Retail Alts Fundraising Exceeded Expectations in 2024

Wealth Management

JANUARY 27, 2025

The volume of fundraising for alternative investment vehicles through the retail channel reached $122 billion, reports Robert A. Stanger & Co.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 27, 2025

The volume of fundraising for alternative investment vehicles through the retail channel reached $122 billion, reports Robert A. Stanger & Co.

Wealth Management

SEPTEMBER 30, 2024

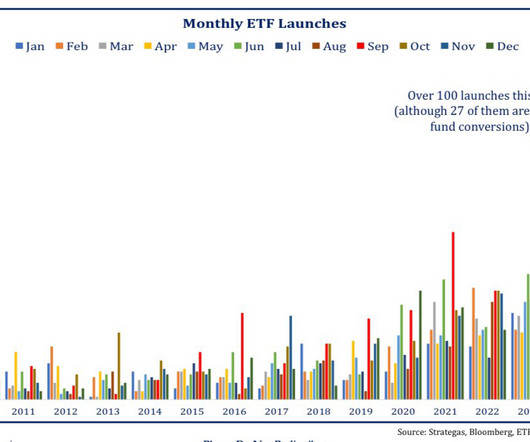

Fidelity's Mike Scarsciotti discusses the growing popularity of ETFs, the resurgence of active management and the evolving approaches to asset allocation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

FEBRUARY 27, 2024

Retail investor activity helped drive the crypto market rally in January, says JP Morgan. These are among the investment must reads we found this week for wealth advisors. Non-traded alternative managers raised $7.6 billion in January, according to data from Robert A.

Abnormal Returns

SEPTEMBER 24, 2024

sherwood.news) Retail Online retailers are cutting back on discounts. bonddad.blogspot.com) Earlier on Abnormal Returns The investment world was a different place when Josh Brown started writing. (riskofruinpod.substack.com) Crypto You can now trade options on BlackRock’s iShares Bitcoin Trust ($IBIT).

Wealth Management

SEPTEMBER 30, 2024

Fidelity's Mike Scarsciotti discusses the growing popularity of ETFs, the resurgence of active management and the evolving approaches to asset allocation.

Abnormal Returns

DECEMBER 19, 2023

advisorperspectives.com) A history of quant investing and the state of the factor zoo. advisorperspectives.com) Can you use alternative measures to invest across countries? quantpedia.com) Retail attention is a mixed blessing for stocks. Factors Timing returns factors is tempting, but difficult in practice. papers.ssrn.com)

Wealth Management

FEBRUARY 27, 2024

Retail investor activity helped drive the crypto market rally in January, says JP Morgan. These are among the investment must reads we found this week for wealth advisors. Non-traded alternative managers raised $7.6 billion in January, according to data from Robert A.

The Big Picture

NOVEMBER 26, 2024

Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. I’m Barry Ritholtz, and on today’s edition of At the Money , we’re going to discuss how retail investors can responsibly invest in crypto.

Wealth Management

OCTOBER 18, 2022

Once a niche play, DSTs have drawn the interest of institutional-grade sponsors to offer as an option to retail investors managing their real estate plays.

Calculated Risk

JULY 7, 2024

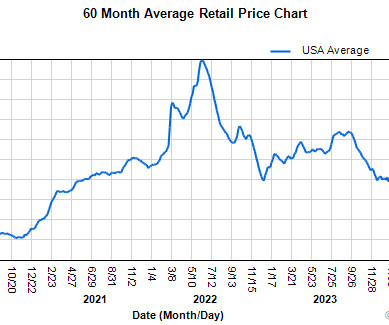

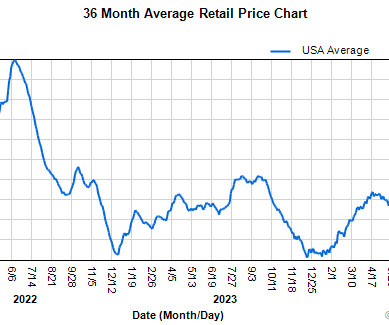

decline in April, retail sales in May were only up by 0.1%, not meeting the anticipated 0.3% This approach involves large retail chains offering a limited selection of their products in more compact locations. Both asking and effective rents experienced a marginal increase of 0.2% and $19.07 per square foot respectively. and $19.07

Wealth Management

SEPTEMBER 24, 2024

Revolut Invest will offer nearly 5,000 assets on debut, including US and European stocks, exchange-traded funds, commodities and bonds, as well as new products such as contracts for difference.

Abnormal Returns

MARCH 17, 2025

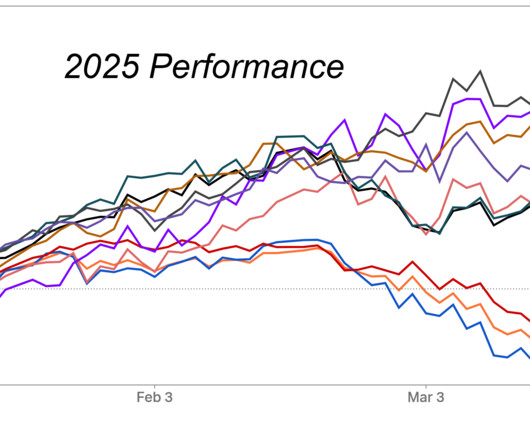

awealthofcommonsense.com) Books "Buffett and Munger Unscripted: Three Decades of Investment and Business Insights from the Berkshire Hathaway Shareholder Meetings" by Alex Morris is a good refresher course. propublica.org) Economy Retail sales are decelerating. Markets Corrections happen more often than you remember.

Calculated Risk

APRIL 9, 2024

During the holiday season, consumer activity was robust but as expected, decelerated in January as retailers reduced their expenditures at the start of the year. However, February marked a resurgence in consumer spending, with retail sales climbing by 0.6%. Asking rents rose slightly by 0.2% increase to $18.98

Wealth Management

SEPTEMBER 28, 2022

Our third quarter virtual forum examined trends in multifamily, grocery-anchored retail and BTRs amid broader discussions about how CRE is dealing with rising interest rates and persistent inflation.

Wealth Management

MARCH 13, 2023

A rising number of investment platforms, asset managers and sponsors are tapping into retail investor appetite for private real estate assets.

Abnormal Returns

OCTOBER 7, 2024

wealthmanagement.com) Derivatives-based ETFs are booming, with retail piling in. (ft.com) Pfizer ($PFE) has an activist in Starboard Value. wsj.com) ETFs Cambria and Alpha Architect are teaming up for the Cambria Tax Aware ETF ($TAX). bloomberg.com) Jane Street Jane Street is seeing extraordinary profits on the back of the ETF boom.

The Big Picture

APRIL 4, 2025

This week, I speak with with Lisa Shalett , Chief Investment Officer and head of Global Investment Office for Morgan Stanley Wealth Management. He was recently appointed to the Harvard Management Company Board.

Wealth Management

AUGUST 20, 2024

The challenge from sports betting should be met with better, more innovative financial solutions for retail investors.

Trade Brains

NOVEMBER 6, 2024

The Indian real estate market, traditionally requiring substantial investments, is evolving with the rise of Real Estate Investment Trusts (REITs). Now even small investors can participate in property investments with minimal capital. Real Estate Investment Trusts (REITs) have revolutionised property investment in India.

Wealth Management

MAY 30, 2024

Apollo’s products for individual investors are distributed through intermediaries such as bank wealth channels and registered investment advisers, and the firm doesn’t expect that to change.

Wealth Management

AUGUST 1, 2024

The finding is part of a broader Cerulli report examining the opportunities and challenges surrounding the use of alternative investments in the retail channel.

Wealth Management

DECEMBER 19, 2022

Advisors and analysts look back on their best and worst calls, with ideas on ways retail investors should position themselves heading for the new year.

Abnormal Returns

JANUARY 20, 2023

news.crunchbase.com) Crypto companies, like FTX, invested in a bunch of crypto startups. bonddad.blogspot.com) Why falling retail sales aren't all bad. (ft.com) Startups How unicorns are dealing with the decline in valuations. Those stakes are set to change hands. theinformation.com) The bloom is off the 'passion economy' rose?

Wealth Management

MAY 25, 2023

Investment sales in the sector have been impacted by the same volatile forces as other commercial real estate assets, but potential long-term returns remain attractive.

Wealth Management

JUNE 12, 2024

The chief investment officers for T. Rowe Price and Schwab Asset Management discussed disconnects between how RIAs and retail investors view current opportunities.

Validea

APRIL 4, 2025

The recent market sell-off, driven by rising tariff concerns and economic uncertainty, has significantly impacted retail and consumer-facing stocks. Using Valideas Guru Stock Screener, we’ve identified a number of quality retail stocks trading at that have declined significantly. Apparel Abercrombie & Fitch Co. Genesco Inc.

Calculated Risk

FEBRUARY 14, 2025

Feb 14th] emphasis added From Goldman: Following this mornings retail sales and industrial production reports, we lowered our Q1 GDP tracking estimate by 0.3pp to +2.0% (quarter-over-quarter annualized) and our Q1 domestic final sales forecast by 0.1pp to +2.2%. From BofA: Next week, we will initiate our 1Q GDP tracker. percent on February 7.

Calculated Risk

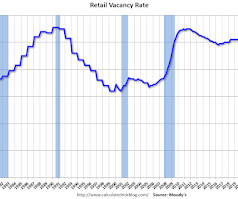

OCTOBER 6, 2024

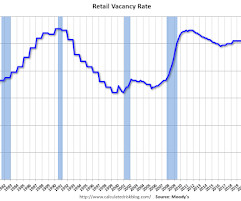

vacancy rate for the retail sector, dropping to 10.3% These results were propelled by robust performance in online purchases and core retail sales, excluding automobiles, gasoline, building materials, and food services, alongside a decline in the unemployment rate following four consecutive monthly increases. this quarter.

Abnormal Returns

DECEMBER 10, 2024

sherwood.news) Annual outlooks It's always going to be a 'stockpicker's market' in strategist investment outlooks. behaviouralinvestment.com) Financial writing Nick's favorite investment writing from 2024 including 'No Regrets' by Jonathan Clements. bloomberg.com) Retail Vinted wants to become the Amazon of secondhand.

Abnormal Returns

AUGUST 6, 2024

Retail Using LLMs to identify retail trader strategies. alphaarchitect.com) Analysts Why are all-start investment analysts influential? papers.ssrn.com) A look at the value, or lack thereof, of WallStreetBets stock picks. papers.ssrn.com) Can LLMs replace the average human analyst?

Wealth Management

JUNE 13, 2023

Retail investors’ beliefs regarding gold investments are contradictory to the empirical evidence.

Calculated Risk

OCTOBER 9, 2023

During the sector’s ongoing revolution, retail clusters have been shifting towards service-centric and experience-oriented uses. As non-performing assets get replaced by modernized retail forms or even mixed-use communities, the retail sector ignited a long-awaited hope at the rise of pent-up consumer demand. [N]eighborhood

Wealth Management

NOVEMBER 21, 2023

Japan’s government pension fund is investing $1 billion in funds managed by Brookfield and Blackstone, reported Bisnow. Private investors have been increasingly focusing on retail real estate in recent months, according to JLL. These are among today’s must reads from around the commercial real estate industry.

Wealth Management

MAY 26, 2023

billion joint venture focused on retail assets. These are some must reads from around the real estate investment world heading into the weekend. Office REITs are trading at their lowest levels since 2009, reports Bloomberg. Crow Holdings formed a $2.6

Abnormal Returns

FEBRUARY 7, 2025

freakonomics.com) Business Josh and Michael talk real estate, investing and sports with David J. joincolossus.com) Miguel Armaza talks with Howard Lindzon about how public investing experience helps when investing in venture-stage companies. Adelman, CEO of Campus Apartments. t: A Love Story."

Abnormal Returns

NOVEMBER 29, 2024

mrzepczynski.blogspot.com) Strategy No one is immune from investment FOMO. ft.com) BlackRock ($BLK) reportedly has a deal to buy HPS Investment Partners, a private credit manager. ft.com) Retail How Target ($TGT) lost its shine. Markets A look at the best performing stocks of the past 20 years.

Wealth Management

AUGUST 18, 2022

The Massachusetts Secretary of the Commonwealth said retail investors should not consider the ETFs as long-term investments.

Wealth Management

NOVEMBER 3, 2022

Fueled by billions of dollars from affluent individuals, Blackstone Real Estate Income Trust has become one of the firm’s top profit drivers, expanding property investing in private markets to the masses. Now, the money machine is facing its biggest test.

Abnormal Returns

JUNE 25, 2024

Alternatives Pension plans could generate equivalent returns with low-cost, index investments. crr.bc.edu) Equity funds with VC investments don't outperform. insights.finominal.com) Retail traders just can't quit lottery stocks. papers.ssrn.com) Just how big is the carried interest loophole. papers.ssrn.com)

Abnormal Returns

AUGUST 13, 2024

Venture capital There is nothing normal about the distribution of angel investment returns. ofdollarsanddata.com) Retail trading frenzies can have real world impacts. blogs.cfainstitute.org) How much AUM do the big hedge funds have per investment professional? papers.ssrn.com) Research How long can stocks underperform inflation?

Calculated Risk

JANUARY 1, 2023

From Moody’s Analytics Senior Economist Lu Chen and economist Xiaodi Li: Apartment struck a balance, Office demand plummeted, and Retail remains flat Corporate profits squeezed under macroeconomic uncertainties and flexible work arrangements weakened office demand and continued to transform the sector’s fundamental.

Wealth Management

JUNE 26, 2024

is expanding further into private-markets investing, striking a new partnership to include the assets alongside traditional ETFs and mutual funds in model portfolios pitched to wealthy US retail clients. (Bloomberg) -- BlackRock Inc. The firm will w

Nerd's Eye View

JANUARY 31, 2023

Ali is a Partner and the Managing Director for Waldron Private Wealth, a multi-family office based in Bridgeville, Pennsylvania that oversees nearly $3 billion in assets under management for 280 ultra-high-net-worth family households.

The Big Picture

NOVEMBER 27, 2024

I think about this when I see the torrent of forecasts this time of year: Price targets for the S&P, inflation forecasts, and most LOL of all, NRF Black Friday retail predictions. It should be both robust and boulder-proof. Never confuse opinion marketing with actual, useful information. ~~~ Give thanks this weekend! Count your blessings.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content