Trust Co.

Nerd's Eye View

JANUARY 6, 2025

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: SEI has acquired LifeYield, which is designed to facilitate tax-efficient management of multiple accounts across an entire household, to bundle into its RIA custodial platform and investment management technology – underscoring (..)

Abnormal Returns

SEPTEMBER 26, 2023

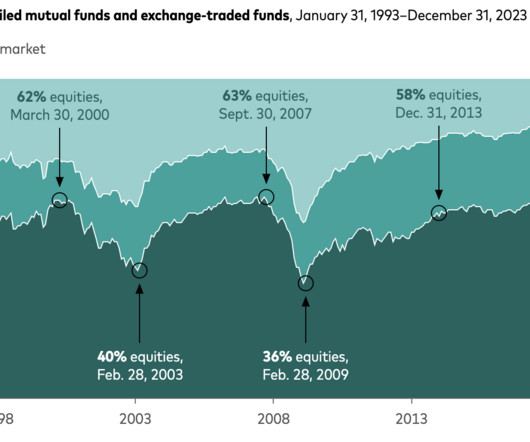

Portfolio management Fund investors prefer managers who stick to their knitting. papers.ssrn.com) Why portfolio managers invest more research into short positions. papers.ssrn.com) Research The structure of the stock market has changed a lot over time, but the results are still largely the same.

Wealth Management

NOVEMBER 30, 2022

Matthew Tuttle's ETF lineup was acquired by AXS Investments. He'll no longer serve as portfolio manager of SARK and more than two dozen other funds.

Abnormal Returns

OCTOBER 10, 2023

AI AI investment models can't explain how they do what they do. msn.com) How JP Morgan Asset Management is rolling out AI tools for its analysts and PMs. libertystreeteconomics.newyorkfed.org) Portfolio managers Why portfolio managers get fired. wsj.com) Global investing Do more honest countries outperform?

Pragmatic Capitalism

SEPTEMBER 19, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ]

The Big Picture

JANUARY 10, 2025

This week, we speak with Brian Hurst , the Founder and Chief Investment Officer of ClearAlpha. Prior to founding ClearAlpha, Brian spent 21 years at AQR Capital Management as a portfolio manager, researcher, head of trading, and the firm’s first non-founding Partner.

Wealth Management

DECEMBER 5, 2023

Therese Icuss, managing director, portfolio management and underwriting, Fidelity Investments, unlocks the vast potential of the U.S. and China middle market, Fidelity's unique approach to bespoke portfolios, and prioritizing client success in the fidelity private credit fund.

Wealth Management

JANUARY 15, 2024

Listen in as Ian Sexsmith, CFA, Portfolio Manager and Senior Research Analyst, Parnassus Investments, and David Armstrong, Director of Editorial Strategy & Operations, WealthManagement.com, discuss the untapped potential in mid cap tech stocks and the unique opportunities and risks they pose.

Abnormal Returns

DECEMBER 5, 2023

Active management Active investing has a tax problem. alphaarchitect.com) Why the active management space may be bigger than currently measured. papers.ssrn.com) Replication Managed futures strategies are ripe for replication. bloomberg.com) Research Passive investing is making markets less efficient, but.

Abnormal Returns

APRIL 16, 2024

(papers.ssrn.com) Research Is sector-neutrality a mistake in factor investing? blogs.cfainstitute.org) Some evidence that it is possible to measure portfolio manager decision making. alphaarchitect.com) How S&P 500 additions (and deletions) have performed, post-rebalancing.

Wealth Management

MARCH 12, 2023

Watch as Shivani Vohra, Portfolio Manager and Senior Research Analyst, Parnassus Investments, discusses the outlook for growth stocks in 2023 and whether now is a good time to buy.

Abnormal Returns

NOVEMBER 15, 2024

capitalallocators.com) Shane Parrish talks with Adam Karr, President and Portfolio Manager at Orbis Investments. (advisoranalyst.com) Ted Seides talks with Scott Bessent who is the CEO and CIO of Key Square Group. fs.blog) Dan Lefkovitz and Christine Benz talk muni bonds with Jim Murphy and Charlie Hill of T. Rowe Price.

The Reformed Broker

NOVEMBER 25, 2022

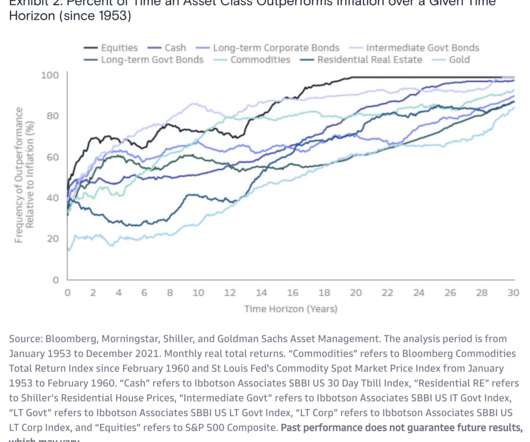

Especially if we’re referring to the past performance of a particular investment strategy, portfolio manager, mutual fund or individual stock. Past performance is not a guarantee of future results. Of course it isn’t. Things change. But past performance of asset classes should be well understood.

Abnormal Returns

SEPTEMBER 3, 2023

theverge.com) The story of a portfolio manager holding onto Credit Suisse stock too long. mr-stingy.com) 15 lessons learned from the quantitative investment research business. The cracks are showing. morningstar.com) Is illiquidity a feature or a bug? savantwealth.com) Don't underestimate how weird the world can be. (mr-stingy.com)

Abnormal Returns

OCTOBER 11, 2024

(morningstar.com) Jack Forehand and Matt Zeigler talk with Michael Mauboussin about nine key, timeless investing lessons. youtube.com) Michael Batnick and Ben Carlson talk with Ted Seides author of "Private Equity Deals: Lessons in investing, dealmaking, and operations from private equity professionals."

Random Roger's Retirement Planning

JUNE 14, 2024

It doesn't get said often enough but really, the most important part of portfolio management is mitigating risk. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

Abnormal Returns

DECEMBER 12, 2023

(riabiz.com) Fund management Diseconomies of scale in fund management are real. alphaarchitect.com) Why portfolio managers shift styles. elmwealth.com) The case against the lifecycle model of investing. papers.ssrn.com) There seems to be a return premium to investing in polluting companies.

Nerd's Eye View

AUGUST 8, 2023

What's unique about Lori, though, is how through her multi-decade career, she has built a deep expertise in the investment intricacies and complex issues faced by small-to-mid-sized institutions and ultra-high-net-worth-families with $10s of millions of dollars each, and has built an RIA that focuses on that serious investing expertise as a differentiator. (..)

The Big Picture

APRIL 8, 2023

His next book, “The Corporate Lifecycle: Business, Investment, and Management Implications,” will be published in December. The average portfolio manager is driven by emotion and mood and while they talk the value investing talk, in the end they are people who are still judged on a quarterly basis.

Abnormal Returns

JUNE 30, 2023

genuineimpact.substack.com) Companies Matt Reustle talks with Tom Walsh, a portfolio manager at Baillie Gifford, about ASML Holdings ($ASML). conversationswithtyler.com) Howard Lindzon talks with Doug Hecht, the CEO and Co-founder of Walla, a modern studio management platform. Audio YouTube will soon allow automatic dubbing.

The Big Picture

OCTOBER 4, 2024

Prior to founding Cutter Capital in November 2022, Vincent spent time as a Senior Analyst for Millennium Partners and a Portfolio Manager at Citadel. We discuss the launch of Cutter Capital and how he managed to combine a love for genetics and business into a successful career. He also received a Ph.D.

The Big Picture

JANUARY 12, 2024

This week, we speak with Cathy Marcus , co-chief executive officer and global chief operating officer of PGIM Real Estate , which manages over $200 billion in assets. As co-CEO, Marcus develops and leads the company’s global strategy; as global COO, she is responsible for overseeing business and investment operations globally.

Nerd's Eye View

SEPTEMBER 12, 2023

Jason is the CEO of Altruist, a relatively new RIA custodian that has quickly grown to serve more than 3,500 advisory firms across the country, making it the 4th-largest independent RIA custodian by firm count.

Abnormal Returns

MAY 10, 2024

(freakonomics.com) Finance Barry Ritholtz talks with Jim O'Shaughnessy about his investing career, VC and the potential of AI. mebfaber.com) Eric Golden talk with Nir Kaissar, founder and portfolio manager at Unison Advisors, about the state of markets.

Validea

JANUARY 23, 2025

Rob discusses his thought-provoking article “50 Years of Innovation, Myth Making and Myth Busting,” written for the 50th anniversary of the Journal of Portfolio Management. His insights are particularly valuable for investors trying to navigate today’s complex market environment.

Abnormal Returns

JULY 12, 2024

(open.spotify.com) Finance Meb Faber talks trend following with Jerry Parker, portfolio manager of the Cambria Chesapeake Pure Trend ETF ($MFUT) ETF. epsilontheory.com) Joe Weisenthal and Tracy Alloway talk thematic investing with James van Geelen, founder of Citrini Research.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content